EXPERIENCEBUSINESS - Harley-Davidson

EXPERIENCEBUSINESS - Harley-Davidson

EXPERIENCEBUSINESS - Harley-Davidson

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

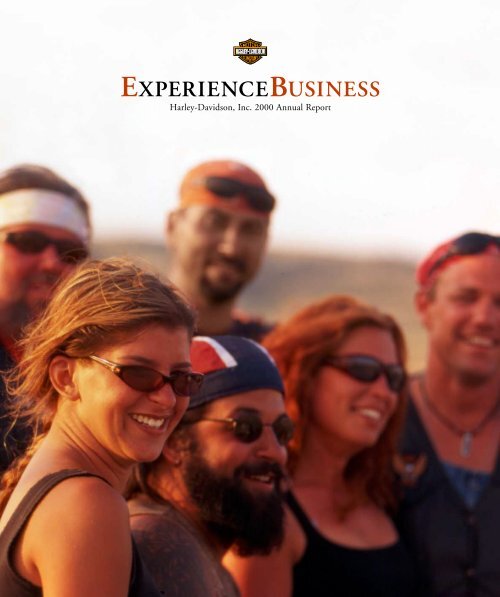

<strong>EXPERIENCEBUSINESS</strong><br />

<strong>Harley</strong>-<strong>Davidson</strong>, Inc. 2000 Annual Report

FINANCIAL HIGHLIGHTS<br />

<strong>Harley</strong>-<strong>Davidson</strong>, Inc.<br />

(In thousands, except per share amounts) 2000 1999 1998<br />

Net sales $2,906,365 $2,452,939 $2,063,956<br />

Income before provision for income taxes 548,556 420,793 336,229<br />

Provision for income taxes 200,843 153,592 122,729<br />

Net income $ 347,713 $ 267,201 $ 213,500<br />

Weighted-average common shares-basic 302,691 304,748 304,454<br />

Weighted-average common shares-diluted 307,470 309,714 309,406<br />

Basic earnings per common share $1.15 $.88 $.70<br />

Diluted earnings per common share $1.13 $.86 $.69<br />

Market prices per share (Low-High) (Low-High) (Low-High)<br />

First quarter 29.46 – 42.58 21.25 – 31.13 12.47 – 16.88<br />

Second quarter 33.15 – 46.54 25.25 – 32.03 15.31 – 19.00<br />

Third quarter 34.15 – 50.60 22.53 – 31.22 14.81 – 21.00<br />

Fourth quarter 34.56 – 49.84 24.19 – 32.03 13.06 – 23.75<br />

Dividends paid per share HARLEY-DAVIDSON, INC. YEAR-END STOCK $.10 PRICES<br />

$.09 $.08<br />

Number of shareholders of record In Dollars 70,942 65,543 60,503<br />

$ 000.0 000.0 000.0 000.0 000.0 000.0 000.0 000.0 000.0 000.0 000.0<br />

70<br />

Balance sheet data as of December 31<br />

60<br />

Working capital<br />

50<br />

$ 799,521 $ 430,840 $ 376,448<br />

Current finance receivables, net 530,859 440,951 360,341<br />

40<br />

Long-term finance 30receivables, net 234,091 354,888 319,427<br />

Total assets 20<br />

2,436,404 2,112,077 1,920,209<br />

10<br />

Shareholders’ equity 1,405,655 1,161,080 1,029,911<br />

0<br />

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

SPLIT ADJUSTED

W<br />

hether it’s the excitement of a kid<br />

®<br />

who sees his first <strong>Harley</strong> or the<br />

®<br />

emotion of a Lifetime H.O.G. member<br />

leading a toy run, the <strong>Harley</strong>-<strong>Davidson</strong><br />

experience manifests itself in many<br />

ways. That experience is no accident;<br />

it is nurtured by dealers, employees and<br />

suppliers alike, brought to life by the<br />

passion of our loyal customers. <strong>Harley</strong>-<br />

<strong>Davidson</strong> is in the business of creating<br />

the unique experiences of which dreams<br />

are made.We create moments in time<br />

that live on long after they are gone.<br />

And that’s something no one can copy.

Jeffrey L. Bleustein, CHAIRMAN & CHIEF EXECUTIVE OFFICER

CHAIRMAN’S LETTER<br />

We fulfill dreams through the experiences of<br />

motorcycling – by providing to motorcyclists and<br />

to the general public an expanding line of<br />

motorcycles, branded products and services in<br />

selected market segments.<br />

–HARLEY-DAVIDSON MISSION STATEMENT<br />

DEAR FELLOW SHAREHOLDERS: Riding a <strong>Harley</strong>-<br />

<strong>Davidson</strong> ® motorcycle generates an abundance of<br />

physical experiences. For Brenda and me it’s things<br />

like the overwhelming beauty of the Great Salt Lake<br />

at dusk, or the scent of pine as we cruise through<br />

a Carolina forest, or the thunder of five thousand<br />

<strong>Harley</strong>s parading down Main Street in Durango, or<br />

the surge of power from our Twin Cam 88 TM<br />

motor as<br />

we soak up the highway miles. It’s also experiences<br />

like shivering in wet clothes when the rain clouds<br />

burst before we can reach the next overpass.<br />

But the experiences of <strong>Harley</strong>-<strong>Davidson</strong> motorcycling<br />

go well beyond the physical and into the<br />

emotional and the transformational. Like the sensation<br />

of witnessing a child’s excitement when the Biker<br />

Toy Run rumbles up to the local hospital, or the<br />

gratitude of the Muscular Dystrophy Association for<br />

the impact we’ve had on the search for a cure. Or it’s<br />

the affect on our psyche when we share our personal<br />

road tales and dreams with newfound friends at a<br />

H.O.G. ®<br />

rally or discover in ourselves an incredible<br />

sense of accomplishment and well-being at the end<br />

of a long ride.<br />

Ask any <strong>Harley</strong> ® rider – they’ll gladly share their<br />

experiences. These experiences of motorcycling create<br />

the thoughts, images and emotions of which dreams<br />

are made. So when we say “We fulfill dreams through<br />

the experiences of motorcycling,” we’re talking about<br />

“E” business – <strong>Harley</strong> style … the Experience Business.<br />

With forces as strong as these at work, perhaps<br />

it’s not surprising that in 2000, <strong>Harley</strong>-<strong>Davidson</strong><br />

achieved its 15th consecutive year of record revenue<br />

and earnings. In 2000, we produced 204,592 <strong>Harley</strong>-<br />

<strong>Davidson</strong> motorcycles, a 15.5 percent increase over<br />

the prior year. Our Buell family of motorcycles also<br />

continued to grow with the single-cylinder Buell ® Blast TM<br />

bringing new riders into the sport and convincing<br />

some of those who used to ride to get back into it.<br />

In Europe, our business continued to expand and<br />

we improved our market share for the second year in<br />

a row. We acquired the business activities of our Italian<br />

distributor and now have direct control over <strong>Harley</strong>-<br />

<strong>Davidson</strong> and Buell sales in eight countries while we<br />

partner with independent distributors in another<br />

seven. In the Asia/Pacific region, our market share<br />

grew as well. We have dealers in eight countries and<br />

are the No.1 heavyweight motorcycle manufacturer in<br />

each of those markets. Our business in Latin America<br />

also grew significantly as we expanded our presence<br />

in Mexico and Brazil.<br />

Both our Parts & Accessories and General Merchandise<br />

businesses made strong gains in 2000. Parts &<br />

Accessories saw revenues rise to $447.9 million, a 23.5<br />

percent increase over 1999, as our customers continued<br />

to personalize their motorcycles to enrich their motorcycling<br />

experiences. Our Custom Vehicle Operations,<br />

which creates limited edition, highly accessorized<br />

motorcycles, also recorded a banner year with revenue<br />

growth approaching 50 percent over the prior year.<br />

3

CHAIRMAN’S LETTER<br />

Under new leadership, our General Merchandise<br />

area saw revenues increase by 14.1 percent. Ruth<br />

Crowley joined the company as Vice President of this<br />

business segment early in the year. Prior to joining<br />

<strong>Harley</strong>, Ruth was Senior Vice President, Retail, of<br />

Universal Studios Recreation Group where she was<br />

responsible for the global retail business of the<br />

Universal Studios brands. We know that many <strong>Harley</strong>-<br />

<strong>Davidson</strong> customers first experience our brand<br />

through the purchase of clothing, children’s toys or<br />

other merchandise items. Ruth’s contributions<br />

are focused on adding new<br />

dimensions to this important part of<br />

the <strong>Harley</strong>-<strong>Davidson</strong> experience.<br />

<strong>Harley</strong>-<strong>Davidson</strong> Financial Services<br />

also had a great year during 2000<br />

as operating income increased an<br />

impressive 34.3 percent to $37.2 million.<br />

More than 60,000 buyers were<br />

able to experience the fun and excitement<br />

of <strong>Harley</strong>-<strong>Davidson</strong> ownership<br />

with the help of HDFS financing.<br />

Consolidated revenues for <strong>Harley</strong>-<strong>Davidson</strong>, Inc.<br />

