Prop Disposal of PLD Pltn Lands _final_2.pdf - Announcements ...

Prop Disposal of PLD Pltn Lands _final_2.pdf - Announcements ...

Prop Disposal of PLD Pltn Lands _final_2.pdf - Announcements ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

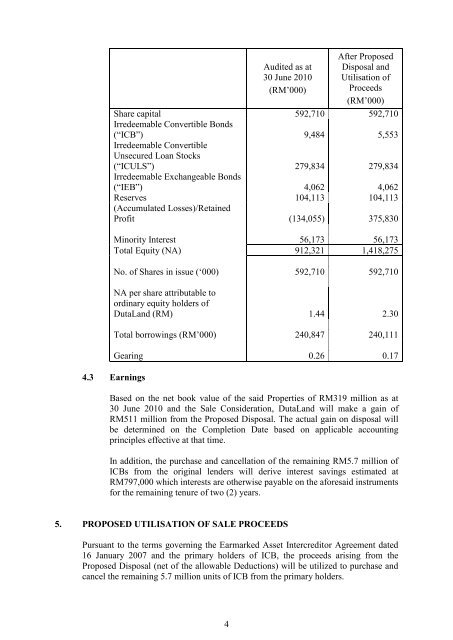

Audited as at<br />

30 June 2010<br />

(RM’000)<br />

After <strong>Prop</strong>osed<br />

<strong>Disposal</strong> and<br />

Utilisation <strong>of</strong><br />

Proceeds<br />

(RM’000)<br />

Share capital 592,710 592,710<br />

Irredeemable Convertible Bonds<br />

(“ICB”) 9,484 5,553<br />

Irredeemable Convertible<br />

Unsecured Loan Stocks<br />

(“ICULS”) 279,834 279,834<br />

Irredeemable Exchangeable Bonds<br />

(“IEB”) 4,062 4,062<br />

Reserves 104,113 104,113<br />

(Accumulated Losses)/Retained<br />

Pr<strong>of</strong>it (134,055) 375,830<br />

Minority Interest 56,173 56,173<br />

Total Equity (NA) 912,321 1,418,275<br />

No. <strong>of</strong> Shares in issue (‘000) 592,710 592,710<br />

NA per share attributable to<br />

ordinary equity holders <strong>of</strong><br />

DutaLand (RM) 1.44 2.30<br />

4.3 Earnings<br />

Total borrowings (RM’000) 240,847 240,111<br />

Gearing 0.26 0.17<br />

Based on the net book value <strong>of</strong> the said <strong>Prop</strong>erties <strong>of</strong> RM319 million as at<br />

30 June 2010 and the Sale Consideration, DutaLand will make a gain <strong>of</strong><br />

RM511 million from the <strong>Prop</strong>osed <strong>Disposal</strong>. The actual gain on disposal will<br />

be determined on the Completion Date based on applicable accounting<br />

principles effective at that time.<br />

In addition, the purchase and cancellation <strong>of</strong> the remaining RM5.7 million <strong>of</strong><br />

ICBs from the original lenders will derive interest savings estimated at<br />

RM797,000 which interests are otherwise payable on the aforesaid instruments<br />

for the remaining tenure <strong>of</strong> two (2) years.<br />

5. PROPOSED UTILISATION OF SALE PROCEEDS<br />

Pursuant to the terms governing the Earmarked Asset Intercreditor Agreement dated<br />

16 January 2007 and the primary holders <strong>of</strong> ICB, the proceeds arising from the<br />

<strong>Prop</strong>osed <strong>Disposal</strong> (net <strong>of</strong> the allowable Deductions) will be utilized to purchase and<br />

cancel the remaining 5.7 million units <strong>of</strong> ICB from the primary holders.<br />

4