PURE FOODS SINCE 1869 - Heinz

PURE FOODS SINCE 1869 - Heinz

PURE FOODS SINCE 1869 - Heinz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

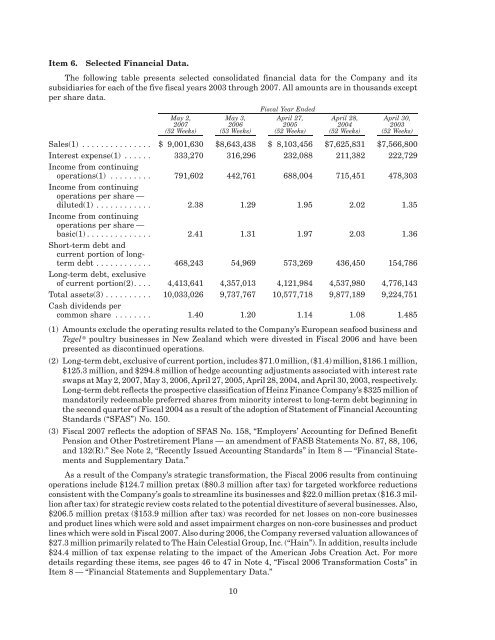

Item 6. Selected Financial Data.<br />

The following table presents selected consolidated financial data for the Company and its<br />

subsidiaries for each of the five fiscal years 2003 through 2007. All amounts are in thousands except<br />

per share data.<br />

May 2,<br />

2007<br />

(52 Weeks)<br />

May 3,<br />

2006<br />

(53 Weeks)<br />

Fiscal Year Ended<br />

April 27,<br />

2005<br />

(52 Weeks)<br />

April 28,<br />

2004<br />

(52 Weeks)<br />

April 30,<br />

2003<br />

(52 Weeks)<br />

Sales(1) . . . . . . . . . . . . . . . $ 9,001,630 $8,643,438 $ 8,103,456 $7,625,831 $7,566,800<br />

Interest expense(1) . . . . . . 333,270 316,296 232,088 211,382 222,729<br />

Income from continuing<br />

operations(1) . . . . . . . . . 791,602 442,761 688,004 715,451 478,303<br />

Income from continuing<br />

operations per share —<br />

diluted(1) . . . . . . . . . . . . 2.38 1.29 1.95 2.02 1.35<br />

Income from continuing<br />

operations per share —<br />

basic(1) . . . . . . . . . . . . . . 2.41 1.31 1.97 2.03 1.36<br />

Short-term debt and<br />

current portion of longterm<br />

debt . . . . . . . . . . . . 468,243 54,969 573,269 436,450 154,786<br />

Long-term debt, exclusive<br />

of current portion(2). . . . 4,413,641 4,357,013 4,121,984 4,537,980 4,776,143<br />

Total assets(3) . . . . . . . . . . 10,033,026 9,737,767 10,577,718 9,877,189 9,224,751<br />

Cash dividends per<br />

common share . . . . . . . . 1.40 1.20 1.14 1.08 1.485<br />

(1) Amounts exclude the operating results related to the Company’s European seafood business and<br />

Tegel» poultry businesses in New Zealand which were divested in Fiscal 2006 and have been<br />

presented as discontinued operations.<br />

(2) Long-term debt, exclusive of current portion, includes $71.0 million, ($1.4) million, $186.1 million,<br />

$125.3 million, and $294.8 million of hedge accounting adjustments associated with interest rate<br />

swaps at May 2, 2007, May 3, 2006, April 27, 2005, April 28, 2004, and April 30, 2003, respectively.<br />

Long-term debt reflects the prospective classification of <strong>Heinz</strong> Finance Company’s $325 million of<br />

mandatorily redeemable preferred shares from minority interest to long-term debt beginning in<br />

the second quarter of Fiscal 2004 as a result of the adoption of Statement of Financial Accounting<br />

Standards (“SFAS”) No. 150.<br />

(3) Fiscal 2007 reflects the adoption of SFAS No. 158, “Employers’ Accounting for Defined Benefit<br />

Pension and Other Postretirement Plans — an amendment of FASB Statements No. 87, 88, 106,<br />

and 132(R).” See Note 2, “Recently Issued Accounting Standards” in Item 8 — “Financial Statements<br />

and Supplementary Data.”<br />

As a result of the Company’s strategic transformation, the Fiscal 2006 results from continuing<br />

operations include $124.7 million pretax ($80.3 million after tax) for targeted workforce reductions<br />

consistent with the Company’s goals to streamline its businesses and $22.0 million pretax ($16.3 million<br />

after tax) for strategic review costs related to the potential divestiture of several businesses. Also,<br />

$206.5 million pretax ($153.9 million after tax) was recorded for net losses on non-core businesses<br />

and product lines which were sold and asset impairment charges on non-core businesses and product<br />

lines which were sold in Fiscal 2007. Also during 2006, the Company reversed valuation allowances of<br />

$27.3 million primarily related to The Hain Celestial Group, Inc. (“Hain”). In addition, results include<br />

$24.4 million of tax expense relating to the impact of the American Jobs Creation Act. For more<br />

details regarding these items, see pages 46 to 47 in Note 4, “Fiscal 2006 Transformation Costs” in<br />

Item 8 — “Financial Statements and Supplementary Data.”<br />

10