You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fundamental<br />

Assessment<br />

<strong>ICRA</strong> EQUITY RESEARCH SERVICE<br />

KEWAL KIRAN CLOTHING LIMITED<br />

Initiating Coverage Industry: Textile & Retail December 30, 2011<br />

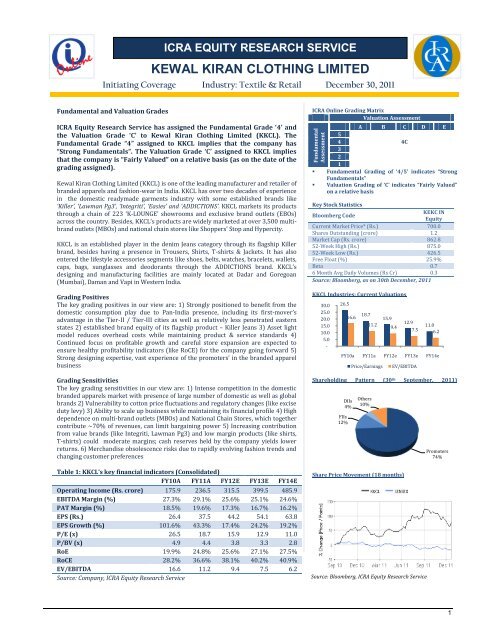

Fundamental and Valuation Grades<br />

<strong>ICRA</strong> Equity Research Service has assigned the Fundamental Grade ‘4’ and<br />

the Valuation Grade ‘C’ to <strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong> (KKCL). The<br />

Fundamental Grade “4” assigned to KKCL implies that the company has<br />

“Strong Fundamentals”. The Valuation Grade ‘C’ assigned to KKCL implies<br />

that the company is “Fairly Valued” on a relative basis (as on the date of the<br />

grading assigned).<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong> (KKCL) is one of the leading manufacturer and retailer of<br />

branded apparels and fashion-wear in India. KKCL has over two decades of experience<br />

in the domestic readymade garments industry with some established brands like<br />

‘Killer’, ‘Lawman Pg3’, ‘Integriti’, ‘Easies’ and ‘ADDICTIONS’. KKCL markets its products<br />

through a chain of 223 ‘K-LOUNGE’ showrooms and exclusive brand outlets (EBOs)<br />

across the country. Besides, KKCL’s products are widely marketed at over 3,500 multibrand<br />

outlets (MBOs) and national chain stores like Shoppers’ Stop and Hypercity.<br />

KKCL is an established player in the denim Jeans category through its flagship Killer<br />

brand, besides having a presence in Trousers, Shirts, T-shirts & Jackets. It has also<br />

entered the lifestyle accessories segments like shoes, belts, watches, bracelets, wallets,<br />

caps, bags, sunglasses and deodorants through the ADDICTIONS brand. KKCL’s<br />

designing and manufacturing facilities are mainly located at Dadar and Goregoan<br />

(Mumbai), Daman and Vapi in Western India.<br />

Grading Positives<br />

The key grading positives in our view are: 1) Strongly positioned to benefit from the<br />

domestic consumption play due to Pan-India presence, including its first-mover’s<br />

advantage in the Tier-II / Tier-III cities as well as relatively less penetrated eastern<br />

states 2) established brand equity of its flagship product – Killer Jeans 3) Asset light<br />

model reduces overhead costs while maintaining product & service standards 4)<br />

Continued focus on profitable growth and careful store expansion are expected to<br />

ensure healthy profitability indicators (like RoCE) for the company going forward 5)<br />

Strong designing expertise, vast experience of the promoters’ in the branded apparel<br />

business<br />

Grading Sensitivities<br />

The key grading sensitivities in our view are: 1) Intense competition in the domestic<br />

branded apparels market with presence of large number of domestic as well as global<br />

brands 2) Vulnerability to cotton price fluctuations and regulatory changes (like excise<br />

duty levy) 3) Ability to scale up business while maintaining its financial profile 4) High<br />

dependence on multi-brand outlets (MBOs) and National Chain Stores, which together<br />

contribute ~70% of revenues, can limit bargaining power 5) Increasing contribution<br />

from value brands (like Integriti, Lawman Pg3) and low margin products (like shirts,<br />

T-shirts) could moderate margins; cash reserves held by the company yields lower<br />

returns. 6) Merchandise obsolescence risks due to rapidly evolving fashion trends and<br />

changing customer preferences<br />

Table 1: KKCL’s key financial indicators (Consolidated)<br />

FY10A FY11A FY12E FY13E FY14E<br />

Operating Income (Rs. crore) 175.9 236.5 315.5 399.5 485.9<br />

EBITDA Margin (%) 27.3% 29.1% 25.6% 25.1% 24.6%<br />

PAT Margin (%) 18.5% 19.6% 17.3% 16.7% 16.2%<br />

EPS (Rs.) 26.4 37.5 44.2 54.1 63.8<br />

EPS Growth (%) 101.6% 43.3% 17.4% 24.2% 19.2%<br />

P/E (x) 26.5 18.7 15.9 12.9 11.0<br />

P/BV (x) 4.9 4.4 3.8 3.3 2.8<br />

RoE 19.9% 24.8% 25.6% 27.1% 27.5%<br />

RoCE 28.2% 36.6% 38.1% 40.2% 40.9%<br />

EV/EBITDA 16.6 11.2 9.4 7.5 6.2<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

<strong>ICRA</strong> Online Grading Matrix<br />

Valuation Assessment<br />

A B C D E<br />

5<br />

4 4C<br />

3<br />

2<br />

1<br />

• Fundamental Grading of ‘4/5’ indicates “Strong<br />

Fundamentals”<br />

• Valuation Grading of ‘C’ indicates “Fairly Valued”<br />

on a relative basis<br />

Key Stock Statistics<br />

Bloomberg Code<br />

KEKC IN<br />

Equity<br />

Current Market Price* (Rs.) 700.0<br />

Shares Outstanding (crore) 1.2<br />

Market Cap (Rs. crore) 862.8<br />

52-Week High (Rs.) 875.0<br />

52-Week Low (Rs.) 426.5<br />

Free Float (%) 25.9%<br />

Beta 0.7<br />

6 Month Avg Daily Volumes (Rs Cr) 0.3<br />

Source: Bloomberg, as on 30th December, 2011<br />

KKCL Industries: Current Valuations<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

-<br />

26.5<br />

16.6<br />

18.7<br />

11.2<br />

15.9<br />

Shareholding Pattern (30 th September, 2011)<br />

9.4<br />

Share Price Movement (18 months)<br />

12.9<br />

11.0<br />

7.5 6.2<br />

FY10a FY11a FY12e FY13e FY14e<br />

DIIs<br />

4%<br />

FIIs<br />

12%<br />

Price/Earnings<br />

Others<br />

10%<br />

EV/EBITDA<br />

Source: Bloomberg, <strong>ICRA</strong> Equity Research Service<br />

Promoters<br />

74%<br />

1

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

INVESTMENT SUMMARY<br />

Strong domestic consumption play with Pan-India presence and negligible dependence on exports<br />

East<br />

29%<br />

South<br />

24%<br />

Export<br />

3%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

North<br />

15%<br />

West<br />

29%<br />

Rising disposable incomes, rapid urbanisation, increasing<br />

organized retail penetration and changing spending<br />

trends are expected to result in branded apparels market<br />

reach ~Rs. 700 billion by 2015 (implying 28% CAGR).<br />

KKCL is strongly positioned to benefit from the domestic<br />

consumption boom due to its pan-India franchise and<br />

distribution through a wide network of multi-brand<br />

outlets across the country. Besides, KKCL enjoys the firstmover’s<br />

advantage in the Tier-II / Tier-III cities and<br />

under-penetrated eastern states, which are expected to<br />

remain the growth engines over the medium term.<br />

Diversified brand portfolio, Strong homegrown brands nurtured over decades; presence across product<br />

spectrum and price points<br />

KKCL has a mature portfolio of well-established fashion<br />

brands like ‘Killer’, ‘Lawman Pg3’ and ‘Integriti’ that have<br />

survived across economic cycles and successfully evolved<br />

with changing customer preferences over last two<br />

decades. KKCL’s flagship ‘Killer’ brand enjoys strong<br />

brand equity and is amongst the few homegrown denim<br />

brands that have survived the competitive pressures<br />

emanating from the entry of leading global brands. As per<br />

recent IMRB research report, Killer brand has been<br />

slotted amongst the Top 5 denim brands in the country.<br />

Shirts<br />

20%<br />

Trousers<br />

15%<br />

T-Shirts<br />

4%<br />

Others<br />

4%<br />

Jeans<br />

57%<br />

Easies<br />

2%<br />

Integriti<br />

25%<br />

Lawman<br />

21%<br />

Others<br />

1%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Killer is positioned mainly to cater to premium and designer wear (mainly denim jeans category), Lawman Pg3 is<br />

positioned as trendy fashion for mid-premium clubwear (across products like jeans, trousers, shirts, t-shirts, jackets),<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Killer<br />

51%<br />

Integriti is positioned as value or mass market brand<br />

(across product range) for the price conscious consumer,<br />

Easies is positioned as formal and semi-formal wear<br />

(mainly trousers and shirts) and ADDICTIONS is<br />

positioned as a dedicated lifestyle accessories brand<br />

(across products like shoes, belts, watches, bracelets,<br />

wallets, caps, bags, sunglasses and deodorants). Overall,<br />

KKCL’s brands are positioned across product spectrum<br />

and price points to garner mind-wallet share of aspiring<br />

young population and burgeoning middle and uppermiddle<br />

class in India.<br />

2

<strong>Kewal</strong><br />

<strong>Kiran</strong><br />

Zodiac<br />

<strong>Clothing</strong><br />

Provogue<br />

Arvind<br />

Lifestyle<br />

Brands<br />

Arvind<br />

Retail<br />

Raymond<br />

Apparel<br />

Colorplus<br />

Fashions<br />

<strong>Kewal</strong><br />

<strong>Kiran</strong><br />

Zodiac<br />

<strong>Clothing</strong><br />

Provogue<br />

Arvind<br />

Lifestyle<br />

Brands<br />

Arvind<br />

Retail<br />

Raymond<br />

Apparel<br />

Colorplus<br />

Fashions<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Industry leading profitability indicators due to careful expansion and efficient working capital management<br />

Unlike some domestic brand apparel manufacturers and large retailers, KKCL has restrained from acquiring market<br />

shares by sacrificing near term profitability. Also, KKCL has maintained a relatively modest presence in intensely<br />

competitive metro markets as high lease rentals and operating expenses could constrain profitability of its<br />

franchisees. The company has also limited its dependence on national chain stores that enjoy higher bargaining power<br />

and squeeze profit margins from the apparel manufacturers. Besides, the company has maintained low focus on the<br />

exports market, since it may not command the same premium and margins as the domestic markets. All these factors<br />

have combined to contribute a healthy profitability for KKCL.<br />

KKCL’s brands are predominantly targeted towards mid-premium and value segments; the strategy has paid rich<br />

dividends on account of down-trading by customers from the premium / ultra-premium catergories due to the twin<br />

impact of high inflation and slower economic / per-capita income growth rates over the last few years. The company<br />

has also demonstrated adequate flexibility in passing on the input cost escalations (cotton prices, fuel prices & labour<br />

costs) relative to its peers in the value / economy segments.<br />

KKCL derives majority of its revenues from denim jeans category that normally enjoy better margins due to higher<br />

scope for designing and value-addition relative to casuals, shirts & trousers categories. The company has introduced<br />

its own brands and nurtured them over the years to save royalty payments, which range around 3 to 5% for some<br />

foreign brands leased by of its domestic competitors. Besides, KKCL’s brands are well established and focused only on<br />

mid-premium to value segments, thereby resulting in relatively moderate advertising requirements (~4-5% of<br />

revenues).<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Branded Apparel Industry: EBITDA Margins<br />

29%<br />

12%<br />

11%<br />

9%<br />

10%<br />

5%<br />

12%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Branded Apparel Industry : RoCE (%)<br />

37%<br />

20%<br />

13%<br />

12%<br />

9%<br />

7%<br />

17%<br />

Source: Company Filings, <strong>ICRA</strong> Equity Research Service<br />

KKCL has made continuous investments in advertising/innovations to increase brand recall and create a ‘customer<br />

pull effect’ rather than pushing its products aggressively through the distribution channel. Since the company follows<br />

an outright sale model instead of consignment model; it has been able to efficiently manage its inventory levels, avoid<br />

major markdowns / write-offs in case of obsolete inventories and hence optimizes operating margins for the<br />

company. Besides, the company has low cost assets (estimated market value of manufacturing facilities, corporate<br />

office and company owned stores significantly exceeds book value of ~Rs. 43 crore) and strong balance sheet (~Rs.<br />

115 crore net cash and investments); resulting in low depreciation / interest costs and high non-operating incomes.<br />

The working capital intensity too is favourable compared to its peers with strict control on receivables, while<br />

inventory risk is partly mitigated by production against confirmed orders from its franchisees. Moreover, the<br />

company mainly outsources production (> 55% outsourced) and distribution (~90% exclusive brand outlets are<br />

franchisee owned) to reduce the fixed capital investments and uses outright sale model to reduce the working capital<br />

requirements; thereby ensuring industry leading return indicators for the company.<br />

3

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Nov-10<br />

Dec-10<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Dec-11<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

On the other side, merchandize obsolescence risks remain high in fashion industry; intense competition and<br />

dependence on MBOs and National Chain Stores reduces margin for error<br />

The company operates in rapidly evolving fashion industry, where it competes with large number of domestic as well<br />

as global brands. Hence, failure to keep abreast with the latest fashion trends and changing customer preferences<br />

Factory<br />

Outlet<br />

3%<br />

National<br />

Chain<br />

Stores<br />

9%<br />

MBO<br />

60%<br />

Exports<br />

3%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

K-Lounge<br />

25%<br />

could result in obsolete inventories and affect the<br />

competitiveness / brand equity of the company. Besides,<br />

high dependence on MBOs and National Chain Stores<br />

reduces the margin for error, as these third party retailers<br />

stock products of all competing brands and are inclined<br />

towards the latest fashion products providing higher<br />

inventory turns and better margins. However, the<br />

company has been able to demonstrate efficient inventory<br />

management so far by regular monitoring of<br />

inventory/products with its franchisses to take swift<br />

corrective actions wherever necessary.<br />

Profitability indicators remain vulnerable to cotton price fluctuations and regulatory changes<br />

KKCL, being a garments manufacturer, remains vulnerable to<br />

steep fluctuations in cotton prices. Raw cotton prices for the<br />

Domestic Cotton Prices (Sankar 6;<br />

Sankar-6 variety had increased from ~30,000 Rs/candy (1 70,000<br />

Rs/Candy)<br />

candy = 355 kg) in July 2010 to ~62,000 Rs/candy (1 candy = 60,000<br />

355 kg) in March 2011 on account of demand revival in 50,000<br />

developed economies and production disruptions due to 40,000<br />

adverse agro-climatic conditions in China and Pakistan. The 30,000<br />

steep rise in cotton prices had resulted in high cost inventories 20,000<br />

and hence constrained volume growth as well as operating<br />

10,000<br />

margins across the value chain until the Q3, FY12. However, the<br />

0<br />

raw cotton prices have corrected significantly over the last 6-8<br />

months to ~35,000 Rs/candy in Nov 2011 on account of<br />

deterioration in global demand outlook and strong productions<br />

Source: EmergingTextiles.com<br />

estimates for the 2011-12 cotton season globally. As the high<br />

cost inventory gets liquidated, the company is expected to benefit from lower cotton prices in the coming quarters.<br />

The company also remains vulnerable to regulatory changes like the 10% excise duty levied on all branded apparel<br />

during the last union budget, leading to a cascading effect across the value chain. After a representation from the<br />

industry participants, the government agreed to a partial rollback, imposing the duty on 45% as against the earlier<br />

60% of the MRP. The excise duty hike complicated matters at the time when the industry was already grappling with<br />

severe cost inflation and higher raw material (cotton, polyester, etc) prices. Besides, the organized retail industry in<br />

India continues to suffer due to stringent labour laws, multiple licences and clearances (40-45 approvals) required for<br />

setting up and operating a retail stores, high stamp duties on property deals and exceptionally high property prices<br />

and lease rentals in cities due to, among other things, urban land ceiling act and delays in new project approvals.<br />

Although the proposed goods and services tax (GST) is expected to reduce complexities in doing business and<br />

allowing foreign direct investments (FDI) in multi-brand retail is expected to improve efficiencies across the supply<br />

chain and give a boost to KKCL’s MBO & national chain store sales, the timelines for their implementation continue to<br />

remain uncertain.<br />

4

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

Return indicator (%)<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Strong revenue growth expected in-line with the branded apparel industry; increasing contribution from value<br />

brands and low margin products could moderate margins<br />

50.0%<br />

45.0%<br />

40.0%<br />

35.0%<br />

30.0%<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%<br />

43%<br />

42%<br />

34% 33%<br />

17%<br />

18%<br />

27%<br />

24%<br />

23%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

22%<br />

19%<br />

18%<br />

FY11a FY12e FY13e FY14e<br />

Sales Growth EBITDA Growth EPS Growth<br />

We expect the company to report 27% CAGR growth in<br />

gross sales over the next three years, in-line with the<br />

industry growth rates for branded apparels in India.<br />

However, increasing contribution from value and mass<br />

market brands like Lawman Pg3 and Integriti (which have<br />

~3.0 times and ~2.8x MRP to prime cost ratio respectively<br />

as compared to ~3.5 times for Killer brand) and lower<br />

margin products like trouser, shirts and T-shirts (due to<br />

lower scope for designing and value-addition) are<br />

expected to moderate margins and result in 20% CAGR<br />

EBITDA growth going forward. Finally, relatively low<br />

depreciation and interest costs on account of asset light<br />

business model, is expected to result in a healthy ~19%<br />

CAGR EPS growth over the FY11-FY14e period.<br />

However, asset light business model of expansion through franchise and third party distribution route are<br />

expected to ensure robust profitability indicators and strong capital structure<br />

The company had changed its business strategy in favour of an asset light model post 2008, when the lease rentals<br />

reached peak levels and threatened the business viability of a large number of retailers. Instead of expanding through<br />

own retail stores, KKCL’s management focussed on expanding through the franchisee and third party distribution<br />

route, thereby lowering operational costs (overhead costs) and capex requirements. Besides, the company opted for<br />

an outright sales model instead of consignment model and maintained tight control on receivables as well as<br />

inventory levels. This strategy of positioning itself as a “fashion brand” rather than a “fashion retailer” has paid rich<br />

dividends and helped the company build a business model with established brand equity, well penetrated distribution<br />

network, healthy profitability indicators and robust capital structure. We expect the company to retain and strengthen<br />

its asset light model with focus on branding and product innovations, supported by increasing outsourcing of<br />

production and franchise lead distribution.<br />

Exhibit 1: KKCL’s store details (September 2011)<br />

KKCL's Profitability Indicators & Gearing<br />

Store type COCO COMFO FOFO Total<br />

K-Lounge 1 11 113 125<br />

Killer EBO 3 45 48<br />

LawmanPg3-EBO 4 3 7<br />

Integriti-EBO 32 32<br />

Addiction-EBO 5 4<br />

Factory Outlet 7 7<br />

Total 1 25 198 223<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

37% 38% 40% 41%<br />

29%<br />

26% 25% 25%<br />

Source: Company<br />

COCO: Company-owned company-operated<br />

COMFO: Company-owned management franchisee-operated<br />

FOFO: Franchisee-owned franchisee-operated<br />

EBITDA Margin<br />

ROCE<br />

Total Debt/(Equity + MI)<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

o<br />

u<br />

5 r<br />

c<br />

e<br />

:<br />

S

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

As shown in the exhibit above, the company currently has 1:8 ratio of company-owned: franchise owned K-Lounge<br />

stores and exclusive brand outlets (EBOs). Going forward, we expect the company to maintain such ratio and add over<br />

50 exclusive stores in each of the next three years. Besides, the company currently outsources ~55% of production to<br />

unorganized third party garment manufactures to reduce capital expenditure, labour costs and concentrate on its core<br />

areas of designing and brand building. Overall, we expect the management to continue to focus on profitable growth<br />

along with a careful store expansion, which will ensure strong return indicators (over 40% returns on capital<br />

employed) and financial profile (below 0.1x debt to equity) for the company going forward.<br />

Premium valuations justified considering the strong market positioning and balance sheet strengths<br />

KKCL’s current valuation multiple (~12.9x times FY13 earnings) is at a premium to broader market indices like Nifty<br />

Index, CNX 500 index or CNX Midcap index. However, KKCL continues to be one of the most reasonably valued<br />

domestic consumption plays with strong established brand, wide distribution reach and strong balance sheet. Overall,<br />

we expect the company to report a healthy 27% CAGR revenue growth and 19% CAGR EPS growth over the FY11a-<br />

FY14e period, aided by rapid expansions in Tier – II and Tier – III cities. Hence, we assign a valuation grade of “C” to<br />

KKCL on a grading scale of ‘A’ to ‘E’, which indicates that the company is “Fairly Valued” on a relative basis.<br />

Exhibit 2: KKCL’S Relative Valuations<br />

<strong>ICRA</strong> Estimates<br />

KEWAL KIRAN<br />

CLOTHING<br />

NIFTY<br />

INDEX<br />

CNX 500<br />

INDEX<br />

CNX MIDCAP<br />

INDEX<br />

FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E<br />

Price/Earnings 15.85 12.93 13.19 11.29 12.38 10.31 10.63 8.79<br />

EV/EBITDA 9.45 7.53 9.25 8.11 9.13 7.69 9.39 7.44<br />

Price /Sales 2.73 2.16 1.45 1.33 1.15 1.04 0.67 0.61<br />

Price /Book Value 3.79 3.26 2.03 1.78 1.78 1.56 1.21 1.09<br />

Price/Cash Flow 14.06 11.46 9.46 8.15 8.93 7.42 8.17 6.34<br />

<strong>ICRA</strong> Estimates<br />

KEWAL KIRAN<br />

CLOTHING<br />

PANTALOON<br />

RETAIL<br />

SHOPPERS<br />

STOP<br />

TRENT<br />

ARVIND<br />

PROVOGUE<br />

(INDIA)<br />

FY12 FY13 FY12 FY13 FY12 FY13 FY12 FY13 FY12 FY13 FY12 FY13<br />

Price/Earnings 15.85 12.93 13.72 10.25 36.49 23.53 n.m. 35.29 6.75 5.27 6.37 5.20<br />

EV/EBITDA 9.45 7.53 9.66 8.26 17.01 12.14 146.01 14.70 6.14 5.54 9.42 8.14<br />

Price /Sales 2.73 2.16 0.21 0.18 0.73 0.59 0.89 0.63 0.38 0.34 0.37 0.34<br />

Price /Book Value 3.79 3.26 0.84 0.78 3.82 3.40 1.99 2.24 0.75 0.66 0.43 0.40<br />

Price/Cash Flow 14.06 11.46 6.30 5.13 19.92 14.35 57.93 19.81 3.45 2.90 5.34 4.59<br />

Source: Bloomberg, <strong>ICRA</strong> Equity Research Service * Bloomberg Consensus Estimates as on 30 th December, 2011<br />

6

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

OPERATING PROFILE<br />

Strong brands built over the years through product designing / innovations rather than competing on price<br />

points; presence in mid-premium / value segments have paid rich dividends due to down-trading by customers<br />

