HudBay Minerals Inc. 2010 Annual Report

HudBay Minerals Inc. 2010 Annual Report

HudBay Minerals Inc. 2010 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

Recent Developments<br />

Acquisition of Norsemont Mining <strong>Inc</strong>.<br />

On January 10, 2011, we announced that we entered into an agreement to acquire all of the outstanding common shares of<br />

Norsemont, together with the associated rights issued under Norsemont’s stockholder rights plan. Holders of Norsemont’s common<br />

shares were given the ability to elect consideration per Norsemont common share, on an individual basis, of 0.2617 common shares<br />

of <strong>HudBay</strong> and $0.001 in cash, $4.50 in cash, or a combination of cash (greater than $0.001 and not to exceed $4.50) and <strong>HudBay</strong><br />

common shares, subject to rounding and proration necessary to effect a maximum aggregate cash consideration of $130 million.<br />

On March 1, 2011, we acquired 104,635,351 common shares of Norsemont through the issuance of approximately 20.5 million of<br />

our common shares and the payment of $119 million in cash and we extended our take‐over bid to holders of Norsemont common<br />

shares until March 15, 2011. As a result, we own approximately 91% of Norsemont’s issued and outstanding shares (calculated on<br />

a fully‐diluted basis). We intend to proceed with a compulsory acquisition transaction to acquire the remaining common shares of<br />

Norsemont that we do not already own or subsequently acquire before the expiry of our take‐over bid.<br />

Norsemont’s principal asset is the Constancia copper project located in the Cuzco district of southern Peru. Norsemont recently<br />

completed and filed an optimized technical report as of February 21, 2011 which outlined an increase in reserves utilizing new<br />

long‐term metal pricing and increasing and sustaining production throughput in the processing plant in the later years of the project.<br />

The feasibility study contemplates an open pit mine feeding a processing plant at up to 70,000 tonnes per day for the estimated<br />

15 year mine life. The average yearly metal production in concentrate for the life of mine is expected to be 85,000 tonnes of<br />

copper, 1,400 tonnes of molybdenum and 69 tonnes of silver. The initial project capital is estimated to be US$920 million with a<br />

life of mine average copper cost of US$0.93/lb. We are currently reviewing the work required to make a construction decision to<br />

optimize and advance the Constancia project. This review process is expected to be complete and a feasibility optimization and<br />

exploration program and budget will be provided by the end of March 2011.<br />

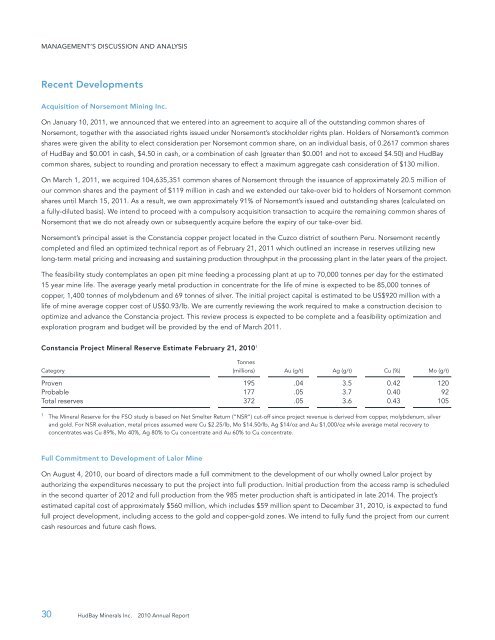

Constancia Project Mineral Reserve Estimate February 21, <strong>2010</strong> 1<br />

Tonnes<br />

Category (millions) Au (g/t) Ag (g/t) Cu (%) Mo (g/t)<br />

Proven 195 .04 3.5 0.42 120<br />

Probable 177 .05 3.7 0.40 92<br />

Total reserves 372 .05 3.6 0.43 105<br />

1<br />

The Mineral Reserve for the FSO study is based on Net Smelter Return (“NSR”) cut‐off since project revenue is derived from copper, molybdenum, silver<br />

and gold. For NSR evaluation, metal prices assumed were Cu $2.25/lb, Mo $14.50/lb, Ag $14/oz and Au $1,000/oz while average metal recovery to<br />

concentrates was Cu 89%, Mo 40%, Ag 80% to Cu concentrate and Au 60% to Cu concentrate.<br />

Full Commitment to Development of Lalor Mine<br />

On August 4, <strong>2010</strong>, our board of directors made a full commitment to the development of our wholly owned Lalor project by<br />

authorizing the expenditures necessary to put the project into full production. Initial production from the access ramp is scheduled<br />

in the second quarter of 2012 and full production from the 985 meter production shaft is anticipated in late 2014. The project’s<br />

estimated capital cost of approximately $560 million, which includes $59 million spent to December 31, <strong>2010</strong>, is expected to fund<br />

full project development, including access to the gold and copper‐gold zones. We intend to fully fund the project from our current<br />

cash resources and future cash flows.<br />

30 <strong>HudBay</strong> <strong>Minerals</strong> <strong>Inc</strong>. <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong>