Resolution: Managing the failure of large financial institutions

Resolution: Managing the failure of large financial institutions

Resolution: Managing the failure of large financial institutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regulatory Briefings<br />

Last update: October 2012<br />

<strong>Resolution</strong>: <strong>Managing</strong> <strong>the</strong> <strong>failure</strong> <strong>of</strong> <strong>large</strong> <strong>financial</strong> <strong>institutions</strong><br />

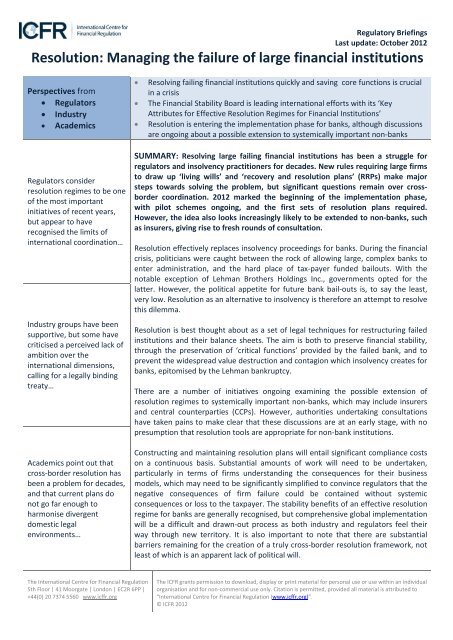

Perspectives from<br />

• Regulators<br />

• Industry<br />

• Academics<br />

Regulators consider<br />

resolution regimes to be one<br />

<strong>of</strong> <strong>the</strong> most important<br />

initiatives <strong>of</strong> recent years,<br />

but appear to have<br />

recognised <strong>the</strong> limits <strong>of</strong><br />

international coordination…<br />

Industry groups have been<br />

supportive, but some have<br />

criticised a perceived lack <strong>of</strong><br />

ambition over <strong>the</strong><br />

international dimensions,<br />

calling for a legally binding<br />

treaty…<br />

Academics point out that<br />

cross-border resolution has<br />

been a problem for decades,<br />

and that current plans do<br />

not go far enough to<br />

harmonise divergent<br />

domestic legal<br />

environments…<br />

The International Centre for Financial Regulation<br />

5th Floor | 41 Moorgate | London | EC2R 6PP |<br />

+44(0) 20 7374 5560 www.icffr.org<br />

• Resolving failing <strong>financial</strong> <strong>institutions</strong> quickly and saving core functions is crucial<br />

in a crisis<br />

• The Financial Stability Board is leading international efforts with its ‘Key<br />

Attributes for Effective <strong>Resolution</strong> Regimes for Financial Institutions’<br />

• <strong>Resolution</strong> is entering <strong>the</strong> implementation phase for banks, although discussions<br />

are ongoing about a possible extension to systemically important non-banks<br />

SUMMARY: Resolving <strong>large</strong> failing <strong>financial</strong> <strong>institutions</strong> has been a struggle for<br />

regulators and insolvency practitioners for decades. New rules requiring <strong>large</strong> firms<br />

to draw up ‘living wills’ and ‘recovery and resolution plans’ (RRPs) make major<br />

steps towards solving <strong>the</strong> problem, but significant questions remain over crossborder<br />

coordination. 2012 marked <strong>the</strong> beginning <strong>of</strong> <strong>the</strong> implementation phase,<br />

with pilot schemes ongoing, and <strong>the</strong> first sets <strong>of</strong> resolution plans required.<br />

However, <strong>the</strong> idea also looks increasingly likely to be extended to non-banks, such<br />

as insurers, giving rise to fresh rounds <strong>of</strong> consultation.<br />

<strong>Resolution</strong> effectively replaces insolvency proceedings for banks. During <strong>the</strong> <strong>financial</strong><br />

crisis, politicians were caught between <strong>the</strong> rock <strong>of</strong> allowing <strong>large</strong>, complex banks to<br />

enter administration, and <strong>the</strong> hard place <strong>of</strong> tax-payer funded bailouts. With <strong>the</strong><br />

notable exception <strong>of</strong> Lehman Bro<strong>the</strong>rs Holdings Inc., governments opted for <strong>the</strong><br />

latter. However, <strong>the</strong> political appetite for future bank bail-outs is, to say <strong>the</strong> least,<br />

very low. <strong>Resolution</strong> as an alternative to insolvency is <strong>the</strong>refore an attempt to resolve<br />

this dilemma.<br />

<strong>Resolution</strong> is best thought about as a set <strong>of</strong> legal techniques for restructuring failed<br />

