Annual Report 2011 - Canlan Ice Sports

Annual Report 2011 - Canlan Ice Sports

Annual Report 2011 - Canlan Ice Sports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

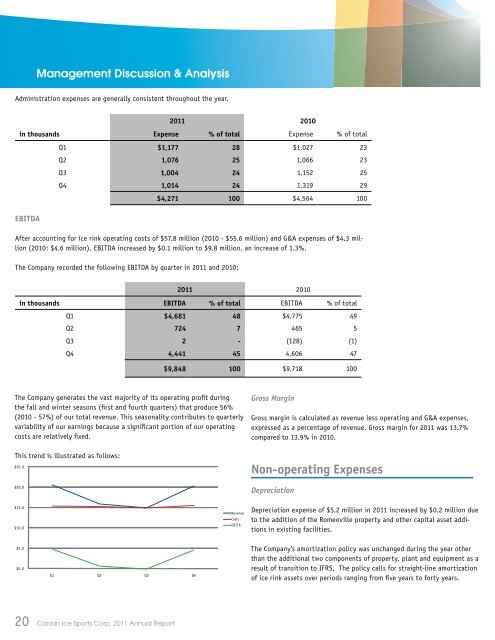

Management Discussion & Analysis<br />

Administration expenses are generally consistent throughout the year.<br />

<strong>2011</strong> 2010<br />

in thousands Expense % of total Expense % of total<br />

Q1 $1,177 28 $1,027 23<br />

Q2 1,076 25 1,066 23<br />

Q3 1,004 24 1,152 25<br />

Q4 1,014 24 1,319 29<br />

$4,271 100 $4,564 100<br />

EBITDA<br />

After accounting for ice rink operating costs of $57.8 million (2010 - $55.6 million) and G&A expenses of $4.3 million<br />

(2010: $4.6 million), EBITDA increased by $0.1 million to $9.8 million, an increase of 1.3%.<br />

The Company recorded the following EBITDA by quarter in <strong>2011</strong> and 2010:<br />

<strong>2011</strong> 2010<br />

in thousands EBITDA % of total EBITDA % of total<br />

Q1 $4,681 48 $4,775 49<br />

Q2 724 7 465 5<br />

Q3 2 - (128) (1)<br />

Q4 4,441 45 4,606 47<br />

$9,848 100 $9,718 100<br />

The Company generates the vast majority of its operating profit during<br />

the fall and winter seasons (first and fourth quarters) that produce 56%<br />

(2010 - 57%) of our total revenue. This seasonality contributes to quarterly<br />

variability of our earnings because a significant portion of our operating<br />

costs are relatively fixed.<br />

Gross Margin<br />

Gross margin is calculated as revenue less operating and G&A expenses,<br />

expressed as a percentage of revenue. Gross margin for <strong>2011</strong> was 13.7%<br />

compared to 13.9% in 2010.<br />

This trend is illustrated as follows:<br />

$25.0<br />

Non-operating Expenses<br />

$20.0<br />

Depreciation<br />

$15.0<br />

$10.0<br />

Revenue<br />

Costs<br />

EBITA<br />

Depreciation expense of $5.2 million in <strong>2011</strong> increased by $0.2 million due<br />

to the addition of the Romeoville property and other capital asset additions<br />

in existing facilities.<br />

$5.0<br />

$0.0<br />

Q1 Q2 Q3 Q4<br />

The Company’s amortization policy was unchanged during the year other<br />

than the additional two components of property, plant and equipment as a<br />

result of transition to IFRS. The policy calls for straight-line amortization<br />

of ice rink assets over periods ranging from five years to forty years.<br />

20 <strong>Canlan</strong> <strong>Ice</strong> <strong>Sports</strong> Corp. <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>