FRANCE UPDATED REPORT MARCH 2009 - Grosvenor

FRANCE UPDATED REPORT MARCH 2009 - Grosvenor

FRANCE UPDATED REPORT MARCH 2009 - Grosvenor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

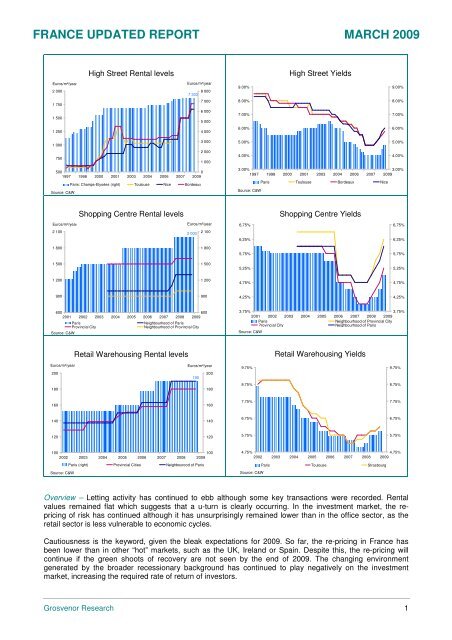

<strong>FRANCE</strong> <strong>UPDATED</strong> <strong>REPORT</strong> <strong>MARCH</strong> <strong>2009</strong><br />

High Street Rental levels<br />

High Street Yields<br />

Euros/m²/year<br />

2 000<br />

1 750<br />

Euros/m²/year<br />

8 000<br />

7 303<br />

7 000<br />

9.00%<br />

8.00%<br />

9.00%<br />

8.00%<br />

1 500<br />

6 000<br />

5 000<br />

7.00%<br />

7.00%<br />

1 250<br />

4 000<br />

6.00%<br />

6.00%<br />

3 000<br />

1 000<br />

2 000<br />

750<br />

1 000<br />

500<br />

0<br />

1997 1998 2000 2001 2003 2004 2006 2007 <strong>2009</strong><br />

Paris: Champs-Elysées (right) Toulouse Nice Bordeaux<br />

Source: C&W<br />

5.00%<br />

5.00%<br />

4.00%<br />

4.00%<br />

3.00%<br />

3.00%<br />

1997 1998 2000 2001 2003 2004 2006 2007 <strong>2009</strong><br />

Paris Toulouse Bordeaux Nice<br />

Source: C&W<br />

Shopping Centre Rental levels<br />

Shopping Centre Yields<br />

Euros/m²/year<br />

Euros/m²/year<br />

6,75%<br />

6,75%<br />

2 100<br />

2 000<br />

2 100<br />

6,25%<br />

6,25%<br />

1 800<br />

1 800<br />

5,75%<br />

5,75%<br />

1 500<br />

1 500<br />

5,25%<br />

5,25%<br />

1 200<br />

1 200<br />

4,75%<br />

4,75%<br />

900<br />

900<br />

4,25%<br />

4,25%<br />

600<br />

600<br />

2001 2002 2003 2004 2005 2006 2007 2008 <strong>2009</strong><br />

Source: C&W<br />

Paris<br />

Provincial City<br />

Neighbourhood of Paris<br />

Neighbourhood of Provincial City<br />

3,75%<br />

3,75%<br />

2001 2002 2003 2004 2005 2006 2007 2008 <strong>2009</strong><br />

Paris<br />

Neighbourhood of Provincial City<br />

Provincial City<br />

Neighbourhood of Paris<br />

Source: C&W<br />

Retail Warehousing Rental levels<br />

Retail Warehousing Yields<br />

Euros/m²/year<br />

200<br />

Euros/m²/year<br />

200<br />

190<br />

9.75%<br />

9.75%<br />

180<br />

180<br />

8.75%<br />

8.75%<br />

160<br />

160<br />

7.75%<br />

7.75%<br />

140<br />

140<br />

6.75%<br />

6.75%<br />

120<br />

120<br />

5.75%<br />

5.75%<br />

100<br />

100<br />

2002 2003 2004 2005 2006 2007 2008 <strong>2009</strong><br />

Source: C&W<br />

Paris (right) Provincial Cities Neighbourood of Paris<br />

4.75%<br />

Source: C&W<br />

4.75%<br />

2002 2003 2004 2005 2006 2007 2008 <strong>2009</strong><br />

Paris Toulouse Strasbourg<br />

Overview – Letting activity has continued to ebb although some key transactions were recorded. Rental<br />