<strong>institutions</strong> and <strong>the</strong>ir balance sheets. The aim is both to preserve <strong>financial</strong> stability,<br />

through <strong>the</strong> preservation <strong>of</strong> ‘critical functions’ provided by <strong>the</strong> failed bank, and to<br />

prevent <strong>the</strong> widespread value destruction and contagion which insolvency creates for<br />

banks, epitomised by <strong>the</strong> Lehman bankruptcy.<br />

There are a number <strong>of</strong> initiatives ongoing examining <strong>the</strong> possible extension <strong>of</strong><br />

resolution regimes to systemically important non-banks, which may include insurers<br />

and central counterparties (CCPs). However, authorities undertaking consultations<br />

have taken pains to make clear that <strong>the</strong>se discussions are at an early stage, with no<br />

presumption that resolution tools are appropriate for non-bank <strong>institutions</strong>.<br />

Constructing and maintaining resolution plans will entail significant compliance costs<br />

on a continuous basis. Substantial amounts <strong>of</strong> work will need to be undertaken,<br />

particularly in terms <strong>of</strong> firms understanding <strong>the</strong> consequences for <strong>the</strong>ir business<br />

models, which may need to be significantly simplified to convince regulators that <strong>the</strong><br />

negative consequences <strong>of</strong> firm <strong>failure</strong> could be contained without systemic<br />

consequences or loss to <strong>the</strong> taxpayer. The stability benefits <strong>of</strong> an effective resolution<br />

regime for banks are generally recognised, but comprehensive global implementation<br />

will be a difficult and drawn-out process as both industry and regulators feel <strong>the</strong>ir<br />

way through new territory. It is also important to note that <strong>the</strong>re are substantial<br />

barriers remaining for <strong>the</strong> creation <strong>of</strong> a truly cross-border resolution framework, not<br />

least <strong>of</strong> which is an apparent lack <strong>of</strong> political will.<br />

The ICFR grants permission to download, display or print material for personal use or use within an individual<br />

organisation and for non-commercial use only. Citation is permitted, provided all material is attributed to<br />

“International Centre for Financial Regulation (www.icffr.org)”.<br />

© ICFR 2012

The ICFR Regulatory Briefing on <strong>Resolution</strong> October 2012<br />

Details in Brief<br />

<strong>Resolution</strong> is multifaceted. The FSB’s Key Attributes<br />

sets out 12 principles and over 60 sub-principles that<br />

resolution regimes should adhere to, and are intended<br />

to be applicable both to banks and non-banks.<br />

Core among <strong>the</strong> aims <strong>of</strong> resolution regimes is to<br />

preserve systemically important functions performed<br />

by <strong>financial</strong> <strong>institutions</strong>. To make this possible, a<br />

resolution framework comprises a range <strong>of</strong> powers,<br />

legal techniques, and forms <strong>of</strong> cooperation agreements<br />

between firms and <strong>the</strong>ir <strong>of</strong>ten multiple supervisors.<br />

Although <strong>the</strong>re are outstanding questions about <strong>the</strong><br />

precise point at which resolution will be ‘triggered’, a<br />

firm will enter resolution generally when it is close to,<br />

but not at, <strong>the</strong> point <strong>of</strong> balance sheet insolvency, and<br />

after its recovery plan has failed to restore it as a going<br />

concern. At this point senior management will be<br />

replaced, and a ‘resolution authority’ will take control<br />

<strong>of</strong> <strong>the</strong> institution. <strong>Resolution</strong> authorities will have <strong>the</strong><br />

