Annual Report 2005 - Boehringer Ingelheim

Annual Report 2005 - Boehringer Ingelheim

Annual Report 2005 - Boehringer Ingelheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Value through Innovation<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2005</strong><br />

nopq

Financial Highlights<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> group of companies<br />

Amounts in millions of EUR, unless otherwise indicated <strong>2005</strong> 2004 Change<br />

Net sales 9,535 8,157 17 %<br />

by region<br />

Europe 33 % 32 %<br />

Americas 48 % 48 %<br />

Asia, Australasia, Africa 19 % 20 %<br />

by business area<br />

Human Pharmaceuticals 96 % 96 %<br />

Animal Health 4 % 4 %<br />

Research and development 1,360 1,232 10 %<br />

Personnel costs 2,671 2,443 9 %<br />

Average number of employees* 37,406 35,529 5 %<br />

Operating income 1,923 1,372 40 %<br />

Operating income as % of sales 20.2 % 16.8 %<br />

Income after taxes 1,514 908 67 %<br />

Income after taxes as % of sales 15.9 % 11.1 %<br />

Shareholders’ equity 4,609 4,363 6 %<br />

Return on shareholders’ equity 34.2 % 23.1 %<br />

Cash flow 2,069 1,430 45 %<br />

Investments in tangible assets 532 427 25 %<br />

Depreciation of tangible assets 439 377 16 %<br />

* including the total number of employees<br />

in joint ventures included in the consolidation

Contents<br />

2 The Shareholders’ Perspective<br />

4 Key Aspects of <strong>2005</strong><br />

8 Our Caring Culture<br />

10 Our Commitment<br />

12 For Our Neighbours<br />

14 For Our People<br />

18 For Our Environment<br />

22 Our R&D Drive<br />

26 “HIV is Being Played Down”<br />

28 Our Strength in R&D + Medicine<br />

Business Development<br />

Prescription Medicines<br />

40 A New Quality of Treatment, a New Quality of Life<br />

44 Overview Prescription Medicines<br />

Consumer Health Care<br />

56 Let’s Talk About it<br />

60 Overview Consumer Health Care<br />

Biopharmaceuticals and Chemicals<br />

62 Time is Critical<br />

66 Overview Biopharmaceuticals and Chemicals<br />

Animal Health<br />

70 Helping the Heart<br />

74 Overview Animal Health<br />

77 Group Management <strong>Report</strong><br />

Consolidated Financial Statements <strong>2005</strong><br />

90 Overview of the Major Consolidated Companies<br />

92 Consolidated Balance Sheet<br />

93 Consolidated Profit and Loss Statement<br />

94 Cash Flow Statement<br />

95 Statement of Changes in Group Equity<br />

96 Notes to the Consolidated Financial Statements<br />

114 Auditor’s <strong>Report</strong><br />

116 Glossary<br />

Flap Comparison of Balance Sheet/Financial Data 1996–<strong>2005</strong>

8 22 40 56 62 70<br />

Our Company<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> is a research-driven group of companies<br />

dedicated to researching, developing, manufacturing and marketing<br />

pharmaceuticals that improve health and quality of life.<br />

Our business consists largely of Prescription Medicines, Consumer Health<br />

Care, Biopharmaceuticals and Animal Health. We focus on the production<br />

of innovative drugs and treatments that represent major therapeutic<br />

advances.<br />

Excellence in innovation and technology guides our actions in all areas.<br />

Our products have long been highly successful in the treatment<br />

of respiratory, cardiovascular, central nervous system, urological and<br />

virological disorders. In addition we have intensified our research into<br />

the immune system, metabolic diseases and cancer.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong>, which currently has almost 37,500 employees,<br />

has 143 affiliated companies spread around the globe. We have research<br />

facilities in nine countries and production plants in more than 20.<br />

Our pharmaceuticals research and development spending corresponds<br />

to about 18 % of net sales in Prescription Medicines.<br />

Our headquarters is at <strong>Ingelheim</strong>, the German town where the company<br />

was founded in 1885.

Value through Innovation<br />

Our vision drives us forward.<br />

It helps us to foster value creation<br />

through innovation throughout<br />

our company and to look to the<br />

future with constantly renewed<br />

commitment and ambition.

The Shareholders’ Perspective<br />

The importance of family-owned companies in<br />

Germany is repeatedly given prominence in the<br />

public debate over significant economic policy<br />

issues, for instance, regarding the labour market<br />

situation or taxation policy. Family-owned<br />

companies represent a peculiarity in the German<br />

system. Of the 50 largest European companies of<br />

this type, more than half come from Germany.<br />

The results of investigations lead to the conclu-<br />

sion that such companies are, in terms of both<br />

revenues and earnings development, more than<br />

competitive compared with companies listed on<br />

the stock exchange. Looking into the reasons for<br />

this, you find features like long-term orientation<br />

combined with higher attention to risk, personal<br />

commitment of the owners as well as a strong<br />

employee focus. These aspects also apply to<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong>, which serves as a positive<br />

example with its successful business and<br />

corporate development.<br />

We are frequently described as a company that<br />

is “different” to its competitors. What is meant<br />

by that? The criteria which mark us out and<br />

form <strong>Boehringer</strong> <strong>Ingelheim</strong>’s identity are our<br />

orientation towards values, such as reliability<br />

and predictability, the close alignment with the<br />

needs of patients and physicians, the awareness<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

of the importance of our employees, and our<br />

long-term thinking and commitment. Our<br />

strength is founded on our stability. As a<br />

family-owned company, we can transform the<br />

parameters mentioned above into a well-<br />

balanced strategic approach along with a market-<br />

orientated growth strategy. We are not under<br />

pressure from the short-term demands of<br />

anonymous investors or the capital market.<br />

This does not, however, mean that we do not<br />

comply with standards and norms that apply to<br />

companies listed on the stock market. In this<br />

respect, we share the approach of those compa-<br />

nies perceiving themselves as Good Corporate<br />

Citizens. Social commitment, openness and<br />

transparency are of utmost importance for us.<br />

The principle of sustainability – applied to the<br />

long-term, stable development of the company’s<br />

value, applied to the selection and targeted<br />

promotion and fair treatment of our employees,<br />

and applied to environment-friendly and socially-<br />

orientated economies – is reflected in our<br />

Leitbild, the guiding principles for our corporate<br />

behaviour. For us, sustainability is the basis of<br />

stability and success.<br />

Our company is growing dynamically. Indeed, in<br />

the last few years, it has clearly outpaced average<br />

growth of the pharmaceutical market. In <strong>2005</strong>,<br />

the successful development continued once<br />

again. Once more we are in the top ranks of<br />

the pharmaceutical companies with the strongest<br />

growth. We have succeeded in providing new<br />

therapeutic options for our patients with a row

of innovative medications. Our expectations for<br />

<strong>2005</strong> have been achieved or were exceeded in a<br />

whole number of areas. On all of these grounds,<br />

the Shareholders of <strong>Boehringer</strong> <strong>Ingelheim</strong> are<br />

very satisfied with the course and results of the<br />

business year.<br />

Nevertheless, we must not ignore the potential<br />

risks the pharmaceutical industry is facing.<br />

Developing new, innovative medicines is a<br />

protracted and expensive process. Only a few<br />

research approaches end up as new medicines<br />

and make it to market approval. The healthcare<br />

policy environment in most countries, which is<br />

afflicted with ever-increasing uncertainties and<br />

continuously deteriorating, represents a<br />

considerable burden for our industry. For capital<br />

expenditure creating new jobs or developing<br />

innovative medicines, we win many public<br />

plaudits. Sadly, these fine-sounding words are in<br />

reality not often followed by corresponding<br />

deeds.<br />

Instead of strengthening the power to innovate –<br />

for which an appropriate risk premium is a<br />

pre-condition, that is to say, reasonable prices<br />

and adequate protection of innovations against<br />

imitation – the precise opposite is happening.<br />

Prices are being forced down, reimbursement<br />

opportunities restricted and parallel imports<br />

encouraged. In our opinion, supporting<br />

economic progress in combating disease looks<br />

different. When making future investment<br />

decisions we will also have to take such aspects<br />

into consideration.<br />

In spite of such limitations, <strong>2005</strong> was once again<br />

a successful business year. The Shareholders and<br />

the Board of Managing Directors of <strong>Boehringer</strong><br />

<strong>Ingelheim</strong> took or prepared the decisions to<br />

achieve the goals we have set in close coopera-<br />

tion and coordination with the Advisory<br />

Board. The decisions concerned the company’s<br />

strategic direction, important business matters or<br />

decisions on capital expenditure.<br />

In regular joint sessions, the Advisory Board,<br />

the Shareholders’ Committee and the Board of<br />

Managing Directors have discussed the short<br />

and medium-term development of the company<br />

and the necessary decisions entailed.<br />

The Shareholders of <strong>Boehringer</strong> <strong>Ingelheim</strong> thank<br />

all employees, the Board of Managing Directors<br />

and the Advisory Board for their successful work<br />

and commitment in <strong>2005</strong>. The path <strong>Boehringer</strong><br />

<strong>Ingelheim</strong> has taken as an independent family-<br />

owned company also promises us growth and<br />

success for the future.<br />

Dr Heribert Johann<br />

Chairman of the Shareholders’ Committee<br />

The Shareholders’ Perspective

Key Aspects of <strong>2005</strong><br />

We are a research-driven pharmaceutical<br />

company that invests about 18 % of net sales of<br />

our Prescription Medicines business every year in<br />

the research and development of medicinal<br />

products. Our goal is to serve mankind through<br />

research into different diseases and to create the<br />

drugs and therapies to treat them. This principle<br />

guides all our business activities. Our success<br />

to date and our future prospects are measured by<br />

the degree of innovation of our new medicines<br />

now available to patients and by the innovative<br />

potential of our product pipeline. We are proud<br />

that in <strong>2005</strong> four million of patients worldwide<br />

affected by chronic obstructive pulmonary<br />

disease could benefit from our spiriva® and live<br />

a better life.<br />

For some years now, <strong>Boehringer</strong> <strong>Ingelheim</strong> has<br />

been one of the fastest-growing companies in the<br />

pharmaceutical industry. In <strong>2005</strong> again, we<br />

maintained a fast pace of dynamic growth.<br />

According to the market analysts IMS, employed<br />

by all pharmaceutical companies, we achieved<br />

the strongest growth of the top 20 pharma-<br />

ceutical companies. We also outpaced the<br />

average for the pharmaceutical market in all<br />

major regions of the world. This takes us to<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

position No. 14 worldwide in terms of sales,<br />

with a market share of 2 %.<br />

Strong international brands<br />

In <strong>2005</strong>, our net sales rose by around 17 % to EUR<br />

9.5 billion. Currency effects played a secondary<br />

role compared with previous years.<br />

Our growth was primarily driven by our pre-<br />

scription medicines products. spiriva®, for the<br />

treatment of chronic obstructive pulmonary<br />

disease, and mobic®, for the treatment of arthri-<br />

tis, both passed the blockbuster threshold of<br />

more than USD 1 billion annual net sales.<br />

micardis®, our product for the treatment of<br />

hypertension, and sifrol®/mirapex®, to treat<br />

Parkinson’s disease, were significant growth<br />

drivers too. flomax®/alna®, our drug for benign<br />

prostatic hyperplasia, also contributed to the<br />

successful sales development.<br />

To measure our development in financial results<br />

is one thing. But of ultimate importance for us<br />

is the benefit we offer to the millions of patients<br />

whom we have supported with our above<br />

mentioned drugs and for people infected with<br />

HIV. Since it was first introduced in 1996, we<br />

have helped a million patients with our drug<br />

viramune®. And the success of our viramune®<br />

Donation Programme to prevent the mother-to-<br />

child transmission of HIV in developing

countries since 2000 encourages us to put even<br />

greater emphasis on our efforts to create value<br />

for patients and society. The launch of our new<br />

HIV drug aptivus® in <strong>2005</strong> is thus another step<br />

towards fulfilling our commitment to ‘Value<br />

through Innovation’.<br />

Prescription Medicines, by far our largest busi-<br />

ness area, accounting for 76 % of total net sales,<br />

increased its turnover by more than 17 % to<br />

total EUR 7.2 billion. The share of our product<br />

portfolio which still enjoys patent protection or<br />

exclusivity rights rose to 59 %.<br />

Our other business areas also achieved signifi-<br />

cant growth. In Consumer Health Care (CHC),<br />

our self-medication business, net sales rose<br />

by 8.5 % to almost EUR 1.1 billion. This was<br />

mainly attributable to our flagship brands and<br />

leading products in the cough & cold and gastro-<br />

intestinal indications, such as bisolvon®,<br />

mucosolvan®, dulcolax® and buscopan®.<br />

In addition, pharmaton®, our well-established<br />

international brand for the improvement and<br />

maintenance of vitality and well-being, held the<br />

second strongest position in our CHC product<br />

portfolio.<br />

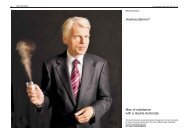

Members of the Board<br />

of Managing Directors:<br />

Dr Hans-Jürgen Leuchs<br />

Dr Andreas Barner<br />

Dr Alessandro Banchi<br />

Prof. Marbod Muff<br />

(from left to right)<br />

For some years, <strong>Boehringer</strong> <strong>Ingelheim</strong> has<br />

been one of the world’s largest manufacturers<br />

of biopharmaceuticals for industrial customers.<br />

We also market our own biotech products,<br />

metalyse® (heart attack) and actilyse® (stroke).<br />

Our overall biopharmaceuticals business,<br />

which grew by 40 % in <strong>2005</strong> to EUR 548 million,<br />

is expected to play an increasingly important<br />

role in combating many major and developing<br />

diseases.<br />

Our Animal Health business, which accounts for<br />

4 % of our net sales, has also grown above the<br />

market average in recent years. In <strong>2005</strong>, sales<br />

rose by almost 8 % to EUR 361 million.<br />

A key factor for <strong>Boehringer</strong> <strong>Ingelheim</strong>’s sustained<br />

success is our well-distributed presence in all<br />

important world markets. Our products are sold<br />

in some 150 countries. The USA, again by far<br />

the most important market in <strong>2005</strong>, generated<br />

36 % of our total net sales. Our US sales grew<br />

by 17 % to EUR 3.4 billion. Japan (+8 % to EUR<br />

1.2 billion) and Europe (+19 % to EUR 3.1 billion)<br />

also posted excellent development. Europe as a<br />

region contributed 33 % of our total net sales.<br />

The healthy business development of the past<br />

business year led to a 40 % rise in operating<br />

income (broadly comparable to EBIT), totalling<br />

EUR 1.9 billion and reflecting an operating<br />

margin of more than 20 %.<br />

Key Aspects of <strong>2005</strong>

Our successful business activities go hand in<br />

hand with increasing effectiveness in cost<br />

management through all areas of the corporation.<br />

Cost-effective pharmaceutical manufacture is<br />

one of the key factors in attracting new partners<br />

for third-party manufacture.<br />

Patented drugs or drugs with exclusivity con-<br />

tinue to drive our growth. Our product pipeline<br />

includes a number of promising substances<br />

in major indication areas such as respiratory,<br />

cardiovascular and inflammatory diseases,<br />

virology, urology and CNS. In addition, good<br />

progress was made with development candidates<br />

in oncology, metabolism and immunology. Our<br />

areas of research are divided across the four main<br />

research sites in Germany (Biberach), Austria<br />

(Vienna), the USA (Ridgefield) and Canada<br />

(Laval), in line with their defined key areas.<br />

In addition, our activities and projects are<br />

supported by strategic alliances and in-licensing<br />

of new technologies. In <strong>2005</strong>, we moved various<br />

candidates into predevelopment and develop-<br />

ment with promising prospects for the future.<br />

In a continued move to support this strong<br />

growth, we took the opportunity to increase our<br />

manpower by 5 % to total 37,400 employees in<br />

the past year, mainly in the USA, Germany and<br />

Spain.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

Outlook<br />

The gratifying development of our business in<br />

<strong>2005</strong> reflects the strengths of our company.<br />

However, yesterday’s successes are today’s history<br />

and the way ahead is uphill. The pharmapolitical<br />

measures in a number of important countries,<br />

starting with Germany, pose an increasing<br />

barrier to innovation and to patient’s access to<br />

new and better therapies. Developing medicines<br />

is a lengthy, costly and risky process. Short patent<br />

lifetimes, frequent regulatory interventions,<br />

rigorous price containment measures and fierce<br />

competition make it all the more difficult to<br />

guarantee the financial basis required for R&D.<br />

We once again expect to grow faster than the<br />

pharmaceutical market in 2006, although we are<br />

unlikely to match the growth rates posted in<br />

<strong>2005</strong>. mobic®, for example, is expected to face<br />

competition of the first generic versions in the<br />

USA in 2006. However, our product portfolio<br />

contains numerous branded medicines with<br />

medium to long-term patent protection which<br />

still have significant potential for growth.<br />

We are also pleased to have a number of interest-<br />

ing drug candidates for various indications<br />

in our promising pipeline. All in all, <strong>Boehringer</strong><br />

<strong>Ingelheim</strong> is optimistic about the future.<br />

Dr Alessandro Banchi Dr Andreas Barner Dr Hans-Jürgen Leuchs<br />

Prof. Marbod Muff

Shareholders’ Committee<br />

Dr Heribert Johann<br />

Chairman of the<br />

Shareholders’ Committee<br />

Albert <strong>Boehringer</strong><br />

Christian <strong>Boehringer</strong><br />

Christoph <strong>Boehringer</strong><br />

Ferdinand von Baumbach<br />

Hubertus von Baumbach<br />

Dr Mathias <strong>Boehringer</strong><br />

Advisory Board<br />

Prof. Michael Hoffmann-Becking<br />

Attorney at Law, Düsseldorf<br />

Chairman of the Advisory Board<br />

Dr Rolf-E. Breuer<br />

Chairman of the Supervisory Board<br />

Deutsche Bank AG,<br />

Frankfurt (Main)<br />

Prof. Fredmund Malik<br />

Chairman of the Board<br />

Managementzentrum<br />

St. Gallen Holding AG<br />

Prof. Axel Ullrich<br />

Director of the Max Planck Institute<br />

for Biochemistry, Martinsried<br />

Dr Heinrich Weiss<br />

Chairman of the Board<br />

SMS AG, Düsseldorf<br />

Board of Managing Directors<br />

Dr Alessandro Banchi<br />

Corporate Board Division<br />

Chairman of the Board<br />

Corporate Board Division<br />

Pharma Marketing and Sales<br />

Dr Andreas Barner<br />

Vice-Chairman of the Board<br />

Corporate Board Division<br />

Pharma Research,<br />

Development and Medicine<br />

Dr Hans-Jürgen Leuchs<br />

Corporate Board Division<br />

Operations<br />

Corporate Board Division<br />

Animal Health<br />

Prof. Marbod Muff<br />

Corporate Board Division<br />

Finance<br />

Corporate Board Division<br />

Human Resources<br />

Key Aspects of <strong>2005</strong>

Our caring culture<br />

The caring culture to which <strong>Boehringer</strong> <strong>Ingelheim</strong> has been committed<br />

for well over a century embraces a broad range of stakeholders from<br />

our patients, our employees and their families through neighbouring<br />

communities and society at large to our natural environment.<br />

Corporate responsibility as practised by our company takes many forms. Of paramount<br />

importance for us are the needs of our patients. It is the quest for innovation and medical<br />

breakthrough which drives all our activities. We understand that the importance of our<br />

company directly depends on the value of the therapies which we can present to those in<br />

need of medical help. And we fully grasp the central role of our employees in all our<br />

endeavours.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> has been always regarded as an excellent employer. From the very<br />

beginning, it has focused on providing employees with an attractive place to work, a place<br />

in which they feel their contribution is fully recognised and properly rewarded. But our<br />

sense of responsibility does not stop there. It has always reached out far beyond our factory<br />

gates and today addresses many issues of a truly global nature.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> complies with the intention and basic principles of corporate<br />

governance and corporate social responsibility as proposed by international organisations,<br />

such as the United Nations (UN), the World Health Organization (WHO), the Organisation<br />

for Economic Co-operation and Development (OECD) or the European Union (EU).<br />

We regard ourselves as a good corporate citizen in all countries in which we operate, or<br />

where our products are available. We fully comply with the principles set out in the Global<br />

Compact in 1999 under a United Nations initiative.<br />

Such principles are already fully integrated into our business activities around the world<br />

and guide our strategy, corporate culture and day-to-day operations. Our aim is to provide<br />

full transparency concerning our business and corporate conduct within the framework of<br />

our annual report and other publications.<br />

In order to sustain our corporate responsibility, we depend on our business success, driven<br />

by product innovation and the morale of our people.<br />

Photo: Young tsunami survivors gather at new school-cum-village hall in Krueng Raya, Indonesia,<br />

supported by <strong>Boehringer</strong> <strong>Ingelheim</strong>.<br />

Our caring culture

10<br />

Our commitment<br />

We have committed ourselves to the goal of serving mankind through<br />

research into diseases and the development of new drugs and therapies.<br />

In this endeavour the future of the Corporation will depend on its innovative<br />

capability. <strong>Boehringer</strong> <strong>Ingelheim</strong> strives for medical breakthroughs and<br />

invests heavily in research, development and medicine for therapies which<br />

fulfil unmet medical needs.<br />

In improving access to anti-AIDS drugs,<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> acknowledges its special<br />

responsibility as a research-driven pharma-<br />

ceutical company in the war on the pandemic.<br />

It is engaged in wide-ranging initiatives to<br />

combat AIDS. The company has increased efforts<br />

in HIV/AIDS research, in supplying anti-AIDS<br />

drugs free of charge to treat the transmission of<br />

the disease from mother-to-child during birth,<br />

or providing them at substantially reduced prices<br />

to developing countries for chronical treatment.<br />

It has furthermore increased its activities supply-<br />

ing knowledge and training and supporting<br />

philanthropic initiatives via its affiliates in areas<br />

strongly affected by HIV/AIDS.<br />

Since 2000, <strong>Boehringer</strong> <strong>Ingelheim</strong> has given free<br />

access to single-dose viramune® (nevirapine),<br />

to be used alone or in combination with other<br />

drugs, to prevent mother-to-child transmission<br />

of the HI virus during birth. The company<br />

currently donates the product to some 140<br />

programmes in around 60 countries in Africa,<br />

Asia, Latin America and Eastern Europe. In total<br />

some 700,000 mother and child pairs have been<br />

treated so far.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> strives to facilitate the<br />

access to life-saving nevirapine. Five voluntary<br />

licenses to manufacture and market generic<br />

nevirapine have been granted to companies in<br />

South Africa, Nigeria, Egypt and Kenya.<br />

Moreover, as a founding partner of the Accelerat-<br />

ing Access Initiative (AAI), <strong>Boehringer</strong> <strong>Ingelheim</strong><br />

offers developing countries considerable dis-<br />

counts in order to enable access to viramune®.<br />

Some 6,000 of Papua New Guinea’s 5.3 million<br />

inhabitants are infected with HIV and the infec-<br />

tion rate is 1,000 per year. Very few infected<br />

people go to healthcare centres so the figures are<br />

likely to be vastly underestimated. Apart from the<br />

viramune® Donation Programme, <strong>Boehringer</strong><br />

<strong>Ingelheim</strong> in partnership with other pharmaceu-<br />

tical companies, the Catholic Aids Office, the<br />

Australasian Society for HIV Medicine (ASHM)<br />

and the government of Papua New Guinea<br />

(PNG), have designed and implemented a pilot<br />

project to train healthcare workers under the<br />

auspices of the Collaboration for Health in Papua<br />

New Guinea.<br />

Unlike other programmes, this model used a<br />

multi-disciplinary approach to train teams of<br />

healthcare workers rather than doctors only.

Uganda has made strong progress in reducing the prevalence<br />

rate of HIV. The key to this success has been public openness,<br />

at all levels of society, in addressing the issue. Here, people<br />

living with HIV in Uganda demonstrate their support<br />

for treatment at the opening of a free AIDS clinic in Masaka,<br />

close to where the pandemic is thought to have begun.<br />

The teams consisted of physicians, nurses,<br />

counsellors, social workers and technicians<br />

working in healthcare centres. Topics covered in<br />

workshops included basic infection control,<br />

infection prevention, record keeping, diagnosis<br />

and management of opportunistic infections.<br />

The collaboration for Health in PNG is an initia-<br />

tive of a group of pharmaceutical manufacturers<br />

committed to the treatment and care of people<br />

living with HIV/AIDS.<br />

Addressing infrastructure needs<br />

As improving access to treatment remains<br />

seriously limited in many developing countries<br />

due to local structural problems in healthcare,<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> has also engaged increas-<br />

ingly in projects to improve education and<br />

relevant infrastructure.<br />

In addition to donation and increasing access to<br />

drugs, the company continues to explore ways<br />

to partner governments and NGOs to improve<br />

healthcare in developing countries.<br />

Initiatives the company has already undertaken<br />

in South Africa include the “Turning the Tide”<br />

programme of training and education for health<br />

professionals in HIV and its management. This<br />

has been extended into Swaziland and Botswana<br />

and now reaches over 1,000 healthcare workers.<br />

In <strong>2005</strong>, <strong>Boehringer</strong> <strong>Ingelheim</strong> opened discus-<br />

sions with healthcare organisations in Uganda<br />

with a view to possibly replicating schemes<br />

which have been successful in other parts of<br />

Africa.<br />

Among other initiatives was the Student<br />

Education Programme in collaboration with the<br />

University of Cape Town, South Africa, which<br />

provides full financial support from <strong>Boehringer</strong><br />

<strong>Ingelheim</strong> for medical students from disadvan-<br />

taged backgrounds. The <strong>Boehringer</strong> <strong>Ingelheim</strong><br />

Lung Institute at the same university has been set<br />

up as a centre of excellence to support clinical<br />

trial activities in the country with research<br />

facilities in infectious and respiratory diseases.<br />

In <strong>2005</strong>, the <strong>Boehringer</strong> <strong>Ingelheim</strong> Training and<br />

Facilitation Unit was opened in Botswana.<br />

Our commitment 11

1<br />

For our neighbours<br />

We are fundamentally committed to fostering economic and social wellbeing<br />

in the countries and communities where we operate. Working together<br />

as a corporate entity and as individuals using their own time, we seek in a<br />

people-orientated and inspirational way to deliver value through innovation<br />

in all we do. We contribute actively to communities, charitable organisations,<br />

research, science, education, healthcare, environmental protection<br />

and cultural projects.<br />

As <strong>2005</strong> began, the world was becoming aware of<br />

the enormous scale of the devastation wreaked<br />

by the tsunami that struck Southeast Asia.<br />

People from our operation in Indonesia reacted<br />

immediately, sending donations of clothes,<br />

food, medication and toys to the Aceh region of<br />

Sumatra. A crisis team made up of volunteer<br />

employees also went to Aceh to see how best to<br />

further support the local population.<br />

Among the displaced in Aceh were more than<br />

150,000 children, many traumatised by the<br />

disaster. The company crisis team therefore<br />

decided to fund the construction of a trauma<br />

centre, which also serves as a school and village<br />

hall in Krueng Raya village. Aksari Ibnu, who<br />

co-headed the <strong>Boehringer</strong> <strong>Ingelheim</strong> Indonesia<br />

tsunami task force, commenting on the school<br />

opening in July, said: “The smiling faces of young<br />

children and the people of Krueng Raya was a<br />

huge reward for our team who had all dedicated<br />

themselves to this worthwhile project.”<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

The company made substantial donations<br />

through its international and local organisations<br />

to aid agencies involved in the <strong>2005</strong> disasters,<br />

the Asian tsunami and the devastating earth-<br />

quake that hit Kashmir in October. In response<br />

to the hurricane Katrina disaster in September,<br />

the company’s US organisation also funded a free<br />

mobile clinic to treat people in New Orleans in<br />

addition to making financial and product contri-<br />

butions through MAP International to disaster<br />

relief efforts in the USA and elsewhere.<br />

Our people taking the initiative<br />

Our wide range of charitable activities in the<br />

USA heavily involves volunteering by employees.<br />

A “Day of Caring” sponsored by the company,<br />

gives employees at our Ridgefield, Connecticut,<br />

USA, site the opportunity to volunteer for tasks<br />

to help the aged and deprived. In many ways,<br />

from decorating homes to reading to children at<br />

day care centres. Our US employees also partici-<br />

pate in numerous sponsored events to raise funds<br />

for good causes. At our Roxane, Ohio, USA, site<br />

employees help the Salvation Army buy and<br />

distribute Christmas presents for poor families.

In the Philippines, our employees stepped in to<br />

help families made homeless when their shanties<br />

burned down at Baseco Compound in Tondo.<br />

Not only did the employees donate funds to build<br />

eight new row houses for the homeless, they also<br />

helped with the construction work in their free<br />

time. The homes, built in cooperation with an<br />

organisation dedicated to eradicating homeless-<br />

ness, were handed over to their new occupants in<br />

June.<br />

Promoting equal opportunity<br />

In Latin America, the company has a long,<br />

solid tradition of charitable activities. In Brazil,<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> launched a two-year social<br />

responsibility programme, “Conectar”, directed at<br />

disabled people to help them prepare for jobs<br />

market (many have never been employed). An<br />

employment assistance programme in the favelas<br />

of São Paulo is another example of how we<br />

actively promote fairness and equal opportunity.<br />

The company’s human resources professionals,<br />

voluntarily and in co-operation with those of<br />

other organisations, provide youngsters with<br />

poor prospects hands-on training and support in<br />

employment counselling, identifying ways to<br />

move forward and ensuring professional and<br />

emotional back-up.<br />

In Venezuela, the company gives training to the<br />

doctors at the respiratory care centres in Chacao<br />

neighbourhood and the Hospital Pérez de León<br />

in Caracas. The hospital also receives free medi-<br />

cines and equipment.<br />

Employees at <strong>Boehringer</strong> <strong>Ingelheim</strong> Portugal volunteered to<br />

build houses for two families in need in Braga in the north of<br />

the country in association with the humanitarian organisation<br />

Habitat for Humanity. Miguel Moreira, Area Manager for<br />

Prescription Medicines in Portugal, an active volunteer, said:<br />

“I am very proud that the company where I work shares the<br />

same concern: helping the ones most in need.”<br />

In Colombia, we not only contribute to health-<br />

care and schooling for people in our immediate<br />

community, but also support two foundations:<br />

the Padre Luna Farms, which help battered<br />

children and teach agricultural labourers; and<br />

Fundafidro, an organisation working with health-<br />

related issues in deprived neighbourhoods.<br />

Despite the extraordinary challenges of the<br />

tsunami disaster, <strong>Boehringer</strong> <strong>Ingelheim</strong><br />

Indonesia succeeded in October in continuing its<br />

established community-awareness programme,<br />

giving general medical treatment to hundreds of<br />

needy people near the company’s Bogor plant as<br />

well as fostering educational improvement.<br />

For our neighbours 1

1<br />

For our people<br />

To achieve our corporate objectives we deploy flexible, mobile, self-confident<br />

employees prepared to accept responsibility and capable of thinking and acting<br />

globally. Our internal principles guide employee selection and assessment.<br />

To attain continuous innovation in all we do, we apply our employees’ and<br />

managers’ creativity, capability, commitment and willingness to learn and<br />

change. The Corporation in this regard delegates responsibilities to employees<br />

and acknowledges their success, performance and commitment in meeting<br />

agreed goals. Remuneration and classification are based on the task,<br />

performance, achievement and competitive comparison.<br />

Successfully pursuing our vision, Value through<br />

Innovation, calls for the dedication, passion and<br />

continuous powers of renewal of our more than<br />

37,000 employees. They are our unique source of<br />

strength and inspiration.<br />

Our persistent, combined efforts and resulting<br />

achievements in pharmaceutical innovation have<br />

enabled us to maintain growth and create new<br />

jobs. In many countries we have generated a<br />

significant volume of employment opportunities,<br />

led by the USA, with a total of 1,000 new jobs.<br />

The increased employment prospects we offer<br />

have been greeted extremely favourably in<br />

countries where lowering unemployment is a<br />

national challenge.<br />

On employment, <strong>Boehringer</strong> <strong>Ingelheim</strong> has<br />

received numerous accolades. In <strong>2005</strong>, we were<br />

awarded first price in “Arbeitsplätze absolut” for<br />

being the company which generated the highest<br />

number of new jobs in Germany. We also gained<br />

considerable public recognition in Germany for<br />

continuing to increase the number of apprentice-<br />

ships which rose from 623 to 698. The relatively<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

large number of apprentices in our extensive<br />

vocational programmes has won widespread<br />

praise as a powerful encouragement to the labour<br />

market.<br />

Great place to work<br />

We are proud of the attractive working environ-<br />

ment that we have created and the status that we<br />

enjoy as a preferred employer. Authoritative,<br />

independent workplace surveys in many coun-<br />

tries have confirmed our position among the top<br />

companies in this area so vital to recruiting and<br />

maintaining high quality employees (see box on<br />

page 17, list of awards).<br />

Such positive recognition of our company as<br />

a great place to work spurs us on to enhance<br />

our distinctive company culture still further.<br />

Ever responsive to the changing needs of our<br />

employees, we at the same time call for everyone<br />

to be personally engaged in improving our<br />

working environment at the heart of which are<br />

mutual respect, fairness, openness and space for<br />

both personal and professional development.

Development opportunities<br />

Our aspiration to continuously innovate requires<br />

firm commitment from everyone in the company.<br />

Ongoing dialogue between our employees and<br />

their supervisors is also essential to allow all<br />

parties to participate in our achievements and<br />

development. And our ability to progress coher-<br />

ently towards realising our vision by developing<br />

and leveraging the immense diversity within the<br />

company is pivotal to our success.<br />

Our annual employee – supervisor dialogue<br />

(Mitarbeitergespraech – MAG) is at the core of<br />

our performance and development culture.<br />

Engaging and stretching performance objectives<br />

are mutually agreed and career aspirations and<br />

perspectives for professional development are<br />

addressed. Every individual is expected to have a<br />

valid and forward-looking development plan to<br />

meet the qualification needs of our rapidly<br />

changing business and work environment.<br />

Career aspirations and prospects are also embed-<br />

ded in our global succession planning process.<br />

Here we seek to guarantee a strong pipeline of<br />

leadership talent for local and international key<br />

positions. Talent reviews linked to the succession<br />

planning support the identification and develop-<br />

ment of leadership talent across the corporation.<br />

Teamwork is a key element of <strong>Boehringer</strong><br />

<strong>Ingelheim</strong>’s corporate culture. In Istanbul,<br />

our Turkish employees are here celebrating<br />

the <strong>2005</strong> launch of Lead & Learn with<br />

its implications for improved teamwork.<br />

International assignments are an integrated part<br />

of our succession planning process and our<br />

business and capability development.<br />

Our international assignees represent a large<br />

number of our organisations and are uniformly<br />

distributed throughout our geographical regions.<br />

While the focus groups and purpose of the<br />

assignment might differ from strategic positions<br />

to development measures or knowledge transfers,<br />

these moves serve clearly as a vehicle to enhance<br />

cultural understanding and broadening a global<br />

mindset.<br />

The <strong>Boehringer</strong> <strong>Ingelheim</strong> Academy, encompass-<br />

ing a variety of development courses and<br />

approaches in numerous countries, is designed to<br />

support and strengthen our core values and<br />

capabilities. Everyone at the company can access<br />

local and international development information<br />

on our intranets. The <strong>Boehringer</strong> <strong>Ingelheim</strong><br />

Academy offers a wide spectrum of options from<br />

vocational subjects to leadership development<br />

programmes.<br />

00 2004 2003 2002 2001<br />

Personnel costs in millions of EUR 2,671 2,443 2,252 2,175 1,916<br />

Personnel costs as % of net sales 28.0 29.9 30.5 28.7 28.6<br />

Number of employees (incl. apprentices) 37,406 35,529 34,221 31,843 27,980<br />

For our people 1

1<br />

We foster good leadership at all levels. Carefully<br />

tailored local and international development<br />

approaches are applied to help our current and<br />

potential leaders to discover ways to create a<br />

context in which our people can excel and all of<br />

us can continuously enhance our outcomes.<br />

Our third consecutive International Management<br />

Development Programme, launched in <strong>2005</strong>,<br />

marked the beginning of 14 months of interna-<br />

tional, interdisciplinary learning and working for<br />

some 100 potentials. The programme involves<br />

participants in hands-on work on 14 strategically<br />

relevant projects, close professional mentoring<br />

and frequent exposure to senior management in<br />

various countries.<br />

Benefits<br />

Our benefits programmes, which vary from<br />

country to country, include, amongst others,<br />

retirement benefits, health coverage, insurance<br />

cover, company restaurants, kindergartens, child-<br />

care centres and access to a variety of personal<br />

and family support services.<br />

Numerous additional initiatives and programmes<br />

are available for our employees and their fami-<br />

lies. These include international clubs, our Inter-<br />

national Cultural Student Exchange programmes,<br />

local internships for family members and sum-<br />

mer camps for children.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

A key benefit for many employees is the provision by<br />

the company of day care facilities for their children.<br />

Here, (left) toddlers enjoy a meal at the kindergarten<br />

in <strong>Ingelheim</strong>, Germany, set up in cooperation<br />

with the local community. In the US, construction of<br />

the Child Development Center on the Ridgefield,<br />

USA, campus is in full swing.<br />

The way we work together<br />

From the mid-1990s, our corporate culture has<br />

built on our vision Value through Innovation<br />

(VTI), which has given direction to all our activi-<br />

ties. An annual VTI Day brings our organisations<br />

together to celebrate our achievements in line<br />

with our vision and encourages and inspires our<br />

employees to participate in realising it in practi-<br />

cal ways.<br />

Value through Innovation has guided and will<br />

continue to guide our way of working together. It<br />

helps us build on our strength and make the most<br />

of our distinctive character, enabling us individu-<br />

ally and collectively to achieve great success.<br />

In <strong>2005</strong>, Lead & Learn was introduced to outline<br />

ways in which we can enhance our culture of<br />

working together to realise and deliver Value<br />

through Innovation. The core principles of Lead<br />

& Learn encourage increased questioning and<br />

seizing opportunities while fostering a culture of<br />

shared leadership and learning.<br />

VTI teams that fairly represent the diversity of<br />

our employees, together with our line manage-<br />

ment, have commenced their challenge to<br />

explore and realise complementary new ways to<br />

support our aspired cultural development<br />

throughout the corporation.