Over the years, the company has built and nourished strong brands through focus on the product innovations and<br />

designs to create a brand identity, rather competing on price points. For example, it has always positioned “Killer” as<br />

an upmarket/international brand by associating with foreign models for the advertisement campaigns. The exclusive<br />

brand outlets (EBOs) are aesthetically designed to maintain consistency with the advertising campaigns and resonate<br />

with the brand appeal. The company has stayed away from advertising on price points, thereby helping it to absorb<br />

cost escalation and report margins better than the competition. Also, KKCL’s brands are predominantly targeted<br />

towards mid-premium and value segments, which has paid rich dividends due to the down-trading of customers from<br />

the premium / ultra-premium catergories due to the twin impacts of high inflation and slower economic / per-capita<br />

income growth rates over the last few years.<br />

Exhibit 3: KKCL’s Brand Portfolio<br />

Brand<br />

Launch<br />

Year<br />

Positioning<br />

Average<br />

MRP in Rs<br />

Average<br />

Denim<br />

MRP in Rs<br />

Competition<br />

FY11<br />

Revenues<br />

(Rs. Cr.)<br />

Revenues<br />

% Share<br />

Killer 1989<br />

Mid-Premium<br />

to Premium<br />

~1,650 1,800<br />

Lee, Levi’s, Wrangler,<br />

UCB, Pepe Jeans<br />

120.6 51%<br />

Lawman Pg3 1998 Mid Premium ~1,500 1,500<br />

Mufti, Trigger, Spykar,<br />

Flying Machine, Bare<br />

49.2 21%<br />

Integriti 2002<br />

Easies 1989<br />

Value<br />

to mid-premium<br />

Value<br />

to mid-premium<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

~1,150 1,200<br />

~1,550<br />

Not<br />

Applicable<br />

Denizen, Indigo Nation,<br />

John Players, Peter England<br />

John Players,<br />

Austin Reed,<br />

Indian Terrain<br />

32.4 25%<br />

5.9 2%<br />

Killer: It was launched in 1989 and is KKCL’s flagship brand positioned as a global Indian brand conveying the trendy,<br />

vibrant and youthful look with an attitude. With average MRP at around Rs, 1,800 per piece, it is focused towards the<br />

mid-premium to premium denim segment for 16-30 years age group. Throughout its brand history, it has focused on<br />

continuous innovation in style, design and product supported by adequate advertising campaign conveying the above<br />

features and creating imagery in sync with an international brand. This has enabled it to compete well with the large<br />

number of international denim players that have entered Indian markets. It is distributed through MBOs, EBOs, both<br />

“K-Lounge” as well as exclusive “Killer” stores and national chain stores like ‘Shoppers Stop’ and ‘Lifestyle’.<br />

Product portfolio: It includes ready-to-wear jeans, trousers, cargos, capris, shirts, jackets, t-shirts, innerwear (vests<br />

and briefs), footwear (shoes, socks). It also has eye-wear and other accessories (belts, bracelets etc) in its portfolio. To<br />

target the growing women-wear denim segment, the 'Killer for her' range was launched in 2007.<br />

Lawman Pg3: The brand was launched in 1998 and targets the 18-30 years age group in the mid-premium segment<br />

with average MRP for denim jeans at around Rs. 1,500. For Lawman, the company has focused on creating a theme<br />

each season under which the designers add different textures, cuts, drapes, washes and feel to the product. The<br />

company holds three patents under the “Lawman” brand - for introducing the ‘Yi-Fi’ stitch, Vertebrae collection<br />

(where it has patented the ‘wash and stitch’) and “Emboss” (which was another stitch related improvement). It is<br />

distributed through MBOs, EBOs, both “K-Lounge” as well as exclusive “Killer” stores and national chain stores like<br />

‘Westside’ and ‘Central’.<br />

7

Zodiac<br />

<strong>Clothing</strong><br />

Raymond<br />

Apparel<br />

Arvind<br />

Lifestyle<br />

Provogue<br />

Colorplus<br />

Fashions<br />

<strong>Kewal</strong><br />

<strong>Kiran</strong><br />

Arvind<br />

Retail<br />

Page<br />

Industries<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Product portfolio: The LawmanPg3 apparel range has shirts, blazers, jackets, denim and cotton trousers, tee-shirts,<br />

cargos, capris, drapes, jeggings, skirts and shorts. It accessories collection includes innerwear, socks, footwear,<br />

headwear, sunglasses, deodorants and trinkets.<br />

Integriti: The brand was launched in 2002 mainly to counter completion from unorganised players as well as other<br />

domestic players competing through low price points. Integriti is aimed at the price conscious value segment with<br />

average MRP at around Rs. 1,150 for its products. Being a value brand, majority (~70%) of its sales are in Tier-II and<br />

Tier-III cities mainly through the MBOs, balance through EBOs and a small proportion through national chain stores.<br />

Product portfolio: The product range under the brand includes casuals and formal shirts, T-shirts, Jeans and cotton<br />

trousers. A sub-brand “Integriti Galz” was also launched to cater to women-wear category.<br />

Thrust on enhancing brand equity, designing latest fashions and introducing innovative product; lower focus on<br />

in-house production to reduce fixed overheads and avoid labour issues<br />

Over the years the company has steadily reduced its focus on manufacturing. In FY10, the company produced 76% of<br />

the garments in-house and rest were outsourced to vendors located in Bangalore and Mumbai. In FY11, the in-house<br />

to outsourced manufacturing ratio was 53:47, which is further expected to tilt in favour of outsourcing in FY12.<br />

Garmenting is a labour intensive business – high labour costs coupled with the rigid labour laws has resulted in weak<br />

competitive positioning for Indian garment manufacturers. Overall, as the management plans to stay focused on<br />

higher value added activities like brand building and product design, significance of activities like manufacturing are<br />

expected to reduce.<br />

Continuous investments in advertising/marketing over the years to nurture brand image; however advertising<br />

costs remain moderate due to established brands and exposure to mid-premium / value segments<br />

15.0%<br />

12.8%<br />

12.0%<br />

9.0%<br />

8.3%<br />

7.0% 7.3% 6.6%<br />

6.0%<br />

3.0%<br />

4.7% 4.1%<br />

2.5%<br />

0.0%<br />

Source: Annual Reports, <strong>ICRA</strong> Equity Research Service<br />

Since it takes decades to nurture superior brands (for<br />

example Levis, Diesel, Tommy Hilfiger, etc), KKCL has<br />

made continuous investments in advertising/marketing to<br />

increase brand recall and pull customers rather pushing<br />

its brand across various channels of distribution. In<br />

addition to print media, the company also attempts to<br />

reach out to target audiences through contemporary<br />

forms of advertising such as in-film placements and<br />

cricket sponsorships (like Pune Warriors in Indian<br />

Premium League, IPL). The company is currently running<br />

a television advertisement campaign for its “Killer”<br />

deodorant. However, since the company has well<br />

established brands focused on mid-premium to value<br />

segments, overall advertising spend for the company has<br />

remained near the industry average (~4-5% of revenues).<br />

Effective distribution strategy through exclusive franchisees and multi-brand outlets ensures wider penetration;<br />

outright sale model ensures efficient inventory management<br />

The company has carved out an effective distribution strategy wherein it has a mix of Exclusive Brand outlets – EBOs<br />

(own as well as franchisees), Multi-brand outlets - MBOs and sales through National Chain Stores (organized retailers)<br />

to maintain an optimum balance between growth rate / penetration levels and profitability margins.<br />

8

FY09<br />

FY10<br />

FY11<br />

FY12e<br />

FY13e<br />

FY14e<br />

FY09<br />

FY10<br />

FY11<br />

FY12e<br />

FY13e<br />

FY14e<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

The aesthetically designed EBOs for its “Killer”, “Lawman Pg3” and “Integriti” brands and complete brand portfolio<br />

under “K-Lounge” stores helps builds brand image and visibility for the company. The company also has considerable<br />

presence through national chain stores such as Shoppers’ Stop that have high footfalls and provide a vital channel for<br />

swiftly building up brand awareness. On the other hand, distribution through multi-brand outlets (MBOs) enables the<br />

company to expand its distribution network wide across the country and deep into Tier-III and Tier-IV towns.<br />

The management has cautiously limited its dependence on national chain stores that enjoy higher bargaining power<br />

and squeeze profit margins for the apparel manufacturers. Even for the exclusive brand outlets, the company mainly<br />

uses franchisee route to reduce capital investments (fixed assets as well as inventories) and concentrate on its core<br />

strengths of designing and brand building. However, careful screening of the franchisees owners in terms of relevant<br />

industry experience and business acumen has helped the company to maintain services standards and brand equity.<br />