values remained flat which suggests that a u-turn is clearly occurring. In the investment market, the repricing<br />

of risk has continued although it has unsurprisingly remained lower than in the office sector, as the<br />

retail sector is less vulnerable to economic cycles.<br />

Cautiousness is the keyword, given the bleak expectations for <strong>2009</strong>. So far, the re-pricing in France has<br />

been lower than in other “hot” markets, such as the UK, Ireland or Spain. Despite this, the re-pricing will<br />

continue if the green shoots of recovery are not seen by the end of <strong>2009</strong>. The changing environment<br />

generated by the broader recessionary background has continued to play negatively on the investment<br />

market, increasing the required rate of return of investors.<br />

<strong>Grosvenor</strong> Research 1

Economic Updated<br />

The French Retail Market<br />

Retailer Demand – The letting market ran out of steam in Q4 2008, in line with the drastic slowdown. In spite<br />

of this feature, there were interesting transactions within the high street submarkets. The luxury brand took a<br />

large premise in the Champs-Elysées. Guess settled in Place de l’Opéra, the shoe maker Repetto took a<br />

scheme in the trendy 6 th district while Marc Jacobs and Stuart Weitzmann took premises in Saint-Honoré.<br />

The trendy Corto Moltedo has launched a flagship store in the Gallery of the Palais Royal, a luxury location.<br />

Despite such a move, the luxury “conquest” observed over the past few years is now fading. Most luxury<br />

groups have reported large decreases in sales since H2 2008, causing a drop in earnings. Therefore, luxury<br />

companies have announced a cost cutting in overheads as well as a reduction in their expansion plans. This<br />

should not come as unexpected, as most of our past empirical studies emphasized the volatility of the luxury<br />

sector, and its downside risks during a downturn. In prime Paris, some new recent fashion designers closed<br />

their units in the wake of the downturn, unable to stand the storm. Retailers are now definitely conscious that<br />

consumers are becoming more price conscious than ever, substituting goods as their budget constraint has<br />

now shifted downward.<br />

Okaïdi, Multimarques, Sprint and other mid market brands also took premises in the High Street shop<br />

submarket. In general, mass markets have shown more resilience to the downturn. In spite of that, they have<br />

also adopted a cautious stance, by freezing potential expansion, to avoid a cannibalization effect in the<br />

future.<br />

Short term indicators continue to trend downward as<br />

concerns are rising. The erosion of household<br />

expenditure, combined with rising unemployment and<br />

loss of income are marring retailer perceptions as a<br />

whole. Sales in department stores have touched a<br />

peak and are slowing down. Conversely,<br />

Supermarkets and Hypermarkets are holding well<br />

given their competitive edge in term or pricing.<br />

Altogether, prospects of future sales are deteriorating<br />

while inventories have globally increased, which does<br />

not bode well for the near term. Breaking down the<br />

retailer’s confidence index the biggest fall is related to<br />

the traditional “expansive” goods, those either related<br />

to big tickets items such as home goods or those<br />

linked to personal care or leisure activities. On a<br />

further negative note, surveys done in both the<br />

Percentage change year-on-year<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

-35<br />

-35<br />

1996 1998 2000 2002 2004 2006 <strong>2009</strong><br />

Source: Global Insight.<br />

Retailers continued to droop<br />

as confidence worsens<br />

Consumer confidence index<br />

Retailer Confidence<br />

shopping centre and the department store submarkets have sharply deteriorated: lingering concerns are<br />

related to the household purchasing power. Tenants confess that the discounting price policy should remain<br />

a cornerstone strategy to boost turnover in the months ahead.<br />

Global retailer turnovers seem to have been resilient – although<br />

December data is not yet available. In spite of this, large<br />

differences remain across subsectors with fashion and footwear<br />

hardly hit. In <strong>2009</strong>, the global turnover is set to decrease in the<br />

