Separate Financial Statements 2007 - Indesit

Separate Financial Statements 2007 - Indesit

Separate Financial Statements 2007 - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Separate</strong> <strong>Financial</strong> <strong>Statements</strong> as of 31 December <strong>2007</strong><br />

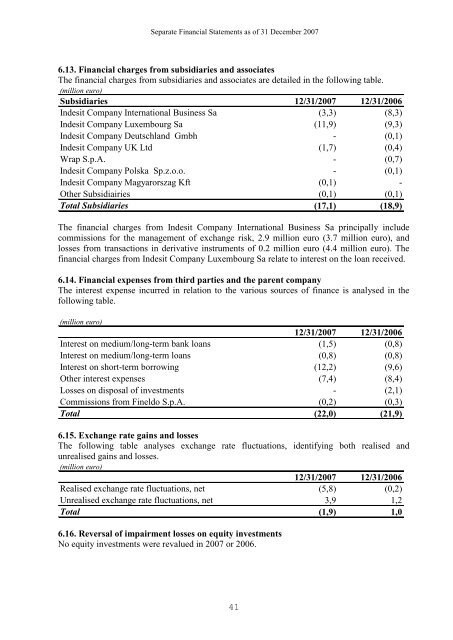

6.13. <strong>Financial</strong> charges from subsidiaries and associates<br />

The financial charges from subsidiaries and associates are detailed in the following table.<br />

(million euro)<br />

Subsidiaries 12/31/<strong>2007</strong> 12/31/2006<br />

<strong>Indesit</strong> Company International Business Sa (3,3) (8,3)<br />

<strong>Indesit</strong> Company Luxembourg Sa (11,9) (9,3)<br />

<strong>Indesit</strong> Company Deutschland Gmbh - (0,1)<br />

<strong>Indesit</strong> Company UK Ltd (1,7) (0,4)<br />

Wrap S.p.A. - (0,7)<br />

<strong>Indesit</strong> Company Polska Sp.z.o.o. - (0,1)<br />

<strong>Indesit</strong> Company Magyarorszag Kft (0,1) -<br />

Other Subsidiairies (0,1) (0,1)<br />

Total Subsidiaries (17,1) (18,9)<br />

The financial charges from <strong>Indesit</strong> Company International Business Sa principally include<br />

commissions for the management of exchange risk, 2.9 million euro (3.7 million euro), and<br />

losses from transactions in derivative instruments of 0.2 million euro (4.4 million euro). The<br />

financial charges from <strong>Indesit</strong> Company Luxembourg Sa relate to interest on the loan received.<br />

6.14. <strong>Financial</strong> expenses from third parties and the parent company<br />

The interest expense incurred in relation to the various sources of finance is analysed in the<br />

following table.<br />

(million euro)<br />

12/31/<strong>2007</strong> 12/31/2006<br />

Interest on medium/long-term bank loans (1,5) (0,8)<br />

Interest on medium/long-term loans (0,8) (0,8)<br />

Interest on short-term borrowing (12,2) (9,6)<br />

Other interest expenses (7,4) (8,4)<br />

Losses on disposal of investments - (2,1)<br />

Commissions from Fineldo S.p.A. (0,2) (0,3)<br />

Total (22,0) (21,9)<br />

6.15. Exchange rate gains and losses<br />

The following table analyses exchange rate fluctuations, identifying both realised and<br />

unrealised gains and losses.<br />

(million euro)<br />

12/31/<strong>2007</strong> 12/31/2006<br />

Realised exchange rate fluctuations, net (5,8) (0,2)<br />

Unrealised exchange rate fluctuations, net 3,9 1,2<br />

Total (1,9) 1,0<br />

6.16. Reversal of impairment losses on equity investments<br />

No equity investments were revalued in <strong>2007</strong> or 2006.<br />

41