Since the management follows an outright sale model instead of a consignment model, for its franchisees as well as<br />

distributors, the company has been able to efficiently manage its inventory levels and hence report better the<br />

operating margins. Again, the management has consciously maintained low focus on the exports market, since the<br />

company may not command the same premium as domestic markets where it has high brand equity. The lower<br />

exports dependence has also shielded the company from near term global economic uncertainties and currency<br />

fluctuations.<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

KKCL : Distribution-wise revenue Break-up<br />

5% 8% 9% 10% 12% 13%<br />

58% 58% 60% 58% 56% 54%<br />

28% 27% 25% 26% 27% 27%<br />

Exports<br />

Factory Outlet<br />

100%<br />

80%<br />

KKCL : Geographic revenue break-up<br />

22% 25% 29% 31% 32% 33%<br />

National Chain<br />

60% 26% 25% 24% 22% 22% 21%<br />

Stores<br />

40%<br />

MBO<br />

34% 32% 29% 27% 27% 26%<br />

20%<br />

K Lounge 14% 15% 16% 16% 16% 17%<br />

0%<br />

Export<br />

East<br />

South<br />

West<br />

North<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Geographically well diversified sales mix; thrust on under-penetrated Eastern region likely to continue<br />

KKCL has a well diversified geographic sales mix, mainly owing to its wide distribution network spanning the length<br />

and breadth of the country. The company is based out of Mumbai and has traditionally had a strong presence in the<br />

Western region and Southern states of the country. However, the Eastern region has emerged as a strong growth<br />

driver for the company in recent periods due to increasing brand recognition, rapid distribution expansion and low<br />

penetration of branded apparels and fashion products in these markets.<br />

However, the company has relatively modest presence and market share in the otherwise lucrative Northern region<br />

due to intense competition, unfavourable credit terms demanded by the distributors and lack of winter-wear products<br />

in its portfolio. Nevertheless, the company has revamped its distribution set-up in the region to focus on growth<br />

through exclusive stores and introduced a wide range of winter-wear merchandises (like jackets and woollen wears)<br />

to cater to the northern region. The above strategies seem to have already started to pay off, as evident through ~43%<br />

revenue growth in the region in FY11.<br />

9

FY09<br />

FY10<br />

FY11<br />

FY12e<br />

FY13e<br />

FY14e<br />

FY09<br />

FY10<br />

FY11<br />

FY12e<br />

FY13e<br />

FY14e<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Dependence on flagship “Killer” brand to reduce with strong growth from value brands as well as recently<br />

launched lifestyle accessories brand ‘ADDICTIONS’<br />

KKCL is an established player in the domestic denim jeans market through its flagship “Killer” brand, which has been<br />

consistently contributing over 50% of KKCL’s revenues in the past. The mid-premium brand continues to be slotted<br />

amongst the Top-5 denim brands in the country, enjoys strong brand equity and is amongst the few homegrown<br />

denim brands that have survived the competitive pressures emanating from the entry of leading global brands.<br />

However, the Killer brand did not cater to the mass value-conscious segment constituting the largest consumer base<br />

in the domestic market. As a result, the company introduced “Lawman Pg3” and “Integriti” cater to “mid-premium”<br />

and “Value” segments respectively and garner its fair market share in the value market segment. These brands have<br />

exhibited robust growth rates over the last few years due to customer down-trading due to high primary articles<br />

inflations and impact of uncertain economic conditions. We expect these brands to continue to grow at a faster CAGR<br />

going forward due to increasing acceptance / brand awareness for these brands. Besides, the recently launched<br />

lifestyle accessories brand “ADDICTIONS” too is expected to start contributing meaningfully in the top-line growth of<br />

the company going forward. Overall, we expect the revenue contribution from ‘Killer’ brand to reduce from ~51% in<br />

FY11 to ~45% in FY14 and thereby reducing the brand concentration of the company over the next three years.<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

KKCL : Brand-wise revenue break-up<br />

Addictions<br />

22% 23% 25% 23% 23% 23% Integriti<br />

21% 22% 21% 20% 21% 21% Easies<br />

52% 52% 51% 47% 46% 45%<br />

Lawman<br />

Killer<br />

KKCL : Product-wise revenue contributions<br />

100%<br />

Others<br />

80% 19% 21% 20% 22% 23% 24% T-Shirts<br />

60% 19% 17% 15% 12% 11% 10%<br />

Shirts<br />

40%<br />

20%<br />

53% 55% 57% 54% 53% 52% Trousers<br />

0%<br />

Jeans<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Presence across product spectrum and price points; dependence on jeans category to reduce with increasing<br />

contribution from Shirts, T-shirts, Winter-wears and lifestyle accessories<br />

“Killer” is positioned mainly to cater to mid-premium to premium and designer wears (mainly denim jeans category),<br />

“Lawman Pg3” is positioned as trendy fashion for mid-premium clubwears (across products like jeans, trousers,<br />

shirts, t-shirts, jackets), “Integriti” is positioned as value or mass market brand (across product range) for the price<br />

conscious consumer, “Easies” is positioned as formal and semi-formal wear (mainly trousers and shirts) and<br />

“ADDICTIONS” is positioned as a dedicated lifestyle accessories brand (across products like shoes, belts, watches,<br />

bracelets, wallets, caps, bags, sunglasses and deodorants). Overall, KKCL’s brands are positioned across product<br />

spectrum and price points to garner mind-wallet share of aspiring young population and burgeoning middle and<br />

upper-middle class in India.<br />

Traditionally, KKCL has been strongly associated with the denim jeans category that contributed over 55% of the<br />

overall revenues of the company. However, the company has introduced large number of products and brand<br />

extension across categories like women’s wears, winter-wears, shirts, t-shirts, trousers and lifestyle accessories. As a<br />

result, we expect the contribution of jeans category to decline from ~57% in FY11 to ~52% in FY14.<br />

10

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Industry leading profitability indicators due to careful expansion and efficient working capital management<br />

KKCL enjoys the highest operating margins among the industry peers attributable to its focus on profitable growth.<br />

Additionally, since the company operates on an outright sales model for majority of its sales, it does not have to<br />

provide for inventory markdowns in its books as compared to the industry players aiding operating profitability. The<br />

working capital intensity too is favourable compared to its peers with strict control on receivables while inventory<br />

risk is partly mitigated by production against confirmed orders. Besides, the company continues to enjoy high net<br />

margins as its depreciation & interest costs are among the lowest in the industry, while the return indicators benefit<br />