wake of a worsening background, more “pain and tears” are<br />

expected as effort ratio are likely to increase further. Occupier<br />

demand is likely to fall, and retailers will definitely pressure<br />

landlords for more commercial incentives.<br />

Supply – According to Procos, a record 8.8 million m² of retail<br />

space is in the pipeline although some might be frozen along<br />

the way. The supply related to town centre regeneration is worth<br />

mentioning, including La Samaritaine redevelopment (26 000<br />

m²) located near the Seine in Paris, some units located in the<br />

Champs-Elysées (6 000 m²), as well as the Théâtre de l’Empire<br />

located in Paris. In the retail warehousing submarket, the top 5<br />

new openings comprise almost 150 000 m², while the main<br />

pipeline for <strong>2009</strong> are located in Provincial areas totalling more<br />

than 170 000 m². The 5 main projects relateing to shopping<br />

centres comprise 202 000 m². Again, an emphasis on retail<br />

parks as well as the new “green spirit” combining architectural<br />

design, price consciousness and high supply of retailers, has<br />

Percent<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

<strong>Grosvenor</strong> Research 2

Economic Updated<br />

The French Retail Market<br />

expanded steadily around the big agglomerations.<br />

However, as retailers warn of a bleak outlook, some developments have been postponed or cancelled,<br />

particularly in the provinces. Procos has already announced the cancellation of more than 800 000 m²<br />

between January 2008 and January <strong>2009</strong>, particularly in the retail park submarket.<br />

Despite poor short term economic prospects reform concerning building consents in early August will allow<br />

new opportunities, especially for downtown developments. The new law which allows the opening of<br />

premises up to 1 000 m² without a building consent (as explained in past reports), might benefit its<br />

application decree does not specify whether it is related to new or old retail space. Therefore, supermarkets<br />

and other large scale stores took advantage of this loophole to push out “their walls” and enlarge their<br />

current store area, a real opportunity for them as their turnover is gaining momentum at a fast pace.<br />

Rental Movements – As expected in past reports, the rental growth increase was not sustainable. Rental<br />

values remained flat across all submarkets in France in Q4 2008. Altogether, rents slowed down to 7% in<br />

2008 compared with 10% in 2007, below the average growth since 1996. We continue to forecast that a<br />

downward adjustment will be seen in the wake of lower spending and an increasing effort ratio. Our<br />

prediction remains that luxury prime schemes will suffer first given the higher volatility of their turnover (refer<br />

to the report written in November 2007). Again, although no drop has been reported so far, commercial<br />

incentives are on the rise, especially lease renewals.<br />

In the SC sector, rents remained stable while on an annual basis rents increased by 9% in 2008 compared<br />

with 2007. Such a rebound is a mitigating effect of the past change in the indexation mechanism: as rents<br />

have been indexed at a lower rate through the ILC than the CCI, the market rent has been able to renew<br />

with a positive trend. Nonetheless, the bright picture will not last as SC have been suffering from a fall in<br />

traffic for couple of quarters. All in all, the shift from the CCI to the new ILC, is not anymore restricted to the<br />

SC tenants. The new popular ILC is spreading at a fast pace and used by landlords as a favour to avoid any<br />

rental value decrease when leases have to be renewed. Nonetheless, as the CCI is expected to decrease in<br />

the wake of the huge drop in commodity and oil prices, the shift from the CCI to the ILC is also a savvy<br />

means for landlords to avoid a drop in their income stream next year!<br />

No sea change has been seen within the retail warehousing submarket. Such a sector usually remains less<br />

vulnerable in a downward phase of the cycle than both shopping centres and the high street. The downward<br />

adjustment of rental values is certain given the current downward trajectory of the global turnover growth<br />

driven by a slowdown in private consumption. The diversity of the retail sector itself in term of (i) premises<br />

