Draft Prospectus - India Infoline Finance Limited

Draft Prospectus - India Infoline Finance Limited

Draft Prospectus - India Infoline Finance Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>India</strong> <strong>Infoline</strong> Investment Services <strong>Limited</strong><br />

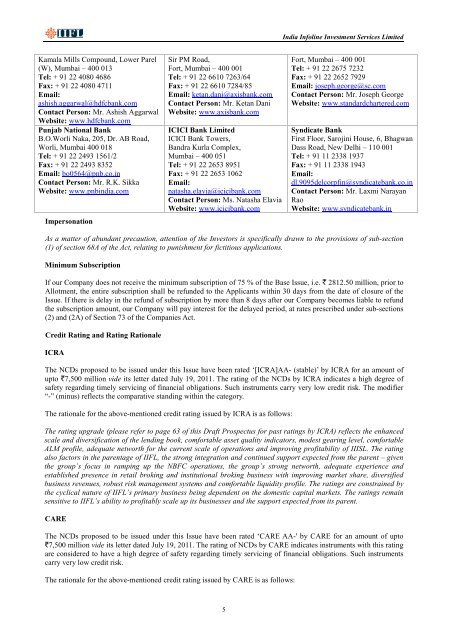

Kamala Mills Compound, Lower Parel<br />

(W), Mumbai – 400 013<br />

Tel: + 91 22 4080 4686<br />

Fax: + 91 22 4080 4711<br />

Email:<br />

ashish.aggarwal@hdfcbank.com<br />

Contact Person: Mr. Ashish Aggarwal<br />

Website: www.hdfcbank.com<br />

Punjab National Bank<br />

B.O.Worli Naka, 205, Dr. AB Road,<br />

Worli, Mumbai 400 018<br />

Tel: + 91 22 2493 1561/2<br />

Fax: + 91 22 2493 8352<br />

Email: bo0564@pnb.co.in<br />

Contact Person: Mr. R.K. Sikka<br />

Website: www.pnbindia.com<br />

Impersonation<br />

Sir PM Road,<br />

Fort, Mumbai – 400 001<br />

Tel: + 91 22 6610 7263/64<br />

Fax: + 91 22 6610 7284/85<br />

Email: ketan.dani@axisbank.com<br />

Contact Person: Mr. Ketan Dani<br />

Website: www.axisbank.com<br />

ICICI Bank <strong>Limited</strong><br />

ICICI Bank Towers,<br />

Bandra Kurla Complex,<br />

Mumbai – 400 051<br />

Tel: + 91 22 2653 8951<br />

Fax: + 91 22 2653 1062<br />

Email:<br />

natasha.elavia@icicibank.com<br />

Contact Person: Ms. Natasha Elavia<br />

Website: www.icicibank.com<br />

Fort, Mumbai – 400 001<br />

Tel: + 91 22 2675 7232<br />

Fax: + 91 22 2652 7929<br />

Email: joseph.george@sc.com<br />

Contact Person: Mr. Joseph George<br />

Website: www.standardchartered.com<br />

Syndicate Bank<br />

First Floor, Sarojini House, 6, Bhagwan<br />

Dass Road, New Delhi – 110 001<br />

Tel: + 91 11 2338 1937<br />

Fax: + 91 11 2338 1943<br />

Email:<br />

dl.9095delcorpfin@syndicatebank.co.in<br />

Contact Person: Mr. Laxmi Narayan<br />

Rao<br />

Website: www.syndicatebank.in<br />

As a matter of abundant precaution, attention of the Investors is specifically drawn to the provisions of sub-section<br />

(1) of section 68A of the Act, relating to punishment for fictitious applications.<br />

Minimum Subscription<br />

If our Company does not receive the minimum subscription of 75 % of the Base Issue, i.e. ` 2812.50 million, prior to<br />

Allotment, the entire subscription shall be refunded to the Applicants within 30 days from the date of closure of the<br />

Issue. If there is delay in the refund of subscription by more than 8 days after our Company becomes liable to refund<br />

the subscription amount, our Company will pay interest for the delayed period, at rates prescribed under sub-sections<br />

(2) and (2A) of Section 73 of the Companies Act.<br />

Credit Rating and Rating Rationale<br />

ICRA<br />

The NCDs proposed to be issued under this Issue have been rated ‘[ICRA]AA- (stable)’ by ICRA for an amount of<br />

upto `7,500 million vide its letter dated July 19, 2011. The rating of the NCDs by ICRA indicates a high degree of<br />

safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk. The modifier<br />

“-” (minus) reflects the comparative standing within the category.<br />

The rationale for the above-mentioned credit rating issued by ICRA is as follows:<br />

The rating upgrade (please refer to page 63 of this <strong>Draft</strong> <strong>Prospectus</strong> for past ratings by ICRA) reflects the enhanced<br />

scale and diversification of the lending book, comfortable asset quality indicators, modest gearing level, comfortable<br />

ALM profile, adequate networth for the current scale of operations and improving profitability of IIISL. The rating<br />

also factors in the parentage of IIFL, the strong integration and continued support expected from the parent – given<br />

the group’s focus in ramping up the NBFC operations, the group’s strong networth, adequate experience and<br />

established presence in retail broking and institutional broking business with improving market share, diversified<br />

business revenues, robust risk management systems and comfortable liquidity profile. The ratings are constrained by<br />

the cyclical nature of IIFL’s primary business being dependent on the domestic capital markets. The ratings remain<br />

sensitive to IIFL’s ability to profitably scale up its businesses and the support expected from its parent.<br />

CARE<br />

The NCDs proposed to be issued under this Issue have been rated ‘CARE AA-' by CARE for an amount of upto<br />

`7,500 million vide its letter dated July 19, 2011. The rating of NCDs by CARE indicates instruments with this rating<br />

are considered to have a high degree of safety regarding timely servicing of financial obligations. Such instruments<br />

carry very low credit risk.<br />

The rationale for the above-mentioned credit rating issued by CARE is as follows:<br />

5