HudBay Minerals Inc. 2010 Annual Report

HudBay Minerals Inc. 2010 Annual Report

HudBay Minerals Inc. 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

New York Stock Exchange (“NYSE”) Listing<br />

On October 22, <strong>2010</strong>, our common shares commenced trading on the NYSE under the symbol “HBM”. We intend to maintain our<br />

listing on the Toronto Stock Exchange.<br />

Copper Smelter and WPCR<br />

On June 11, <strong>2010</strong>, our copper smelter in Flin Flon, Manitoba, ceased operations. Operations at WPCR ceased in July due to the<br />

smelter closure.<br />

Outlook<br />

This outlook includes forward‐looking information about <strong>HudBay</strong>’s operations and financial expectations that is subject to risks,<br />

uncertainties and assumptions. The outlook and financial targets are for 2011 only. The information provided in this section is<br />

forward‐looking, based on <strong>HudBay</strong>’s expectations and outlook and shall be effective only as of the date the targets were originally issued<br />

on March 9, 2011. Refer to “Forward‐Looking Information” on page 25. The overall outlook, including targets, and our performance is<br />

generally subject to various risks and uncertainties which may impact future performance and our achievement of these targets.<br />

Copper, gold and silver prices have recovered substantially over the course of <strong>2010</strong> and are currently significantly higher than<br />

average prices in 2009. If these prices and current exchange rates are sustained during 2011 and our production, sales and cost<br />

performance are as expected, our operating financial results are likely to improve substantially over <strong>2010</strong> results. <strong>HudBay</strong> may<br />

update its outlook depending on changes in metals prices and other factors.<br />

For our sensitivity to metal prices and foreign exchange rates, refer to “Sensitivity Analysis” on page 39.<br />

Material Assumptions<br />

Our 2011 operational and financial performance will be influenced by a number of factors. At the macro‐level, the general<br />

performance of the North American and global economies will influence the demand for our products. The realized prices we<br />

achieve in the commodity markets significantly affect our performance. Our general expectations regarding prices for metals and<br />

foreign exchange rates are included in the “Commodity Markets” and “Sensitivity Analysis” sections of this MD&A.<br />

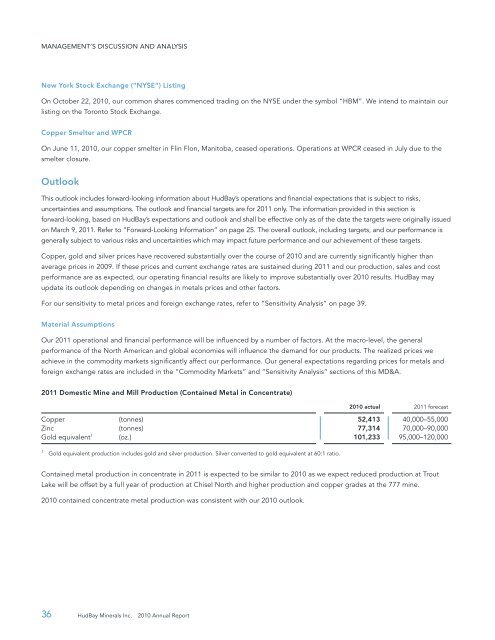

2011 Domestic Mine and Mill Production (Contained Metal in Concentrate)<br />

<strong>2010</strong> actual 2011 forecast<br />

Copper (tonnes) 52,413 40,000–55,000<br />

Zinc (tonnes) 77,314 70,000–90,000<br />

Gold equivalent 1 (oz.) 101,233 95,000–120,000<br />

1<br />

Gold equivalent production includes gold and silver production. Silver converted to gold equivalent at 60:1 ratio.<br />

Contained metal production in concentrate in 2011 is expected to be similar to <strong>2010</strong> as we expect reduced production at Trout<br />

Lake will be offset by a full year of production at Chisel North and higher production and copper grades at the 777 mine.<br />

<strong>2010</strong> contained concentrate metal production was consistent with our <strong>2010</strong> outlook.<br />

36 <strong>HudBay</strong> <strong>Minerals</strong> <strong>Inc</strong>. <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong>