Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Managing the Checkbook<br />

Financial Services Department<br />

The <strong>City</strong>’s Annual <strong>Budget</strong>

Municipal<br />

• Operating <strong>Budget</strong><br />

• Capital <strong>Budget</strong><br />

• Debt Service<br />

• Excise Tax Backed<br />

• Property Tax Backed<br />

• Dedicated revenues<br />

[water/sewer, etc]<br />

• Contingency<br />

Personal<br />

• Food, utilities, clothing<br />

• New home, new car,<br />

home improvements<br />

• Mortgage, car loan,<br />

credit card<br />

• Savings

• Residential sanitation collection rates<br />

unchanged<br />

• Water rates unchanged<br />

• Sewer rates unchanged

• Rose Lane Aquatic Center and Foothills Aquatic<br />

Center open for the summer<br />

• Library hours remain unchanged<br />

• Parks remain open for use<br />

• Police CAT Team services<br />

• Fire Crisis Response services<br />

• All special events except Jazz & Blues Festival<br />

• <strong>Glendale</strong> 11 TV broadcasts

Managing the Checkbook<br />

Financial Services Department<br />

The <strong>City</strong>’s Annual <strong>Budget</strong>

B = Adopted, E = Estimate, D =<br />

Draft

B = Adopted, E = Estimate, D =<br />

Draft

B = Adopted, E = Estimate, D =<br />

Draft

B = Adopted, E = Estimate, D =<br />

Draft

2-Year Lag<br />

B = Adopted, E = Estimate, D =<br />

Draft

B = Adopted, E = Estimate, D =<br />

Draft

Rate<br />

Increase<br />

Dec 2007<br />

(Mid-Year FY08)<br />

B = Adopted, E = Estimate, D =<br />

Draft

B = Adopted, E = Estimate, D =<br />

Draft

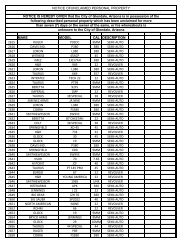

Average Minimum Maximum Current Proposed<br />

FY 94-2013 FY 1999 FY 2009 FY 2013 FY 2014<br />

COG Primary Property Tax Rate $0.4400 $0.2432 $0.2252 $0.4974<br />

COG Secondary Property Tax Rate $1.3400 $1.3519 $1.6753 $1.7915<br />

Primary Property Tax to COG $71.17 $64.73 $81.08 $39.77 $70.88<br />

Secondary Property Tax to COG $305.42 $197.13 $655.67 $295.86 $255.29<br />

Total Property Tax to COG $376.59 $261.86 $736.75 $335.63 $326.17<br />

Secondary Valuation $221,830 $147,114 $485,000 $176,600 $142,500

• Taxes<br />

• State Shared Revenues<br />

• User Fees & Charges<br />

• Penalties & Fines<br />

• Development Fees

• “Mortgage Payment” on city facilities<br />

• Determined by a payment schedule<br />

• Normally a 10-15 year term, but can be<br />

up to 30 years depending on market<br />

conditions

• Allows for unforeseen emergencies<br />

• Can cover revenue shortfalls<br />

• Spending <strong>of</strong> it must be authorized by Council<br />

• Rainy day fund is essential for sound<br />

financial planning and fiscal stability