The Archi - November 2011 - Alpha Rho Chi

The Archi - November 2011 - Alpha Rho Chi

The Archi - November 2011 - Alpha Rho Chi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

From Cattle to Coinage<br />

(and Beyond)<br />

<strong>The</strong> Evolution of Our Financial System<br />

and the Buildings That House It<br />

Based on a new book by Homer L. Williams, FAIA, Anthemios Alumnus<br />

(University of Illinois at Urbana-Champaign)<br />

18<br />

From Cattle<br />

to Coinage<br />

(and Beyond)<br />

Banks sure seem to be in the<br />

news a lot these days, what with the<br />

ongoing financial crisis. But Homer<br />

Williams, for one, seems confident<br />

that our nation’s banking system<br />

will emerge from the crisis stronger<br />

than ever.<br />

And Williams is well versed on<br />

the subject. As principal of Williams,<br />

Spurgeon, Kuhl, and Freshnock<br />

<strong>Archi</strong>tects (WSKF) in North<br />

Kansas City, Missouri, Williams has<br />

more than four decades of experience<br />

in the design of more than one<br />

hundred bank and financial service<br />

projects, and he recently published<br />

a book with Wiley & Sons on the<br />

design of financial institutions.<br />

While the book focuses primarily<br />

on the pragmatic aspects of bank<br />

design, it also delves into the history<br />

of banking and the structure of<br />

our financial system.<br />

According to Williams, the first<br />

“banks” probably originated in the<br />

third millennium BC—in the form of<br />

temples. At temples “people could<br />

exchange items such as cattle,<br />

implements, or precious metals,<br />

before the use of coins,” Williams<br />

explains in Building Type Basics for<br />

Banks and Financial Institutions.<br />

“When coins of precious metals<br />

began to be used as payment,<br />

‘money changers’ were those who<br />

understood the relative value of<br />

various coins and could provide the<br />

means for a desired exchange.”<br />

Banking has seen its share of<br />

ups and downs over the centuries.<br />

“Banking declined in medieval<br />

Europe,” says Williams, “because<br />

of religious opposition to ‘usury,’<br />

which is the collection of interest<br />

added to a loaned amount. <strong>The</strong><br />

renaissance brought a revival of<br />

banking, most prominently in Italy<br />

where Marco Polo had introduced<br />

a trade route to the east, and with<br />

that, its exotic products. In the<br />

fourteenth century, the famous<br />

banking houses in Venice and Florence<br />

brought about the modern<br />

practice of banking.” Williams<br />

points out that the English word<br />

bank derives from the Italian banco,<br />

meaning “bench”—the tables<br />

where early banking transactions<br />

occurred.<br />

“As trade increased and more<br />

people traveled greater distances<br />

to exchange goods,” says Williams,<br />

“the need for an accurate means<br />

of monetary measure increased as<br />

well.” Plus, coins were “unwieldy to<br />

carry in large numbers.” Over time,<br />

people began using paper money.<br />

“In England, the safekeeping<br />

of precious coins or objects was<br />

entrusted to goldsmiths,” explains<br />

Williams, noting that goldsmiths<br />

had the only safe storage vaults.<br />

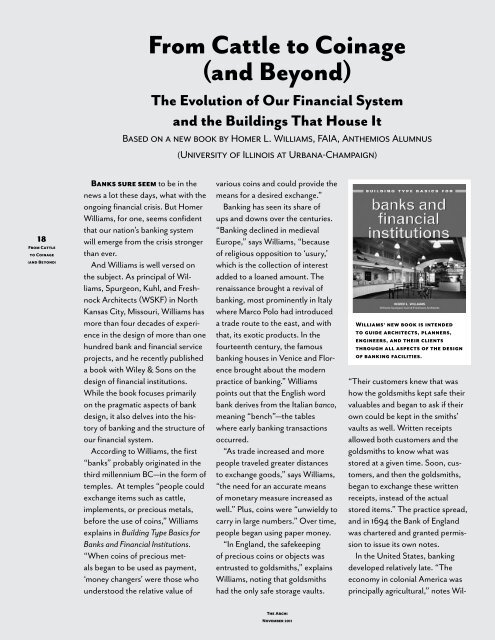

Williams’ new book is intended<br />

to guide architects, planners,<br />

engineers, and their clients<br />

through all aspects of the design<br />

of banking facilities.<br />

“<strong>The</strong>ir customers knew that was<br />

how the goldsmiths kept safe their<br />

valuables and began to ask if their<br />

own could be kept in the smiths’<br />

vaults as well. Written receipts<br />

allowed both customers and the<br />

goldsmiths to know what was<br />

stored at a given time. Soon, customers,<br />

and then the goldsmiths,<br />

began to exchange these written<br />

receipts, instead of the actual<br />

stored items.” <strong>The</strong> practice spread,<br />

and in 1694 the Bank of England<br />

was chartered and granted permission<br />

to issue its own notes.<br />

In the United States, banking<br />

developed relatively late. “<strong>The</strong><br />

economy in colonial America was<br />

principally agricultural,” notes Wil-<br />

<strong>The</strong> <strong>Archi</strong><br />

<strong>November</strong> <strong>2011</strong>