1999 BC Gas Utility Ltd. annual report - FortisBC

1999 BC Gas Utility Ltd. annual report - FortisBC

1999 BC Gas Utility Ltd. annual report - FortisBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Discussion and Analysis<br />

Unbundling<br />

Over the past year, the Company and a number of interested<br />

parties actively explored an arrangement that would allow<br />

residential and smaller commercial users to purchase natural<br />

gas directly from suppliers other than the Company and use<br />

the Company’s system to transport the commodity. The<br />

Company does not anticipate that the introduction of these<br />

arrangements will have a material impact on the Company’s<br />

financial results. Direction from the <strong>BC</strong>UC on this matter is<br />

anticipated in the spring of 2000.<br />

Business Risks<br />

Regulatory Treatment<br />

Through the regulatory process, the <strong>BC</strong>UC approves the return<br />

on equity which the Company is allowed to earn, in addition<br />

to various other aspects of the Company’s operation. Fair<br />

regulatory treatment that allows the Company to earn a risk<br />

adjusted rate of return comparable to that available on<br />

alternative investments is essential for ongoing success.<br />

Long-Term Competitiveness<br />

Natural gas continues to enjoy a strong competitive position<br />

relative to alternative sources of energy in British Columbia.<br />

The increasing use of natural gas-fired electricity generating<br />

plants should help to preserve this advantage relative to<br />

electricity. However, it is essential that the Company continue<br />

to focus on improving productivity and minimizing the cost of<br />

natural gas for its customers in order to sustain its competitive<br />

advantage. Incentive regulatory arrangements are an<br />

important part of ensuring that the Company will be able<br />

to deliver customer value in an increasingly competitive<br />

environment.<br />

Customer Additions<br />

New customer additions at <strong>BC</strong> <strong>Gas</strong> are typically a result of<br />

population growth and new housing starts. The state of the<br />

provincial economy has a significant impact on these factors.<br />

The Company is working to expand its market for natural gas<br />

service by increasing its penetration of the multiple family<br />

development market.<br />

<strong>Gas</strong> Supply<br />

<strong>1999</strong> ANNUAL REPORT<br />

<strong>BC</strong> <strong>Gas</strong> continues to face significant physical risk related to gas<br />

supply disruption as it is dependent on a limited selection of<br />

pipeline and storage providers. This risk is particularly acute in<br />

the Vancouver-Lower Mainland service area where the majority<br />

of <strong>BC</strong> <strong>Gas</strong>’ core market customers are located. Currently, these<br />

customers rely primarily on the transportation services of one<br />

pipeline company. In addition, the limited transportation and<br />

storage alternatives present risks of both supply disruption<br />

and lack of access to competitive sources of natural gas.<br />

To the extent possible, <strong>BC</strong> <strong>Gas</strong> has attempted to minimize<br />

gas supply and price risk through the use of long-term<br />

transportation, storage and supply contracts, hedging<br />

instruments and a diverse supply portfolio. The construction<br />

of the Southern Crossing Pipeline adds to <strong>BC</strong> <strong>Gas</strong>’ choice<br />

of resources and is intended to mitigate this risk in addition<br />

to minimizing the delivered cost of gas to the Company’s<br />

core customers over the long term.<br />

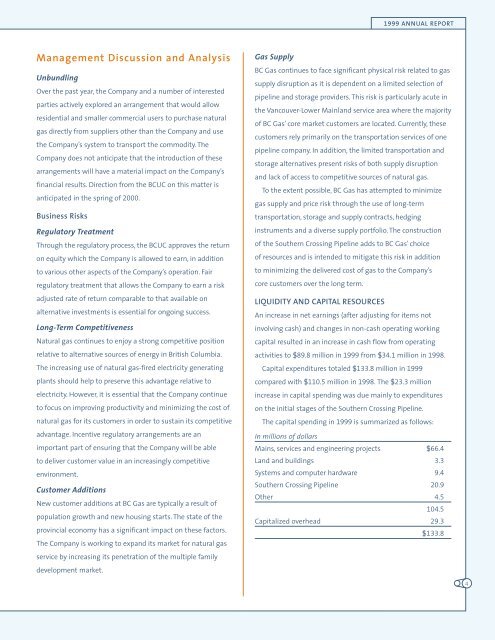

LIQUIDITY AND CAPITAL RESOURCES<br />

An increase in net earnings (after adjusting for items not<br />

involving cash) and changes in non-cash operating working<br />

capital resulted in an increase in cash flow from operating<br />

activities to $89.8 million in <strong>1999</strong> from $34.1 million in 1998.<br />

Capital expenditures totaled $133.8 million in <strong>1999</strong><br />

compared with $110.5 million in 1998. The $23.3 million<br />

increase in capital spending was due mainly to expenditures<br />

on the initial stages of the Southern Crossing Pipeline.<br />

The capital spending in <strong>1999</strong> is summarized as follows:<br />

In millions of dollars<br />

Mains, services and engineering projects $66.4<br />

Land and buildings 3.3<br />

Systems and computer hardware 9.4<br />

Southern Crossing Pipeline 20.9<br />

Other 4.5<br />

104.5<br />

Capitalized overhead 29.3<br />

$133.8<br />

4