Reaching and empowering women - Genfinance

Reaching and empowering women - Genfinance

Reaching and empowering women - Genfinance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

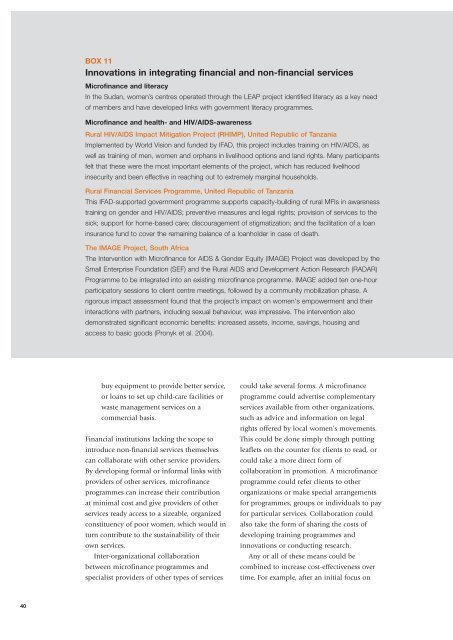

BOX 11<br />

Innovations in integrating financial <strong>and</strong> non-financial services<br />

Microfinance <strong>and</strong> literacy<br />

In the Sudan, <strong>women</strong>’s centres operated through the LEAP project identified literacy as a key need<br />

of members <strong>and</strong> have developed links with government literacy programmes.<br />

Microfinance <strong>and</strong> health- <strong>and</strong> HIV/AIDS-awareness<br />

Rural HIV/AIDS Impact Mitigation Project (RHIMP), United Republic of Tanzania<br />

Implemented by World Vision <strong>and</strong> funded by IFAD, this project includes training on HIV/AIDS, as<br />

well as training of men, <strong>women</strong> <strong>and</strong> orphans in livelihood options <strong>and</strong> l<strong>and</strong> rights. Many participants<br />

felt that these were the most important elements of the project, which has reduced livelihood<br />

insecurity <strong>and</strong> been effective in reaching out to extremely marginal households.<br />

Rural Financial Services Programme, United Republic of Tanzania<br />

This IFAD-supported government programme supports capacity-building of rural MFIs in awareness<br />

training on gender <strong>and</strong> HIV/AIDS; preventive measures <strong>and</strong> legal rights; provision of services to the<br />

sick; support for home-based care; discouragement of stigmatization; <strong>and</strong> the facilitation of a loan<br />

insurance fund to cover the remaining balance of a loanholder in case of death.<br />

The IMAGE Project, South Africa<br />

The Intervention with Microfinance for AIDS & Gender Equity (IMAGE) Project was developed by the<br />

Small Enterprise Foundation (SEF) <strong>and</strong> the Rural AIDS <strong>and</strong> Development Action Research (RADAR)<br />

Programme to be integrated into an existing microfinance programme. IMAGE added ten one-hour<br />

participatory sessions to client centre meetings, followed by a community mobilization phase. A<br />

rigorous impact assessment found that the project’s impact on <strong>women</strong>'s empowerment <strong>and</strong> their<br />

interactions with partners, including sexual behaviour, was impressive. The intervention also<br />

demonstrated significant economic benefits: increased assets, income, savings, housing <strong>and</strong><br />

access to basic goods (Pronyk et al. 2004).<br />

buy equipment to provide better service,<br />

or loans to set up child-care facilities or<br />

waste management services on a<br />

commercial basis.<br />

Financial institutions lacking the scope to<br />

introduce non-financial services themselves<br />

can collaborate with other service providers.<br />

By developing formal or informal links with<br />

providers of other services, microfinance<br />

programmes can increase their contribution<br />

at minimal cost <strong>and</strong> give providers of other<br />

services ready access to a sizeable, organized<br />

constituency of poor <strong>women</strong>, which would in<br />

turn contribute to the sustainability of their<br />

own services.<br />

Inter-organizational collaboration<br />

between microfinance programmes <strong>and</strong><br />

specialist providers of other types of services<br />

could take several forms. A microfinance<br />

programme could advertise complementary<br />

services available from other organizations,<br />

such as advice <strong>and</strong> information on legal<br />

rights offered by local <strong>women</strong>’s movements.<br />

This could be done simply through putting<br />

leaflets on the counter for clients to read, or<br />

could take a more direct form of<br />

collaboration in promotion. A microfinance<br />

programme could refer clients to other<br />

organizations or make special arrangements<br />

for programmes, groups or individuals to pay<br />

for particular services. Collaboration could<br />

also take the form of sharing the costs of<br />

developing training programmes <strong>and</strong><br />

innovations or conducting research.<br />

Any or all of these means could be<br />

combined to increase cost-effectiveness over<br />

time. For example, after an initial focus on<br />

40