from the franchisee model requiring lower capital investments.<br />

Exhibit 4: Industry Comparison<br />

Brands<br />

Brand<br />

ownership<br />

Category<br />

Domestic-<br />

Export mix<br />

Distribution<br />

Manufacturing<br />

<strong>Kewal</strong> <strong>Kiran</strong> Zodiac Provogue<br />

Killer, Lawman<br />

Pg 3,Integriti<br />

Owned<br />

Present across<br />

premium, midpremium<br />

and<br />

value segments<br />

for casual wear<br />

Domestic<br />

~95%, balance<br />

5% exports<br />

Mainly through<br />

MBOs and<br />

exclusive<br />

franchisees<br />

53% in-house,<br />

balance 47%<br />

outsourced<br />

Zodiac, Z3 and<br />

ZOD!<br />

Licensed from<br />

its group<br />

company<br />

Premium<br />

segment across<br />

formal wear,<br />

party and<br />

relaxed casual<br />

wear<br />

60% Exports<br />

and balance<br />

40% domestic<br />

Through MBOs,<br />

company leased<br />

stores and<br />

national chain<br />

stores<br />

In-house<br />

Provogue<br />

Owned<br />

Mid-premium<br />

to premium<br />

segment for<br />

casual, party<br />

and formal<br />

wear<br />

44% Exports<br />

and balance<br />

56% domestic<br />

sales<br />

Through<br />

exclusive<br />

outlets and<br />

national chain<br />

stores<br />

60% in-house,<br />

balance<br />

outsourced<br />

Arvind<br />

Lifestyle<br />

Brands<br />

<strong>Limited</strong><br />

Flying Machine,<br />

Arrow, US Polo<br />

Assn., IZOD,<br />

Energee, Gant<br />

Except Flying<br />

Machine others<br />

are licensed<br />

Premium to<br />

super-premium<br />

segment for<br />

casual wear,<br />

semi-formal<br />

and formal<br />

wear<br />

Majority<br />

domestic sales<br />

Own retail<br />

stores, MBOs as<br />

well as National<br />

chain stores<br />

Arvind Retail<br />

Excalibur,<br />

Cherokee,<br />

Mix of owned<br />

and licensed<br />

Value segment<br />

across casual<br />

wear, formal<br />

wear and semiformal<br />

wear<br />

Majority<br />

domestic sales<br />

Distribution<br />

through own<br />

retail<br />

Raymond<br />

Apparel<br />

Raymond, Park<br />

Avenue and<br />

Parx<br />

Owned<br />

Premium<br />

segment for<br />

casual and<br />

formal wear<br />

Majority<br />

domestic sales<br />

Through<br />

wholesalers,<br />

MBOs, national<br />

chain stores<br />

and exclusive<br />

stores<br />

Colorplus<br />

Fashions<br />

Colorplus<br />

Owned<br />

Premium<br />

segment for<br />

casual wear<br />

Majority<br />

domestic sales<br />

Through<br />

wholesalers,<br />

MBOs, national<br />

chain stores<br />

and exclusive<br />

stores<br />

Not available Not available Not available Not available<br />

FY11 (Rs Cr) FY11 (Rs Cr) FY11 (Rs Cr) FY11 (Rs Cr) FY11 (Rs Cr) FY11 (Rs Cr) FY11 (Rs Cr)<br />

Net Sales 236.5 356.3 561.3 415.8 374.6 471.3 172.2<br />

EBITDA 68.9 38.3 69.9 38.2 20.1 48.6 20.5<br />

PAT 46.2 33.2 33.5 10.2 -0.2 22.6 10.4<br />

Sales growth 34% 8% 26% 64% 32% 8% 5%<br />

PAT growth 42% 26% 9% 387% n.m.* 99% n.m.*<br />

EBITDA (%) 29% 11% 12% 9% 5% 10% 12%<br />

PAT (%) 20% 9% 6% 2% 0% 5% 6%<br />

ROCE 37% 20% 7% 13% 9% 12% 17%<br />

RONW 25% 17% 5% 7% 0% 22% 14%<br />

Gearing 0.0 0.2 0.3 0.7 1.8 1.4 0.1<br />

Debtor days 46 37 114 105 5 30 20<br />

Payable days 51 42 47 177 142 70 62<br />

Inventory days 112 127 235 209 164 196 194<br />

Source: Company filings, <strong>ICRA</strong> Equity Research Service<br />

*n.m. stands for ‘not meaningful’<br />

11

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Nov-10<br />

Dec-10<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Dec-11<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Profitability indicators remain vulnerable to cotton price fluctuations; volume/margin pressures likely to ease<br />

from Q4, FY12 onwards when the decline in cotton prices will reflect for the garment retail industry<br />

KKCL, being a leading garments manufacturer, remains<br />

vulnerable to steep fluctuations in cotton prices. Raw cotton<br />

Domestic Cotton Prices (Sankar 6;<br />

prices for the Sankar-6 variety had increased from ~30,000<br />

Rs/Candy)<br />

Rs/candy (1 candy = 355 kg) in July 2010 to ~62,000 70,000<br />

Rs/candy (1 candy = 355 kg) in March 2011 on account of 60,000<br />

demand revival in developed economies and production 50,000<br />

disruptions due to adverse agro-climatic conditions in China<br />

40,000<br />

and Pakistan. The steep rise in cotton prices had resulted in<br />

30,000<br />

high cost inventories and hence constrained volume growth<br />

20,000<br />

as well as operating margins across the value chain until the<br />

10,000<br />

Q3, FY12. However, the raw cotton prices have corrected<br />

0<br />

significantly over the last 6-8 months to ~35,000 Rs/candy<br />

in Dec 2011 on account of deterioration in global demand<br />

outlook and healthy productions estimates for the 2011-12<br />

cotton season globally.<br />

Source: EmergingTextiles.com; <strong>ICRA</strong> Equity Research Service<br />

Raw material costs accounts for a higher proportion of the<br />

Denim fabric costs due to higher cotton yarn usage than trouser/shirting fabrics. As a result, the denim fabric prices<br />

had risen by approximately 30-40% in the past one year while shirting fabric prices had risen by 20-25% in the same<br />

period. Faced with the twin challenge of rising input costs and excise duty hike, most players had increased their<br />

prices with KKCL increasing it by about 10-12%. Since the production cycle for branded apparel manufacturers<br />

function with a lag of about eight-nine months, the pricier garments produced from high cost fabric inventory will<br />

remain in the retail stores until Q3, FY12. This has led to some volume pressure as witnessed in slowdown in same<br />

store sales during the current season as well as margin pressure as the raw material cost increases could not be<br />

passed on completely. The lower cotton costs will start reflecting for branded apparel industry only from Q4 FY12<br />

onwards, easing pressure on the volumes as well as operating margins of the players across the value chain.<br />

Regulatory changes a risk factor..<br />

The company also remains vulnerable to regulatory changes like the 10% excise duty levied on all branded apparel<br />

during the last union budget, leading to a cascading effect across the value chain. After a representation from the<br />

industry participants, the government agreed to a partial rollback, imposing the duty on 45% as against the earlier<br />

60% of the MRP. The excise duty hike complicated matters at the time when the industry was already grappling with<br />

severe cost inflation and higher raw material (cotton, polyester, etc) prices. Besides, the organized retail industry in<br />

India continues to suffer due to stringent labour laws, multiple licences and clearances (40-45 approvals) required for<br />

setting up and operating a retail stores, high stamp duties on property deals and exceptionally high property prices<br />

and lease rentals in cities due to urban land ceiling act and delays in new project approvals. Although the proposed<br />

goods and services tax (GST) is expected to reduce complexities in doing business and allowing foreign direct<br />

investments (FDI) in multi-brand retail is expected to improve efficiencies across the supply chain and give a boost to<br />

KKCL’s MBO & national chain store sales, the timelines for their implementation continue to remain uncertain.<br />

Free Trade Agreement with Bangladesh likely to result in cost efficiencies for the branded apparel companies<br />

KKCL’s strategy towards outsourcing is expected to receive a thrust after the recent Free Trade Agreement signed<br />

with Bangladesh. Earlier, there was a cap on import of garments from Bangladesh at 10 million pieces, which is now<br />

removed with effect from September, 2011. Though the Bangladeshi garment sector lacks a raw material base, it has<br />

12

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

emerged more cost competitive than even the Chinese manufacturers owing to significant low labour cost costs,<br />

economies of scale, flexible labour laws and subsidies from the Government which makes garmenting cost effective.<br />

The recent free trade agreement is likely to create substantial cost savings for the industry and help the branded<br />

apparel industry to reduce prices after recent inflationary trends witnessed over the past one year. KKCL has also<br />

started making efforts in this direction for exploring the options of outsourcing manufacturing to Bangladesh.<br />

Proposed Goods and Services Tax (GST) could provide further fillip<br />

The implementation of the proposed goods and services tax (GST) can provide further fillip to organized retail growth<br />

by reducing complexities of doing business, improving efficiencies across the supply chain and optimizing the taxation<br />

system of the country. Currently organized retailers pay value added tax (VAT: 5% to 12.5%) which is generally<br />

evaded by the unorganized players. Besides, organized retailers pay service tax (10.3%) on lease rentals which would<br />

be completely setoff once GST is implemented. Again, Inter-state taxes like central sales tax (2%) and local octroi taxes<br />

result in retailers having multiple warehouses to reduce taxes. This results in losses due to wastage, over-investments<br />

and sub-optimal inventories, while investments in high-end warehousing and storage facilities remain restricted. GST<br />

implementation will enable efficient implementation of hub-and-spoke distribution model, help rationalize entire<br />

supply chain, optimize warehousing capacities and reduce storage, handling and transport costs for the organized<br />

retailers. Besides, GST is expected to streamline documentation and reduce multiple tax incidences from central, state<br />

and local government bodies; thereby facilitating uniform retail pricing across the country.<br />

