EXPERIENCEBUSINESS - Harley-Davidson

EXPERIENCEBUSINESS - Harley-Davidson

EXPERIENCEBUSINESS - Harley-Davidson

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

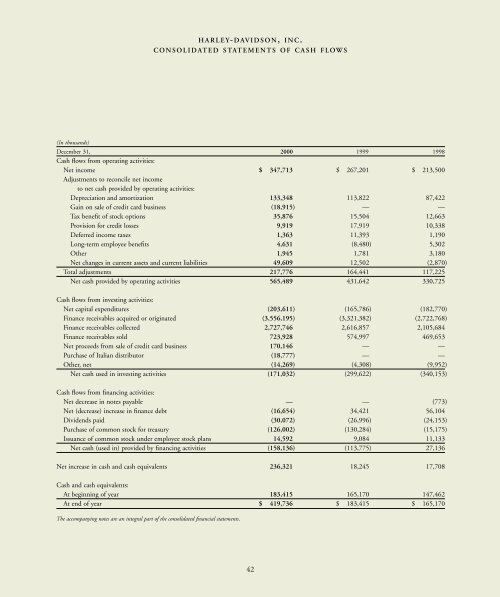

HARLEY- DAVIDSON, INC.<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

(In thousands)<br />

December 31, 2000 1999 1998<br />

Cash flows from operating activities:<br />

Net income $ 347,713 $ 267,201 $ 213,500<br />

Adjustments to reconcile net income<br />

to net cash provided by operating activities:<br />

Depreciation and amortization 133,348 113,822 87,422<br />

Gain on sale of credit card business (18,915) — —<br />

Tax benefit of stock options 35,876 15,504 12,663<br />

Provision for credit losses 9,919 17,919 10,338<br />

Deferred income taxes 1,363 11,393 1,190<br />

Long-term employee benefits 4,631 (8,480) 5,302<br />

Other 1,945 1,781 3,180<br />

Net changes in current assets and current liabilities 49,609 12,502 (2,870)<br />

Total adjustments 217,776 164,441 117,225<br />

Net cash provided by operating activities 565,489 431,642 330,725<br />

Cash flows from investing activities:<br />

Net capital expenditures (203,611) (165,786) (182,770)<br />

Finance receivables acquired or originated (3,556,195) (3,321,382) (2,722,768)<br />

Finance receivables collected 2,727,746 2,616,857 2,105,684<br />

Finance receivables sold 723,928 574,997 469,653<br />

Net proceeds from sale of credit card business 170,146 — —<br />

Purchase of Italian distributor (18,777) — —<br />

Other, net (14,269) (4,308) (9,952)<br />

Net cash used in investing activities (171,032) (299,622) (340,153)<br />

Cash flows from financing activities:<br />

Net decrease in notes payable — — (773)<br />

Net (decrease) increase in finance debt (16,654) 34,421 56,104<br />

Dividends paid (30,072) (26,996) (24,153)<br />

Purchase of common stock for treasury (126,002) (130,284) (15,175)<br />

Issuance of common stock under employee stock plans 14,592 9,084 11,133<br />

Net cash (used in) provided by financing activities (158,136) (113,775) 27,136<br />

Net increase in cash and cash equivalents 236,321 18,245 17,708<br />

Cash and cash equivalents:<br />

At beginning of year 183,415 165,170 147,462<br />

At end of year $ 419,736 $ 183,415 $ 165,170<br />

The accompanying notes are an integral part of the consolidated financial statements.<br />

42