Global Outlook February 2009.pdf - Grosvenor

Global Outlook February 2009.pdf - Grosvenor

Global Outlook February 2009.pdf - Grosvenor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Global</strong> <strong>Outlook</strong> <strong>February</strong> 2009<br />

The case for investment in European healthcare property<br />

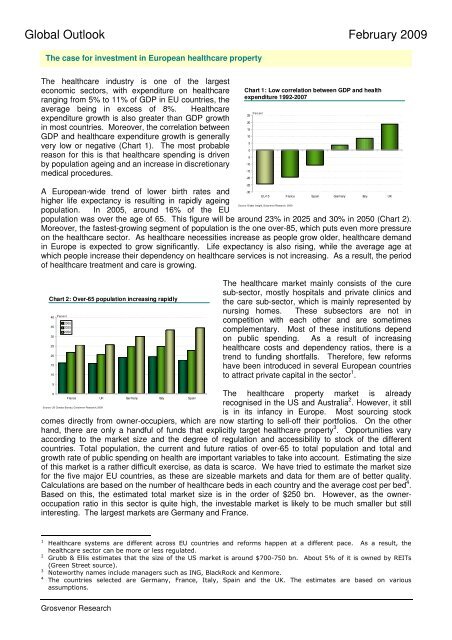

The healthcare industry is one of the largest<br />

economic sectors, with expenditure on healthcare<br />

ranging from 5% to 11% of GDP in EU countries, the<br />

average being in excess of 8%. Healthcare<br />

expenditure growth is also greater than GDP growth<br />

in most countries. Moreover, the correlation between<br />

GDP and healthcare expenditure growth is generally<br />

very low or negative (Chart 1). The most probable<br />

reason for this is that healthcare spending is driven<br />

by population ageing and an increase in discretionary<br />

medical procedures.<br />

Chart 1: Low correlation between GDP and health<br />

expenditure 1992-2007<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

Percent<br />

A European-wide trend of lower birth rates and -30<br />

EU-15 France Spain Germany Italy UK<br />

higher life expectancy is resulting in rapidly ageing<br />

Source: <strong>Global</strong> Insight, <strong>Grosvenor</strong> Research, 2009<br />

population. In 2005, around 16% of the EU<br />

population was over the age of 65. This figure will be around 23% in 2025 and 30% in 2050 (Chart 2).<br />

Moreover, the fastest-growing segment of population is the one over-85, which puts even more pressure<br />

on the healthcare sector. As healthcare necessities increase as people grow older, healthcare demand<br />

in Europe is expected to grow significantly. Life expectancy is also rising, while the average age at<br />

which people increase their dependency on healthcare services is not increasing. As a result, the period<br />

of healthcare treatment and care is growing.<br />

Chart 2: Over-65 population increasing rapidly<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

Percent<br />

2005<br />

2025<br />

2050<br />

The healthcare market mainly consists of the cure<br />

sub-sector, mostly hospitals and private clinics and<br />

the care sub-sector, which is mainly represented by<br />

nursing homes. These subsectors are not in<br />

competition with each other and are sometimes<br />

complementary. Most of these institutions depend<br />

on public spending. As a result of increasing<br />

healthcare costs and dependency ratios, there is a<br />

trend to funding shortfalls. Therefore, few reforms<br />

have been introduced in several European countries<br />

to attract private capital in the sector 1 .<br />

0<br />

The healthcare property market is already<br />

France UK Germany Italy Spain<br />

recognised in the US and Australia 2 . However, it still<br />

Source: US Censes Bureau, <strong>Grosvenor</strong> Research, 2009<br />

is in its infancy in Europe. Most sourcing stock<br />

comes directly from owner-occupiers, which are now starting to sell-off their portfolios. On the other<br />

hand, there are only a handful of funds that explicitly target healthcare property 3 . Opportunities vary<br />

according to the market size and the degree of regulation and accessibility to stock of the different<br />

countries. Total population, the current and future ratios of over-65 to total population and total and<br />

growth rate of public spending on health are important variables to take into account. Estimating the size<br />

of this market is a rather difficult exercise, as data is scarce. We have tried to estimate the market size<br />

for the five major EU countries, as these are sizeable markets and data for them are of better quality.<br />

Calculations are based on the number of healthcare beds in each country and the average cost per bed 4 .<br />

Based on this, the estimated total market size is in the order of $250 bn. However, as the owneroccupation<br />

ratio in this sector is quite high, the investable market is likely to be much smaller but still<br />

interesting. The largest markets are Germany and France.<br />

-25<br />

1 Healthcare systems are different across EU countries and reforms happen at a different pace. As a result, the<br />

healthcare sector can be more or less regulated.<br />

2 Grubb & Ellis estimates that the size of the US market is around $700-750 bn. About 5% of it is owned by REITs<br />

(Green Street source).<br />

3 Noteworthy names include managers such as ING, BlackRock and Kenmore.<br />

4 The countries selected are Germany, France, Italy, Spain and the UK. The estimates are based on various<br />

assumptions.<br />

<strong>Grosvenor</strong> Research

<strong>Global</strong> <strong>Outlook</strong> <strong>February</strong> 2009<br />

Chart 3: Germany is the largest market<br />

$ bn<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Spain UK Italy France Germany<br />

Source: WHO, <strong>Grosvenor</strong> Research, 2009<br />

Compared with standard commercial property,<br />

healthcare property vacancy and rental rates are less<br />

likely to exhibit the peaks and troughs of the property<br />

cycle. Healthcare property can offer attractive<br />

income returns. Although our analysis is limited by<br />

data availability, anecdotal evidence suggests that<br />

yields are relatively high, when compared to the main<br />

commercial sectors. This is hardly surprising, given<br />

the higher risk implied by this type of investment.<br />

Prime yields should range are expected to be<br />

between 7.0% and 9.0% for this kind of product.<br />

Moreover, the healthcare market in Continental<br />

Europe is characterised by long leases and offers<br />

indexation, albeit maybe not at full rate.<br />

As mentioned, investing in healthcare property is not, however, exempt from risks. The sector is still<br />

quite illiquid and lack of transparency maybe an issue as legislation and regulation are rather different<br />

across European countries. A specific risk of this sector is mismanagement risk, as it carries a severe<br />

reputational risk. On the other hand, re-letting risk may be mitigated as a result of government concern<br />

about continuity of services. These types of properties are also generally located in good central or<br />

countryside locations, making it easier to change the use of the building.<br />

This document is for general informative purposes only. The information has been compiled from sources believed to be reliable however its accuracy and<br />

completeness are not guaranteed. The opinions expressed are those of the Research Department of <strong>Grosvenor</strong> Group Limited ("<strong>Grosvenor</strong>") at this date<br />

and are subject to change without notice. Reliance should not be placed on the information, forecasts and opinions set out herein for any investment<br />

purposes and <strong>Grosvenor</strong> will not accept any liability arising from such use. This document is intended for professional and non-private investors only. No<br />

part of this publication may be reproduced in any form without the prior written permission of <strong>Grosvenor</strong>.