Awards 00<br />

Country Ranking Survey<br />

Austria 1 Great Place to Work<br />

Belgium 11 Great Place to Work<br />

Brazil < 1 0 Great Place to Work: The best companies to work for in Brazil<br />

Brazil Great Place to Work: The best companies to work for in Latin America<br />

Brazil < 0 Great Place to Work: The best companies to work for women<br />

Denmark 11 Denmark’s Best Place to Work<br />

Germany 1 Germany’s Best Employers (VAA)<br />

Germany 1 Germany’s Best Employers (Capital)<br />

Germany Germany’s Best Employers with more than 5,000 employees (Capital)<br />

Netherlands non given The 49 Preferred Employers in the Netherlands<br />

Mexico Great Place to Work<br />

United Kingdom 1 100 Best Companies to Work for (Sunday Times)<br />

USA (Roxane) Business First Places to Work in Central Ohio<br />

“Great Place to Work”®, USA, is an international initiative that has been undertaken for many years<br />

in various countries to evaluate the world of work and employee satisfaction.<br />

For our people 1

1<br />

For our environment<br />

In all our activities we will protect our employees, the facilities and the<br />

environment from harmful influences, conserve natural resources and promote<br />

environmental awareness.<br />

These tenets, which are firmly established in our<br />

guiding principles (Leitbild) and formulated in<br />

our Principles on Safety, Quality and Environ-<br />

mental Protection, are put into practice through<br />

systematic environmental protection, health<br />

and safety (EHS) management. Global standards<br />

are defined and enforced wherever they are<br />

indicated. Goals are set annually, while our<br />

EHS status is checked regularly by Corporate<br />

Headquarters. In <strong>2005</strong> alone, this involved<br />

twelve audits at various sites. Every plant<br />

undertakes to set up a local management system<br />

and is free to have this certified or not. For fur-<br />

ther details of our EHS management please visit<br />

www.boehringer-ingelheim.com/ehs.<br />

With our declared support for the concepts of<br />

the Responsible Care® Initiative of the chemical<br />

industry, we have undertaken to exceed the<br />

minimum legal requirements wherever we<br />

consider it appropriate. Consequently, each site<br />

draws up its own programme for continuous<br />

improvements in the EHS field.<br />

Frequently it is not only our employees and the<br />

environment that benefit, but measures taken<br />

can also have an economic impact, as illustrated<br />

by the example of our wood-fired power station<br />

in <strong>Ingelheim</strong>, Germany, described below. Other<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

examples show that we accept responsibility for<br />

our products and attach great value to EHS,<br />

not only at our own plants but also at those of<br />

our business partners.<br />

Climate protection<br />

In the wake of disasters, such as those caused<br />

by the hurricanes Wilma and Katrina in <strong>2005</strong>,<br />

the subject of climate protection moved to centrestage<br />

in public debate.<br />

By converting the power station at our <strong>Ingelheim</strong><br />

site to burn a renewable source of energy, waste<br />

wood, <strong>Boehringer</strong> <strong>Ingelheim</strong> has already made<br />

an active contribution to improving the carbon<br />

dioxide (CO2) balance. Compared with the two<br />

Work accidents<br />

■ Frequency rate =<br />

accidents x 1 million hours / total labour hours<br />

■ Severity rate =<br />

lost labour days x 1 million hours / total labour hours<br />

4<br />

3<br />

2<br />

1<br />

’01 ’02 ’03 ’04 ’05<br />

80<br />

70<br />

60<br />

50<br />

40

The safety checklist for vehicles carrying hazardous materials to<br />

and from company sites is longer as that for a passenger<br />

aircraft. Here the tyres on a truck are being examined at the<br />

<strong>Ingelheim</strong> site in Germany as part of the comprehensive checks<br />

made before it may leave the plant.<br />

previous years, the balance has improved by<br />

about 60,000 tonnes, or a quarter of the Corpo-<br />

ration’s total CO2 emissions.<br />

A secondary benefit of the conversion has been a<br />

major reduction in emissions of sulphur dioxide,<br />

a contributor to acid rain.<br />

In a move to reduce emissions of gases detrimen-<br />

tal to the global climate, in accordance with the<br />

Kyoto Protocol, the European Union introduced<br />

the Emissions Trading Scheme for CO2 in <strong>2005</strong>.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> has joined this scheme.<br />

Our heating power station in <strong>Ingelheim</strong> was<br />

issued trading certificates on the basis of the<br />

emissions in 2000–2002. Following the switch<br />

to wood, a CO2-neutral power source, we can<br />

now trade any certificates that we no longer need.<br />

This project has allowed us to pursue both<br />

ecological and economic goals at the same time.<br />

Water<br />

■ Water consumption (in millions of m 3 )<br />

■ Water consumption index (in %)<br />

10<br />

8<br />

6<br />

4<br />

2<br />

’01 ’02 ’03 ’04 ’05<br />

120<br />

100<br />

80<br />

60<br />

Another example of our responsible approach to<br />

climate protection came within the framework of<br />

a programme run by the Swiss national energy<br />

authorities in 2003. Our Swiss site undertook to<br />

reduce CO2 emissions by 10 % by the year 2010<br />

and has already met interim goals.<br />

Pharmaceuticals in the environment<br />

We are not only responsible for clean production,<br />

but also for ensuring our products have minimal<br />

impact on the environment.<br />

An environmental risk assessment is now<br />

required when registering new products. This is<br />

prepared on the basis of studies on environmen-<br />

tal impact and ecotoxicological effects. We also<br />

assess the environmental data for products<br />

already on the market and, where necessary, run<br />

further voluntary studies to assess the ultimate<br />

impact.<br />

Energy<br />

■ Energy consumption (in millions of gigajoules)<br />

■ Energy consumption index (in %)<br />

5<br />

4<br />

3<br />

2<br />

1<br />

’01 ’02 ’03 ’04 ’05<br />

140<br />

120<br />

100<br />

For our environment 1

0<br />

Assessments to date show that our substances<br />

present no risk to man.<br />

Business partners<br />

Our EHS management system guarantees that<br />

all <strong>Boehringer</strong> <strong>Ingelheim</strong> sites satisfy set require-<br />

ments and make constant improvements.<br />

However, we also attach great value to ensuring<br />

that our business partners likewise meet our<br />

expectations in terms of EHS, while satisfying<br />

minimum requirements, in order to ensure the<br />

continuity of our own business. For this reason,<br />

we increasingly check EHS aspects as well as<br />

quality during qualification of suppliers and<br />

contract manufacturers.<br />

Awards<br />

In <strong>2005</strong>, a number of sites were again awarded<br />

prizes by external agencies for their efforts in<br />

EHS. For the 6th time running, our site in<br />

Colombia won an award for its excellent contri-<br />

bution to long-term development. The local<br />

agencies awarded the site in Toride, Japan, a<br />

prize for its exemplary efforts in the storage of<br />

hazardous goods and fire safety, while the site in<br />

Petersburg, Virginia, USA, was given an award<br />

for its modern wastewater treatment plant.<br />

Our French chemical plant received first place<br />

in a countrywide external safety audit conducted<br />

to international standards.<br />

Carbon dioxide (CO2)<br />

■ CO2 by energy purchased (in 1,000 tonnes)<br />

■ CO2 by process emissions (in 1,000 tonnes)<br />

■ CO2 emissions index, direct emissions (in %)<br />

(without company car park)<br />

500<br />

400<br />

300<br />

200<br />

100<br />

’01 ’02 ’03 ’04 ’05<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

120<br />

100<br />

80<br />

60<br />

Incidents<br />

Our local and global crisis management<br />

allows us to react rapidly to potential incidents.<br />

No major incidents occurred in <strong>2005</strong>.<br />

Our performance<br />

The graphs show the EHS performance figures<br />

for the last five years.<br />

Performance in the field of safety at work is<br />

measured by the number of accidents and their<br />

rate adjusted for the number of employees.<br />

As can be seen from the graph (page 18), the rate<br />

of accidents has fallen again since 2004.<br />

Our environmental impacts are shown both<br />

as absolute values and relative to production –<br />

represented in our production index. The index<br />

represents our overall production in all business<br />

areas and is weighted to compensate for differ-<br />

ences in environmental impact. Our baseline year<br />

is 1995. Since <strong>2005</strong> the figures include the values<br />

for the company microParts, Germany, which<br />

was acquired in 2004. They do not include<br />

SSP Co., Ltd. , Japan, which has also not been<br />

included in previous years.<br />

Over the last few years, most indicators have<br />

reached a relative stable level because many<br />

prior technical or organisational improvements<br />

resulted in a high performance standard. This is<br />

Volatile organic carbon (VOC)<br />

■ VOC emissions, non-halogenated (in tonnes)<br />

■ VOC emissions, halogenated (in tonnes)<br />

■ VOC emissions index (in %)<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