“It isn’t whe<strong>the</strong>r <strong>the</strong> bank<br />

fails or not. It is how it is<br />

handled subsequent to its<br />

<strong>failure</strong> that matters. And we<br />

have to find a way.”<br />

C.T. Conover, Former US Comptroller <strong>of</strong> <strong>the</strong><br />

Currency, speaking in <strong>the</strong> wake <strong>of</strong> <strong>the</strong> 1984 <strong>failure</strong><br />

<strong>of</strong> Continental Illinois which gave rise to <strong>the</strong> term<br />

‘too big to fail’.<br />

power to restructure <strong>the</strong> balance sheet and <strong>the</strong> firm itself, to terminate contracts, to sell assets or whole sections <strong>of</strong><br />

<strong>the</strong> firm, and so on. Such authorities may establish a ‘bridge institution’, which can continue to operate <strong>the</strong> firm in<br />

resolution. They may also establish an asset management firm to take control <strong>of</strong> ‘bad’ assets.<br />

<strong>Resolution</strong> authorities may also trigger a ‘bail-in’, whereby senior creditors have <strong>the</strong>ir debt claims converted to<br />

equity in order to fund <strong>the</strong> firm through resolution. Bail-in itself presents significant difficulties, but represents only<br />

one <strong>of</strong> many powers that resolution authorities will possess. The need for bail-in points to a more general funding<br />

problem associated with resolution, as firms in resolution will need not just equity in order to operate, but significant<br />

amounts <strong>of</strong> liquidity, which may well have to be provided through <strong>of</strong>ficial channels.<br />

Firms will be subjected to ‘resolvability assessments’ by <strong>the</strong>ir ‘crisis management groups’ (CMGs – groups <strong>of</strong><br />

supervisors responsible for dealing with firms in crisis situations). The FSB has advised that banks will be resolvable if<br />

<strong>the</strong>ir resolution plans are both “feasible” and “credible”. There is a degree <strong>of</strong> uncertainty at present as to how such<br />

terms will be interpreted, and it may be that more experience <strong>of</strong> resolution is needed in order to set precedents.<br />

Until such experience is gained, <strong>the</strong>re will be inevitable concern that regulators adopt an overly cautious approach.<br />

As an example <strong>of</strong> <strong>the</strong> potential impact <strong>of</strong> such a concept, <strong>the</strong> FSB’s Key Attributes, suggest supervisors or resolution<br />

authorities should have powers to require changes to firms’ business practices or structures in order to improve<br />

resolvability. Such changes could be required without an institution actually being in danger <strong>of</strong> entering resolution.<br />

Progress has been made in a number <strong>of</strong> jurisdictions. The Dodd-Frank Act creates <strong>the</strong> Orderly Liquidation Authority<br />

(OLA) through which <strong>the</strong> Federal Deposit Insurance Corporation (FDIC) can go beyond its existing resolution powers.<br />

In <strong>the</strong> EU, <strong>the</strong> European Commission published its resolution Directive proposals in June 2012, and <strong>the</strong>se are<br />

currently being negotiated with <strong>the</strong> European Parliament and Council. The Commission has called for <strong>the</strong> legislation<br />

to be expedited as part <strong>of</strong> its broader plans on bank union, but <strong>the</strong> final shape <strong>of</strong> <strong>the</strong> legislation remains uncertain.<br />

The UK has been ahead <strong>of</strong> <strong>the</strong> curve on resolution, although it has been waiting for <strong>the</strong> final EU Directive before<br />

proceeding fur<strong>the</strong>r. However, <strong>the</strong> UK’s Financial Services Authority (FSA) has committed to publishing final rules by<br />

autumn 2012 at <strong>the</strong> latest. In Japan, regulators are yet to provide detailed guidance on <strong>the</strong>ir expectations for such<br />

plans, and several o<strong>the</strong>r jurisdictions, such as Hong Kong, are only in <strong>the</strong> early stages <strong>of</strong> work on resolution.<br />

There are a number <strong>of</strong> consultations being conducted with respect to non-bank resolution. In August, HM Treasury<br />

in <strong>the</strong> UK consulted on <strong>the</strong> issue, followed in October by <strong>the</strong> European Commission. However, both consultations<br />

made clear that it was an open question as to whe<strong>the</strong>r resolution would be appropriate for non-banks. The<br />

International Association <strong>of</strong> Insurance Supervisors (IAIS) recently confirmed that insurers designated as systemically<br />

important would be expected to develop recovery and resolution plans, and has stated that <strong>the</strong> FSB’s Key Attributes<br />

would form <strong>the</strong> basis for improving resolvability. However, no insurer has as yet been designated as systemic.

