2006 - TCL Communication Technology Holdings Limited

2006 - TCL Communication Technology Holdings Limited

2006 - TCL Communication Technology Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>TCL</strong> COMMUNICATION TECHNOLOGY HOLDINGS LIMITED<br />

Notes to Financial Statements<br />

31 December <strong>2006</strong><br />

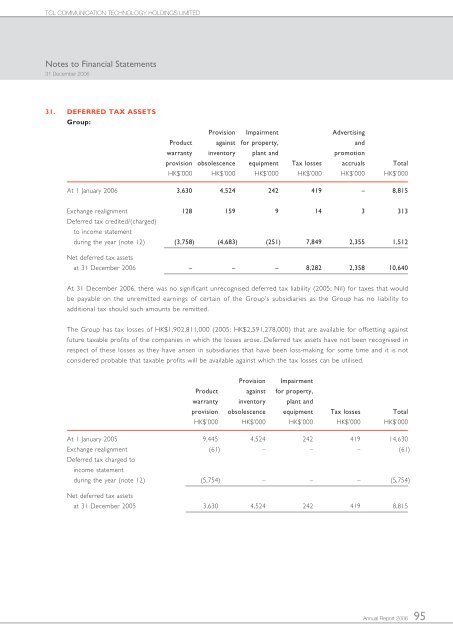

31. DEFERRED TAX ASSETS<br />

Group:<br />

Provision Impairment Advertising<br />

Product against for property, and<br />

warranty inventory plant and promotion<br />

provision obsolescence equipment Tax losses accruals Total<br />

HK$’000 HK$’000 HK$’000 HK$’000 HK$’000 HK$’000<br />

At 1 January <strong>2006</strong> 3,630 4,524 242 419 – 8,815<br />

Exchange realignment 128 159 9 14 3 313<br />

Deferred tax credited/(charged)<br />

to income statement<br />

during the year (note 12) (3,758) (4,683) (251) 7,849 2,355 1,512<br />

Net deferred tax assets<br />

at 31 December <strong>2006</strong> – – – 8,282 2,358 10,640<br />

At 31 December <strong>2006</strong>, there was no significant unrecognised deferred tax liability (2005: Nil) for taxes that would<br />

be payable on the unremitted earnings of certain of the Group’s subsidiaries as the Group has no liability to<br />

additional tax should such amounts be remitted.<br />

The Group has tax losses of HK$1,902,811,000 (2005: HK$2,591,278,000) that are available for offsetting against<br />

future taxable profits of the companies in which the losses arose. Deferred tax assets have not been recognised in<br />

respect of these losses as they have arisen in subsidiaries that have been loss-making for some time and it is not<br />

considered probable that taxable profits will be available against which the tax losses can be utilised.<br />

Provision Impairment<br />

Product against for property,<br />

warranty inventory plant and<br />

provision obsolescence equipment Tax losses Total<br />

HK$’000 HK$’000 HK$’000 HK$’000 HK$’000<br />

At 1 January 2005 9,445 4,524 242 419 14,630<br />

Exchange realignment (61) – – – (61)<br />

Deferred tax charged to<br />

income statement<br />

during the year (note 12) (5,754) – – – (5,754)<br />

Net deferred tax assets<br />

at 31 December 2005 3,630 4,524 242 419 8,815<br />

Annual Report <strong>2006</strong><br />

95