’01 ’02 ’03 ’04 ’05<br />

80<br />

60<br />

40

eflected clearly in the respective indices com-<br />

pared with 1995. The production-adjusted<br />

amount of pollutants in wastewater produced<br />

has been reduced by 60 %, solvent emissions<br />

(volatile organic hydrocarbon – VOC) have been<br />

halved and water consumption lowered by a<br />

quarter. Our recycling rate has stabilised at a very<br />

high level of about 80 %. Many of our ongoing<br />

efforts are therefore no longer reflected as<br />

clearly as in earlier years. For a more detailed<br />

explanation of the individual graphs, please visit<br />

www.boehringer-ingelheim.com/ehs<br />

Our goals<br />

We are aware that there is further potential for<br />

optimisation in terms of solvent emissions (VOC)<br />

into the air. We are making changes at our chemi-<br />

cal site in Spain, where VOCs will be eliminated<br />

in future through thermal oxidation rather than<br />

by scrubbing with aqueous media. In <strong>Ingelheim</strong>,<br />

Germany, too, additional plants are to be con-<br />

nected to the existing incinerator. Our goal for<br />

2008 is to reduce VOC emissions by at least 50 %.<br />

Our wastewater treatment plants are already<br />

performing on a very high level. To maintain and<br />

further improve this level and to adapt to<br />

increasing loads, we started a major investment<br />

in our <strong>Ingelheim</strong> wastewater treatment plant.<br />

An additional state-of-the art treatment step will<br />

make the process more effective, will increase<br />

Wastewater — chemical oxygen demand (COD)<br />

■ COD load before treatment (in tonnes)<br />

■ COD load after treatment (in tonnes)<br />

■ COD load (after treatment) index (in %)<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

’01 ’02 ’03 ’04 ’05<br />

80<br />

60<br />

40<br />

20<br />

nitrogen removal by improving the nitrification/<br />

denitrification process, and will also target the<br />

specific halogen-containing wastewater which<br />

can be difficult to treat when using only conven-<br />

tional technology.<br />

Our chemical sites in Malgrat, Spain, and<br />

Fornovo, Italy, are seeking to have their environ-<br />

mental management systems certified in 2006<br />

in accordance with ISO 14001.<br />

This report only mentions some of the activities<br />

we engage in to fulfil our responsibilities.<br />

Please visit the internet for further details about<br />

our product responsibility, the safe handling<br />

of highly potent substances in production and<br />

other examples of our many safety activities.<br />

www.boehringer-ingelheim.com/ehs<br />

Disposed waste<br />

■ Domestic waste (in tonnes)<br />

■ Hazardous waste (in tonnes), incl. pharmaceutical waste<br />

■ Disposed waste index (in %)<br />

■ Recycling rate (in %)<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

’01 ’02 ’03 ’04 ’05<br />

100<br />

90<br />

80<br />

70<br />

For our environment 1

Our R&D drive<br />

Holger Pfister has been treated with almost all of the 22 currently<br />

available HIV drugs. “But my doctors never managed to bring my viral<br />

load under the detectable limit,” says Holger. The viral load, the number<br />

of virus particles in the blood, measures a person’s HIV / AIDS status.<br />

Owing to the failure to treat Holger’s virus effectively, it has become<br />

resistant in his body to almost all AIDS medications. Resistance is<br />

a very serious HIV issue. In 2003, Holger took part in the resist clinical<br />

study for <strong>Boehringer</strong> <strong>Ingelheim</strong>’s novel protease inhibitor (PI) aptivus®<br />

(tipranavir). “Since then I’ve been under the measurable limit for the<br />

first time ever,” he says. Continuing the treatment, he is in good mental<br />

and physical health.<br />

Professor Schlomo Staszewski from Frankfurt university, a leading AIDS expert and the<br />

first person in Germany to hold a professorship in HIV infections, hails aptivus®,<br />

launched in the first markets in <strong>2005</strong>, as “the most efficacious protease inhibitor so far”.<br />

And it is not just a question of efficacy. “Tipranavir is the largest antiretroviral development<br />

to date,” says Dr Paul Carter, who coordinated the project at <strong>Boehringer</strong> <strong>Ingelheim</strong>.<br />

“This project has clearly shown that our closely integrated development network, which<br />

links our R&D centres around the world, together with our well established interactions<br />

with clinical investigators, gives us access to all the capabilities necessary to achieve<br />

successful and timely development of even the most challenging drugs,” he notes. In only<br />

five years, tipranavir was taken from a promising candidate to a potent new drug.<br />

Tipranavir, in-licensed in phase II development from the former Pharmacia-Upjohn in<br />

2000, is a non-peptidic PI. It works by inhibiting protease, an enzyme needed to complete<br />

the HIV replication process. Based on available clinical and in vitro data, tipranavir is<br />

active against most strains of HIV-1 that are resistant to commercially available protease<br />

inhibitors. Tipranavir does not cure HIV infection/AIDS or prevent the transmission of HIV<br />

to others. What it importantly offers is a treatment that benefits patients with limited<br />

therapeutic options.<br />

Our R&D drive

AIDS drug resistance — a big issue<br />

Since the initial detection of AIDS in the early<br />

1980s, viral resistance to drugs treating HIV has<br />

become a crucial issue. The pharmaceutical<br />

industry has thus sought to constantly develop<br />

new drugs. To date, a total of over 20 are avail-<br />

able. However, the HI virus has proved to be a<br />

very dangerous master of metamorphosis, always<br />

finding ways to change its genetic pattern and<br />

thus ward off the attacks of antiviral drugs.<br />

A recent six-year study demonstrated a high<br />

prevalence of drug-resistant virus in a European<br />

group of patients under treatment for HIV-1<br />

infection. Data from the United Kingdom indi-<br />

cate that the transmission of drug-resistant virus<br />

is on the rise, with 47 % of patients resistant to at<br />

least one PI. The estimated prevalence of people<br />

with drug resistant virus in a recent large-scale<br />

study in the United States was 78 % (Richmann et<br />

al., 2001). For all of HIV infected, new and potent<br />

drugs, like aptivus®, are a last resort.<br />

The RESIST clinical programme<br />

In 2003, the first patients were recruited for the<br />

resist pivotal trial programmes. These involved<br />

the most clinically advanced population ever<br />

studied and included 1,500 patients with highly<br />

resistant virus in 270 hospitals in 21 countries.<br />

Recruitment was completed in just eight months.<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