(either located in high street, shopping centre and retail warehousing) (ii) location in large or small<br />

agglomeration, (iii) existing supply, (iv) forthcoming supply, and (v) turnover of retailers currently open the<br />

spectrum of potential forecasts. As commercial incentives have hidden the potential drops – brokers confess<br />

an increasing share of confidential deals, meaning that the level of rents must not be released – more<br />

adjustment is set to be seen. As <strong>2009</strong> will be tough for retailers, households tightening their belts, our<br />

baseline scenario has not changed: in regional cities, downward corrections between -15% (where the<br />

highest increases have been observed) and -5% are likely.<br />

Investment Market – “Why should we buy today, as it<br />

will be cheaper tomorrow?” Such a tune may have<br />

Investment the Retail Market<br />

been the mantra of investors in <strong>2009</strong>. Indeed, the<br />

remaining fears of further falls in capital values in<br />

€ million<br />

6000<br />

<strong>2009</strong> have acted as a brake in the investment market,<br />

notably in Q4 2008. Altogether, the activity within the<br />

5000<br />

4800<br />

retail investment market decreased by almost 80% on<br />

the back of a wait and see stance of both buyers and<br />

sellers. Indeed, it has to be kept in mind that although<br />

4000<br />

3000<br />

2050<br />

the French market has not appeared to be poised for 2000<br />

1700<br />

crash, potential buyers have continued to adjust<br />

800<br />

950<br />

1100<br />

1100<br />

1000<br />

downwards their expectations in the wake of the<br />

dreadful environment. Practically, the active buyers 0<br />

2002 2003 2004 2005 2006 2007 2008<br />

are taking more time to structure deals but also put<br />

pressure on potential sellers as increasing credit<br />

S ource: Immostat<br />

conditions and guarantees have decreased their<br />

willingness to pay. More generally, domestic players continue to be in a good position to benefit from the<br />

downward adjustment (Insurance companies, SCPI –non listed real estate vehicles). Given their long term<br />

<strong>Grosvenor</strong> Research 3

Economic Updated<br />

The French Retail Market<br />

profile, they seem to be less vulnerable to a second round of downward adjustment as they highly favour<br />

regular and large income streams – rather than yield play. Such a reason explains their remaining strategy<br />

to hold core assets.<br />

As explained, since the beginning of the year, there has been a common expectation of a fall in capital<br />

values as a result of the financial turmoil. Such an environment has implied a “sell strategy” rather than a<br />

“hold one”. As noticed and anticipated, sellers have been reluctant to reduce their prices while buyers have<br />

taken an opportunistic stance with a hard-line approach: such a mismatch has continued to weigh on the<br />

pace of transactions. The sellers have also taken an opportunistic stance, as some of them have decided to<br />

hold back their assets when the bid price was not satisfying enough. As the domestic players have<br />

financially remained in good shape, no distress opportunities have been observed for prime assets like in<br />

other European countries, although some listed companies have undertaken some arbitrage to fulfil bank’s<br />

requirements. In the prime submarkets, the lack of sales activity continues to make it difficult to appraise<br />

prices, but valuers have taken a consensus view for the end of 2008.<br />

Yield movements across submarkets<br />

Moving now to some key market features, the<br />

downward adjustment in capital values has been<br />

1 Weighted-average of the different moves observed across cities.<br />

bps<br />

quicker in the high street submarket while an 125<br />

overshooting was observed both in the retail 100<br />

HS Paris<br />

HS Prov<br />

RW IDF<br />

RW Prov<br />

warehousing and shopping centres submarkets in Q4.<br />

75<br />

SC Paris + Prov SC Prov<br />

It is as if valuers wanted to catch-up the lag.<br />

50<br />

Altogether, in 2008 - as shown by the chart - the<br />

outward yield shift was the highest in the shopping<br />

centre submarket, while the high street shop<br />

25<br />

0<br />

-25<br />

1996 1998 2000 2002 2004 2006 2008<br />

submarket testified stronger resilience. In the high<br />

-50<br />

street shop submarket, the outward yield shift was<br />

-75<br />

between [75bps;125bps] which generates a capital<br />

value fall 1 of 19% on average. In the SC the yield shift<br />

-100<br />

Source: <strong>Grosvenor</strong> Research modelling, C&W<br />

was stronger [100bps;150bps] representing 22% on<br />

average. The stronger adjustment is not that<br />

surprising given the magnitude of the past yield compression. Finally, in the retail warehousing submarket,<br />

the outward move was between [50bps;100bps] which means a fall of 13% on average.<br />

