1999 BC Gas Utility Ltd. annual report - FortisBC

1999 BC Gas Utility Ltd. annual report - FortisBC

1999 BC Gas Utility Ltd. annual report - FortisBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Discussion and Analysis<br />

Operation and maintenance expenses decreased to<br />

$116.0 million in <strong>1999</strong> from $120.6 million in 1998. This<br />

decrease was due largely to productivity improvements<br />

flowing from a significant restructuring program at <strong>BC</strong> <strong>Gas</strong><br />

which was implemented in early 1998, offset by increases<br />

in other operating costs.<br />

Increased investment in gas plant in service resulted in<br />

depreciation and amortization expense rising to $62.4 million<br />

in <strong>1999</strong> from $61.3 million in 1998. Growth in the asset base<br />

of the Company resulted in property and other taxes<br />

increasing by $0.4 million to $31.9 million in <strong>1999</strong>.<br />

Financing costs increased to $87.4 million in <strong>1999</strong> from<br />

$86.8 million in the previous year largely as a result of higher<br />

debt balances and higher short-term interest rates during <strong>1999</strong>.<br />

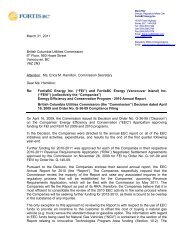

Regulation and Rates – <strong>BC</strong> <strong>Gas</strong> <strong>Utility</strong><br />

<strong>BC</strong> <strong>Gas</strong> is regulated by the British Columbia Utilities<br />

Commission (“the <strong>BC</strong>UC”), which approves rates and tolls for<br />

services and the construction of facilities. Traditionally, rates<br />

have been set using the historical cost rate base and a rate<br />

of return. Since 1996, incentive-based regulation has been<br />

incorporated into the rate setting process in order to enhance<br />

both value to customers and returns to shareholders.<br />

The Company’s rates are based on estimates of a number<br />

of items, such as natural gas sales, cost of natural gas and<br />

interest rates. In order to manage the risks associated with<br />

some of these estimates, a number of regulatory deferral<br />

accounts are in place. The three most significant deferral<br />

accounts relate to the risks of weather, cost of natural gas,<br />

and interest rates.<br />

<strong>1999</strong> ANNUAL REPORT<br />

The deferral accounts for weather and cost of natural gas<br />

reduce the Company’s earnings exposure to these risks by<br />

deferring any variances between projected and actual gas<br />

consumption and gas costs, and refunding or recovering those<br />

variances in future customer rates. Transportation and sales<br />

services to industrial customers are not covered by these<br />

deferral accounts. As a result of these deferral accounts,<br />

changes in <strong>report</strong>ed revenues from year to year are caused<br />

mainly by changes in gas costs and other components of the<br />

Company’s cost of service which are recovered in customer<br />

rates. Changes in volumes of gas sold to residential and<br />

commercial customers due to weather or other factors have<br />

a less significant impact on <strong>report</strong>ed revenues.<br />

<strong>BC</strong> <strong>Gas</strong> also has in place short-term and long-term interest<br />

deferral accounts to absorb interest rate fluctuations. The<br />

Company’s interest deferral accounts effectively locked in the<br />

cost of short-term funds attributable to regulated assets at<br />

5% during <strong>1999</strong> and 1998.<br />

Allowed Return on Equity (“ROE”)<br />

The Company’s <strong>1999</strong> allowed ROE of 9.25% was determined<br />

based on a formula that applied a risk premium to a forecast<br />

of long-term Government of Canada bond yields. The decline<br />

from 10.0% in 1998 was a result of a decline in forecast longterm<br />

bond yields.<br />

In June <strong>1999</strong>, the <strong>BC</strong>UC held a public hearing to review<br />

the ROE formula, which had been in effect since 1995. In its<br />

decision dated August 26, <strong>1999</strong>, the <strong>BC</strong>UC amended the<br />

formula for the years beginning in 2000. The effect of these<br />

revisions is a lower allowed ROE for the Company with the<br />

new formula than with the old formula, under most potential<br />

long-term bond yields. For 2000, the Company’s allowed ROE<br />

has been set at 9.50% using the revised formula, reflecting<br />

higher forecasted long-term bond yields compared to the <strong>1999</strong><br />

ROE calculation. Had the original formula remained in place,<br />

the Company’s 2000 allowed ROE would have been 9.75%.<br />

2