also experienced an 18.5 percent increase to $2.91<br />

billion compared with $2.45 billion in 1999. Our<br />

diluted earnings per share grew at an even faster rate<br />

of 31.1 percent, to $1.13.<br />

These are impressive financial results. But we’re<br />

not complacent.<br />

During the past five years, we have invested more<br />

than $800 million in new information systems, equipment<br />

and production facilities as we prepared to offer<br />

the <strong>Harley</strong>-<strong>Davidson</strong> experience of motorcycling to<br />

more and more people.<br />

“<br />

<strong>Harley</strong>-<strong>Davidson</strong><br />

achieved its 15th<br />

consecutive year<br />

of record revenue<br />

and earnings.”<br />

As different as our “E” business is from the common<br />

notion of e-business, in areas where it makes<br />

sense for the Company, we are quite active in the<br />

e-business “revolution.” We have one of the finest<br />

product-oriented Internet sites on the World Wide<br />

Web and our motorcycle dealer network is “wired”<br />

with the Motor Company through our h-dnet.com<br />

and Talon ®<br />

systems.<br />

Our internal communications are made all the<br />

more efficient through R.I.D.E., our Rapid Information<br />

Delivery & Exchange network<br />

that is available to every employee,<br />

and we and our suppliers provide<br />

information via the Internet.<br />

Our employees are committed<br />

to quality and to the brand, and<br />

they are the primary source of our<br />

sustainable competitive advantage.<br />

Once again, Fortune magazine has<br />

named <strong>Harley</strong>-<strong>Davidson</strong> one of the<br />

Top 100 Companies to work for in<br />

America. Our relationship with the<br />

unionized workforce is also one of the best in the<br />

country. In fact, last fall we entered into a new agreement<br />

with our union partners in York, Pennsylvania<br />

that extends our relationship into 2007. This agreement<br />

demonstrates the collaborative approach we take<br />

with all our employees and it helps ensure a positive<br />

climate for continued investment in the business.<br />

To help manage <strong>Harley</strong>-<strong>Davidson</strong>’s tremendous<br />

growth in personnel around the world, we have<br />

brought in Harold Scott as Vice President of Human<br />

Resources. Harold’s experience and guidance will<br />

help the Company preserve its unique culture of<br />

4

CHAIRMAN’S LETTER<br />

employee involvement while it undergoes the tremendous<br />

change inherent in our plans for future growth.<br />

Prior to joining <strong>Harley</strong>-<strong>Davidson</strong>, Harold served as<br />

Vice President of Human Resources for Otis Elevator<br />

Company, a division of United Technologies.<br />

To assure continued demand for our products we<br />

are constantly expanding the number of ways for<br />

people to enjoy the <strong>Harley</strong>-<strong>Davidson</strong> experience.<br />

For example, our website www.harley-davidson.com,<br />

with its e-commerce section, brought the <strong>Harley</strong>-<br />

<strong>Davidson</strong> experience to more than five million unique<br />

visitors during the past year. <strong>Harley</strong>-<strong>Davidson</strong> and<br />

Buell demo rides and new product displays at major<br />

events like Daytona, Sturgis and throughout the world<br />

brought the experience to millions of additional<br />

motorcycle enthusiasts.<br />

Last year, Rider’s Edge, SM<br />

the <strong>Harley</strong>-<strong>Davidson</strong><br />

Academy of Motorcycling, introduced nearly 1,000<br />

aspiring motorcyclists to the excitement of riding and<br />

the camaraderie of <strong>Harley</strong>-Davdison. For many, the<br />

New Rider Course fulfilled a long-held dream of<br />

learning how to ride. Through their direct involvement<br />

in fulfilling these dreams, participating dealers<br />

are creating new customers today and forging the<br />

bonds that will lead to lifetime relationships.<br />

Authorized <strong>Harley</strong>-<strong>Davidson</strong> ® Rentals brought the<br />

experience to another 100,000 riders. Today, we have<br />

almost 100 rental operators in 24 states and we’re<br />

actively expanding into international markets.<br />

As always, the <strong>Harley</strong> Owners Group ®<br />

offered a<br />

variety of experiences to nearly 600,000 members<br />

worldwide during 2000. From Mexico to Mount<br />

Fuji, from Austria to Australia, H.O.G. chapters<br />

sponsored rides, events and fund-raisers in more<br />

than 100 countries around the globe. And the Buell<br />

owners group, B.R.A.G., ®<br />

is growing rapidly, adding<br />

more events and members as each day passes.<br />

To help ensure that the experiences of motorcycling<br />

are more enjoyable each day, we’ve embarked on<br />

an aggressive quality plan that involves every employee<br />

of the corporation. We are very proud of the worldclass<br />

products we build and the services we deliver,<br />

but we know that we must always continue to improve.<br />

In late 2000, we completed work on the first chapter<br />

of our Strategic Plan for Sustainable Growth. This plan<br />

sets out the strategic direction of the Company – our<br />

product strategy, production goals, sales, marketing<br />

and communications activities, training, dealer relations,<br />

and much more. It’s a comprehensive guide to<br />

sustaining the growth of our Experience Business.<br />

As you read through this Annual Report you’ll<br />

witness the unfolding of a variety of motorcycling<br />

experiences. But these are just a sampling of the<br />

plethora of experiences that surround our <strong>Harley</strong><br />

riders. Whether you’re a rider who has shared something<br />

similar, or a current or prospective employee,<br />

or supplier, or a community partner, or an investor –<br />

I’m certain that you will feel the power of this brand<br />

and this Company to serve our stakeholders well. We<br />

dedicate ourselves to that goal.<br />

Jeffrey L. Bleustein<br />

Chairman & Chief Executive Officer,<br />

<strong>Harley</strong>-<strong>Davidson</strong>, Inc.<br />

5

THE<br />

RIDE<br />

GREAT RIVER ROAD<br />

Sunday 3:26 PM<br />

Not yet … no, not yet. Your<br />

body tells you it’s not quite<br />

time to upshift into third. It<br />

doesn’t feel right. It’s not time.<br />

A millisecond later the world<br />

aligns; a synchronized motion of<br />

hand and foot will result in a<br />

seamless increase in power to<br />

the rear wheel. For a <strong>Harley</strong> rider,<br />

that is a defining moment, when<br />

operator and machine are one.<br />

Your fingers tense, your foot<br />

rises slightly. But your instinct<br />

and experience tells you it’s not<br />

time; not yet … no, not yet.

The shifting of gears may seem like a relatively<br />

isolated moment, however, in reality, it is a point<br />

in time that has taken years to create. From styling<br />

and manufacturing, to the dealer who adjusts the<br />

clutch tension, each customer experience relies on a<br />

finely tuned collaboration. It is this teamwork that<br />

helps drive us into the future; a future our customers<br />

are just now beginning to dream about.<br />

Product Development<br />

The ride actually begins years earlier at the Willie G. <strong>Davidson</strong> Product Development<br />

Center (PDC) in Milwaukee. There, Willie G. and his team of styling masters begin to turn<br />

dreams into reality by drawing on a lifetime of experience. At the PDC, a concurrent<br />

development process pulls styling, engineering, marketing, manufacturing and purchasing<br />

together as new motorcycle and accessory ideas work their way through to fruition. 1<br />