With the recessionary phase is looming, consumption is set to lose momentum, dampening rental value<br />

growth potential. In such a setting, new capital value falls are set to be seen in <strong>2009</strong> and 2010, if no silver<br />

lining is seen from the real economic sphere by then. Although no negative wealth effect is foreseen<br />

compared with other countries, France will also have to fight against the headwinds if consumption falls<br />

below 1%.<br />

Key investments deals were undertaken between Q42008 and beginning of <strong>2009</strong>:<br />

In the High Street shop submarket:<br />

- Groupe Pierre and Entreprise acquired ‘Foncière du Marais’, a portfolio of 8 Parisian assets, (1,600<br />

m²) for €13m (8,125 €/m²).<br />

- A private investor acquired 6, Place de la Madeleine from Bluestone Group for €7.9m at a yield of<br />

5.07%.<br />

- A private investor acquired a forward-funded shopping centre investment and supermarket (1,535<br />

m²) in Rue de l’Arbalette, Reims for €7.4m.<br />

- Terrëis acquired a portfolio in Paris Rue Chabrol, Angers, Biarritz and Agde (918 m²) for €5.5m<br />

(5991 €/m²).<br />

- Sofidy acquired Naturalia in Paris 75011 (213 m²) for €1.2m (5,634 €/m²).<br />

- 231m² were acquired in Marseille, Boulevard Robert Schumann, for approximately 2,500 €/m².<br />

- A private investor acquired 47 Avenue de Saxe (330 m²) from Gécina for €1m (3,030 €/m²).<br />

<strong>Grosvenor</strong> Research 4

Economic Updated<br />

The French Retail Market<br />

In other submarkets:<br />

- AEW Immocommerical acquired a portfolio of 42 supermarkets under the brands Casino, Leader<br />

Price and Franprix from Casino Group for €80m.<br />

- Klémurs acquired a sale and lease-back of 21 King Jouet units (17,541 m²) for €18.3m, reflecting a<br />

net initial yield of 8.2%.<br />

- Klémurs acquired 6 units under construction in Châlon-sur-Saône (9,800 m²) for €14.8m reflecting a<br />

net initial yield of 6.6%.<br />

- Financière Teychené acquired a portfolio of medium-sized units in the East of France from Groupe<br />

Secyvest for €14.44m, reflecting a net initial yield of 6.75%-7%.<br />

- Placement Ciloger 1 OPCI acquired a forward-funded retail park retail park in Yvetot (7,000 m²), for<br />

€11m, reflecting a net initial yield of 6.5%.<br />

- Cenor Asset Management acquired a sale and leaseback of 6 Zolpan assets in the Ile de France<br />

region (12,680 m²) for €10m, reflecting a gross yield of approximately 9%.<br />

- A private investor acquired an asset at Noyelles Goudault (2,600 m²) for €5.18m, reflecting a net<br />

initial yield of 6%.<br />

- Financière Teychené acquired the Aubert and Picard units in Houdemont (1900 m²) from Secyvest<br />

for €2.9m.<br />

- Financière Teychené acquired 1,238m² in Bonneuil sur Marne for €2.95m.<br />

- Sofidy acquired La Halle and Le Dragon d’Or in Concarneau (1,067 m²) for €2.19m.<br />

- Financière Teychené acquired two assets let to La Halle and La Halle ô Chaussures in Commercy<br />

(2,000 m²) for €2.15m, reflecting a net initial yield of 8%.<br />

- Finexel acquired the Leader Price unit (1,484 m²) in Clermont Ferrand for €1.63m.<br />

- Immorente acquired Centre Auto Feu Vert at Saran, Orléans (1,280 m²) for €1.13m.<br />

- Uffi Ream bought from <strong>Grosvenor</strong> 10 500 m² of retail spaces in Villeneuve d’Ascq for €21.2 million<br />

reflected in a yield of 7.05%.<br />

- Mercialys bought from CCSO a part (2 850 m²) of “CC Geant Plein Ciel” (8 100 m²) in Narbonne.<br />

