Separate Financial Statements 2007 - Indesit

Separate Financial Statements 2007 - Indesit

Separate Financial Statements 2007 - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Separate</strong> <strong>Financial</strong> <strong>Statements</strong> as of 31 December <strong>2007</strong><br />

Percentages (margins and changes) are determined with reference to amounts stated in<br />

thousands of euro. <strong>Indesit</strong> Company S.p.A. is referred to by its full name or simply as the<br />

Company, while the Group reporting to it is referred to as <strong>Indesit</strong> Company or simply the<br />

Group. When the commentary relates to subsidiaries, their names and legal form are stated in<br />

full.<br />

Summary of results<br />

<strong>Indesit</strong> Company S.p.A. plays a dual role as an operating company that supplies goods and<br />

services to its local market (Italy) and other Group companies, and as an investment holding<br />

company. Accordingly, the results of the Company do not reflect the economic performance of<br />

the Group as a whole, or the performance of the market (Italy) in which it operates.<br />

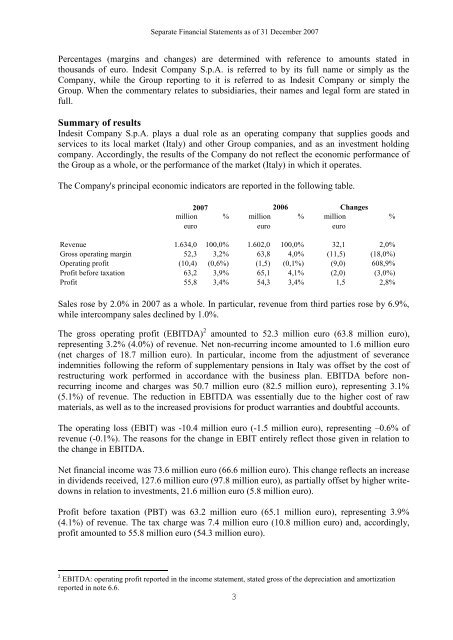

The Company's principal economic indicators are reported in the following table.<br />

<strong>2007</strong> 2006 Changes<br />

million<br />

euro<br />

% million<br />

euro<br />

% million<br />

euro<br />

%<br />

Revenue 1.634,0 100,0% 1.602,0 100,0% 32,1 2,0%<br />

Gross operating margin 52,3 3,2% 63,8 4,0% (11,5) (18,0%)<br />

Operating profit (10,4) (0,6%) (1,5) (0,1%) (9,0) 608,9%<br />

Profit before taxation 63,2 3,9% 65,1 4,1% (2,0) (3,0%)<br />

Profit 55,8 3,4% 54,3 3,4% 1,5 2,8%<br />

Sales rose by 2.0% in <strong>2007</strong> as a whole. In particular, revenue from third parties rose by 6.9%,<br />

while intercompany sales declined by 1.0%.<br />

The gross operating profit (EBITDA) 2 amounted to 52.3 million euro (63.8 million euro),<br />

representing 3.2% (4.0%) of revenue. Net non-recurring income amounted to 1.6 million euro<br />

(net charges of 18.7 million euro). In particular, income from the adjustment of severance<br />

indemnities following the reform of supplementary pensions in Italy was offset by the cost of<br />

restructuring work performed in accordance with the business plan. EBITDA before nonrecurring<br />

income and charges was 50.7 million euro (82.5 million euro), representing 3.1%<br />

(5.1%) of revenue. The reduction in EBITDA was essentially due to the higher cost of raw<br />

materials, as well as to the increased provisions for product warranties and doubtful accounts.<br />

The operating loss (EBIT) was -10.4 million euro (-1.5 million euro), representing –0.6% of<br />

revenue (-0.1%). The reasons for the change in EBIT entirely reflect those given in relation to<br />

the change in EBITDA.<br />

Net financial income was 73.6 million euro (66.6 million euro). This change reflects an increase<br />

in dividends received, 127.6 million euro (97.8 million euro), as partially offset by higher writedowns<br />

in relation to investments, 21.6 million euro (5.8 million euro).<br />

Profit before taxation (PBT) was 63.2 million euro (65.1 million euro), representing 3.9%<br />

(4.1%) of revenue. The tax charge was 7.4 million euro (10.8 million euro) and, accordingly,<br />

profit amounted to 55.8 million euro (54.3 million euro).<br />

2 EBITDA: operating profit reported in the income statement, stated gross of the depreciation and amortization<br />

reported in note 6.6.<br />

3