Robust growth expected over the next three years through product/brand extensions and entry into “lifestyle”<br />

products such as bags, headgear, eyewear etc. and personal care segment<br />

The company initially mainly focused on jeans under its flagship brand, “Killer”. However, over the years, it gradually<br />

expanded into other product categories such as trousers, shirts and T-shirts under “Killer” as well as its other brands.<br />

Additionally, most of the sales were of men’s apparels until now, with little focus on women’s wear. With the increase<br />

in number of working women, rising income levels and a cultural shift in favour of western outfits, the women’s<br />

branded apparels market has seen higher growth rates where KKCL has already started tapping the opportunity. We<br />

expect the proportion of sales from women’s apparels to increase in the coming future and drive part of the growth<br />

for the company. Additionally, with rise in disposable incomes, spend on personal care products like deodorants and<br />

lifestyle accessories such as eyewear, sunglasses etc., has received a huge thrust in the past few years. With the<br />

growth the segment has seen increased competition from players such as Provogue and Titan which have launched<br />

their own stores in the past. The company has started retailing such products through its newly launched<br />

“ADDICTIONS” outlets. Currently, the concept is in the initial stage and management expects to give the segment a<br />

push once it is able to gauge the initial market response and demand. We expect “ADDICTIONS” to contribute ~9% of<br />

overall sales by FY14.<br />

Asset light franchisee model leading to low capital requirements and high return on investments<br />

Post FY08, the company had changed its retail distribution model from company owned/leased stores to franchisee<br />

owned/leased stores, where the franchisee bears all capital investments as well as the operational costs, chiefly rental<br />

and overhead costs for the stores. While the company shares considerable margins with its franchisees, distributors<br />

as well as third party manufacturers; the asset light business model facilitates rapid ramp-up in operations without<br />

substantial capital requirements. Besides, substantial outsourced production provides economies of scale while<br />

keeping the company relatively immune to demand slowdowns or labour unrest related issues. Moreover, lower<br />

capital requirements results in robust return indicators (RoCE ~36%) and strong balance sheet position with almost<br />

zero debt and free cash & cash equivalents of ~Rs. 120 crore. Currently the ratio of company owned to franchisee<br />

stores stand at 1:8; going forward we expect the company to maintain such ratio and add about 75 exclusive stores in<br />

each of the next three years ensuring strong free cash flow generation and return indicators.<br />

13

2005<br />

2009<br />

2010e<br />

2015e<br />

2020e<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Industry Scenario<br />

As per Images Yearbook 2011, the size of the domestic textile and apparel Industry is estimated at Rs. 246,000 crore<br />

with apparels constituting approximately 70% of the market at Rs. 170,900 crore. The apparel segment is expected to<br />

grow at a CAGR of 11% over the next five years to grow to Rs, 288,880 crore. Increasing population with rising<br />

disposable incomes, rapid urbanisation, change in spending attitude and increasing retail penetration into smaller<br />

cities are expected to be crucial growth drivers.<br />

Total Apparel Market (Rs Crore)<br />

470,000<br />

Total Apparel Market (Rs Crore)<br />

11%<br />

101,425<br />

154,000 170,900<br />

288,880<br />

1%<br />

5% 5%<br />

Population<br />

Growth<br />

Increase in<br />

Individual<br />

Consumption<br />

Growth in Unit<br />

Value<br />

Total CAGR<br />

Source: Images Yearbook, <strong>ICRA</strong> Equity Research Service<br />

Percentage of Organized and Unorganized Sectors<br />

in Retail Industry<br />

87% 86% 83% 75%<br />

13% 14% 17% 25%<br />

Source: Images Yearbook, <strong>ICRA</strong> Equity Research Service<br />

60%<br />

40%<br />

2005 2009 2010e 2015e 2020e<br />

Organised<br />

Unorganized<br />

The organised apparel retail sector shall lead the way for<br />

the domestic apparel industry, likely to grow at ~28%<br />

CAGR between 2010 and 2015. Thus the organised<br />

garment retail penetration shall increase to ~25%<br />

(translating to a market of Rs. 72,200 crore) in 2015 from<br />

~16% at present (~Rs. 27,350 crore). This presents ample<br />

room for all organised players to compete and grow while<br />

presenting significant advantage for established industry<br />

players such as KKCL to capture a greater share of the<br />

consumer’s wallet.<br />

KKCL’s target segment between 16-25 age is expected to witness higher than the average 11% growth expected for<br />

the readymade garment industry. This is expected to be fuelled by the growth of services sector especially the new<br />

generation IT and BPOs which is expected to generate higher employment among the youth leading to their greater<br />

consumption. Furthermore, Segment wise, women’s wear and girl’s wear is expected to lead the growth with CAGR of<br />

12% and 11% respectively while menswear and boy’s wear are expected to grow at relatively lower CAGR of 9% and<br />

10% respectively. The increased growth in women’s wear reflects increasing independence among women as a<br />

greater number enters the workforce and changing lifestyle which encourages higher spending among women. In line<br />

with higher expected growth for women’s wear, KKCL too has increased its focus on the segment and is marketing<br />

aggressively through events and advertising focussing on women. Also there is paucity of national brands targeted<br />

exclusively at women and KKCL intends to capture this largely untapped market.<br />

14

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Currently share of urban market is higher at 55% with greater organised retail penetration than the rural market.<br />

However, the rural market at 45% share remains extremely underserved with huge potential for organised retail to<br />

grow. KKCL is well positioned with respect to the rural market too having its value to mid-premium brand, Integriti<br />

and mid-premium offering, Lawman Pg3 in the portfolio.<br />

Boys<br />

10%<br />

Girls<br />

9%<br />

2009<br />

Mens<br />

43%<br />

Boys<br />

10%<br />

Girls<br />

9%<br />

2015e<br />

Mens<br />

40%<br />

Boys<br />

10%<br />

Girls<br />

10%<br />

2020e<br />

Mens<br />

37%<br />

Women<br />

38%<br />

Women<br />

41%<br />

Women<br />

43%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

The Indian denim market (CY 2009) is estimated at Rs. 4,600 crore with menswear segment dominating at Rs. 3,900<br />

crore, followed by women-wear at Rs. 415 crore and balance comprised by girls-wear and boys-wear categories. The<br />

menswear market is expected to exhibit a moderate 9% CAGR with the women-wear category to expand at 13%<br />

CAGR. Even though the readymade denim wear market has been on a growth trajectory, the per capita consumption<br />

still lags behind considerably that of large consuming economies. The Indian average is between 2-3 pairs of jeans visa-vis<br />

China at 4 and US with 9, indicating the growth potential of the domestic denim market. A fast growing middle<br />

class and changing income pyramid is further expected to fuel growth. In terms of demanding the latest fashion<br />

trends, the Indian consumer is less dynamic as compared to the more fashion forward western consumers. Currently,<br />

basic denims comprise 50-60% of the denim category, 25-30% is value-added while only 5-10% can be considered as<br />

a “fashion” product. The proportion is broadly expected to remain on similar lines in the medium term.<br />

The company has maintained distinct identity of each of its brands by focussing on the softer aspects such as unique<br />

features and creating a lifestyle product so that people are drawn towards the brand for these reasons and not on<br />

price. For example, it has always positioned “Killer” as an upmarket brand by associating/using foreign models for the<br />

advertisement campaigns. It has never advertised on pricing of its products, as it is difficult to retain customers once<br />

the price point moves. Thus it has been able to pass on cost increases better than the peer group, which in-turn has<br />

allowed it to generate above-average operating margins.<br />

15

FY10a<br />

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

FY10a<br />

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

Rs Crore<br />

Rs Crore<br />

FY09a<br />

FY10a<br />

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

FY09a<br />

FY10a<br />

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

Rs Crore<br />

Rs Crore<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

FINANCIAL OUTLOOK<br />

Healthy revenue growth visibility through higher sales volumes and increasing realizations<br />

We expect KKCL to remain a leading branded apparel manufacturer with a strong retail presence across the country<br />

through a mix of own stores, franchisee stores, national chain stores and multi-brand outlets. We expect KKCL’s sales<br />

to increase from ~3.36 million pieces in FY11 to ~5.55 million pieces by FY14e, resulting in a healthy 18% CAGR<br />

volume growth. While the realizations are expected to increase by ~10% in FY12e due to the increase in excise duties<br />

on branded apparels, we have assumed 5% CAGR increase in realizations thereafter.<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

