CONSOLIDATED FINANCIAL STATEMENTS - Boston Scientific

CONSOLIDATED FINANCIAL STATEMENTS - Boston Scientific

CONSOLIDATED FINANCIAL STATEMENTS - Boston Scientific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES to the consolidated financial statements<br />

Research and Development<br />

Research and development costs, including new product development<br />

programs, regulatory compliance and clinical research, are<br />

expensed as incurred.<br />

Pension Plans<br />

The Company maintains pension plans covering certain international<br />

employees, which the Company accounts for in accordance with<br />

FASB Statement No. 87, Employers’ Accounting for Pensions. The<br />

assets, liabilities and costs associated with these plans were not<br />

material in 2004, 2003 and 2002.<br />

Net Income Per Common Share<br />

Net income per common share is based upon the weighted average<br />

number of common shares and common share equivalents outstanding<br />

each year.<br />

New Accounting Standards<br />

On December 16, 2004, the FASB issued Statement No.123(R),<br />

Share-Based Payment, which is a revision of Statement No.123,<br />

Accounting for Stock-Based Compensation. Statement No.123(R)<br />

supersedes APB Opinion No. 25, Accounting for Stock Issued to<br />

Employees and amends Statement No. 95, Statement of Cash<br />

Flows. In general, Statement No.123(R) contains similar accounting<br />

concepts as those described in Statement No.123. However,<br />

Statement No.123(R) requires all share-based payments to employees,<br />

including grants of employee stock options, to be recognized in the<br />

income statement based on their fair values. Pro forma disclosure is<br />

no longer an alternative. The Company expects to adopt Statement<br />

No.123(R) when it becomes effective on July 1, 2005.<br />

Statement No.123(R) permits public companies to adopt the new<br />

requirements using one of two methods:<br />

1. A “modified prospective” method in that compensation cost is<br />

recognized beginning with the effective date (a) based on the<br />

requirements of Statement No.123(R) for all share-based payments<br />

granted after the effective date of Statement No. 123(R)<br />

and (b) based on the requirements of Statement No. 123 for all<br />

awards granted to employees before July 1, 2005 that remain<br />

unvested as of July 1, 2005.<br />

2. A “modified retrospective” method that includes the requirements<br />

of the modified prospective method described above, but<br />

also permits entities to restate based on the amounts previously<br />

recognized under Statement No.123 for purposes of pro forma<br />

disclosures either (a) for all prior periods presented or (b) for prior<br />

interim periods of the year of adoption.<br />

The Company is currently evaluating which method it will use to adopt<br />

the requirements of Statement No.123(R).<br />

BOSTON SCIENTIFIC AND SUBSIDIARIES<br />

30<br />

As permitted by Statement No.123, the Company is currently<br />

accounting for share-based payments to employees using Opinion<br />

No. 25’s intrinsic value method and, as such, generally recognizes no<br />

compensation cost for employee stock options, except as disclosed<br />

in Note M. Accordingly, the adoption of Statement No.123(R)’s fair<br />

value method will impact the Company’s statements of operations.<br />

The impact of adoption of Statement No.123(R) cannot be quantified<br />

at this time because it will depend on the level of share-based<br />

payments granted in the future and the method used to value such<br />

awards. However, had the Company adopted Statement No.123(R)<br />

in prior periods, the impact of that standard would have approximated<br />

the impact of Statement No.123 and net income and net income per<br />

share would have been reported as the following pro forma amounts:<br />

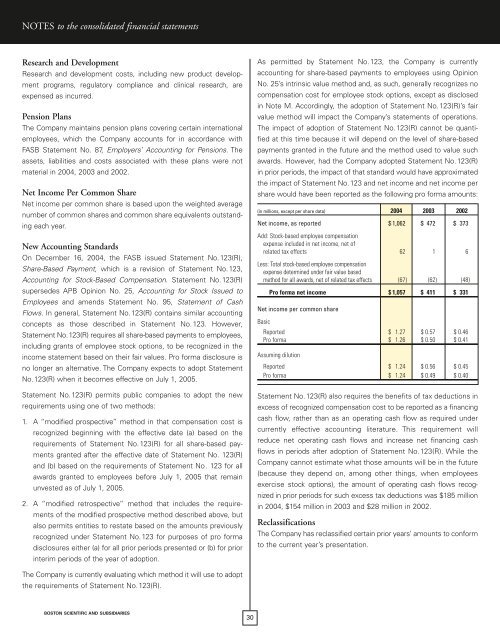

(in millions, except per share data) 2004 2003 2002<br />

Net income, as reported<br />

Add: Stock-based employee compensation<br />

expense included in net income, net of<br />

$ 1,062 $ 472 $ 373<br />

related tax effects<br />

Less: Total stock-based employee compensation<br />

expense determined under fair value based<br />

62 1 6<br />

method for all awards, net of related tax effects (67) (62) (48)<br />

Pro forma net income $ 1,057 $ 411 $ 331<br />

Net income per common share<br />

Basic<br />

Reported $ 1.27 $ 0.57 $ 0.46<br />

Pro forma $ 1.26 $ 0.50 $ 0.41<br />

Assuming dilution<br />

Reported $ 1.24 $ 0.56 $ 0.45<br />

Pro forma $ 1.24 $ 0.49 $ 0.40<br />

Statement No.123(R) also requires the benefits of tax deductions in<br />

excess of recognized compensation cost to be reported as a financing<br />

cash flow, rather than as an operating cash flow as required under<br />

currently effective accounting literature. This requirement will<br />

reduce net operating cash flows and increase net financing cash<br />

flows in periods after adoption of Statement No.123(R). While the<br />

Company cannot estimate what those amounts will be in the future<br />

(because they depend on, among other things, when employees<br />

exercise stock options), the amount of operating cash flows recognized<br />

in prior periods for such excess tax deductions was $185 million<br />

in 2004, $154 million in 2003 and $28 million in 2002.<br />

Reclassifications<br />

The Company has reclassified certain prior years’ amounts to conform<br />

to the current year’s presentation.