MARKETS WITH MARKET POWER - Tufts University

MARKETS WITH MARKET POWER - Tufts University

MARKETS WITH MARKET POWER - Tufts University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

convenience, etc., but it can also reduce social well-being. Students should recognize that<br />

advertising can impose costs on society by increasing prices, encouraging irresponsible<br />

spending, and targeting children. Some non-price competition, such as disposable products<br />

and single-serve portions can increase environmental impacts.<br />

4.1. a) In a prisoner’s dilemma situation, each firm would benefit from having the lower price.<br />

However, with both firms taking a low-price strategy and no cooperation, neither firm will<br />

gain a price advantage. The result will likely be lower profits for both due to a price war.<br />

b) If the two firms collude to set price, they can both maintain high profits. Note, however,<br />

that each firm also has an incentive to lower price and capture a larger market share and<br />

higher profits.<br />

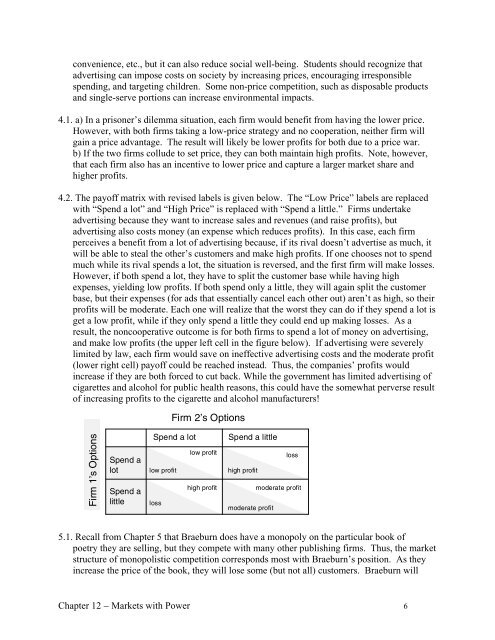

4.2. The payoff matrix with revised labels is given below. The “Low Price” labels are replaced<br />

with “Spend a lot” and “High Price” is replaced with “Spend a little.” Firms undertake<br />

advertising because they want to increase sales and revenues (and raise profits), but<br />

advertising also costs money (an expense which reduces profits). In this case, each firm<br />

perceives a benefit from a lot of advertising because, if its rival doesn’t advertise as much, it<br />

will be able to steal the other’s customers and make high profits. If one chooses not to spend<br />

much while its rival spends a lot, the situation is reversed, and the first firm will make losses.<br />

However, if both spend a lot, they have to split the customer base while having high<br />

expenses, yielding low profits. If both spend only a little, they will again split the customer<br />

base, but their expenses (for ads that essentially cancel each other out) aren’t as high, so their<br />

profits will be moderate. Each one will realize that the worst they can do if they spend a lot is<br />

get a low profit, while if they only spend a little they could end up making losses. As a<br />

result, the noncooperative outcome is for both firms to spend a lot of money on advertising,<br />

and make low profits (the upper left cell in the figure below). If advertising were severely<br />

limited by law, each firm would save on ineffective advertising costs and the moderate profit<br />

(lower right cell) payoff could be reached instead. Thus, the companies’ profits would<br />

increase if they are both forced to cut back. While the government has limited advertising of<br />

cigarettes and alcohol for public health reasons, this could have the somewhat perverse result<br />

of increasing profits to the cigarette and alcohol manufacturers!<br />

Firm 2’s Options<br />

Firm 1’s Options<br />

Spend a<br />

lot<br />

Spend a<br />

little<br />

Spend a lot<br />

low profit<br />

low profit<br />

high profit<br />

loss<br />

Spend a little<br />

loss<br />

high profit<br />

moderate profit<br />

moderate profit<br />

5.1. Recall from Chapter 5 that Braeburn does have a monopoly on the particular book of<br />

poetry they are selling, but they compete with many other publishing firms. Thus, the market<br />

structure of monopolistic competition corresponds most with Braeburn’s position. As they<br />

increase the price of the book, they will lose some (but not all) customers. Braeburn will<br />

Chapter 12 − Markets with Power 6