The Letter - Bordier & Cie

The Letter - Bordier & Cie

The Letter - Bordier & Cie

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

How to hedge<br />

against future infl ation<br />

1. Introduction: anticipation is vital<br />

2. Gold<br />

3. Commodities<br />

4. Property<br />

5. Equities<br />

6. Focus on infl ation and growth<br />

7. Infl ation-linked government bonds<br />

8. Conclusion: it will soon be time to buy infl ation-linked bonds<br />

1. Introduction : anticipation is vital<br />

United States, euro zone, Switzerland, United Kingdom, Japan: deep<br />

recession is everywhere. Back in July 2008 observers had still been<br />

forecasting the risk of stagfl ation with a barrel of crude priced at<br />

USD 150, but in the meantime many countries have either gone into<br />

defl ation or are about to do so. <strong>The</strong>n again the property crisis in<br />

the United States has caused a serious deterioration of bank balance<br />

sheets on both sides of the Atlantic.<br />

To fi ght the fi nancial crisis and recession, the central banks have<br />

cut their base rates to historically low levels, close to zero. As this<br />

did not seem enough to drag us out of the crisis, the central banks<br />

have even begun to practice quantitative easing policies, by which<br />

is meant that they are buying up massive quantities of government<br />

bonds, commercial paper or property-backed securities (commonly<br />

known as toxic assets). All of these purchases are helping to swell<br />

money supply hugely and in fact represent a return to the old habit<br />

of printing new bank notes. In the course of history that practice<br />

has always preceded bouts of infl ation; infl ation therefore awaits us<br />

4<br />

round the corner, sooner or later. To hedge against infl ation, economic<br />

literature identifi es gold, commodities, property and equities;<br />

more recently, infl ation-linked issues have made their appearance on<br />

the bond market.<br />

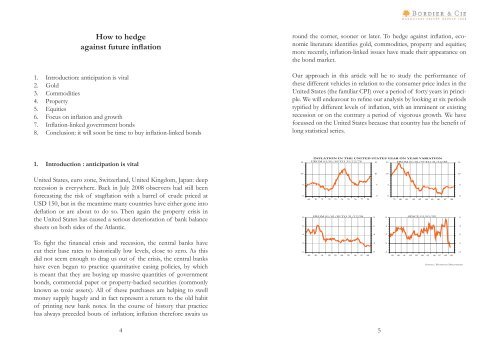

Our approach in this article will be to study the performance of<br />

these different vehicles in relation to the consumer price index in the<br />

United States (the familiar CPI) over a period of forty years in principle.<br />

We will endeavour to refi ne our analysis by looking at six periods<br />

typifi ed by different levels of infl ation, with an imminent or existing<br />

recession or on the contrary a period of vigorous growth. We have<br />

focussed on the United States because that country has the benefi t of<br />

long statistical series.<br />

15<br />

10<br />

5<br />

0<br />

8<br />

6<br />

4<br />

2<br />

0<br />

INFLATION IN THE UNITED STATES YEAR ON YEAR VARIATION<br />

FROM 01/01/69 TO 31/12/78 15 15 FROM 01/01/79 TO 31/12/88<br />

69 70 71 72 73 74 75 76 77 78<br />

FROM 01/01/89 TO 31/12/98<br />

89 90 91 92 93 94 95 96 97 98<br />

8<br />

6<br />

4<br />

2<br />

0<br />

10<br />

5<br />

0<br />

5<br />

10<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

5<br />

0<br />

79 80 81 82 83 84 85 86 87 88<br />

SINCE 01/01/99<br />

99 00 01 02 03 04 05 06 07 08 09<br />

15<br />

10<br />

5<br />

0<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

Source: Thomson Datastream