1<br />

2<br />

Engineering & Product Innovation<br />

Engineering designs take form as rough conceptual<br />

drawings, which are reviewed and elaborated<br />

upon. Then, sophisticated computer equipment<br />

guided by experienced hands helps render the<br />

drawings into three dimensions.<strong>Harley</strong>-<strong>Davidson</strong><br />

employs some of the most advanced technology<br />

in the industry including computer design modeling,<br />

finite element analysis, electro magnetic<br />

compatibility and radiated immunity testing as<br />

our engineering and design teams take projects<br />

forward. 2, 3<br />

Manufacturing<br />

During the past five years, we have invested<br />

more than $800 million in new and upgraded<br />

information systems, R&D technology, manufacturing<br />

facilities and more, but we’ve also<br />

invested in our people. By empowering our<br />

employees and working in a Partnering relationship<br />

with our unions, all our employees are<br />

able to grow both personally and professionally<br />

right along with the Company. 4<br />

The Motorcycle<br />

Since 1903, <strong>Harley</strong>-<strong>Davidson</strong> has produced the<br />

world’s best heavyweight motorcycles and our<br />

bikes lead the cruiser and touring segments<br />

everywhere they are sold. In 2000, we surpassed<br />

our production target for 2003, by producing<br />

and selling 204,592 units. Current demand has<br />

given us the confidence to raise <strong>Harley</strong>-<strong>Davidson</strong><br />

production targets to 227,000 units in 2001.<br />

In North America, our retail sales reached<br />

163,984 units during 2000, in Europe, 19,870;<br />

and in the Asia/Pacific Region, 12,213 units.<br />

<strong>Harley</strong>-<strong>Davidson</strong> ® motorcycles continue to win<br />

worldwide acclaim. For example, one of the<br />

leading motorcycle magazines in North America<br />

selected the Softail ®<br />

TM<br />

Deuce as Cruiser of the<br />

Year and named the Electra Glide ®<br />

the Touring<br />

Bike of the Millennium. In Australia, the Buell ®<br />

Lightning ®<br />

X1 was named Best Naked Sport<br />

Bike for the second year in a row. 5<br />

Supplier Network<br />

Experience has taught us that our relationships<br />

with suppliers should focus on mutual success.<br />

Today, we are jointly committed to developing<br />

strategies for sustained growth, while at the<br />

same time improving delivery, raising quality<br />

and reducing costs. From the custom seats<br />

that adorn our motorcycles to the complex<br />

mechanical components formed from hot<br />

wax and molten steel, our suppliers provide an<br />

extension of our design and manufacturing<br />

capabilities. 6, 7<br />

Dealer Network<br />

Our dealers are the envy of the industry and in<br />

their stores they deliver an experience beyond<br />

motorcycle sales and service. Today, there are<br />

more than 1,300 <strong>Harley</strong>-<strong>Davidson</strong> dealerships<br />

around the world. From Japan to Jamaica, from<br />

Italy to Indonesia, <strong>Harley</strong>-<strong>Davidson</strong> dealers set<br />

the standard for motorcycle retailing. 8, 9<br />

3

4<br />

7<br />

5<br />

8<br />

6<br />

9

THE<br />

FAMILY<br />

MILWAUKEE, WISCONSIN<br />

Saturday 6:34 PM<br />

A chill sweeps through your<br />

body, created by a spontaneous<br />

outburst of pure, unadulterated<br />

joy. You are surrounded by people<br />

from all walks of life and from<br />

every corner of the globe. They<br />

are complete strangers, but you<br />

know them like your own family.<br />

They were drawn to this place<br />

by the same passion – the same<br />

dream. And they arrived here<br />

on the same machine. This is<br />

one place where you can truly<br />

be yourself. Because you don’t<br />

just fit in. You belong.

Few companies can claim a customer relationship<br />

like that enjoyed by <strong>Harley</strong>-<strong>Davidson</strong>. It is forged<br />

by time spent with <strong>Harley</strong> and Buell owners at rallies<br />

and racetracks around the world. In the process, we<br />

get feedback that helps improve our products and we<br />

nurture the kind of loyalty that is unsurpassed in the<br />

industry. We’re doing more than making customers<br />

happy. We’re making customers for life.<br />

2<br />

1 3

H.O.G. ®<br />

Nobody understands the <strong>Harley</strong>-<strong>Davidson</strong> experience better than<br />

the people who ride them. And nobody rides them more than the<br />

enthusiasts who comprise the <strong>Harley</strong> Owners Group, ®<br />

the largest<br />

motorcycle club in the world. With nearly 600,000 members worldwide,<br />

H.O.G. provides a firsthand motorcycling experience to millions<br />

more through local and national events, its website (www.hog.com),<br />

and its never-ending enthusiasm for “everything <strong>Harley</strong>.”1<br />

Community Involvement<br />

There’s another side to the <strong>Harley</strong>-<strong>Davidson</strong> experience that is as<br />

important to us as riding: the need to share our success with others in<br />

the communities where we live, work and ride. Since 1980, <strong>Harley</strong>-<br />

<strong>Davidson</strong> has been a national corporate sponsor of the Muscular<br />

Dystrophy Association and since then we’ve contributed more than<br />

$35 million to the cause. The <strong>Harley</strong>-<strong>Davidson</strong> Foundation also contributes<br />

millions annually to organizations that support education,<br />

community revitalization, the arts, and other needs. 2<br />

Rallies<br />

Daytona, Sturgis, Houston, Faaker See, Saint-Tropez, Sungwoo or<br />

Lillehammer, <strong>Harley</strong>-<strong>Davidson</strong> and Buell motorcycle riders love to<br />

get together. Today, riders can experience <strong>Harley</strong>-<strong>Davidson</strong> at events<br />

in more than 100 countries. At many, the <strong>Harley</strong>-<strong>Davidson</strong> and Buell<br />

demo and display teams is on hand extending the experience to<br />

hundreds of thousands more. Our employee-volunteers staff these<br />

events around the world. 3, 4<br />

B.R.A.G. ®<br />

For those interested in a different kind of motorcycle experience,<br />

the Buell Riders Adventure Group fills the bill. B.R.A.G. brings<br />

sport motorcycle enthusiasts together for rides and rallies throughout<br />

North America. Together, Buell enthusiasts share the fun and excitement<br />

of the brand along with its founder Erik Buell. During 2000,<br />

Erik traveled to more than a dozen events as a new list of B.R.A.G.<br />

benefits was rolled out. 5<br />

4 5

THE<br />

LIFESTYLE<br />

BATON ROUGE, LOUISIANA<br />

Monday 7:12 AM<br />

You back your motorcycle into<br />

a spot out front and lean it on<br />

the sidestand, satisfied with the<br />

miles you just left behind. The<br />

parking lot is almost empty, but<br />

soon it will be filled with dozens<br />

of <strong>Harley</strong> ®<br />

motorcycles, each as<br />

unique as its owner. Each with its<br />

own story to tell. You dismount<br />

and take off your helmet, gloves<br />

and jacket, anticipating a well-<br />

deserved cup of coffee and a<br />

chance to catch up with friends.<br />

But your ride doesn’t end here .<br />

In fact, you’re just getting started.

1<br />

2<br />

3

It’s true, our motorcycles are the center of<br />

the <strong>Harley</strong>-<strong>Davidson</strong> universe, but creating<br />

the experiences that fulfill the dreams of our<br />

customers requires much more. In the end,<br />

we’re not just selling products. We’re offering<br />

a unique and fulfilling lifestyle. We’re helping<br />

customers create an experience like no other.<br />

Parts & Accessories<br />

They are the jewels that adorn our motorcycles and anyone who has experienced a<br />

<strong>Harley</strong>-<strong>Davidson</strong> ®<br />

motorcycle decked out in our Genuine Motor Parts & Genuine<br />

Motor Accessories understands. An aggressive customer-focused product development<br />

program has created thousands of different parts and accessories for models across the<br />

Buell ® and <strong>Harley</strong> lines. From custom paint, to leather saddlebags, to exhaust systems,<br />

to engine performance parts, our riders create their own experiences by creating a<br />

motorcycle only they can own. And demand grows stronger everyday. In 2000, P&A<br />

revenues totaled almost $448 million, a 23.5 percent increase over the prior year. 1<br />

SM<br />

Rider’s Edge<br />

The experience of riding a motorcycle isn’t restricted to our current owners. Now,<br />

with Rider’s Edge, the <strong>Harley</strong>-<strong>Davidson</strong> Academy of Motorcycling, those interested<br />

in learning to ride can get in on the action at their participating <strong>Harley</strong>-<strong>Davidson</strong>/<br />

Buell dealership. During 2000, the Rider’s Edge New Rider Course provided instruction<br />

to approximately 1,000 new members of the <strong>Harley</strong> family. Those new riders<br />

first experienced <strong>Harley</strong>-<strong>Davidson</strong> on board the new single-cylinder Buell ®<br />

TM<br />

Blast.<br />

Introduced in 2000, the Blast provides new riders a low seat height and even lower<br />

center of gravity to make their first step into motorcycling an enjoyable one. 2<br />

TM<br />

MotorClothes Products and Licensed Products<br />

Our extensive line of General Merchandise products, comprised of MotorClothes<br />

branded and licensed products, adds significant value to our customers’ experience<br />

with <strong>Harley</strong>-<strong>Davidson</strong>. From kid’s toys, to leather jackets and functional riding gear,<br />

to collectibles and t-shirts, we understand what our customers want and we deliver.<br />

Our line of fashion merchandise continued to expand and we began a concentrated<br />

effort to develop a fashion line that reflects the culture and style preferences of<br />

Europe and Japan. General Merchandise revenues were $151 million in 2000, up<br />

14.1 percent over 1999. 3, 4, 5<br />

Financial Services<br />

<strong>Harley</strong>-<strong>Davidson</strong> Financial Services also makes entry into the <strong>Harley</strong>-<strong>Davidson</strong> family<br />

easier. During 2000, a partnership with U.S. Bancorp expanded the marketing of<br />

the popular <strong>Harley</strong>-<strong>Davidson</strong> ® Chrome Visa ® Card throughout the U.S. Almost<br />

