Applied Public Economics - IZA

Applied Public Economics - IZA

Applied Public Economics - IZA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

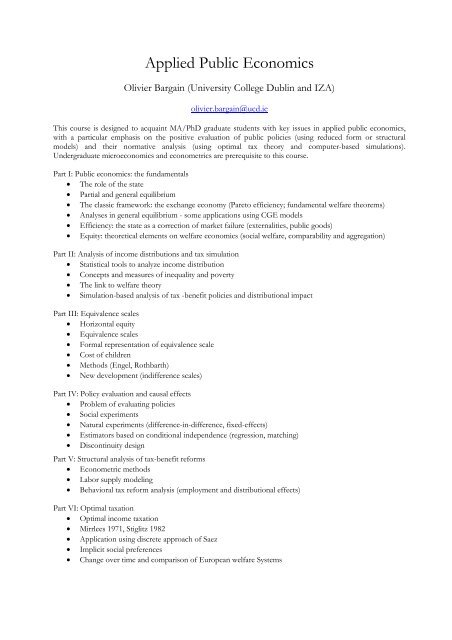

<strong>Applied</strong> <strong>Public</strong> <strong>Economics</strong><br />

Olivier Bargain (University College Dublin and <strong>IZA</strong>)<br />

olivier.bargain@ucd.ie<br />

This course is designed to acquaint MA/PhD graduate students with key issues in applied public economics,<br />

with a particular emphasis on the positive evaluation of public policies (using reduced form or structural<br />

models) and their normative analysis (using optimal tax theory and computer-based simulations).<br />

Undergraduate microeconomics and econometrics are prerequisite to this course.<br />

Part I: <strong>Public</strong> economics: the fundamentals<br />

• The role of the state<br />

• Partial and general equilibrium<br />

• The classic framework: the exchange economy (Pareto efficiency; fundamental welfare theorems)<br />

• Analyses in general equilibrium - some applications using CGE models<br />

• Efficiency: the state as a correction of market failure (externalities, public goods)<br />

• Equity: theoretical elements on welfare economics (social welfare, comparability and aggregation)<br />

Part II: Analysis of income distributions and tax simulation<br />

• Statistical tools to analyze income distribution<br />

• Concepts and measures of inequality and poverty<br />

• The link to welfare theory<br />

• Simulation-based analysis of tax -benefit policies and distributional impact<br />

Part III: Equivalence scales<br />

• Horizontal equity<br />

• Equivalence scales<br />

• Formal representation of equivalence scale<br />

• Cost of children<br />

• Methods (Engel, Rothbarth)<br />

• New development (indifference scales)<br />

Part IV: Policy evaluation and causal effects<br />

• Problem of evaluating policies<br />

• Social experiments<br />

• Natural experiments (difference-in-difference, fixed-effects)<br />

• Estimators based on conditional independence (regression, matching)<br />

• Discontinuity design<br />

Part V: Structural analysis of tax-benefit reforms<br />

• Econometric methods<br />

• Labor supply modeling<br />

• Behavioral tax reform analysis (employment and distributional effects)<br />

Part VI: Optimal taxation<br />

• Optimal income taxation<br />

• Mirrlees 1971, Stiglitz 1982<br />

• Application using discrete approach of Saez<br />

• Implicit social preferences<br />

• Change over time and comparison of European welfare Systems

General references<br />

• Auerbach, A and MS Feldstein Handbook of <strong>Public</strong> <strong>Economics</strong>, Amsterdam: North-Holland (volume 1, 1986;<br />

volume 2, 1987; volumes 3 & 4, 2002).<br />

• Blundell, R. , and T. MaCurdy, “Labor Supply: A Review of Alternative Approaches.” In Handbook of Labour<br />

<strong>Economics</strong>, eds. Orley Ashenfelter, and David Card, Volume 3: 1559-1695. Amsterdam: Elsevier Science,<br />

1999<br />

• Blundell R. and M. Costa Dias : “Alternative Approaches to Evaluation in Empirical Microeconomics”,<br />

forthcoming in the Journal of Human Resources; also as <strong>IZA</strong> discussion paper 3800.<br />

• Myles, G.: <strong>Public</strong> <strong>Economics</strong>, Cambridge University Press, 1995<br />

• Lambert, P. The Distribution and Redistribution of Income: A Mathematical Analysis. (Manchester: Manchester<br />

University Press, 2002)<br />

• Salanié, B., The <strong>Economics</strong> of Taxation, MIT Press, London, 2003.