The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

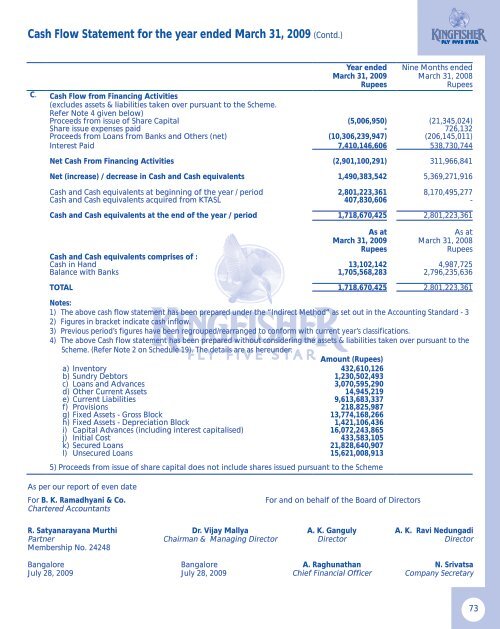

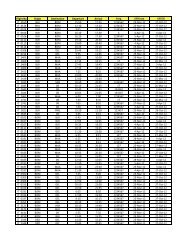

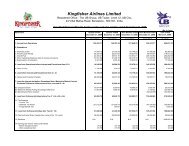

Cash Flow Statement for the year ended March 31, 2009 (Contd.)<br />

Year ended<br />

March 31, 2009<br />

Rupees<br />

Nine Months ended<br />

March 31, 2008<br />

Rupees<br />

C. Cash Flow from Financing Activities<br />

(excludes assets & liabilities taken over pursuant to the Scheme.<br />

Refer Note 4 given below)<br />

Proceeds from issue <strong>of</strong> Share Capital (5,006,950) (21,345,024)<br />

Share issue expenses paid - 726,132<br />

Proceeds from Loans from Banks and Others (net) (10,306,239,947) (206,145,011)<br />

Interest Paid 7,410,146,606 538,730,744<br />

Net Cash From Financing Activities (2,901,100,291) 311,966,841<br />

Net (increase) / decrease in Cash and Cash equivalents 1,490,383,542 5,369,271,916<br />

Cash and Cash equivalents at beginning <strong>of</strong> the year / period 2,801,223,361 8,170,495,277<br />

Cash and Cash equivalents acquired from KTASL 407,830,606 -<br />

Cash and Cash equivalents at the end <strong>of</strong> the year / period 1,718,670,425 2,801,223,361<br />

As at<br />

March 31, 2009<br />

Rupees<br />

As at<br />

March 31, 2008<br />

Rupees<br />

Cash and Cash equivalents comprises <strong>of</strong> :<br />

Cash in Hand 13,102,142 4,987,725<br />

Balance with Banks 1,705,568,283 2,796,235,636<br />

TOTAL 1,718,670,425 2,801,223,361<br />

Notes:<br />

1) <strong>The</strong> above cash flow statement has been prepared under the “Indirect Method” as set out in the Accounting Standard - 3<br />

2) Figures in bracket indicate cash inflow.<br />

3) Previous period’s figures have been regrouped/rearranged to conform with current year’s classifications.<br />

4) <strong>The</strong> above Cash flow statement has been prepared without considering the assets & liabilities taken over pursuant to the<br />

Scheme. (Refer Note 2 on Schedule 19). <strong>The</strong> details are as hereunder:<br />

Amount (Rupees)<br />

a) Inventory 432,610,126<br />

b) Sundry Debtors 1,230,502,493<br />

c) Loans and Advances 3,070,595,290<br />

d) Other Current Assets 14,945,219<br />

e) Current Liabilities 9,613,683,337<br />

f) Provisions 218,825,987<br />

g) Fixed Assets - Gross Block 13,774,168,266<br />

h) Fixed Assets - Depreciation Block 1,421,106,436<br />

i) Capital Advances (including interest capitalised) 16,072,243,865<br />

j) Initial Cost 433,583,105<br />

k) Secured Loans 21,828,640,907<br />

l) Unsecured Loans 15,621,008,913<br />

5) Proceeds from issue <strong>of</strong> share capital does not include shares issued pursuant to the Scheme<br />

As per our report <strong>of</strong> even date<br />

For B. K. Ramadhyani & Co. For and on behalf <strong>of</strong> the Board <strong>of</strong> Directors<br />

Chartered Accountants<br />

R. Satyanarayana Murthi Dr. Vijay Mallya A. K. Ganguly A. K. Ravi Nedungadi<br />

Partner Chairman & Managing Director Director Director<br />

Membership No. 24248<br />

Bangalore Bangalore A. Raghunathan N. Srivatsa<br />

July 28, 2009 July 28, 2009 Chief Financial Officer Company Secretary<br />

73