The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

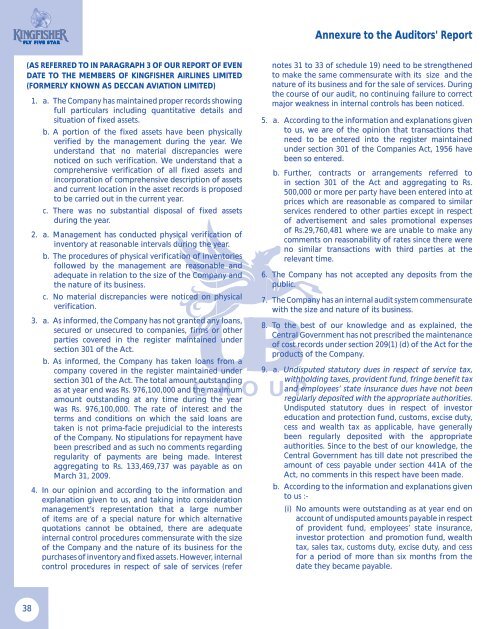

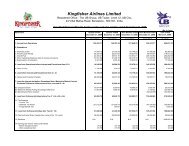

(AS REFERRED TO IN PARAGRAPH 3 OF OUR REPORT OF EVEN<br />

DATE TO THE MEMBERS OF KINGFISHER AIRLINES LIMITED<br />

(FORMERLY KNOWN AS DECCAN AVIATION LIMITED)<br />

38<br />

1. a. <strong>The</strong> Company has maintained proper records showing<br />

full particulars including quantitative details and<br />

situation <strong>of</strong> fixed assets.<br />

b. A portion <strong>of</strong> the fixed assets have been physically<br />

verified by the management during the year. We<br />

understand that no material discrepancies were<br />

noticed on such verification. We understand that a<br />

comprehensive verification <strong>of</strong> all fixed assets and<br />

incorporation <strong>of</strong> comprehensive description <strong>of</strong> assets<br />

and current location in the asset records is proposed<br />

to be carried out in the current year.<br />

c. <strong>The</strong>re was no substantial disposal <strong>of</strong> fixed assets<br />

during the year.<br />

2. a. Management has conducted physical verification <strong>of</strong><br />

inventory at reasonable intervals during the year.<br />

b. <strong>The</strong> procedures <strong>of</strong> physical verification <strong>of</strong> inventories<br />

followed by the management are reasonable and<br />

adequate in relation to the size <strong>of</strong> the Company and<br />

the nature <strong>of</strong> its business.<br />

c. No material discrepancies were noticed on physical<br />

verification.<br />

3. a. As informed, the Company has not granted any loans,<br />

secured or unsecured to companies, firms or other<br />

parties covered in the register maintained under<br />

section 301 <strong>of</strong> the Act.<br />

b. As informed, the Company has taken loans from a<br />

company covered in the register maintained under<br />

section 301 <strong>of</strong> the Act. <strong>The</strong> total amount outstanding<br />

as at year end was Rs. 976,100,000 and the maximum<br />

amount outstanding at any time during the year<br />

was Rs. 976,100,000. <strong>The</strong> rate <strong>of</strong> interest and the<br />

terms and conditions on which the said loans are<br />

taken is not prima-facie prejudicial to the interests<br />

<strong>of</strong> the Company. No stipulations for repayment have<br />

been prescribed and as such no comments regarding<br />

regularity <strong>of</strong> payments are being made. Interest<br />

aggregating to Rs. 133,469,737 was payable as on<br />

March 31, 2009.<br />

4. In our opinion and according to the information and<br />

explanation given to us, and taking into consideration<br />

management’s representation that a large number<br />

<strong>of</strong> items are <strong>of</strong> a special nature for which alternative<br />

quotations cannot be obtained, there are adequate<br />

internal control procedures commensurate with the size<br />

<strong>of</strong> the Company and the nature <strong>of</strong> its business for the<br />

purchases <strong>of</strong> inventory and fixed assets. However, internal<br />

control procedures in respect <strong>of</strong> sale <strong>of</strong> services (refer<br />

Annexure to the Auditors' Report<br />

notes 31 to 33 <strong>of</strong> schedule 19) need to be strengthened<br />

to make the same commensurate with its size and the<br />

nature <strong>of</strong> its business and for the sale <strong>of</strong> services. During<br />

the course <strong>of</strong> our audit, no continuing failure to correct<br />

major weakness in internal controls has been noticed.<br />

5. a. According to the information and explanations given<br />

to us, we are <strong>of</strong> the opinion that transactions that<br />

need to be entered into the register maintained<br />

under section 301 <strong>of</strong> the Companies Act, 1956 have<br />

been so entered.<br />

b. Further, contracts or arrangements referred to<br />

in section 301 <strong>of</strong> the Act and aggregating to Rs.<br />

500,000 or more per party have been entered into at<br />

prices which are reasonable as compared to similar<br />

services rendered to other parties except in respect<br />

<strong>of</strong> advertisement and sales promotional expenses<br />

<strong>of</strong> Rs.29,760,481 where we are unable to make any<br />

comments on reasonability <strong>of</strong> rates since there were<br />

no similar transactions with third parties at the<br />

relevant time.<br />

6. <strong>The</strong> Company has not accepted any deposits from the<br />

public.<br />

7. <strong>The</strong> Company has an internal audit system commensurate<br />

with the size and nature <strong>of</strong> its business.<br />

8. To the best <strong>of</strong> our knowledge and as explained, the<br />

Central Government has not prescribed the maintenance<br />

<strong>of</strong> cost records under section 209(1) (d) <strong>of</strong> the Act for the<br />

products <strong>of</strong> the Company.<br />

9. a. Undisputed statutory dues in respect <strong>of</strong> service tax,<br />

withholding taxes, provident fund, fringe benefit tax<br />

and employees’ state insurance dues have not been<br />

regularly deposited with the appropriate authorities.<br />

Undisputed statutory dues in respect <strong>of</strong> investor<br />

education and protection fund, customs, excise duty,<br />

cess and wealth tax as applicable, have generally<br />

been regularly deposited with the appropriate<br />

authorities. Since to the best <strong>of</strong> our knowledge, the<br />

Central Government has till date not prescribed the<br />

amount <strong>of</strong> cess payable under section 441A <strong>of</strong> the<br />

Act, no comments in this respect have been made.<br />

b. According to the information and explanations given<br />

to us :-<br />

(i) No amounts were outstanding as at year end on<br />

account <strong>of</strong> undisputed amounts payable in respect<br />

<strong>of</strong> provident fund, employees’ state insurance,<br />

investor protection and promotion fund, wealth<br />

tax, sales tax, customs duty, excise duty, and cess<br />

for a period <strong>of</strong> more than six months from the<br />

date they became payable.