The total investment was €18 million, reflected in a yield of 5.6%.<br />

- Mercialys bought 2 700 m² out of the 18 000 m² of “CC Geant Casino” in Istres for €13 million,<br />

reflected in a yield of 5.4%.<br />

- Ciloger bought from Les Arches a Retail Park (8 000 m²) in Yvetot for €10.1 million, reflected in a<br />

yield of 6.3%.<br />

- One property fund represented by Cenor Asset Management acquired in sale and lease back<br />

operation 6 assets from Zolpan. The portfolio comprises 12 680 m² and was purchased for €10<br />

million.<br />

- Mercialys acquired from CCSO a part (2 300 m²) of “CC Géant Casino” in Lons for €8 million,<br />

reflected in a yield of 6.2%.<br />

<strong>Grosvenor</strong> Research 5

Economic Updated<br />

The French Retail Market<br />

GDP Slumped amid global recession fears<br />

% year-on-year<br />

5<br />

4<br />

150<br />

140<br />

Retail sales in value have lost momentum,<br />

more to come with easing inflation<br />

3<br />

130<br />

2<br />

1<br />

0<br />

-1<br />

120<br />

110<br />

100<br />

-2<br />

1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 2006Q1 <strong>2009</strong> Q1<br />

90<br />

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08<br />

Source: Global Insight<br />

GDP<br />

Private Consumption<br />

Retail Shops ( 3 mth ma) High Street & Popular Shops Supermarkets Hypermarkets<br />

Source: Banque de France<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

Unemployment to rise spurs<br />

by a contracting Employment growth<br />

Percentage change year-on-year<br />

-3<br />

7<br />

1991Q1 1994Q1 1997Q1 2000Q1 2003Q1 2006Q1 <strong>2009</strong> Q1<br />

Employment<br />

Source: Global Insight.<br />

Rate of Unemployment (Right)<br />

Percent<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

Consumer Confidence Index falling<br />

Retail sales lost momentum<br />

Percentage change year-on-year<br />

-35<br />

-2<br />

1996 1998 2000 2002 2004 2006 <strong>2009</strong><br />

Source: Global Insight.<br />

Consumer confidence index<br />

Retail sales (right scale)<br />

Percent<br />

6<br />

4<br />

2<br />

0<br />

Inflation declines<br />

as inflationary pressures ease<br />

% %<br />

4<br />

3<br />

8<br />

6<br />

2<br />

4<br />

1<br />

2<br />

0<br />

0<br />

-1<br />

-2<br />

-2<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 <strong>2009</strong><br />

Recession fears forced<br />

the ECB to cut rates<br />

% %<br />

10<br />

9<br />

12<br />

11<br />

8<br />

10<br />

9<br />

7<br />

8<br />

6<br />

7<br />

5<br />

6<br />

4<br />

5<br />

3<br />

4<br />

3<br />

2<br />

2<br />

1<br />

1<br />

0<br />

0<br />

1991 1993 1995 1997 1999 2001 2003 2005 2007 <strong>2009</strong><br />

Source: INSEE<br />

CPI<br />

Producer Prices Index<br />

Source: Banque de France<br />

10 year Gov't Bond Yields ECB Refi Rate<br />

Outlook Summary<br />

In 2008, economic activity slowed down to 0.8% the worst performance since the latest deepest crisis in<br />

1993. As expected France will soon enter into a recessionary phase. According to preliminary results, output<br />

growth contracted by 4.8% annualized rate, and by -1.0% on a year-on-year basis, as forecasted in the<br />

latest report. Therefore, the carry-over effect for <strong>2009</strong> is negative, confirming our baseline scenario that<br />

economic activity will contract vigorously in <strong>2009</strong>.<br />

Turning now to the breakdown by components, the picture is not encouraging as investment has been held<br />

back by 6% annualized rate in the wake of (i) tightening credit conditions and (ii) poor prospects in the near<br />

term. The high level of inventories does not bode well for future investment. Altogether, leading indicators<br />

