FY 2009 Comprehensive Annual Financial Report - Harford County ...

FY 2009 Comprehensive Annual Financial Report - Harford County ...

FY 2009 Comprehensive Annual Financial Report - Harford County ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

HARFORD COUNTY PUBLIC SCHOOLS<br />

NOTES TO FINANCIAL STATEMENTS<br />

June 30, <strong>2009</strong><br />

NOTE 6 - POSTEMPLOYMENT BENEFITS OTHER THAN PENSION BENEFITS<br />

(continued)<br />

Life Insurance Benefits - The Board pays 90% of the life insurance premiums for retirees<br />

with at least 10 years of service with the amount of insurance coverage reducing from<br />

$20,000 upon retirement to $10,000 five years after retirement. The life insurance benefits<br />

paid by the Board for the year ended June 30, <strong>2009</strong> was $42,782. As of June 30, <strong>2009</strong>, 1,694<br />

of approximately 1,926 eligible participants were receiving benefits.<br />

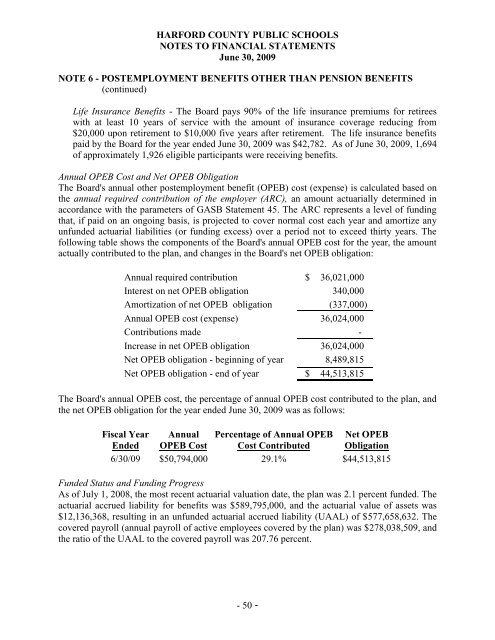

<strong>Annual</strong> OPEB Cost and Net OPEB Obligation<br />

The Board's annual other postemployment benefit (OPEB) cost (expense) is calculated based on<br />

the annual required contribution of the employer (ARC), an amount actuarially determined in<br />

accordance with the parameters of GASB Statement 45. The ARC represents a level of funding<br />

that, if paid on an ongoing basis, is projected to cover normal cost each year and amortize any<br />

unfunded actuarial liabilities (or funding excess) over a period not to exceed thirty years. The<br />

following table shows the components of the Board's annual OPEB cost for the year, the amount<br />

actually contributed to the plan, and changes in the Board's net OPEB obligation:<br />

<strong>Annual</strong> required contribution $ 36,021,000<br />

Interest on net OPEB obligation 340,000<br />

Amortization of net OPEB obligation (337,000)<br />

<strong>Annual</strong> OPEB cost (expense) 36,024,000<br />

Contributions made -<br />

Increase in net OPEB obligation 36,024,000<br />

Net OPEB obligation - beginning of year 8,489,815<br />

Net OPEB obligation - end of year $ 44,513,815<br />

The Board's annual OPEB cost, the percentage of annual OPEB cost contributed to the plan, and<br />

the net OPEB obligation for the year ended June 30, <strong>2009</strong> was as follows:<br />

Fiscal Year <strong>Annual</strong> Percentage of <strong>Annual</strong> OPEB Net OPEB<br />

Ended OPEB Cost Cost Contributed Obligation<br />

6/30/09 $50,794,000 29.1% $44,513,815<br />

Funded Status and Funding Progress<br />

As of July 1, 2008, the most recent actuarial valuation date, the plan was 2.1 percent funded. The<br />

actuarial accrued liability for benefits was $589,795,000, and the actuarial value of assets was<br />

$12,136,368, resulting in an unfunded actuarial accrued liability (UAAL) of $577,658,632. The<br />

covered payroll (annual payroll of active employees covered by the plan) was $278,038,509, and<br />

the ratio of the UAAL to the covered payroll was 207.76 percent.<br />

- 50 -