The ICFR Regulatory Briefing on <strong>Resolution</strong> October 2012<br />

The Regulators<br />

Regulators have consistently identified resolution as a fundamentally important part <strong>of</strong> <strong>the</strong> future <strong>of</strong> <strong>financial</strong><br />

regulation, and crucial to overcoming <strong>the</strong> “too big to fail” problem. The FSB has coordinated international work, with<br />

regular input from a wide range <strong>of</strong> countries. The FSB has also stated that it sees resolution as providing “incentives<br />

for market-based solutions.” As an example <strong>of</strong> this, <strong>the</strong> UK’s FSA has stated that it would leave trigger points for<br />

initiating recovery plans down to firms, ra<strong>the</strong>r than mandate <strong>the</strong>m. However, it was made clear that <strong>the</strong>se should be<br />

set at “appropriate levels,” in order to prevent proactive regulatory intervention. A fur<strong>the</strong>r example <strong>of</strong> such<br />

incentives can be seen with so-called ‘bail-in’ capital, whereby debt can be converted into equity when a triggerpoint<br />

is breached. Regulators have been keen to stress that statutory bail-in regimes, which could be triggered by<br />

regulators, should not prevent firms from entering into private contractually-based bail-in agreements with higher<br />

trigger points than statutory bail-in would require, thus reducing <strong>the</strong> need for regulatory intervention.<br />

Regulators have pointed to a crucial difference between <strong>the</strong> objectives <strong>of</strong> special resolution regimes and <strong>the</strong><br />

objectives <strong>of</strong> corporate insolvency proceedings. The former have a “public interest” objective, such as <strong>the</strong><br />

maintenance <strong>of</strong> <strong>financial</strong> stability, while <strong>the</strong> latter are designed to achieve <strong>the</strong> best outcomes for creditors.<br />

Regulators have recognised <strong>the</strong> implications this may have for <strong>the</strong> creditor hierarchy in insolvency, and <strong>the</strong> FSB has<br />

accepted that <strong>the</strong> creditor hierarchy should be preserved in resolution.<br />

The Basel Committee on Banking Supervision noted in July 2011 that <strong>the</strong> various new Special <strong>Resolution</strong> Regimes<br />

brought in after <strong>the</strong> crisis fail to address <strong>the</strong> difficulties <strong>of</strong> resolving whole <strong>financial</strong> groups, with particular<br />

shortcomings in <strong>the</strong> cross-border context. Even with <strong>the</strong> FSB’s new principles, however, <strong>the</strong> problem <strong>of</strong> resolving<br />

cross-border <strong>institutions</strong> looks set to remain. The FSB has stated that “<strong>the</strong>re is no immediate prospect <strong>of</strong> [a] formal<br />

multilateral agreement addressing <strong>the</strong> set <strong>of</strong> issues raised in <strong>the</strong> resolution <strong>of</strong> <strong>financial</strong> <strong>institutions</strong>” and that binding<br />

mechanisms “will not be feasible” until existing proposals are already in place. In this respect, regulators have<br />

recognised <strong>the</strong> limits <strong>of</strong> international coordination, and appear to be taking a pragmatic approach to <strong>the</strong> short-term.<br />

Regulators are currently examining whe<strong>the</strong>r and how to extend resolution principles to non-banks.<br />

The Industry<br />

The industry’s views have been laid out in responses to consultation papers and industry-led research. Interestingly,<br />

