2009/2010 IFA Annual Report - Institute of Foresters of Australia

2009/2010 IFA Annual Report - Institute of Foresters of Australia

2009/2010 IFA Annual Report - Institute of Foresters of Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

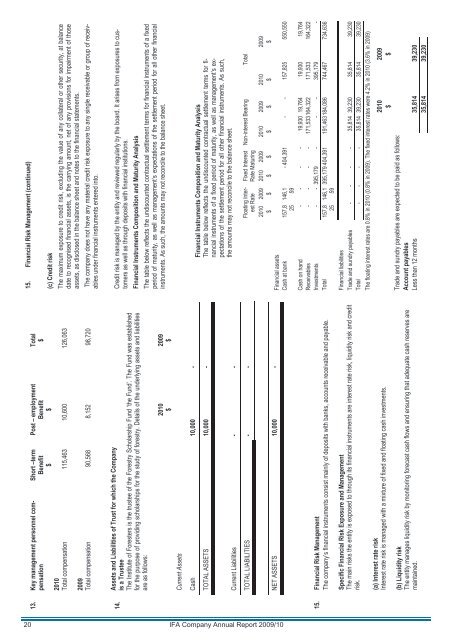

15. Financial Risk Management (continued)<br />

Total<br />

$<br />

Post – employment<br />

Benefit<br />

$<br />

Short –term<br />

Benefit<br />

$<br />

Key management personnel compensation<br />

13.<br />

(c) Credit risk<br />

The maximum exposure to credit risk, excluding the value <strong>of</strong> any collateral or other security, at balance<br />

date to recognised financial assets, is the carrying amount, net <strong>of</strong> any provisions for impairment <strong>of</strong> those<br />

assets, as disclosed in the balance sheet and notes to the financial statements.<br />

The company does not have any material credit risk exposure to any single receivable or group <strong>of</strong> receivables<br />

under financial instruments entered into.<br />

<strong>2010</strong><br />

Total compensation 115,463 10,600 126,063<br />

<strong>2009</strong><br />

Total compensation 90,568 8,152 98,720<br />

Credit risk is managed by the entity and reviewed regularly by the board. It arises from exposures to customers<br />

as well as through deposits with financial institutions.<br />

Financial Instruments Composition and Maturity Analysis<br />

The table below reflects the undiscounted contractual settlement terms for financial instruments <strong>of</strong> a fixed<br />

period <strong>of</strong> maturity, as well as management’s expectations <strong>of</strong> the settlement period for all other financial<br />

instruments. As such, the amounts may not reconcile to the balance sheet.<br />

Assets and Liabilities <strong>of</strong> Trust for which the Company<br />

is a Trustee<br />

The <strong>Institute</strong> <strong>of</strong> <strong>Foresters</strong> is the trustee <strong>of</strong> the Forestry Scholarship Fund ‘the Fund’. The Fund was established<br />

for the purpose <strong>of</strong> providing scholarships for the study <strong>of</strong> forestry. Details <strong>of</strong> the underlying assets and liabilities<br />

are as follows:<br />

14.<br />

<strong>2009</strong><br />

$<br />

<strong>2010</strong><br />

$<br />

20 <strong>IFA</strong> Company <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong>/10<br />

Current Assets<br />

Cash 10,000 -<br />

Financial Instruments Composition and Maturity Analysis<br />

The table below reflects the undiscounted contractual settlement terms for financial<br />

instruments <strong>of</strong> a fixed period <strong>of</strong> maturity, as well as management’s expectations<br />

<strong>of</strong> the settlement period for all other financial instruments. As such,<br />

the amounts may not reconcile to the balance sheet.<br />

TOTAL ASSETS 10,000 -<br />

Current Liabilities - -<br />

Floating Inter- Fixed Interest Non-interest Bearing Total<br />

est Rate Rate Maturing<br />

<strong>2010</strong> <strong>2009</strong> <strong>2010</strong> <strong>2009</strong> <strong>2010</strong> <strong>2009</strong> <strong>2010</strong> <strong>2009</strong><br />

$ $ $ $ $ $ $ $<br />

Financial assets<br />

Cash at bank 157,8 146,1 - 404,391 - - 157,825 550,550<br />

25 59<br />

Cash on hand - - - - 19,930 19,764 19,930 19,764<br />

Receivables - - - - 171,533 164,322 171,533 164,322<br />

Investments - - 395,179 - - - 395,179 -<br />

Total 157,8 146,1 395,179 404,391 191,463 184,086 744,467 734,636<br />

25 59<br />

Financial liabilities<br />

Trade and sundry payables - - - - 35,814 39,230 35,814 39,230<br />

Total - - - - 35,814 39,230 35,814 39,230<br />

The floating interest rates are 0.8% in <strong>2010</strong> (0.8% in <strong>2009</strong>). The fixed interest rates were 4.2% in <strong>2010</strong> (3.6% in <strong>2009</strong>)<br />

TOTAL LIABILITIES - -<br />

NET ASSETS 10,000 -<br />

15. Financial Risk Management<br />

The company’s financial instruments consist mainly <strong>of</strong> deposits with banks, accounts receivable and payable.<br />

Specific Financial Risk Exposure and Management<br />

The main risks the entity is exposed to through its financial instruments are interest rate risk, liquidity risk and credit<br />

risk.<br />

<strong>2010</strong> <strong>2009</strong><br />

$ $<br />

(a) Interest rate risk<br />

Interest rate risk is managed with a mixture <strong>of</strong> fixed and floating cash investments.<br />

Trade and sundry payables are expected to be paid as follows:<br />

Account payables<br />

Less than 12 months 35,814 39,230<br />

35,814 39,230<br />

(b) Liquidity risk<br />

The entity manages liquidity risk by monitoring forecast cash flows and ensuring that adequate cash reserves are<br />

maintained.