Comprehensive Annual Financial Report - Harford County Public ...

Comprehensive Annual Financial Report - Harford County Public ...

Comprehensive Annual Financial Report - Harford County Public ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

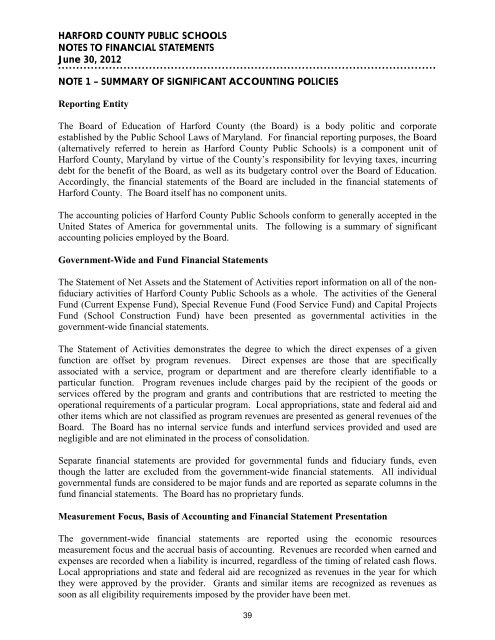

HARFORD COUNTY PUBLIC SCHOOLS<br />

NOTES TO FINANCIAL STATEMENTS<br />

June 30, 2012<br />

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

<strong>Report</strong>ing Entity<br />

The Board of Education of <strong>Harford</strong> <strong>County</strong> (the Board) is a body politic and corporate<br />

established by the <strong>Public</strong> School Laws of Maryland. For financial reporting purposes, the Board<br />

(alternatively referred to herein as <strong>Harford</strong> <strong>County</strong> <strong>Public</strong> Schools) is a component unit of<br />

<strong>Harford</strong> <strong>County</strong>, Maryland by virtue of the <strong>County</strong>’s responsibility for levying taxes, incurring<br />

debt for the benefit of the Board, as well as its budgetary control over the Board of Education.<br />

Accordingly, the financial statements of the Board are included in the financial statements of<br />

<strong>Harford</strong> <strong>County</strong>. The Board itself has no component units.<br />

The accounting policies of <strong>Harford</strong> <strong>County</strong> <strong>Public</strong> Schools conform to generally accepted in the<br />

United States of America for governmental units. The following is a summary of significant<br />

accounting policies employed by the Board.<br />

Government-Wide and Fund <strong>Financial</strong> Statements<br />

The Statement of Net Assets and the Statement of Activities report information on all of the nonfiduciary<br />

activities of <strong>Harford</strong> <strong>County</strong> <strong>Public</strong> Schools as a whole. The activities of the General<br />

Fund (Current Expense Fund), Special Revenue Fund (Food Service Fund) and Capital Projects<br />

Fund (School Construction Fund) have been presented as governmental activities in the<br />

government-wide financial statements.<br />

The Statement of Activities demonstrates the degree to which the direct expenses of a given<br />

function are offset by program revenues. Direct expenses are those that are specifically<br />

associated with a service, program or department and are therefore clearly identifiable to a<br />

particular function. Program revenues include charges paid by the recipient of the goods or<br />

services offered by the program and grants and contributions that are restricted to meeting the<br />

operational requirements of a particular program. Local appropriations, state and federal aid and<br />

other items which are not classified as program revenues are presented as general revenues of the<br />

Board. The Board has no internal service funds and interfund services provided and used are<br />

negligible and are not eliminated in the process of consolidation.<br />

Separate financial statements are provided for governmental funds and fiduciary funds, even<br />

though the latter are excluded from the government-wide financial statements. All individual<br />

governmental funds are considered to be major funds and are reported as separate columns in the<br />

fund financial statements. The Board has no proprietary funds.<br />

Measurement Focus, Basis of Accounting and <strong>Financial</strong> Statement Presentation<br />

The government-wide financial statements are reported using the economic resources<br />

measurement focus and the accrual basis of accounting. Revenues are recorded when earned and<br />

expenses are recorded when a liability is incurred, regardless of the timing of related cash flows.<br />

Local appropriations and state and federal aid are recognized as revenues in the year for which<br />

they were approved by the provider. Grants and similar items are recognized as revenues as<br />

soon as all eligibility requirements imposed by the provider have been met.<br />

39