Cosalt Marine We provide inspection and maintenance services for ...

Cosalt Marine We provide inspection and maintenance services for ...

Cosalt Marine We provide inspection and maintenance services for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Governance<br />

Directors’ report<br />

continued<br />

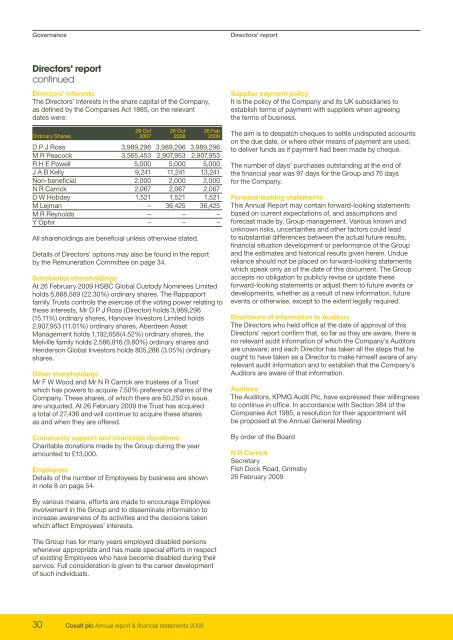

Directors’ interests<br />

The Directors’ interests in the share capital of the Company,<br />

as defined by the Companies Act 1985, on the relevant<br />

dates were:<br />

28 Oct 26 Oct 26 Feb<br />

Ordinary Shares 2007 2008 2009<br />

D P J Ross 3,989,296 3,989,296 3,989,296<br />

M R Peacock 3,565,453 2,907,953 2,907,953<br />

R H E Powell 5,000 5,000 5,000<br />

J A B Kelly 9,241 11,241 13,241<br />

Non-beneficial 2,000 2,000 2,000<br />

N R Carrick 2,067 2,067 2,067<br />

D W Hobdey 1,521 1,521 1,521<br />

M Lejman – 36,425 36,425<br />

M R Reynolds – – –<br />

Y Ophir – – –<br />

All shareholdings are beneficial unless otherwise stated.<br />

Details of Directors’ options may also be found in the report<br />

by the Remuneration Committee on page 34.<br />

Substantial shareholdings<br />

At 26 February 2009 HSBC Global Custody Nominees Limited<br />

holds 5,888,569 (22.30%) ordinary shares. The Rappaport<br />

family Trusts controls the exercise of the voting power relating to<br />

these interests, Mr D P J Ross (Director) holds 3,989,296<br />

(15.11%) ordinary shares, Hanover Investors Limited holds<br />

2,907,953 (11.01%) ordinary shares, Aberdeen Asset<br />

Management holds 1,192,658(4.52%) ordinary shares, the<br />

Melville family holds 2,586,916 (9.80%) ordinary shares <strong>and</strong><br />

Henderson Global Investors holds 805,286 (3.05%) ordinary<br />

shares.<br />

Other shareholdings<br />

Mr F W Wood <strong>and</strong> Mr N R Carrick are trustees of a Trust<br />

which has powers to acquire 7.50% preference shares of the<br />

Company. These shares, of which there are 50,250 in issue,<br />

are unquoted. At 26 February 2009 the Trust has acquired<br />

a total of 27,436 <strong>and</strong> will continue to acquire these shares<br />

as <strong>and</strong> when they are offered.<br />

Community support <strong>and</strong> charitable donations<br />

Charitable donations made by the Group during the year<br />

amounted to £13,000.<br />

Employees<br />

Details of the number of Employees by business are shown<br />

in note 8 on page 54.<br />

By various means, ef<strong>for</strong>ts are made to encourage Employee<br />

involvement in the Group <strong>and</strong> to disseminate in<strong>for</strong>mation to<br />

increase awareness of its activities <strong>and</strong> the decisions taken<br />

which affect Employees’ interests.<br />

The Group has <strong>for</strong> many years employed disabled persons<br />

whenever appropriate <strong>and</strong> has made special ef<strong>for</strong>ts in respect<br />

of existing Employees who have become disabled during their<br />

service. Full consideration is given to the career development<br />

of such individuals.<br />

30 <strong>Cosalt</strong> plc Annual report & financial statements 2008<br />

Directors’ report<br />

Supplier payment policy<br />

It is the policy of the Company <strong>and</strong> its UK subsidiaries to<br />

establish terms of payment with suppliers when agreeing<br />

the terms of business.<br />

The aim is to despatch cheques to settle undisputed accounts<br />

on the due date, or where other means of payment are used,<br />

to deliver funds as if payment had been made by cheque.<br />

The number of days’ purchases outst<strong>and</strong>ing at the end of<br />

the financial year was 97 days <strong>for</strong> the Group <strong>and</strong> 75 days<br />

<strong>for</strong> the Company.<br />

Forward-looking statements<br />

This Annual Report may contain <strong>for</strong>ward-looking statements<br />

based on current expectations of, <strong>and</strong> assumptions <strong>and</strong><br />

<strong>for</strong>ecast made by, Group management. Various known <strong>and</strong><br />

unknown risks, uncertainties <strong>and</strong> other factors could lead<br />

to substantial differences between the actual future results,<br />

financial situation development or per<strong>for</strong>mance of the Group<br />

<strong>and</strong> the estimates <strong>and</strong> historical results given herein. Undue<br />

reliance should not be placed on <strong>for</strong>ward-looking statements<br />

which speak only as of the date of this document. The Group<br />

accepts no obligation to publicly revise or update these<br />

<strong>for</strong>ward-looking statements or adjust them to future events or<br />

developments, whether as a result of new in<strong>for</strong>mation, future<br />

events or otherwise, except to the extent legally required.<br />

Disclosure of in<strong>for</strong>mation to Auditors<br />

The Directors who held office at the date of approval of this<br />

Directors’ report confirm that, so far as they are aware, there is<br />

no relevant audit in<strong>for</strong>mation of which the Company’s Auditors<br />

are unaware; <strong>and</strong> each Director has taken all the steps that he<br />

ought to have taken as a Director to make himself aware of any<br />

relevant audit in<strong>for</strong>mation <strong>and</strong> to establish that the Company’s<br />

Auditors are aware of that in<strong>for</strong>mation.<br />

Auditors<br />

The Auditors, KPMG Audit Plc, have expressed their willingness<br />

to continue in office. In accordance with Section 384 of the<br />

Companies Act 1985, a resolution <strong>for</strong> their appointment will<br />

be proposed at the Annual General Meeting.<br />

By order of the Board<br />

N R Carrick<br />

Secretary<br />

Fish Dock Road, Grimsby<br />

26 February 2009