Pioneering Solution â Collateral Management - Clearstream

Pioneering Solution â Collateral Management - Clearstream

Pioneering Solution â Collateral Management - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

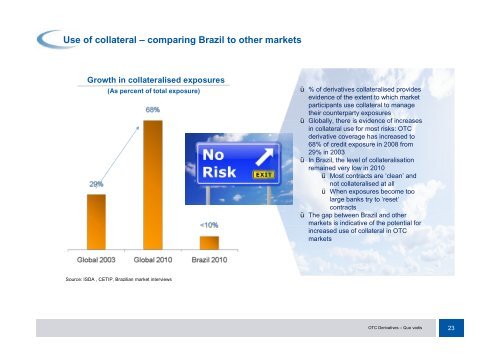

Use of collateral – comparing Brazil to other markets<br />

Growth in collateralised exposures<br />

(As percent of total exposure)<br />

Source: ISDA , CETIP, Brazilian market interviews<br />

% of derivatives collateralised provides<br />

evidence of the extent to which market<br />

participants use collateral to manage<br />

their counterparty exposures<br />

Globally, there is evidence of increases<br />

in collateral use for most risks: OTC<br />

derivative coverage has increased to<br />

68% of credit exposure in 2008 from<br />

29% in 2003<br />

In Brazil, the level of collateralisation<br />

remained very low in 2010<br />

Most contracts are ‘clean’ and<br />

not collateralised at all<br />

When exposures become too<br />

large banks try to ‘reset’<br />

contracts<br />

The gap between Brazil and other<br />

markets is indicative of the potential for<br />

increased use of collateral in OTC<br />

markets<br />

OTC Derivatives – Quo vadis<br />

23