Since Holger Pfister was diagnosed with human<br />

immune deficiency virus (HIV) infection in 1986, he has<br />

been fighting AIDS (acquired immune deficiency<br />

syndrome). “I am one of the few who survived,” he says.<br />

The resist programme examined the treatment<br />

response of tipranavir boosted with ritonavir<br />

versus a comparator group in which patients<br />

received one of several marketed ritonavir-<br />

boosted PIs. The comparator PI was lopinavir,<br />

indinavir, saquinavir or amprenavir. In addition,<br />

patients received in both arms a personally<br />

optimised background regimen of another<br />

antiretroviral.<br />

The results of the resist studies demonstrated<br />

that a statistically significant greater percentage<br />

of HIV-positive patients taking tipranavir<br />

boosted with ritonavir achieved a treatment<br />

response versus the comparator group (40 %<br />

compared to 18 %). Furthermore, more than<br />

twice the number of patients receiving regimens<br />

that contain boosted tipranavir were able to<br />

reduce the amount of HIV in their blood to<br />

undetectable levels than in the boosted compara-<br />

tor group (viral load

New data presented at the 10th European AIDS<br />

Conference in Dublin demonstrate that through<br />

48 weeks, aptivus® provides a convincing and<br />

durable benefit, achieving and maintaining a<br />

superior treatment response in patients with<br />

resistant HIV. A large number of further clinical<br />

studies with tipranavir boosted with ritonavir<br />

are currently running or planned to start in the<br />

near future. Some of these are designed to inves-<br />

tigate tipranavir’s safety and efficacy in other<br />

patient populations such as children, women,<br />

patients co-infected with hepatitis B or C and<br />

naïve (previously untreated) patients. This range<br />

of studies demonstrates <strong>Boehringer</strong> <strong>Ingelheim</strong>’s<br />

continuing commitment to fully understand the<br />

profile of aptivus®.<br />

Our development strength<br />

aptivus® is not the only AIDS drug to emerge<br />

from our development programmes. The now<br />

widely-used antiretroviral agent nevirapine<br />

(viramune®) is a product of original <strong>Boehringer</strong><br />

<strong>Ingelheim</strong> R&D and was the first member of the<br />

non-nucleoside reverse transcriptase inhibitor<br />

(NNRTI) class of anti-HIV drugs. In many other<br />

indication areas there are also new medications<br />

discovered and developed in-house by<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong>, amongst them tiotropium<br />

bromide (spiriva®), a treatment for chronic<br />

obstructive pulmonary disease (COPD),<br />

pramipexole (sifrol®/mirapex®) against<br />

Parkinson’s disease or telmisartan (micardis®)<br />

for treating essential hypertension.<br />

A key indicator for <strong>Boehringer</strong> <strong>Ingelheim</strong>’s<br />

strength in R&D is the ratio of products still<br />

patented or under exclusivity protection to<br />

our net sales. It rose to 59 % in <strong>2005</strong>.<br />

Speed and efficiency are key to successful<br />

pharmaceutical development projects, as novel<br />

medicines that bring real benefit in terms of<br />

health and well-being are taking longer and<br />

longer to get to the market. And more time adds<br />

further expenditure to the enormous cost of<br />

developing modern medications.<br />

Our R&D expenditure in <strong>2005</strong> amounted to<br />

18.2 % of our net sales in Prescription Medicines,<br />

indicating the extent to which a modern research-<br />

driven pharmaceutical company has to invest<br />

in discovering and developing new products,<br />

or extending the life and indication coverage of<br />

existing drugs in its portfolio.<br />

The development of effective treatments<br />

for viral infections, such as human<br />

immunodeficiency virus (HIV), presents<br />

a significant scientific challenge.<br />

A researcher studies an HIV-infected<br />

T lymphocyte cell on-screen. T cells,<br />

a type of white blood cell, are important<br />

for protecting the immune system<br />

against viral infections and are a prime<br />

target for the HI virus that causes a<br />

reduction in the number of T cells.<br />

Our R&D drive

‘HIV is being played down’<br />

An interview with Prof. Schlomo Staszewski<br />

Q: Prof. Staszewski, let’s start by discussing AIDS in the<br />

industrialised world. Hasn’t the disease here to a consider-<br />

able extent already disappeared from public awareness,<br />

even though it naturally remains with us? What’s your<br />

experience with this issue?<br />

Prof. Staszewski: AIDS, or HIV infection, is the most<br />

dangerous epidemic, and the one with the greatest<br />

consequences, in the latter part of the 20th<br />

century and the beginning of the 21st century.<br />

According to the World Health Organization, we<br />

have more than 40 million infected people. Some<br />

three million died of the disease in <strong>2005</strong>. In the<br />

same year, an additional five million were infected.<br />

Most deaths occur in sub-Saharan Africa. AIDS is<br />

really a deadly disease there. In our countries<br />

nobody needs to die of AIDS any longer. With<br />

the appropriate treatment the progression of the<br />

disease can be halted and patients can be<br />

prevented from developing the manifestations<br />

of AIDS.<br />

The dilemma with AIDS is, on the one hand, its<br />

good treatability, and, on the other hand, that it’s<br />

the most dangerous infectious disease of our time.<br />

The question is how do we deal with it?<br />

Naturally you can gloss over or keep AIDS secret,<br />

if you live in the western world, where patients can<br />

receive all the available medications. You can<br />

conceal the fact that some things in the world are<br />

not in order. You can also see that in the number of<br />

<strong>Boehringer</strong> <strong>Ingelheim</strong> A n n u A l R e p o R t 2 0 0 5<br />

new infections in European countries. In <strong>2005</strong>,<br />

they rose by about 10 %, in Germany, even by as<br />

much as 20 %.<br />

Q: What’s the reason?<br />

Prof. Staszewski: HIV is being played down.<br />

Awareness of the therapies and their effects on the<br />

course of the disease HIV are removed and remote<br />

from the real situation. This we have to correct.<br />

We must say what kind of disease it is.<br />

My criticism of the current trend is also that,<br />

content with the possibility of individual therapy,<br />

we’ve lost sight of the overall epidemic. People no<br />

longer regard HIV as a fatal disease.<br />

Advertising by the pharmaceutical industry often<br />

also contributes considerably to glossing over the<br />

disease. It focuses the HIV disease to the<br />

industrialised world and shows in its pictures and<br />

personal testimonials people who are well. It<br />

presents things as though there is no problem<br />

at all.<br />

Q: A problem in the West is the development of drug-<br />

resistance. How do we deal with this?<br />

Prof. Staszewski: Resistance is a common phenom-<br />

enon. In the event of therapy failure or side-effects,<br />

the switch to a tolerable or effective therapy<br />

is more difficult. When resistance has occurred,<br />

you have to switch therapy to combine those

Thanks to new treatments and innovative drugs,<br />

AIDS has become controllable in the developed<br />

world. Although it is still a deadly disease,<br />

HIV awareness has weakened, leading to<br />

increasing infection rates. In Mainz, Germany,<br />

with the support of <strong>Boehringer</strong> <strong>Ingelheim</strong>,<br />

a group of teenage schoolchildren put on a play,<br />

“Damned positive”, which highlights the dangers<br />

of an HIV infection.<br />

medications to which the virus is still sensitive.<br />

Here, the right combination is decisive. If we use<br />

an effective medication in the wrong combination,<br />

there is a danger that it will be wasted because of<br />

resistance developing.<br />

Q: Is APTIvuS® effective because of the very fact that it can<br />

also be used for patients who are already resistant to many<br />

other medications? Is that its strength?<br />

Prof. Staszewski: That’s currently the most important<br />

indication area for aptivus®, as it is effective<br />

against viruses that have already become resistant<br />

to other protease inhibitors (ed: PI). But there are<br />

viruses that are resistant to aptivus®. This, one has<br />

to know. Because only then it becomes clear that<br />

aptivus® must also be used sensibly. When I use it<br />

too late, or use it in the wrong combination,<br />

I waste the medication.<br />

aptivus® has strengths and weaknesses.<br />

Basically, it has all the side-effects familiar to<br />

protease inhibitors. As dosage-related side-effects<br />

occur, it is a good idea to test lower doses in<br />

patients whose disease is less advanced than the<br />

dose necessary for the patient with PI-resistent<br />

virus. This should though at present only occur<br />