15%<br />

2.36 2.72<br />

23% 30%<br />

20% 20% 25%<br />

15% 20%<br />

15%<br />

10%<br />

5.55<br />

5%<br />

4.82<br />

0%<br />

4.03<br />

3.36<br />

-5%<br />

-10%<br />

-15%<br />

-20%<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

8% 5% 7%<br />

10% 5%<br />

5%<br />

608 639 685 750 787 827<br />

10%<br />

9%<br />

8%<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

Apparels in Mns Growth %<br />

Realization Rs/Pc Growth %<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Strong revenue growth expected in-line with the industry; increasing contribution from value brands & low<br />

margin products could moderate margins<br />

Overall, we expect the company to report a strong 27% CAGR in net sales over the next three years in line with the<br />

strong industry growth rates and KKCL’s established position in branded apparels in India. However, increasing<br />

contribution from value and mass market brands like Integriti (which has ~2.8x MRP to prime cost ratio vs. ~3.0<br />

times for Lawman Pg3 and ~3.5 times for Killer brand) and lower margin products like trouser, shirts and T-shirts<br />

(due to lower scope for designing than in denim jeans) are expected to moderate the EBITDA margins by ~450 bps<br />

(from ~29.1% in FY11 to ~24.6% in FY14e). However, relatively low depreciation and interest costs, on account of<br />

asset light business model followed by the company, is expected to reduce the impact on net profit margins, which are<br />

expected to contract by ~340 bps (from 19.6% in FY11 to 16.2% in FY14e) over the next three years.<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

KKCL's Consolidated Revenue Growth<br />

21%<br />

176<br />

34% 33% 27% 22%<br />

236<br />

315<br />

400<br />

486<br />

40.0%<br />

30.0%<br />

20.0%<br />

10.0%<br />

0.0%<br />

150<br />

100<br />

50<br />

0<br />

KKCL's Trend in Profitability Margins<br />

30.0%<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%<br />

Operating Income (OI) Growth Rate (%)<br />

EBITDA<br />

EBITDA Margin (RHS)<br />

PAT<br />

PAT Margin (RHS)<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

16

FY10a<br />

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

FY10a<br />

FY11a<br />

FY12e<br />

FY13e<br />

FY14e<br />

Rs / Share<br />

Return indicator (%)<br />

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

Asset light business model of expansion through franchise and third party retailing route would ensure industry<br />

leading profitability indicators and strong capital structure going forward<br />

We expect the company to retain and strengthen its asset light model with optimal mix of own vs. outsourced<br />

production as well as own vs. franchise distribution that reduces overhead costs while maintaining product & service<br />

standards. The company currently has 1:8 ratio of company-owned: franchise owned K-Lounge stores and exclusive<br />

brand outlets (EBOs). Going forward, we expect the company to maintain similar ratio and add about 75 exclusive<br />

stores in each of the next three years at an estimated capex of Rs. 130 crore (Rs. 60 crore for infrastructure and Rs. 70<br />

crore for working capital management).<br />

Strong operating profitability and relatively moderate capital requirements are expected resulting in further<br />

improvement in RoCE (from ~36.6% to ~40.9%) and RoE (from ~24.8% to ~27.5%) during the next three years.<br />

Besides, healthy cash accruals are expected to increase the cash and bank balances from ~Rs 95 crore to ~Rs. 125<br />

crore during the same period. Overall, we expect a robust 19% CAGR growth in EPS from 37.5 Rs/share to 63.8<br />

Rs/share for the company over the FY11-FY14e period, aided by stable store expansion and healthy domestic demand<br />

for branded / fashion apparels.<br />

KKCL's EPS Growth<br />

KKCL's Return Indicators & Gearing<br />

70.0<br />

60.0<br />

50.0<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

0.0<br />

26<br />

38<br />

44<br />

54<br />

64<br />

140.0%<br />

120.0%<br />

100.0%<br />

80.0%<br />

60.0%<br />

40.0%<br />

20.0%<br />

0.0%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

0.10<br />

0.08<br />

0.06<br />

0.04<br />

0.02<br />

0.00<br />

EPS<br />

EPS Growth<br />

ROCE RoE Total Debt/(Equity + MI)<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

17

<strong>ICRA</strong> Equity Research Service<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong><br />

COMPANY PROFILE<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong> (KKCL) is a leading manufacturer and retailer of branded apparels and fashion-wear in<br />

India. KKCL has over two decades of experience in the domestic readymade garments industry with some leading<br />

brands like ‘Killer’, ‘Lawman Pg3’, ‘Integriti’, ‘Easies’ and ‘ADDICTIONS’.<br />

KKCL is an established player in the ‘Jeans’ segment through its flagship Killer brand, besides having a formidable<br />

presence in Trousers, Shirts, T-shirts & Jackets segments and an emerging presence in lifestyle accessories like shoes,<br />

belts, watches, bracelets, wallets, caps, bags, sunglasses and deodorants through the ADDICTIONS brand.<br />

KKCL markets its products through a chain of 223 ‘K-LOUNGE’ showrooms and exclusive brand outlets (EBOs) across<br />

the country. Besides, KKCL’s products are widely marketed at over 3,500 multi-brand outlets (MBOs) and national<br />

chain stores like Shoppers stop and Hypercity. KKCL’s designing, fabric washing, cutting, stitching and garment<br />

manufacturing facilities are mainly located at Dadar and Goregoan (Mumbai), Daman and Vapi in Western India.<br />

Exhibit 5: Company Factsheet<br />

Name of the Company<br />

<strong>Kewal</strong> <strong>Kiran</strong> <strong>Clothing</strong> <strong>Limited</strong> (KKCL)<br />

Year of Incorporation 1980<br />

Nature of Businesses<br />

Branded apparels manufacturing and retailing<br />

Products<br />

Jeans, Trousers, Shirts, T-shirts, Jackets and Lifestyle accessories<br />

Brands<br />

‘Killer’, ‘Lawman Pg3’, ‘Integriti’, ‘Easies’ and ‘ADDICTIONS’<br />

Company Stores<br />

125 K-Lounges, 48 Killer EBOs, 32 Integriti EBOs, 7 LawmanPg3-EBOs, 4 Addiction-EBO, 7 Factoy Outlet<br />

Distribution Network<br />

Over 3,500 Multi-brand outlets (MBOs) and National Chain stores (like Shoppers stop and Hypercity)<br />

Exports<br />

Middle East, Sri Lanka, Nepal and other countries<br />

Vendors<br />

Fabric manufacturers like Arvind Mills, Raymond, KG Denim, etc<br />

Manufacturing Capacity<br />

3.5 Million pieces per annum (could be stretched further depending on product mix)<br />

Manufacturing Locations Washing, cutting, stitching and garmenting facilities at Dadar and Goregaon (Mumbai), Daman and Vapi<br />

Board of Directors<br />

Mr. <strong>Kewal</strong>chand P. Jain<br />

Mr. Hemant P. Jain<br />

Mr. Dinesh P. Jain<br />

Mr. Vikas P. Jain<br />

Mr. Popatlal F. Sundesha<br />

Mr. Mrudul D. Inamdar<br />

Dr. Prakash A.Mody<br />

Mr. Nimish G. Pandya<br />

- Chairman & Managing Director<br />

- Executive Director<br />

- Executive Director<br />

- Executive Director<br />

- Independent Director<br />

- Independent Director<br />

- Independent Director<br />

- Independent Director<br />

Key Joint Ventures<br />

33% stake in White Knitwear Private Ltd in Surat SEZ<br />

Bankers<br />

Standard Chartered Bank<br />

Auditors<br />

M/s. Jain & Trivedi, M/s. N.A. Shah Associates<br />

IPO Details<br />

Rs. 80.6 crore raised in 2006, Issue of 31 lac shares at Rs. 260 per share, shares are listed on BSE and NSE<br />

Registered & Corporate Office <strong>Kewal</strong> <strong>Kiran</strong> Estate, Behind Tirupati Udyog, 460/7, I.B. Patel Road, Goregaon (East), Mumbai - 400 063<br />

Windmill<br />