60,000 <strong>Harley</strong> and Buell customers financed their purchases with the help of HDFS<br />

and more than 150,000 riders were protected by an Extended Service Plan. Almost<br />

100,000 carried HDFS Casualty Insurance. To assist our dealers, new E* Pay and E*<br />

Fund programs were introduced by HDFS to help reduce paperwork and improve<br />

efficiency in the finance and sales process. With the help of an expanding list of<br />

services and marketing initiatives, HDFS posted operating income of $37 million<br />

during 2000, a 34.3 percent increase over 1999. 6<br />

4<br />

5<br />

6

THE<br />

CONNECTION<br />

CODY, WYOMING<br />

Thursday 12:53 PM<br />

After several miles of serene<br />

straightaway, the “curves ahead”<br />

road sign is a welcome sight to<br />

everyone. The ride is about to<br />

change dramatically. Instinctively,<br />

we increase the distance between<br />

bikes and lean forward in our<br />

saddles, focusing on the road<br />

ahead. Ten bikes weave through<br />

a series of turns. Ten throttles<br />

react with precision. Ten heart<br />

rates quicken, as if controlled<br />

from the same network. Not a<br />

word is spoken. But we under-<br />

stand each other perfectly.

1<br />

2<br />

The Dealership<br />

<strong>Harley</strong>-<strong>Davidson</strong> and Buell dealers are unlike any others in the<br />

industry. Their stores are destinations for hundreds of thousands<br />

of devotees of the <strong>Harley</strong>-<strong>Davidson</strong> experience. During<br />

the past three years, almost half of all U.S. <strong>Harley</strong>-<strong>Davidson</strong><br />

dealers opened new retail stores or completed major renovations<br />

to their existing facilities. In Europe and the Asia/Pacific<br />

region, dealer growth also continues at a rapid pace. <strong>Harley</strong>-<br />

<strong>Davidson</strong> sales in Europe experienced their second straight<br />

year of strong market gains, up almost 9 percent in a market<br />

that declined slightly. <strong>Harley</strong>-<strong>Davidson</strong> increased it’s market<br />

share in Japan more than 1 percent while the market declined<br />

slightly. It was Japan’s ninth record year out of 10. 1, 2<br />

<strong>Harley</strong>-<strong>Davidson</strong> ® and Buell ® Motorcycles<br />

<strong>Harley</strong>-<strong>Davidson</strong> and Buell are about motorcycles and the<br />

experiences of riding those motorcycles; the freedom and<br />

adventure of a 30-minute blast through the back roads near<br />

home or a 17-day tour across the continent. Our motorcycles<br />

are the center of a lifestyle that provides riders and nonriders<br />

a multitude of ways to experience what is <strong>Harley</strong>-<br />

<strong>Davidson</strong>. From the Ultra Classic ® Electra Glide ® to the Buell ®<br />

TM<br />

Blast, our motorcycles contribute to the passion that makes<br />

the experience unique. 3, 4<br />

Authorized Rental Program<br />

Introduced in 1999, <strong>Harley</strong>-<strong>Davidson</strong> Authorized Rentals<br />

is bringing the experience of motorcycling to hundreds of<br />

To the uninitiated, riding a m<br />

experience, but it requires<br />

different levels. Whether it’s th<br />

rentals or <strong>Harley</strong>-<strong>Davidson</strong>.co<br />

our customers is one of the th<br />

apart. The <strong>Harley</strong> experience i<br />

and more people every day. Bec<br />

more motorcycles. It’s about bu<br />

5<br />

6

3 4<br />

otorcycle seems to be a solitary<br />

a personal connection at many<br />

rough demo rides, dealerships,<br />

m, the way we connect with<br />

ngs that sets <strong>Harley</strong>-<strong>Davidson</strong><br />

s becoming accessible to more<br />

ause it’s not just about building<br />

ilding more relationships.<br />

riders every day. Authorized rental operations opened in<br />

almost 100 locations in 24 states during 2000. To date,<br />

more than 100,000 rental days have been booked through<br />

the program. Extending the brand experience even further,<br />

Authorized Tours provide the <strong>Harley</strong>-<strong>Davidson</strong> experience<br />

to riders throughout Europe. 5<br />

<strong>Harley</strong>-<strong>Davidson</strong>.com<br />

<strong>Harley</strong>-<strong>Davidson</strong> enthusiasts rumbling along the information<br />

superhighway have enjoyed the experience of riding into the<br />

new e-commerce section of the harley-davidson.com website<br />

during the last nine months of 2000. Unlike traditional<br />

e-commerce sites, which service customers with a centralized<br />

warehouse system, a network of actual <strong>Harley</strong>-<strong>Davidson</strong><br />

dealers services online customers. This helps bring the <strong>Harley</strong>-<br />

<strong>Davidson</strong> experience to the customers and offers them the<br />

option of purchasing products to be shipped directly or<br />

held for pick-up from their selected dealer. More than three<br />

million visitors surfed through the e-commerce area during<br />

the year, collecting information, creating “wish lists,” and<br />

purchasing products. 6<br />

Demo Rides<br />

The <strong>Harley</strong>-<strong>Davidson</strong> /Buell demo fleets were active during<br />

2000, providing more than 300,000 demo rides throughout the<br />

world. Demo fleet activities were conducted in North America<br />

and in Europe, the Asia /Pacific region and Latin America.<br />

Often, one ride is all it takes to create a customer for life. 7, 8<br />

7<br />

8

FINANCIAL OVERVIEW<br />

Numbers are revealing, but they hardly<br />

begin to tell the story of why <strong>Harley</strong>-<br />

<strong>Davidson</strong> is successful. Ask our customers<br />

about return on investment and they’ll<br />

show you some pictures they took in<br />

the Badlands. Talk to our dealers about<br />

the bottom line and they’ll send you<br />

®<br />

on a ride with their local H.O.G.<br />

®<br />

or B.R.A.G. chapter. They understand<br />

what you’re asking, but for them, it’s<br />

not just about selling motorcycles. It’s<br />

about making experiences. It’s about<br />

making memories of a lifetime.

TABLE OF CONTENTS<br />

Performance Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24-28<br />

Selected Financial Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .29<br />

Management’s Discussion and Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .30<br />

Consolidated Statements of Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .39<br />

Consolidated Balance Sheets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .40-41<br />

Consolidated Statements of Cash Flows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .42<br />

Consolidated Statements of Shareholders’ Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43<br />

Notes to Consolidated Financial Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .44<br />

Supplementary Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .63<br />

Report of Independent Auditors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .63<br />

Board of Directors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .64-65<br />

Corporate Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .66<br />

23

FINANCIAL PERFORMANCE<br />

For The Year Two Thousand<br />

In 2000, the Company’s net sales and net income grew<br />

18.5 percent and 30.1 percent, respectively, making 2000<br />

the 15th consecutive year of record net sales and net<br />

income. Net sales of $2.9 billion were $453 million<br />

higher than in 1999 while 2000 net income of $347.7<br />

million was $80.5 million higher than last year.<br />

Total sales of <strong>Harley</strong>-<strong>Davidson</strong> ® motorcycles grew to $2.2 billion in 2000,<br />

an increase of 18.8 percent over 1999. Buell motorcycle sales of $58.1 million<br />

were down 8.5 percent as the Company targeted new riders with the<br />

introduction of its lower priced Buell ® Blast. Revenue from Genuine Parts &<br />

Accessories in 2000 totaled $447.9 million, a 23.5 percent increase over the<br />

previous year, and General Merchandise revenue was $151.4 million or 14.1<br />

percent higher than in 1999.<br />

The Company’s share price increased 24.1 percent during 2000 and we<br />

increased our dividend for the eighth consecutive year. Since becoming a<br />

public company in 1986, holders of <strong>Harley</strong>-<strong>Davidson</strong>, Inc. stock have realized<br />

a compound annual growth rate of over 40 percent, and participated<br />

in five 2-for-1 stock splits. The most recent stock split occurred on April 7,<br />

2000 for shareholders of record on March 22, 2000.<br />

24

40<br />

HARLEY-DAVIDSON, INC. YEAR-END STOCK PRICES<br />

In Dollars<br />

0.33 0.41 0.80 1.23 1.21 2.80 4.71 5.52 7.00 7.19 11.75 13.63 23.69 32.03 39.75<br />

30<br />

20<br />

10<br />

0<br />

1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

SPLIT ADJUSTED<br />

HARLEY-DAVIDSON AND BUELL<br />

The worldwide heavyweight motorcycle market (651+cc and<br />

above) has grown for nine consecutive years. Worldwide registrations<br />

of <strong>Harley</strong>-<strong>Davidson</strong> and Buell motorcycles grew 13.8<br />

percent and exceeded the worldwide market growth rate for the<br />

third year in a row.<br />

In the U.S., 2000 retail registrations of <strong>Harley</strong>-<strong>Davidson</strong><br />

and Buell motorcycles increased 15.7 percent over 1999. In<br />

Europe, registrations of our motorcycles increased 9.4 percent,<br />

and in the Asia/Pacific region, where our major markets are<br />

Japan and Australia, retail registrations of <strong>Harley</strong>-<strong>Davidson</strong> and<br />

Buell motorcycles increased 4.3 percent over 1999.<br />

In 2000, <strong>Harley</strong>-<strong>Davidson</strong> motorcycle production was at<br />

a record high of 204,592 <strong>Harley</strong>-<strong>Davidson</strong> motorcycles, up 15.5<br />

percent over 1999. This production increase and the growing<br />

worldwide demand, allowed the Company to achieve a 28.2<br />

percent share of the worldwide heavyweight market.<br />

Looking ahead to 2001, we anticipate continued strength in<br />

the worldwide heavyweight motorcycle market. Our production<br />

target for <strong>Harley</strong>-<strong>Davidson</strong> motorcycles has been increased to<br />

227,000 motorcycles. To insure our leadership in this attractive<br />

market, we will continue to increase production and to introduce<br />

exciting new products combined with targeted marketing<br />

strategies that appeal to a diverse and growing motorcycle<br />

enthusiast population.<br />

HARLEY-DAVIDSON FINANCIAL SERVICES<br />

<strong>Harley</strong>-<strong>Davidson</strong> Financial Services (HDFS) continued an<br />

eight-year run of strong earnings growth. Operating income<br />

increased 34.3 percent, from $27.7 million in 1999 to $37.2<br />

million in 2000. HDFS further strengthened its offerings by<br />

selling its <strong>Harley</strong>-<strong>Davidson</strong> Chrome Visa ®<br />

business to U.S.<br />

Bancorp in a move that reduced risk to the Company and allows<br />

greater service offerings to cardholders. Since it was established<br />

eight years ago, HDFS has experienced strong growth by providing<br />

a comprehensive selection of financial services to our<br />

dealers and enthusiasts.<br />

25

210<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

0.0<br />

68.6<br />

0.0<br />

76.5<br />

WORLDWIDE HARLEY-DAVIDSON, INC. MOTORCYCLE SHIPMENTS<br />

Units in Thousands<br />

0.0<br />

81.7<br />

0.6<br />

95.8<br />

1.4<br />

105.1<br />

2.8<br />

118.8<br />

4.4<br />

132.3<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

<strong>Harley</strong>-<strong>Davidson</strong> Buell<br />

COMPOUND ANNUAL GROWTH RATE SINCE 1991: 13.5%<br />

6.3<br />

150.8<br />

7.8<br />

177.2<br />

10.2<br />

204.6<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

HARLEY-DAVIDSON, INC. CONSOLIDATED REVENUE<br />

Dollars in Millions<br />

702 823 933 1,159 1,351 1,531 1,763 2,064 2,453 2,906<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

COMPOUND ANNUAL GROWTH RATE SINCE 1991: 17.1%<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

HARLEY-DAVIDSON, INC. INCOME FROM CONTINUING OPERATIONS<br />

Dollars in Millions<br />

48 57 76 96 111 143 174 214 267 348<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

COMPOUND ANNUAL GROWTH RATE SINCE 1991: 24.5%<br />

4,000<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

130<br />

233<br />

HARLEY-DAVIDSON, INC. VS. STANDARD & POOR’S 500 COMPOSITE INDEX<br />

140<br />

391<br />

155<br />

460<br />

157<br />

587<br />

215<br />

606<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

265<br />

997<br />

353<br />

1,162<br />

<strong>Harley</strong>-<strong>Davidson</strong> Standard & Poor’s 500<br />

YEAR-END MARKET VALUE OF $100 INVESTED JANUARY 2,1991<br />

454<br />

2,029<br />

550<br />

2,752<br />

500<br />

3,423<br />

26

WORLDWIDE HARLEY-DAVIDSON, INC. REVENUE<br />

Dollars in Millions<br />

<strong>Harley</strong>-<strong>Davidson</strong> Motorcycles<br />

Parts & Accessories<br />

General Merchandise<br />

Buell Motorcycles<br />

$2,246.4<br />

447.9<br />

151.4<br />

58.1<br />

Other 0.1%<br />

Buell Motorcycles 2.0%<br />

General Merchandise 5.2%<br />

Parts & Accessories 15.4%<br />

<strong>Harley</strong>-<strong>Davidson</strong><br />

Motorcycles 77.3%<br />

Other<br />

Total $2,906.4<br />

2.6<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

21.6<br />

47.0<br />

23.3<br />

53.2<br />

24.5<br />

57.2<br />

DOMESTIC/ EXPORT MOTORCYCLE SHIPMENTS<br />

Units in Thousands<br />

29.3<br />

67.1<br />

32.1<br />

74.3<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

Domestic<br />

35.1<br />

86.5<br />

Export<br />

38.2<br />

98.5<br />

42.9<br />

114.2<br />

44.6<br />

140.4<br />

48.3<br />

166.4<br />

500<br />

WORLDWIDE PARTS & ACCESSORIES REVENUE<br />

Dollars in Millions<br />

94.3 103.6 127.8 162.0 192.1 210.2 241.9 297.1 362.6 447.9<br />

400<br />

300<br />

200<br />

100<br />

0<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

COMPOUND ANNUAL GROWTH RATE SINCE 1991: 18.9%<br />

160<br />

WORLDWIDE GENERAL MERCHANDISE REVENUE<br />

Dollars in Millions<br />

36.0 52.1 71.2 94.3 100.2 90.7 95.1 114.5 132.7 151.4<br />

120<br />

80<br />

40<br />

0<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

COMPOUND ANNUAL GROWTH RATE SINCE 1991: 17.3%<br />

27

2000 NORTH AMERICAN 651+CC MOTORCYCLE REGISTRATION<br />

Units in Thousands<br />

%<br />

100.7 112.0 132.8 150.4 163.1 178.5 205.4 246.2 297.8 363.4<br />

48.3 56.0 63.4 69.7 77.8 86.8 101.2 119.4 146.1 168.3<br />

48.0 50.0 47.7 46.3 47.7 48.6 49.3 48.5 49.0 46.3<br />

Total Industry<br />

<strong>Harley</strong>-<strong>Davidson</strong> /Buell Motorcycles<br />

Percentage of Market Share<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

<strong>Harley</strong>-<strong>Davidson</strong>/Buell Market Share<br />

INCLUDES U.S.A. AND CANADA<br />

Ducati 1.9%<br />

BMW 3.2%<br />

Yamaha 9.0%<br />

Kawasaki 9.1%<br />

Suzuki 9.5%<br />

Honda 19.1%<br />

Other 1.9%<br />

<strong>Harley</strong>-<strong>Davidson</strong> /Buell<br />

46.3%<br />

2000 EUROPEAN 651+CC MOTORCYCLE REGISTRATION<br />

Units in Thousands<br />

194.7 212.1 218.6 201.9 207.2 224.7 250.3 270.2 306.7 293.4<br />

11.0 12.1 13.2 14.4 15.4 15.3 16.1 17.3 19.9 21.8<br />

Total Industry<br />

<strong>Harley</strong>-<strong>Davidson</strong> /Buell Motorcycles<br />

%<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

5.6 5.7 6.1 7.1 7.4 6.8 6.4 6.4 6.5 7.4<br />

Percentage of Market Share<br />

Aprilla 2.1%<br />

Triumph 4.2%<br />

Ducati 6.3%<br />

<strong>Harley</strong>-<strong>Davidson</strong> /Buell<br />

7.4%<br />

Kawasaki 9.4%<br />

BMW 13.0%<br />

Other 4.2%<br />

Honda 21.8%<br />

Yamaha 17.3%<br />

Suzuki 14.3%<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

<strong>Harley</strong>-<strong>Davidson</strong>/Buell Market Share<br />

INCLUDES AUSTRIA, BELGIUM, FRANCE, GERMANY, ITALY, NETHERLANDS, SPAIN, SWITZERLAND, AND UNITED KINGDOM<br />

2000 ASIA/ PACIFIC 651+CC MOTORCYCLE REGISTRATION<br />

Units in Thousands<br />

27.0 37.5 35.7 39.1 39.4 37.4 58.9 69.2 63.1 62.7<br />

5.3 6.0 6.7 7.6 7.9 8.4 10.1 10.8 12.3 12.9<br />

Total Industry<br />

<strong>Harley</strong>-<strong>Davidson</strong> /Buell Motorcycles<br />

%<br />

80<br />

60<br />

40<br />

20<br />

0<br />

19.5 16.1 18.7 19.4 20.1 22.4 17.2 15.6 19.6 20.5<br />

Percentage of Market Share<br />

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000<br />

<strong>Harley</strong>-<strong>Davidson</strong>/Buell Market Share<br />

INCLUDES JAPAN AND AUSTRALIA<br />

BMW 4.0%<br />

Ducati 4.6%<br />

Suzuki 10.4%<br />

Yamaha 17.0%<br />

Kawasaki 18.9%<br />

Other 4.2%<br />

<strong>Harley</strong>-<strong>Davidson</strong> /Buell<br />

20.5%<br />

Honda 20.4%<br />

Data provided by R.L. Polk & Company (1991-1996), Motorcycle Industry Council, Inc. (1997-2000), Giral S.A., Australian Bureau of Statistics (ABS),<br />

Japan Automobile Manufacturer’s Association, Inc. (JAMA) and Motorcycle and Moped Industry Council.<br />

28

HARLEY- DAVIDSON, INC.<br />

SELECTED FINANCIAL DATA<br />

(In thousands, except per share amounts) 2000 1999 1998 1997 1996<br />

Income statement data:<br />

Net sales $2,906,365 $2,452,939 $2,063,956 $1,762,569 $1,531,227<br />

Cost of goods sold 1,915,547 1,617,253 1,373,286 1,176,352 1,041,133<br />

Gross profit 990,818 835,686 690,670 586,217 490,094<br />

Operating income from financial services 37,178 27,685 20,211 12,355 7,801<br />

Selling, administrative and engineering (513,024) (447,512) (377,265) (328,569) (269,449)<br />

Income from operations 514,972 415,859 333,616 270,003 228,446<br />

Gain on sale of credit card business 18,915 — — — —<br />

Interest income, net 17,583 8,014 3,828 7,871 3,309<br />

Other, net (2,914) (3,080) (1,215) (1,572) (4,133)<br />

Income from continuing operations<br />

before provision for income taxes 548,556 420,793 336,229 276,302 227,622<br />

Provision for income taxes 200,843 153,592 122,729 102,232 84,213<br />

Income from continuing operations 347,713 267,201 213,500 174,070 143,409<br />

Income from discontinued operations, net of tax — — — — 22,619<br />

Net income $ 347,713 $ 267,201 $ 213,500 $ 174,070 $ 166,028<br />

Weighted-average common shares:<br />

Basic 302,691 304,748 304,454 303,300 301,366<br />

Diluted 307,470 309,714 309,406 307,896 305,850<br />

Earnings per common share from continuing operations:<br />

Basic $1.15 $.88 $.70 $.57 $.48<br />

Diluted $1.13 $.86 $.69 $.57 $.47<br />

Dividends paid $ .10 $.09 $.08 $.07 $.06<br />

Balance sheet data:<br />

Working capital $ 799,521 $ 430,840 $ 376,448 $ 342,333 $ 362,031<br />

Current finance receivables, net 530,859 440,951 360,341 293,329 183,808<br />

Long-term finance receivables, net 234,091 354,888 319,427 249,346 154,264<br />

Total assets 2,436,404 2,112,077 1,920,209 1,598,901 1,299,985<br />

Short-term debt, including<br />

current maturities of long-term debt — — — — 2,580<br />

Long-term debt, less current maturities 5,145 10,078 14,145 20,934 25,122<br />

Short-term finance debt 89,509 181,163 146,742 90,638 8,065<br />

Long-term finance debt 355,000 280,000 280,000 280,000 250,000<br />

Total debt 449,654 471,241 440,887 391,572 285,767<br />

Shareholders’ equity 1,405,655 1,161,080 1,029,911 826,668 662,720<br />

29

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

2000 COMPARED TO 1999<br />

OVERALL Net sales for 2000 totaled $2.91 billion, a $453.5<br />

million, or 18.5%, increase over 1999. Net income and diluted<br />

earnings per share for 2000 were $347.7 million and $1.13<br />

compared to $267.2 million and $.86 for 1999, increases of<br />

30.1% and 31.1%, respectively. Net income in 2000 includes<br />

a one-time after tax gain of $6.9 million, which resulted from<br />

the sale of the <strong>Harley</strong>-<strong>Davidson</strong> ® Chrome Visa ® Card business.<br />

Excluding the one-time gain, net income and diluted earnings<br />

per share for 2000 increased 27.6% and 28.5%, respectively,<br />

over last year.<br />

The Company increased its quarterly dividend payment<br />

in June 2000 from $.0225 per share to $.025 per share which<br />

resulted in a total year payout of $.0975 per share.<br />

Results of Operations<br />

Motorcycle Unit Shipments and Net Sales<br />

Increase<br />

(Dollars in millions) 2000 1999 (Decrease) % Change<br />

Motorcycle Unit Shipments<br />

<strong>Harley</strong>-<strong>Davidson</strong> ® motorcycle units 204,592 177,187 27,405 15.5%<br />

Buell ® motorcycle units 10,189 7,767 2,422 31.2<br />

Total motorcycle units 214,781 184,954 29,827 16.1%<br />

Net Sales<br />

<strong>Harley</strong>-<strong>Davidson</strong> motorcycles $ 2,246.4 $ 1,890.9 $ 355.5 18.8%<br />

Buell motorcycles 58.1 63.5 (5.4) (8.5)<br />

Total motorcycles 2,304.5 1,954.4 350.1 17.9%<br />

Motorcycle Parts and Accessories 447.9 362.6 85.3 23.5<br />

General Merchandise 151.4 132.7 18.7 14.1<br />

Other 2.6 3.2 (.6) (18.7)<br />

Total Motorcycles and Related Products $ 2,906.4 $ 2,452.9 $ 453.5 18.5%<br />

The Motorcycles and Related Products (Motorcycles)<br />

segment recorded an 18.5% increase in net sales driven by a<br />

15.5% increase in <strong>Harley</strong>-<strong>Davidson</strong> unit shipments. During<br />

2000, the Company produced and shipped approximately<br />

205,000 <strong>Harley</strong>-<strong>Davidson</strong> motorcycle units, approximately<br />

27,400 units more than in 1999. These increases were driven<br />

by the Company’s ongoing success with its manufacturing<br />

strategy combined with strong retail demand for the<br />

Company’s <strong>Harley</strong>-<strong>Davidson</strong> motorcycles.<br />

The Company’s ongoing manufacturing strategy is<br />

designed to increase capacity, improve product quality, reduce<br />

costs and increase flexibility to respond to changes in the<br />

marketplace. Based on the results achieved in 2000, the<br />

Company has increased its 2001 annual production target to<br />

227,000 <strong>Harley</strong>-<strong>Davidson</strong> units. (1)<br />

In 2000, Buell ® motorcycle revenue was down $5.4<br />

million from 1999 on 2,422 additional unit shipments. The<br />

average revenue per unit was down from prior year as a result<br />

of a shift in the mix of units sold to the new lower priced<br />

Buell Blast. The Blast was introduced during 2000 as a<br />

smaller motorcycle targeted at new motorcycle riders. The<br />

Company shipped 5,146 Blast models and 5,043 Buell<br />

V-Twin models during 2000. The Company has set a 2001<br />

Buell motorcycle production target of 10,000 units. (1)<br />

30

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

The Company’s ability to reach the 2001 targeted production<br />

levels and to attain growth rates in other areas will<br />

depend upon, among other factors, the Company’s ability to<br />

(i) continue to realize production efficiencies at its production<br />

facilities through the implementation of innovative manufacturing<br />

techniques and other means, (ii) successfully<br />

implement production capacity increases in its facilities, (iii)<br />

successfully introduce new products, (iv) avoid unexpected<br />

P&A or General Merchandise supplier backorders, and (v)<br />

sell all of the motorcycles it has the capacity to produce. In<br />

addition, the Company could experience delays in making<br />

changes to facilities as a result of risks normally associated<br />

with the operation of manufacturing facilities, including<br />

delays in the delivery of machinery and equipment or difficulties<br />

in making such machinery and equipment operational,<br />

work stoppages, difficulties with suppliers, natural<br />

causes or other factors. These risks, potential delays and<br />

uncertainties regarding the costs could also adversely impact<br />

the Company’s capital expenditure estimates (see “Liquidity<br />

and Capital Resources” section).<br />

During 2000, the worldwide heavyweight (651+cc)<br />

motorcycle market grew 7.8%, while retail registrations for<br />

the Company’s motorcycles grew 13.8%, resulting in a worldwide<br />

market share (<strong>Harley</strong>-<strong>Davidson</strong> ® and Buell) of 28.2%<br />

compared to 26.7% in 1999 (worldwide information is<br />

derived from the individual market information, page 28.)<br />

Industry registrations of domestic (United States) heavyweight<br />

motorcycles were up 22.7% (data provided by the<br />

Motorcycle Industry Council) over 1999, while domestic<br />

retail registrations for the Company’s motorcycles (<strong>Harley</strong>-<br />

<strong>Davidson</strong> and Buell) increased 15.7%. The Company ended<br />

2000 with a domestic market share of 47.4% compared to<br />

50.2% in 1999.<br />

The Company believes the loss of market share was due<br />

to the shortage of supply of its product in the market as a<br />

result of the Company's ongoing capacity constraints.<br />

International revenues totaled $585.6 million during<br />

2000, an increase of $48.3 million, or 9.0%, over 1999. The<br />

Company exported approximately 22.4% of its <strong>Harley</strong>-<br />

<strong>Davidson</strong> motorcycle shipments in 2000 compared to 23.5%<br />

during 1999. In order to support the continued strong<br />

demand in the U.S. market, the Company expects to allocate<br />

a similar percentage of unit shipments to international customers<br />

in 2001. (1)<br />

In Europe, the Company ended 2000 with a 7.4% share<br />

of the heavyweight (651+cc) market, up from 6.5% in 1999<br />

(data provided by Giral S.A.). The European market<br />

decreased 4.3% in 2000, while retail registrations for the<br />

Company’s motorcycles (<strong>Harley</strong>-<strong>Davidson</strong> and Buell) were<br />

up 9.4%. 2000 marks the second consecutive year that the<br />

Company has increased its market share in Europe. The<br />

positive results can be attributed to the continuing efforts<br />

to grow in this market, which have included accelerated<br />

dealer development, new product introductions and focused<br />

marketing programs.<br />

Asia/Pacific (Japan and Australia) data for 2000 (provided<br />

by JAMA and ABS) showed the Company with a 20.5% share<br />

of the heavyweight (651+cc) market, up from 19.6% in 1999.<br />

In 2000, retail registrations for the Company’s motorcycles<br />

(<strong>Harley</strong>-<strong>Davidson</strong> and Buell) increased 4.3%, while registrations<br />

for the Asia/Pacific market in total decreased .7%.<br />

During 2000, Parts & Accessories (P&A) sales totaled<br />

$447.9 million, up $85.3 million, or 23.5%, compared to<br />

1999. The increase in P&A sales was driven by strong motorcycle<br />

shipments and was led by higher sales for performance<br />

parts, custom paint, controls and electrical parts. The<br />

Company expects that the long-term growth rate for P&A<br />

sales will be slightly higher than the growth rate for <strong>Harley</strong>-<br />

<strong>Davidson</strong> motorcycle units. (1)<br />

General Merchandise sales for 2000, which include<br />

clothing and collectibles, of $151.4 million were up $18.7<br />

million, or 14.1%, compared to 1999. The Company expects<br />

that the long-term growth rate for General Merchandise sales<br />

will be slightly lower than the growth rate for <strong>Harley</strong>-<br />

<strong>Davidson</strong> ® motorcycle units. (1)<br />

GROSS PROFIT Gross profit in 2000 of $990.8 million was<br />

$155.1 million, or 18.6%, higher than gross profit in 1999.<br />

31

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

The increase in gross profit is primarily related to the increase<br />

in net sales. The gross profit margin was 34.1% in both 2000<br />

and 1999. Although unchanged from the prior year, gross<br />

profit margin was positively impacted in 2000 by favorable<br />

motorcycle mix and model year price increases. These factors,<br />

however, were offset primarily by the negative effect of weaker<br />

European currencies experienced during 2000.<br />

Operating Expenses<br />

(Dollars in millions) 2000 1999 Increase % Change<br />

Motorcycles and<br />

Related Products $503.3 $438.1 $65.2 14.9%<br />

Corporate 9.7 9.4 .3 3.2<br />

Total operating expenses $513.0 $447.5 $65.5 14.6%<br />

Total operating expenses for 2000 increased $65.5 million,<br />

or 14.6%, over 1999 and were 17.7% and 18.2% of net sales in<br />

2000 and 1999, respectively. Operating expense consists of selling,<br />

administrative and engineering expense, which increased<br />

$25.5 million, $21.5 million and $18.5 million, respectively,<br />

over 1999. During 2000, the Company continued to invest in<br />

its future growth as it increased spending in areas such as marketing,<br />

product development and other initiatives.<br />

OPERATING INCOME FROM FINANCIAL SERVICES The<br />

Financial Services segment reported operating income of<br />

$37.2 million for 2000, an increase of $9.5 million, or 34.3%,<br />

over 1999. Growth was particularly strong during 2000 in<br />

wholesale lending where <strong>Harley</strong>-<strong>Davidson</strong> Financial Services,<br />

Inc. (HDFS) experienced increases in both market share and<br />

profitability. Increased volumes and amounts outstanding in<br />

the retail installment lending business and commission revenue<br />

growth from the insurance agency business also contributed to<br />

increased operating income in 2000.<br />

GAIN ON SALE OF CREDIT CARD BUSINESS In the first<br />

quarter of 2000, the Company sold its <strong>Harley</strong>-<strong>Davidson</strong> ®<br />

Chrome Visa ® Card business, which consisted of approximately<br />

$142 million of revolving charge receivables. The sale<br />

resulted in a pre-tax gain of approximately $18.9 million after<br />

a $15 million write-down of goodwill, which related to the<br />

business sold. Net of taxes, the transaction resulted in a gain<br />

of approximately $6.9 million. The majority of the proceeds<br />

from the sale have been used to reduce finance debt.<br />

OTHER Other expense was $2.9 million and $3.1 million in<br />

2000 and 1999, respectively.<br />

INTEREST INCOME 2000 interest income was higher than<br />

in the prior year primarily due to higher interest rates and<br />

higher levels of cash available for short-term investing when<br />

compared to 1999.<br />

CONSOLIDATED INCOME TAXES The Company’s effective<br />

income tax rate was 36.6% and 36.5% for 2000 and 1999,<br />

respectively. The increase in the tax rate for 2000 was due to<br />

the $15 million non-deductible write-off of goodwill recorded<br />

in connection with the sale of the <strong>Harley</strong>-<strong>Davidson</strong> ® Chrome<br />

Visa ® Card business in the first quarter of 2000. This increase<br />

was partially offset by a lower tax rate implemented in the second<br />

quarter of 2000 as a result of various tax minimization<br />

programs implemented by the Company.<br />

32

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

1999 COMPARED TO 1998<br />

OVERALL Net sales for 1999 totaled $2.45 billion, a $388.9<br />

million, or 18.8%, increase over 1998. Net income and diluted<br />

earnings per share for 1999 were $267.2 million and $.86<br />

compared to $213.5 million and $.69 for 1998, increases of<br />

25.2% and 25.0%, respectively.<br />

The Company increased its quarterly dividend payment<br />

in June 1999 from $.02 per share to $.0225 per share, which<br />

resulted in a total year payout of $.0875 per share.<br />

Results of Operations<br />

Motorcycle Unit Shipments and Net Sales<br />

Increase<br />

(Dollars in millions) 1999 1998 (Decrease) % Change<br />

Motorcycle Unit Shipments<br />

<strong>Harley</strong>-<strong>Davidson</strong> ® motorcycle units 177,187 150,818 26,369 17.5%<br />

Buell ® motorcycle units 7,767 6,334 1,433 22.6<br />

Total motorcycle units 184,954 157,152 27,802 17.7%<br />

Net Sales<br />

<strong>Harley</strong>-<strong>Davidson</strong> motorcycles $1,890.9 $1,595.4 $295.5 18.5%<br />

Buell motorcycles 63.5 53.5 10.0 18.6<br />

Total motorcycles 1,954.4 1,648.9 305.5 18.5%<br />

Motorcycle Parts and Accessories 362.6 297.1 65.5 22.0<br />

General Merchandise 132.7 114.5 18.2 15.9<br />

Other 3.2 3.5 (.3) (8.6)<br />

Total Motorcycles and Related Products $2,452.9 $2,064.0 $388.9 18.8%<br />

The Motorcycles segment recorded an 18.8% increase in<br />

net sales driven primarily by a 17.5% increase in <strong>Harley</strong>-<br />

<strong>Davidson</strong> unit shipments. During 1999, the Company<br />

increased its <strong>Harley</strong>-<strong>Davidson</strong> motorcycle unit shipments and<br />

production to almost 177,200 units, approximately 26,400<br />

units higher than in 1998. This production increase was<br />

accomplished while executing an extensive model year 2000<br />

product launch that included a completely redesigned Softail ®<br />

family and the new Twin Cam 88B counterbalanced engine.<br />

In 1999, Buell ® motorcycle revenue was up $10.0 million<br />

over 1998 on 1,433 additional unit shipments. The average<br />

revenue per unit, however, was down slightly from prior<br />

year as a result of the high demand for Buell’s lower priced<br />

M2 Cyclone model.<br />

33

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

During 1999, the worldwide heavyweight (651+cc)<br />

motorcycle market grew 14.0%, while retail registrations for<br />

the Company’s motorcycles grew 20.9%, resulting in a worldwide<br />

market share (<strong>Harley</strong>-<strong>Davidson</strong> ® and Buell) of 26.7%<br />

compared to 25.2% in 1998 (worldwide information is<br />

derived from the individual market information, page 28.)<br />

Industry registrations of domestic (United States) heavyweight<br />

motorcycles were up 21.3% (data provided by the<br />

Motorcycle Industry Council) over 1998, while domestic<br />

retail registrations for the Company’s motorcycles (<strong>Harley</strong>-<br />

<strong>Davidson</strong> and Buell) increased 23.2%. The Company ended<br />

1999 with a domestic market share of 50.2% compared to<br />

49.5% in 1998.<br />

International revenues totaled $537.3 million during<br />

1999, an increase of $39.9 million, or 8.0%, over 1998. The<br />

Company exported approximately 23.5% of its <strong>Harley</strong>-<br />

<strong>Davidson</strong> motorcycle shipments in 1999 compared to 26.5%<br />

during 1998.<br />

In Europe, the Company ended 1999 with a 6.5% share<br />

of the heavyweight (651+cc) market, up from 6.4% in 1998<br />

(data provided by Giral S.A.). The European market grew at a<br />

13.5% rate in 1999, while retail registrations for the Company’s<br />

motorcycles (<strong>Harley</strong>-<strong>Davidson</strong> and Buell) were up 15.4%.<br />

Asia/Pacific (Japan and Australia) data for 1999 (provided<br />

by JAMA and ABS) showed the Company with a 19.6%<br />

share of the heavyweight (651+cc) market, up from 15.6% in<br />

1998. In 1999, retail registrations for the Company’s motorcycles<br />

(<strong>Harley</strong>-<strong>Davidson</strong> and Buell) increased 14.2%, while registrations<br />

for the Asia/Pacific market in total decreased 8.8%.<br />

During 1999, Parts and Accessories (P&A) sales totaled<br />

$362.6 million, up $65.5 million, or 22.0%, compared to<br />

1998. Key factors that contributed to the strong growth in<br />

P&A included custom painted motor parts, which were<br />

offered in limited quantities, new accessories offered in connection<br />

with the redesigned Softail family, and strong chrome<br />

accessory sales.<br />

General Merchandise sales for 1999, which include<br />

clothing and collectibles, of $132.7 million were up $18.2<br />

million, or 15.9%, compared to 1998. General Merchandise<br />

sales have been positively impacted by a significant number<br />

of independent dealer upgrades and relocations during 1999.<br />

GROSS PROFIT In 1999, gross profit was $145.0 million or<br />

21.0% higher than gross profit in 1998. The increase in gross<br />

profit is primarily related to the increase in net sales. The<br />

gross profit margin was 34.1% in 1999 compared to 33.5%<br />

in 1998. The increase in gross profit margin resulted from a<br />

combination of items, including a higher percentage of shipments<br />

to domestic customers, a higher average revenue per<br />

unit related to a modest price increase and the absence of<br />

facilities start up costs incurred in the prior year. These items<br />

were partially offset by the negative impact of additional costs<br />

related to the extensive model year 2000 product launch and<br />

a higher proportion of lower margin Sportster motorcycle<br />

sales in 1999.<br />

Operating Expenses<br />

Increase<br />

(Dollars in millions) 1999 1998 (Decrease) % Change<br />

Motorcycles and<br />

Related Products $438.1 $366.2 $71.9 19.6%<br />

Corporate 9.4 11.0 (1.6) (14.6)<br />

Total operating expenses $447.5 $377.2 $70.3 18.6%<br />

Total operating expenses for 1999 increased $70.3 million,<br />

or 18.6%, over 1998 and were 18.2% and 18.3% of net<br />

sales in 1999 and 1998, respectively. Operating expenses in<br />

1999 were higher than the same period a year ago primarily<br />

in the areas of sales, marketing and product development.<br />

Operating expenses in 1999 also included a $7.6 million<br />

charge related to a recall of Buell ® motorcycles.<br />

34

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

OPERATING INCOME FROM FINANCIAL SERVICES The<br />

Financial Services segment reported operating income of<br />

$27.7 million for 1999, an increase of $7.5 million, or 37%<br />

over 1998 levels. This increase was due to growth in all business<br />

lines during 1999. The growth was particularly strong in<br />

retail installment lending where HDFS experienced increases<br />

in both market share and profitability. During 1999, HDFS<br />

financed 22% of new <strong>Harley</strong>-<strong>Davidson</strong> ® motorcycles retailed<br />

in the U.S., up from 21% in 1998. Additionally, increased<br />

volumes and outstandings in the wholesale lending business<br />

and commission revenue growth from the insurance agency<br />

business contributed to increased operating income in 1999.<br />

OTHER Other expense for 1999 was $1.9 million higher than<br />

in 1998. Included in 1998 other expense is a $1.8 million onetime<br />

benefit related to a rebate of harbor maintenance fees.<br />

The levy of these fees was found unconstitutional by the U.S.<br />

Supreme Court and related to fees collected over the previous<br />

five years. Other non-operating expense items, including<br />

foreign currency exchange losses, remained consistent from<br />

1998 to 1999.<br />

INTEREST INCOME 1999 interest income was higher than in<br />

the prior year primarily due to higher levels of cash available<br />

for short-term investing when compared to 1998.<br />

CONSOLIDATED INCOME TAXES The Company’s effective<br />

tax rate was 36.5% in 1999 and 1998.<br />

OTHER MATTERS<br />

ACCOUNTING CHANGES In June 1998, the Financial<br />

Accounting Standards Board issued Statement of Financial<br />

Accounting Standards (SFAS) 133, “Accounting for Derivative<br />

Instruments and for Hedging Activities,” which in its amended<br />

form is effective for fiscal years beginning after June 15, 2000.<br />

The statement requires the Company to recognize all derivatives<br />

on the balance sheet at fair value. Derivatives that are not<br />

hedges must be adjusted to fair value through income. If the<br />

derivative is a hedge, depending on the nature of the hedge,<br />

changes in the fair value will either be offset against the change<br />

in fair value of hedged assets, liabilities or firm commitments<br />

through earnings or recognized in other comprehensive income<br />

until the hedged item is recognized in earnings. The ineffective<br />

portion of a hedge’s change in fair value will be immediately<br />

recognized in earnings. The Company anticipates it will continue<br />

to use derivatives to reduce the impact of fluctuations in<br />

exchange rates and interest rates. The Company intends for the<br />

derivatives to qualify as cash flow hedges in accordance with<br />

SFAS 133. The Company also intends that the net gain or loss<br />

on the derivative instruments designated and qualifying as cash<br />

flow hedges will be reported in comprehensive income. The<br />

adoption of SFAS 133 will not have a material impact on the<br />

Company’s statement of income.<br />

ENVIRONMENTAL MATTERS The Company’s policy is to<br />

comply with all applicable environmental laws and regulations,<br />

and the Company has a compliance program in place<br />

to monitor and report on environmental issues. The<br />

Company has reached a settlement agreement with the U.S.<br />

Navy regarding groundwater remediation at the Company’s<br />

manufacturing facility in York, Pennsylvania and currently<br />

estimates that it will incur approximately $5.4 million of net<br />

additional costs related to the remediation effort. (1) The<br />

Company has established reserves for this amount. The<br />

Company’s estimate of additional response costs is based on<br />

35

MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL<br />

CONDITION AND RESULTS OF OPERATIONS<br />

reports of environmental consultants retained by the<br />

Company, the actual costs incurred to date and the estimated<br />

costs to complete the necessary investigation and remediation<br />

activities. Response costs are expected to be incurred over a<br />

period of approximately 9 years, ending in 2009. See Note 7<br />

of the notes to condensed consolidated financial statements.<br />

Recurring costs associated with managing hazardous<br />

substances and pollution in on-going operations have not<br />

been material.<br />

The Company regularly invests in equipment to support<br />

and improve its various manufacturing processes. While the<br />

Company considers environmental matters in capital expenditure<br />

decisions, and while some capital expenditures also act to<br />

improve environmental compliance, only a small portion of<br />

the Company’s annual capital expenditures relate to equipment<br />

which has the sole purpose of meeting environmental<br />

compliance obligations. The Company anticipates that capital<br />

expenditures for equipment used to limit hazardous substances/pollutants<br />

during 2001 will approximate $1.8 million.<br />

The Company does not expect that these expenditures related<br />

to environmental matters will have a material effect on future<br />

operating results or cash flows. (1)<br />

LIQUIDITY AND CAPITAL RESOURCES<br />

The Company’s main source of liquidity is cash from operating<br />