You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

INVESTMENT SUMMARY<br />

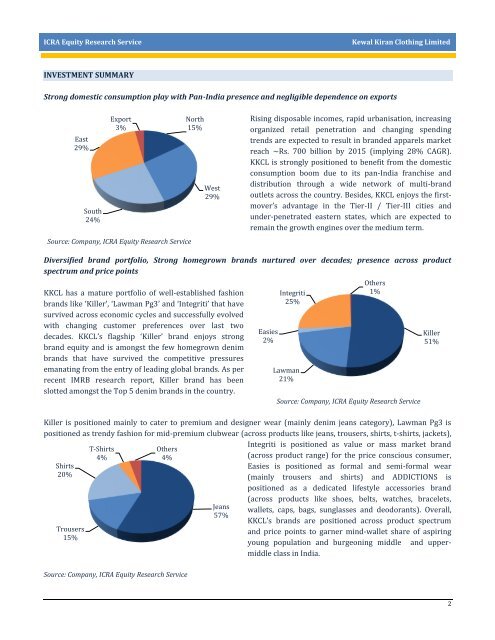

Strong domestic consumption play with Pan-India presence and negligible dependence on exports<br />

East<br />

29%<br />

South<br />

24%<br />

Export<br />

3%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

North<br />

15%<br />

West<br />

29%<br />

Rising disposable incomes, rapid urbanisation, increasing<br />

organized retail penetration and changing spending<br />

trends are expected to result in branded apparels market<br />

reach ~Rs. 700 billion by 2015 (implying 28% CAGR).<br />

KKCL is strongly positioned to benefit from the domestic<br />

consumption boom due to its pan-India franchise and<br />

distribution through a wide network of multi-brand<br />

outlets across the country. Besides, KKCL enjoys the firstmover’s<br />

advantage in the Tier-II / Tier-III cities and<br />

under-penetrated eastern states, which are expected to<br />

remain the growth engines over the medium term.<br />

Diversified brand portfolio, Strong homegrown brands nurtured over decades; presence across product<br />

spectrum and price points<br />

KKCL has a mature portfolio of well-established fashion<br />

brands like ‘Killer’, ‘Lawman Pg3’ and ‘Integriti’ that have<br />

survived across economic cycles and successfully evolved<br />

with changing customer preferences over last two<br />

decades. KKCL’s flagship ‘Killer’ brand enjoys strong<br />

brand equity and is amongst the few homegrown denim<br />

brands that have survived the competitive pressures<br />

emanating from the entry of leading global brands. As per<br />

recent IMRB research report, Killer brand has been<br />

slotted amongst the Top 5 denim brands in the country.<br />

Shirts<br />

20%<br />

Trousers<br />

15%<br />

T-Shirts<br />

4%<br />

Others<br />

4%<br />

Jeans<br />

57%<br />

Easies<br />

2%<br />

Integriti<br />

25%<br />

Lawman<br />

21%<br />

Others<br />

1%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Killer is positioned mainly to cater to premium and designer wear (mainly denim jeans category), Lawman Pg3 is<br />

positioned as trendy fashion for mid-premium clubwear (across products like jeans, trousers, shirts, t-shirts, jackets),<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Killer<br />

51%<br />

Integriti is positioned as value or mass market brand<br />

(across product range) for the price conscious consumer,<br />

Easies is positioned as formal and semi-formal wear<br />

(mainly trousers and shirts) and ADDICTIONS is<br />

positioned as a dedicated lifestyle accessories brand<br />

(across products like shoes, belts, watches, bracelets,<br />

wallets, caps, bags, sunglasses and deodorants). Overall,<br />

KKCL’s brands are positioned across product spectrum<br />

and price points to garner mind-wallet share of aspiring<br />

young population and burgeoning middle and uppermiddle<br />

class in India.<br />

2