EXPERIENCEBUSINESS - Harley-Davidson

EXPERIENCEBUSINESS - Harley-Davidson

EXPERIENCEBUSINESS - Harley-Davidson

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

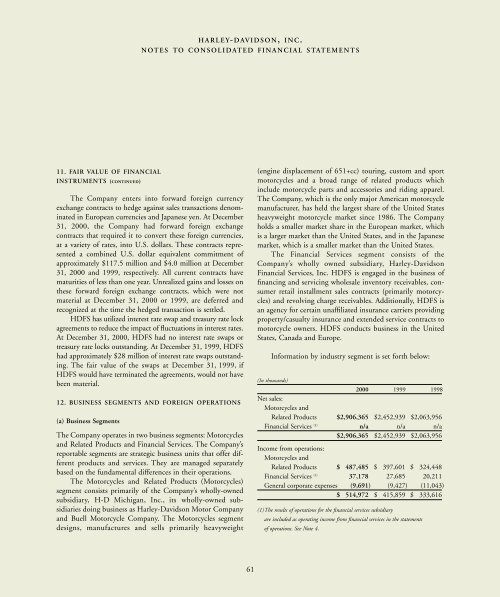

HARLEY- DAVIDSON, INC.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

11. FAIR VALUE OF FINANCIAL<br />

INSTRUMENTS (CONTINUED)<br />

The Company enters into forward foreign currency<br />

exchange contracts to hedge against sales transactions denominated<br />

in European currencies and Japanese yen. At December<br />

31, 2000, the Company had forward foreign exchange<br />

contracts that required it to convert these foreign currencies,<br />

at a variety of rates, into U.S. dollars. These contracts represented<br />

a combined U.S. dollar equivalent commitment of<br />

approximately $117.5 million and $4.0 million at December<br />

31, 2000 and 1999, respectively. All current contracts have<br />

maturities of less than one year. Unrealized gains and losses on<br />

these forward foreign exchange contracts, which were not<br />

material at December 31, 2000 or 1999, are deferred and<br />

recognized at the time the hedged transaction is settled.<br />

HDFS has utilized interest rate swap and treasury rate lock<br />

agreements to reduce the impact of fluctuations in interest rates.<br />

At December 31, 2000, HDFS had no interest rate swaps or<br />

treasury rate locks outstanding. At December 31, 1999, HDFS<br />

had approximately $28 million of interest rate swaps outstanding.<br />

The fair value of the swaps at December 31, 1999, if<br />

HDFS would have terminated the agreements, would not have<br />

been material.<br />

12. BUSINESS SEGMENTS AND FOREIGN OPERATIONS<br />

(a) Business Segments<br />

The Company operates in two business segments: Motorcycles<br />

and Related Products and Financial Services. The Company’s<br />

reportable segments are strategic business units that offer different<br />

products and services. They are managed separately<br />

based on the fundamental differences in their operations.<br />

The Motorcycles and Related Products (Motorcycles)<br />

segment consists primarily of the Company’s wholly-owned<br />

subsidiary, H-D Michigan, Inc., its wholly-owned subsidiaries<br />

doing business as <strong>Harley</strong>-<strong>Davidson</strong> Motor Company<br />

and Buell Motorcycle Company. The Motorcycles segment<br />

designs, manufactures and sells primarily heavyweight<br />

(engine displacement of 651+cc) touring, custom and sport<br />

motorcycles and a broad range of related products which<br />

include motorcycle parts and accessories and riding apparel.<br />

The Company, which is the only major American motorcycle<br />

manufacturer, has held the largest share of the United States<br />

heavyweight motorcycle market since 1986. The Company<br />

holds a smaller market share in the European market, which<br />

is a larger market than the United States, and in the Japanese<br />

market, which is a smaller market than the United States.<br />

The Financial Services segment consists of the<br />

Company’s wholly owned subsidiary, <strong>Harley</strong>-<strong>Davidson</strong><br />

Financial Services, Inc. HDFS is engaged in the business of<br />

financing and servicing wholesale inventory receivables, consumer<br />

retail installment sales contracts (primarily motorcycles)<br />

and revolving charge receivables. Additionally, HDFS is<br />

an agency for certain unaffiliated insurance carriers providing<br />

property/casualty insurance and extended service contracts to<br />

motorcycle owners. HDFS conducts business in the United<br />

States, Canada and Europe.<br />

Information by industry segment is set forth below:<br />

(In thousands)<br />

2000 1999 1998<br />

Net sales:<br />

Motorcycles and<br />

Related Products $2,906,365 $2,452,939 $2,063,956<br />

Financial Services (1) n/a n/a n/a<br />

$2,906,365 $2,452,939 $2,063,956<br />

Income from operations:<br />

Motorcycles and<br />

Related Products $ 487,485 $ 397,601 $ 324,448<br />

Financial Services (1) 37,178 27,685 20,211<br />

General corporate expenses (9,691) (9,427) (11,043)<br />

$ 514,972 $ 415,859 $ 333,616<br />

(1)The results of operations for the financial services subsidiary<br />

are included as operating income from financial services in the statements<br />

of operations. See Note 4.<br />

61