Annual Report 2011 - Canlan Ice Sports

Annual Report 2011 - Canlan Ice Sports

Annual Report 2011 - Canlan Ice Sports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Discussion & Analysis<br />

Gain on sale of assets<br />

During the year, we sold two ice rink properties, <strong>Ice</strong> <strong>Sports</strong> Regina, Saskatchewan<br />

and Les Deux Glaces in Candiac, Quebec.<br />

<strong>Ice</strong> <strong>Sports</strong> Regina was sold for $3.6 million in September <strong>2011</strong>. Due to<br />

over capacity in the Regina marketplace, management decided to exit the<br />

market. Proceeds from the sale were redeployed towards a combination of<br />

debt reduction and equity contribution towards <strong>Ice</strong> <strong>Sports</strong> Romeoville. An<br />

accounting gain of $2.3 million was recorded from the sale.<br />

Les Deux Glaces was sold for $4.6 million in December <strong>2011</strong>. This facility<br />

had been leased to the City of Candiac since 2008 and pursuant to the<br />

lease agreement, the lessee had an option to purchase the facility by the<br />

end of the lease term which was to be December 31, 2012. The City of Candiac<br />

exercised its option in December <strong>2011</strong> and the proceeds of disposition<br />

were partially used to reduce debt and the remainder will be maintained<br />

for future expansion opportunities in strategic markets. An accounting<br />

gain of $0.3 million was recorded from the sale.<br />

Valuation Adjustment on Investment Property<br />

The Company owns a one-half interest in a plot of vacant land in Fort<br />

Worth, Texas. Due to current real estate market conditions in the area, the<br />

carrying amount of the property was written down by $0.2 million. The<br />

carrying amount of this property at December 31, <strong>2011</strong> was $0.3 million.<br />

Finance Income and Costs<br />

Finance income and costs consist of interest income earned on cash on<br />

hand, unrealized gains related to the fair value adjustment of an interest<br />

rate swap contract, interest expense on mortgage debt and finance leases,<br />

and amortization of deferred financing costs. The interest rate swap contract<br />

is a derivative instrument used to fix the interest rate on $8.9 million<br />

of mortgage debt that would otherwise be accruing interest at variable<br />

rates. The financial instrument has not been designated as a hedge for accounting<br />

purposes; therefore, the resulting gain or loss from the change in<br />

fair value of the instrument is recognized in the statement of earnings and<br />

comprehensive income.<br />

Net finance costs of $2.9 million decreased by $0.1 million or 4.9% from<br />

2010 as a result of debt reduction and lower interest rates.<br />

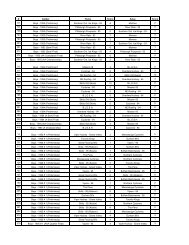

A breakdown of our net finance cost is as follows:<br />

in thousands <strong>2011</strong> 2010<br />

Mortgage interest, net of interest<br />

income<br />

$2,775 $3,156<br />

Equipment lease interest 102 105<br />

Unrealized gain on financial<br />

instrument<br />

(113) (342)<br />

Amortization of deferred financing<br />

costs and other<br />

103 96<br />

$2,867 3,015<br />

At year end, the Company had interest bearing, mortgage secured debt<br />

totaling $41.2 million (2010 – $44.4 million).<br />

The Company has fixed the interest rate on 83% of its mortgage debt, or<br />

$34.4 million at a weighted average rate of 6.11%. Debt with variable interest<br />

rates consists of $4.3 million at the Prime rate plus 1.25% and $2.5<br />

million at the LIBOR plus 2.5%.<br />

Costs related to debt financing are amortized using the effective interest<br />

rate method in accordance with IFRS and classified as interest expense. In<br />

<strong>2011</strong> this amounted to $0.1 million, same as 2010.<br />

Net Earnings before Income Taxes<br />

Net earnings before income taxes were $4.1 million in <strong>2011</strong> compared to<br />

$1.8 million in 2010; an increase of $2.3 million.<br />

Taxes<br />

Each year, management reviews assumptions regarding deferred income tax<br />

assets and liabilities to ensure that the reported balances appropriately<br />

reflect tax benefits available to offset future income taxes and future<br />

reversal of those benefits. As a result of utilizing tax benefits related to<br />

tax loss carry forwards, capital cost allowance, cumulative eligible capital<br />

and deferred revenue deductions, there is no current income tax payable<br />

for the <strong>2011</strong> fiscal year.<br />

After fiscal <strong>2011</strong>, the Company will have utilized virtually all tax benefits<br />

associated with non-capital losses carried forward related to Canadian operations.<br />

However, we anticipate that capital cost allowance and deferred<br />

revenue deductions will still be available to offset taxable income in 2012.<br />

<strong>Canlan</strong> <strong>Ice</strong> <strong>Sports</strong> Corp. <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

21