Annual Report 2004 - Gammon India

Annual Report 2004 - Gammon India

Annual Report 2004 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

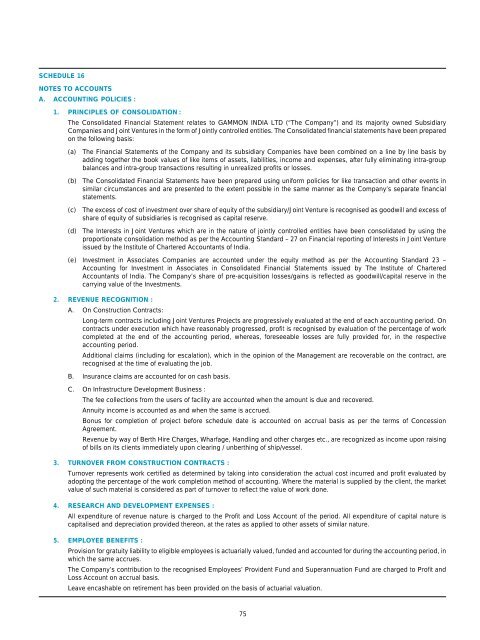

SCHEDULE 16<br />

NOTES TO ACCOUNTS<br />

A. ACCOUNTING POLICIES :<br />

1. PRINCIPLES OF CONSOLIDATION :<br />

The Consolidated Financial Statement relates to GAMMON INDIA LTD (“The Company”) and its majority owned Subsidiary<br />

Companies and Joint Ventures in the form of Jointly controlled entities. The Consolidated financial statements have been prepared<br />

on the following basis:<br />

(a) The Financial Statements of the Company and its subsidiary Companies have been combined on a line by line basis by<br />

adding together the book values of like items of assets, liabilities, income and expenses, after fully eliminating intra-group<br />

balances and intra-group transactions resulting in unrealized profits or losses.<br />

(b) The Consolidated Financial Statements have been prepared using uniform policies for like transaction and other events in<br />

similar circumstances and are presented to the extent possible in the same manner as the Company’s separate financial<br />

statements.<br />

(c) The excess of cost of investment over share of equity of the subsidiary/Joint Venture is recognised as goodwill and excess of<br />

share of equity of subsidiaries is recognised as capital reserve.<br />

(d) The Interests in Joint Ventures which are in the nature of jointly controlled entities have been consolidated by using the<br />

proportionate consolidation method as per the Accounting Standard – 27 on Financial reporting of Interests in Joint Venture<br />

issued by the Institute of Chartered Accountants of <strong>India</strong>.<br />

(e) Investment in Associates Companies are accounted under the equity method as per the Accounting Standard 23 –<br />

Accounting for Investment in Associates in Consolidated Financial Statements issued by The Institute of Chartered<br />

Accountants of <strong>India</strong>. The Company’s share of pre-acquisition losses/gains is reflected as goodwill/capital reserve in the<br />

carrying value of the Investments.<br />

2. REVENUE RECOGNITION :<br />

A. On Construction Contracts:<br />

Long-term contracts including Joint Ventures Projects are progressively evaluated at the end of each accounting period. On<br />

contracts under execution which have reasonably progressed, profit is recognised by evaluation of the percentage of work<br />

completed at the end of the accounting period, whereas, foreseeable losses are fully provided for, in the respective<br />

accounting period.<br />

Additional claims (including for escalation), which in the opinion of the Management are recoverable on the contract, are<br />

recognised at the time of evaluating the job.<br />

B. Insurance claims are accounted for on cash basis.<br />

C. On Infrastructure Development Business :<br />

The fee collections from the users of facility are accounted when the amount is due and recovered.<br />

Annuity income is accounted as and when the same is accrued.<br />

Bonus for completion of project before schedule date is accounted on accrual basis as per the terms of Concession<br />

Agreement.<br />

Revenue by way of Berth Hire Charges, Wharfage, Handling and other charges etc., are recognized as income upon raising<br />

of bills on its clients immediately upon clearing / unberthing of ship/vessel.<br />

3. TURNOVER FROM CONSTRUCTION CONTRACTS :<br />

Turnover represents work certified as determined by taking into consideration the actual cost incurred and profit evaluated by<br />

adopting the percentage of the work completion method of accounting. Where the material is supplied by the client, the market<br />

value of such material is considered as part of turnover to reflect the value of work done.<br />

4. RESEARCH AND DEVELOPMENT EXPENSES :<br />

All expenditure of revenue nature is charged to the Profit and Loss Account of the period. All expenditure of capital nature is<br />

capitalised and depreciation provided thereon, at the rates as applied to other assets of similar nature.<br />

5. EMPLOYEE BENEFITS :<br />

Provision for gratuity liability to eligible employees is actuarially valued, funded and accounted for during the accounting period, in<br />

which the same accrues.<br />

The Company’s contribution to the recognised Employees’ Provident Fund and Superannuation Fund are charged to Profit and<br />

Loss Account on accrual basis.<br />

Leave encashable on retirement has been provided on the basis of actuarial valuation.<br />

75