Managing GSA SmartPay® Purchase Card Use

Managing GSA SmartPay® Purchase Card Use

Managing GSA SmartPay® Purchase Card Use

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

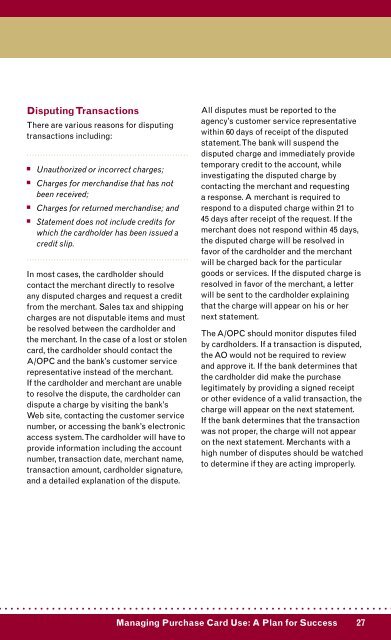

Disputing Transactions<br />

There are various reasons for disputing<br />

transactions including:<br />

............................................................<br />

n<br />

n<br />

n<br />

n<br />

Unauthorized or incorrect charges;<br />

Charges for merchandise that has not<br />

been received;<br />

Charges for returned merchandise; and<br />

Statement does not include credits for<br />

which the cardholder has been issued a<br />

credit slip.<br />

............................................................<br />

In most cases, the cardholder should<br />

contact the merchant directly to resolve<br />

any disputed charges and request a credit<br />

from the merchant. Sales tax and shipping<br />

charges are not disputable items and must<br />

be resolved between the cardholder and<br />

the merchant. In the case of a lost or stolen<br />

card, the cardholder should contact the<br />

A/OPC and the bank’s customer service<br />

representative instead of the merchant.<br />

If the cardholder and merchant are unable<br />

to resolve the dispute, the cardholder can<br />

dispute a charge by visiting the bank’s<br />

Web site, contacting the customer service<br />

number, or accessing the bank’s electronic<br />

access system. The cardholder will have to<br />

provide information including the account<br />

number, transaction date, merchant name,<br />

transaction amount, cardholder signature,<br />

and a detailed explanation of the dispute.<br />

All disputes must be reported to the<br />

agency’s customer service representative<br />

within 60 days of receipt of the disputed<br />

statement. The bank will suspend the<br />

disputed charge and immediately provide<br />

temporary credit to the account, while<br />

investigating the disputed charge by<br />

contacting the merchant and requesting<br />

a response. A merchant is required to<br />

respond to a disputed charge within 21 to<br />

45 days after receipt of the request. If the<br />

merchant does not respond within 45 days,<br />

the disputed charge will be resolved in<br />

favor of the cardholder and the merchant<br />

will be charged back for the particular<br />

goods or services. If the disputed charge is<br />

resolved in favor of the merchant, a letter<br />

will be sent to the cardholder explaining<br />

that the charge will appear on his or her<br />

next statement.<br />

The A/OPC should monitor disputes filed<br />

by cardholders. If a transaction is disputed,<br />

the AO would not be required to review<br />

and approve it. If the bank determines that<br />

the cardholder did make the purchase<br />

legitimately by providing a signed receipt<br />

or other evidence of a valid transaction, the<br />

charge will appear on the next statement.<br />

If the bank determines that the transaction<br />

was not proper, the charge will not appear<br />

on the next statement. Merchants with a<br />

high number of disputes should be watched<br />

to determine if they are acting improperly.<br />

<strong>Managing</strong> <strong>Purchase</strong> <strong>Card</strong> <strong>Use</strong>: A Plan for Success 27