<strong>the</strong> FSB has acknowledged a “significant minority” <strong>of</strong> respondents to its 2011 consultation who pointed to an<br />

apparent lack <strong>of</strong> ambition in <strong>the</strong> FSB’s proposals. This group included a range <strong>of</strong> <strong>large</strong>, cross-border banks, as well as<br />

various banking associations, such as <strong>the</strong> British, French and German bankers’ associations. There were concerns<br />

that <strong>the</strong>re will still be a “considerable danger that national self-interest may prevail over global interest in <strong>the</strong><br />

resolution <strong>of</strong> a global SIFI.” It was argued that it is <strong>the</strong> responsibility <strong>of</strong> <strong>the</strong> FSB and G20 to promote a more<br />

ambitious programme, and many called for an internationally binding treaty.<br />

Construction and maintenance <strong>of</strong> recovery and resolution plans will require extensive work by firms, with<br />

consequences for governance, strategy, and structure. “Resolvability assessments” will require firms to convince<br />

resolution authorities that it is “feasible and credible” for those authorities to perform a resolution without severe<br />

systemic disruption or taxpayer loss. This will be a continuous and demanding process. However, resolution planning<br />

has also brought benefits by forcing an acquaintance with and understanding <strong>of</strong> complex legal structures. It is clearly<br />

in <strong>the</strong> interests <strong>of</strong> firms to have robust recovery plans, as successful recovery planning may stave <strong>of</strong>f resolution.<br />

While <strong>the</strong> banking industry is in some jurisdictions advancing through <strong>the</strong> process <strong>of</strong> writing plans and working with<br />

regulatory authorities, o<strong>the</strong>r industry sectors are only beginning <strong>the</strong>ir journeys, and not all are supportive. For<br />

instance, many in <strong>the</strong> insurance industry are keen to point out that several aspects <strong>of</strong> resolution are designed with<br />

<strong>the</strong> specificities <strong>of</strong> <strong>the</strong> banking sector in mind, and highlight fundamental differences in business models between<br />

banks and insurers as a reason why resolution should not be applied to <strong>the</strong> insurance sector. However, work is<br />

continuing at both national and international levels, revolving around <strong>the</strong> issue <strong>of</strong> systemic importance. There is also<br />

resistance from investment firms to proposals to extend <strong>the</strong> net broadly over <strong>the</strong> sector. However, support for an<br />

extension to cover central counterparties has been widespread, given <strong>the</strong> likely systemic importance <strong>of</strong> <strong>the</strong>se<br />

<strong>institutions</strong> as a result <strong>of</strong> new requirements for over-<strong>the</strong>-counter derivatives to pass through such <strong>institutions</strong>.

The ICFR Regulatory Briefing on <strong>Resolution</strong> October 2012<br />

The Academics<br />

Richard Herring points out that <strong>the</strong> problems <strong>of</strong> cross-border resolution have been with us for many decades. To<br />

name but a few cases, Herstatt (1974), BCCI (1991), Barings (1996), LTCM (1998), Fortis (2007-8), Dexia (2008), <strong>the</strong><br />

Icelandic system (2008), and <strong>of</strong> course, Lehman Bro<strong>the</strong>rs (2008), to which we can now add MF Global, are all<br />

illustrative <strong>of</strong> <strong>the</strong> difficulties <strong>of</strong> resolving failing <strong>institutions</strong> with cross-border operations. Unfortunately, despite this<br />

“long, troubling history”, Herring argued as recently as 2011 that “no real progress has been made.”<br />

Schoenmaker and Osterloo investigated <strong>the</strong> cross-border externalities <strong>of</strong> firm <strong>failure</strong> in Europe in 2004, concluding<br />

that <strong>the</strong> extent <strong>of</strong> cross-border externalities is closely tied with <strong>the</strong> extent <strong>of</strong> cross-border banking business, but that<br />

national authorities tend to focus on national consequences ra<strong>the</strong>r than cross-border externalities. Schoenmaker<br />

notes that without a convergence <strong>of</strong> national interests <strong>the</strong>re are few incentives for internalising <strong>the</strong>se externalities.<br />

It is interesting to note in this regard <strong>the</strong> rise to prominence <strong>of</strong> concerns for systemic consequences and stability,<br />

which may prove to be <strong>the</strong> glue with which to join national interests in a world <strong>of</strong> cross-border banking. However,<br />

