Global Outlook February 2009.pdf - Grosvenor

Global Outlook February 2009.pdf - Grosvenor

Global Outlook February 2009.pdf - Grosvenor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Global</strong> <strong>Outlook</strong> <strong>February</strong> 2009<br />

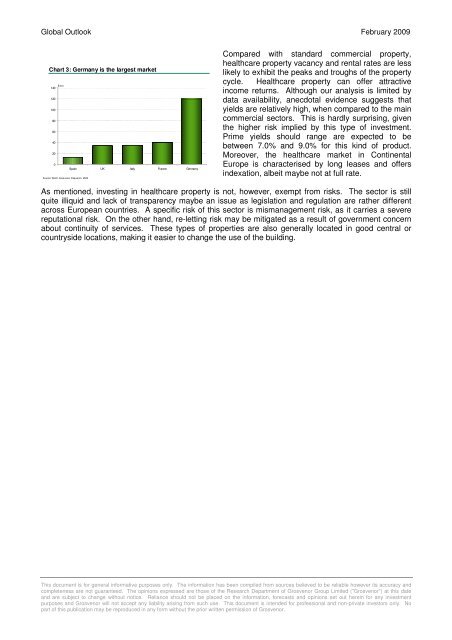

Chart 3: Germany is the largest market<br />

$ bn<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Spain UK Italy France Germany<br />

Source: WHO, <strong>Grosvenor</strong> Research, 2009<br />

Compared with standard commercial property,<br />

healthcare property vacancy and rental rates are less<br />

likely to exhibit the peaks and troughs of the property<br />

cycle. Healthcare property can offer attractive<br />

income returns. Although our analysis is limited by<br />

data availability, anecdotal evidence suggests that<br />

yields are relatively high, when compared to the main<br />

commercial sectors. This is hardly surprising, given<br />

the higher risk implied by this type of investment.<br />

Prime yields should range are expected to be<br />

between 7.0% and 9.0% for this kind of product.<br />

Moreover, the healthcare market in Continental<br />

Europe is characterised by long leases and offers<br />

indexation, albeit maybe not at full rate.<br />

As mentioned, investing in healthcare property is not, however, exempt from risks. The sector is still<br />

quite illiquid and lack of transparency maybe an issue as legislation and regulation are rather different<br />

across European countries. A specific risk of this sector is mismanagement risk, as it carries a severe<br />

reputational risk. On the other hand, re-letting risk may be mitigated as a result of government concern<br />

about continuity of services. These types of properties are also generally located in good central or<br />

countryside locations, making it easier to change the use of the building.<br />

This document is for general informative purposes only. The information has been compiled from sources believed to be reliable however its accuracy and<br />

completeness are not guaranteed. The opinions expressed are those of the Research Department of <strong>Grosvenor</strong> Group Limited ("<strong>Grosvenor</strong>") at this date<br />

and are subject to change without notice. Reliance should not be placed on the information, forecasts and opinions set out herein for any investment<br />

purposes and <strong>Grosvenor</strong> will not accept any liability arising from such use. This document is intended for professional and non-private investors only. No<br />

part of this publication may be reproduced in any form without the prior written permission of <strong>Grosvenor</strong>.