Annual Report 2004 - Gammon India

Annual Report 2004 - Gammon India

Annual Report 2004 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(c) Reviewing with management the annual financial statements before submission to the Board, focusing<br />

primarily on:<br />

Any changes in accounting policies and practices<br />

Major accounting entries based on exercise of judgement by management<br />

Qualifications in draft audit report<br />

Significant adjustments arising out of audit<br />

The going concern assumption<br />

Compliance with accounting standards<br />

Compliance with Stock Exchange and legal requirements concerning financial statements<br />

Any related party transactions i.e transactions of the Company of material nature, with promoters or the<br />

management, their subsidiaries or relatives etc. that may have potential conflict with the interests of the<br />

Company at large.<br />

(d) Reviewing with the management, external and internal auditors, the adequacy of internal control systems.<br />

(e) Reviewing the adequacy of internal audit functions, including the structure of the internal audit department,<br />

staffing and seniority of the official heading the department, reporting structure coverage and frequency of<br />

internal audit.<br />

(f) Discussion with internal auditors, any significant findings and follow up thereon.<br />

(g) Reviewing the findings of any internal investigations by the internal auditors into matters where there is<br />

suspected fraud or irregularity or a failure of internal control systems of a material nature and reporting the<br />

matter to the board.<br />

(h) Discussion with external auditors before the audit commences, nature and scope of audit as well as have<br />

post audit discussion to ascertain any area of concern.<br />

(i) Reviewing the Company’s financial and risk management policies.<br />

(j) To look into the reasons for substantial defaults in the payment to the depositors, debenture-holders,<br />

shareholders (in the case of non payment of declared dividends) and creditors.<br />

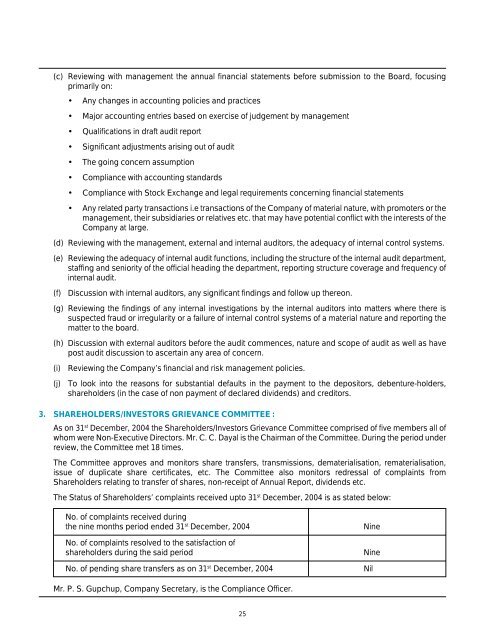

3. SHAREHOLDERS/INVESTORS GRIEVANCE COMMITTEE :<br />

As on 31st December, <strong>2004</strong> the Shareholders/Investors Grievance Committee comprised of five members all of<br />

whom were Non-Executive Directors. Mr. C. C. Dayal is the Chairman of the Committee. During the period under<br />

review, the Committee met 18 times.<br />

The Committee approves and monitors share transfers, transmissions, dematerialisation, rematerialisation,<br />

issue of duplicate share certificates, etc. The Committee also monitors redressal of complaints from<br />

Shareholders relating to transfer of shares, non-receipt of <strong>Annual</strong> <strong>Report</strong>, dividends etc.<br />

The Status of Shareholders’ complaints received upto 31 st December, <strong>2004</strong> is as stated below:<br />

No. of complaints received during<br />

the nine months period ended 31 st December, <strong>2004</strong> Nine<br />

No. of complaints resolved to the satisfaction of<br />

shareholders during the said period Nine<br />

No. of pending share transfers as on 31 st December, <strong>2004</strong> Nil<br />

Mr. P. S. Gupchup, Company Secretary, is the Compliance Officer.<br />

25