<strong>the</strong>re is <strong>of</strong>ten a gap between agreement in principle and committed action in practice.<br />

For Avgouleas, Goodhart and Schoenmaker, <strong>the</strong> problem <strong>of</strong> cross-border resolution is that <strong>the</strong>re is a “gross<br />

incompatability” between global cross-border reality and national regulatory/legal attempts to respond. They point<br />

to a continuing divergence in insolvency regimes between jurisdictions, between those that operate a “territorial”<br />

approach, whereby assets held in a particular country are ring-fenced, and those that operate a “universal”<br />

approach, whereby <strong>the</strong> group is treated as a whole, across borders. Institutions which operate in multiple<br />

jurisdictions may as a result be subject to conflicting regimes, which may create conflict between regulators and<br />

insolvency practitioners. This marks a “glaring weakness” in <strong>the</strong> system. It is not clear that this weakness has been<br />

addressed by existing proposals, though many academics recognise that significant progress has been made in many<br />

o<strong>the</strong>r respects.<br />

Outstanding Issues<br />

Practical implementation <strong>of</strong> recovery and resolution regimes is now crucial. However, implementation <strong>of</strong>ten throws<br />

up difficulties, both expected and unexpected. Progress is likely to be regionally diverse. Both US and UK banks have<br />

achieved much, owing to <strong>the</strong> proactivity <strong>of</strong> <strong>the</strong>ir respective regulators, who required draft plans in 2010. This<br />

progress is not reflected in <strong>the</strong> EU or Japan, and particularly in <strong>the</strong> latter, where guidance is yet to be published.<br />

However, in all cases it appears that recovery plans are being prioritised over resolution plans, for which less work<br />

has been done in all jurisdictions. The level <strong>of</strong> work required for <strong>the</strong> resolution aspects plans will vary depending on<br />

banks’ domicile There is a danger that <strong>the</strong> sheer difficulty <strong>of</strong> rationalising complex banking structures to such a level<br />

as to satisfy regulators <strong>of</strong> <strong>the</strong>ir resolvability will delay <strong>the</strong> process. Companies should not underestimate <strong>the</strong> extent<br />

<strong>of</strong> <strong>the</strong> work required, both now and on a continuous basis in <strong>the</strong> future.<br />

The core problems for cross-border resolution remain <strong>the</strong> divergence <strong>of</strong> local legal systems for dealing with<br />

insolvency, and <strong>the</strong> lack <strong>of</strong> an international burden-sharing protocol for funding <strong>the</strong> resolution <strong>of</strong> failed firms. Given<br />

that regulators believe a binding treaty to be infeasible, <strong>the</strong> key developments will be <strong>the</strong> ongoing drafting and<br />

revision <strong>of</strong> banks’ plans, as well as <strong>the</strong> requisite data collection. More progress on cross-border elements may come<br />

in time as current plans are assessed and regulators can compare <strong>the</strong>oretical aspirations against practical outcomes.<br />

But regulators will need to work toge<strong>the</strong>r closely to overcome mistrust between home and host authorities.<br />

<strong>Resolution</strong> is <strong>of</strong> course more complicated for systemically important <strong>financial</strong> <strong>institutions</strong> (SIFIs). By definition, <strong>the</strong><br />

<strong>failure</strong> <strong>of</strong> <strong>the</strong>se <strong>institutions</strong> will have systemic implications, and it is an open question as to whe<strong>the</strong>r resolution tools<br />

which may work for single non-systemic <strong>institutions</strong> will function as intended in <strong>the</strong> midst <strong>of</strong> a systemic crisis.<br />

Finally, <strong>the</strong> extension <strong>of</strong> resolution regimes to non-bank <strong>institutions</strong> such as insurance companies, investment firms<br />

and CCPs will provide more difficulties for regulatory authorities and firms <strong>the</strong>mselves. Discussions about non-bank<br />

resolution are in <strong>the</strong>ir relative infancy, and a lot is still to play for in terms <strong>of</strong> <strong>the</strong> eventual outcomes.<br />

For more analysis, as well as a more complete bibliography, upcoming events, and past event proceedings, visit www.icffr.org