You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

There are several developments under construction,<br />

including Novi Zagreb’s Avenue Mall shopping centre<br />

and Erste Bank new headquarters. In the wider<br />

centre, Hypo Centre and Zagreb Tower are due to<br />

be fi nished in early <strong>20</strong>07. Among others, block B,<br />

C and D of Almeria tower, Poslovni Centar <strong>20</strong>00<br />

and Fingo Project are due to be delivered in <strong>20</strong>07.<br />

The refurbishment of ILICA 1 tower in the centre of<br />

Zagreb is also under way, and it is expected to be<br />

fi nished in the second half of <strong>20</strong>07.<br />

Demand<br />

In <strong>20</strong>06 the supply of good quality offi ce space in the<br />

market was higher than demand for the fi rst time.<br />

Tenants who generally require higher quality and<br />

fl exible space with high density parking are tending<br />

to move from class B/C city-centre buildings to class<br />

A offi ces in the CBD and secondary business zone.<br />

Despite reductions in rents for down-town class B/C<br />

offi ces over <strong>20</strong>06, this may mean that older offi ce<br />

buildings will lose some tenants and potentially be<br />

converted back into residential premises over the<br />

next few years.<br />

Recent signifi cant offi ce lettings<br />

Building Size (m²) Tenants<br />

NETCity office<br />

building<br />

Almeria Tower 2,000<br />

3,000<br />

1,000<br />

6,000 VolksBank Leasing,<br />

Vestigo, Croatia Telecom<br />

(Mobile)<br />

Asea Brown Boveri (ABB)<br />

SG (Splitska Banka)<br />

Agrokor<br />

Almeria B 9,500 Siemens<br />

Eurotower 800 Zagreb Stock Exchange<br />

Eurotower 1,600 KPMG<br />

Business Centre<br />

International<br />

1,000 Zagrebačka Županija<br />

Grawe Vukovarska 1,500 Iskon Internet<br />

Grand Centre 2,000 Generali<br />

Grand Centre<br />

Source: <strong>King</strong> <strong>Sturge</strong> <strong>20</strong>07<br />

2,000 Strabag<br />

Vacancy<br />

In <strong>20</strong>05, Zagreb’s class A offi ce vacancy rates was nil<br />

due to limited supply. However, vacancy rates rose<br />

substantially in <strong>20</strong>06 and this trend may continue<br />

over the next 12-18 months due to increasing<br />

development activity and is expected to top-out at<br />

around 5-7%.<br />

Vacancy rates of class B offi ce space are expected<br />

to grow more strongly, triggering rental decline<br />

followed by a potential change of use for these<br />

buildings.<br />

www.kingsturge.com 11<br />

Rents<br />

Prime offi ce rents have been slightly falling during<br />

<strong>20</strong>06 and currently stand around €18/m 2 /month.<br />

Due to a number of new developments that will be<br />

fi nished in the fi rst half of <strong>20</strong>07, Zagreb prime rents<br />

are expected to fall slightly. The current range is<br />

from €17 to €18/m 2 /month in the CBD, €13 to €16<br />

/m 2 /month in the wider centre, and €10 to €14/m 2 /<br />

month in out-of-town locations.<br />

City-centre rents are falling more dramatically than<br />

in other areas due to occupiers moving to class A<br />

offi ces in other locations.<br />

Zagreb’s prime rents are slightly lower that in other<br />

Eastern European capitals.<br />

Offi ce rents<br />

Location Range <strong>20</strong>06 €/m²/month<br />

CBD – Class A 17 - 18<br />

Wider Centre – Class A 13 - 16<br />

Out of Town 10 - 14<br />

Footnote: rents assume an office of 500m² to 1,000m². Figures quoted are<br />

asking or headline rents where rents are measured on gross internal floor<br />

area with common areas rentalised. Rents exclude occupational costs such as<br />

service charges and incentives.<br />

Source: <strong>King</strong> <strong>Sturge</strong>, January <strong>20</strong>07<br />

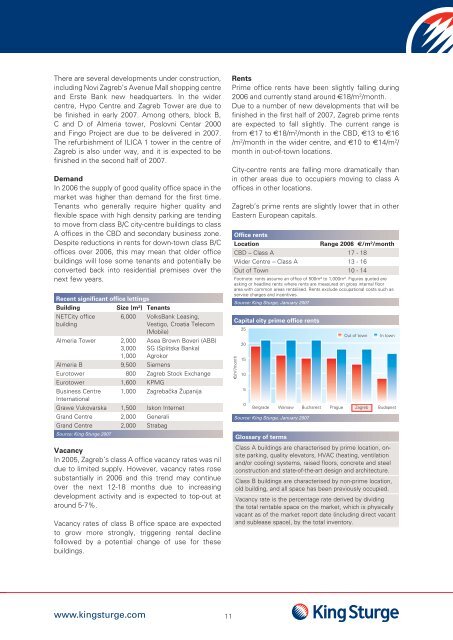

Capital city prime offi ce rents<br />

€/m 2 /month<br />

25<br />

<strong>20</strong><br />

15<br />

10<br />

5<br />

0<br />

Belgrade<br />

Warsaw<br />

Source: <strong>King</strong> <strong>Sturge</strong>, January <strong>20</strong>07<br />

Glossary of terms<br />

Bucharest<br />

Prague<br />

Out of town In town<br />

Zagreb<br />

Budapest<br />

Class A buildings are characterised by prime location, onsite<br />

parking, quality elevators, HVAC (heating, ventilation<br />

and/or cooling) systems, raised floors, concrete and steel<br />

construction and state-of-the-art design and architecture.<br />

Class B buildings are characterised by non-prime location,<br />

old building, and all space has been previously occupied.<br />

Vacancy rate is the percentage rate derived by dividing<br />

the total rentable space on the market, which is physically<br />

vacant as of the market report date (including direct vacant<br />

and sublease space), by the total inventory.