<strong>Grosvenor</strong> Research 6

Economic Updated<br />

The French Retail Market<br />

and investment surveys have continued to be badly oriented, trending in a negative territory as companies<br />

do not see the end of the tunnel so far. Simulations suggest that investment, could contract by 10% in 2010<br />

pressuring deeply global domestic demand.<br />

The big question remains if the fiscal stimulus will be able to sustain economic activity as a whole. The<br />

government has decided to target sector, such as the car industry, instead of more global measures such as<br />

a decrease in VAT or income taxes rebates, like the UK did. Such a decision is mainly explained by the<br />

exposure of French GDP, as well as the overall French economic model, to the industry (16%). As the<br />

labour market is not as flexible as in the UK, companies have not been able to lay-off as many employees<br />

as they would have in a rationalization process. In such a context, the French government is sustaining<br />

companies to avoid any more lay-off and social discontent. The overall package in the car industry reached<br />

€6bn.<br />

Despite capital injections in the national companies, labour market prospects continue to be badly oriented<br />

in line with the past contraction in employment. As a result, unemployment has increased and is foreseen to<br />

jump to 9.5% before the end of the year, a level not seen since the end of the 90’s. As employment is the<br />

main driver for income growth, purchasing power and consumption growth, a new contraction in employment<br />

will spillover into retail sales. To set the scene, private payroll decreased by 89k in Q4, following a drop of<br />

47k in Q3 and -28k in Q2, explaining mainly the downbeat view of consumers regarding (i) their financial<br />

position and (ii) their ability to save money.<br />

Despite such a bleak background, the rebound of the<br />

private consumption came has a relief. In Q4 2008,<br />

household spending increased by 2%, annualized<br />

rate, in the wake of an increasing purchasing power,<br />

as inflation notably ebbed. Nonetheless, latest results<br />

released confirm that the recent rebound is shortlived.<br />

December figures measuring an annualized rate<br />

seemed to set the tone: -2% in equipment<br />

(households, white and black goods), -4.8% in fashion<br />

and leather, and -4% for other manufactured goods.<br />

Retail sales in volume have sharply decreased<br />

through 2008<br />

Easing inflation has probably avoided a deeper fall as<br />

90<br />

it the best means of increasing purchasing power 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08<br />

when no earning growth is forecast. In the final Retail Shops ( 3 mth ma) High Street & Popular Shops Supermarkets Hypermarkets<br />

quarter, inflation dropped to 1.8% 2 , the lowest level Source: Banque de France<br />

since Q4 1999. Inflationary pressures receded in line<br />

with the continuing fall in both oil and commodity prices and are set to remain low given the recessionary<br />

environment and the deflationary pressures in the retail sector. The winter sales might have sustained<br />

spending in January, but consumption should remain subdued in the back of remaining uncertainties. More<br />

structurally, the strong household deleveraging process foreseen in Spain, Ireland, UK or the US for<br />

instance will not take place as French households are less indebted and no negative wealth effect is on play.<br />

Despite of this, consumption should slow 0.6% in <strong>2009</strong>, its lowest level since 1993.<br />

The stimulus package agreed at the end of the year totalling €26bn is set to spill over into the real sphere by<br />

the second half of the year, through investment and corporate treasuries. The authorities have also pledged<br />

to help households’ interest payments on loans extended to the banking sector, which totalling €1.4bn.<br />

Altogether the fiscal package amounts 1% of GDP for <strong>2009</strong>, far lower what has been seen in both the UK<br />

and the US. Nonetheless, its impact will be huge on the public finances as the general government deficit is<br />

set to widen to 6% of GDP in <strong>2009</strong> - 3.4% in 2008 - while economic growth will contract by around 2%. Data<br />

confirms our baseline scenario of a weak economic backdrop for 2010.<br />

140<br />

130<br />

120<br />

110<br />

100<br />

2 In 2008, inflation rose to 2.8% compared with 2007.<br />

This document is for general informative purposes only. The information has been compiled from sources believed<br />

to be reliable however its accuracy and completeness are not guaranteed. The opinions expressed are those of the<br />

Research Department of <strong>Grosvenor</strong> Group Limited ("<strong>Grosvenor</strong>") at this date and are subject to change without<br />

notice. Reliance should not be placed on the information, forecasts and opinions set out herein for any investment<br />

purposes and <strong>Grosvenor</strong> will not accept any liability arising from such use. This document is intended for<br />

professional and non-private investors only. No part of this publication may be reproduced in any form without the<br />

prior written permission of <strong>Grosvenor</strong>.