Cosalt Marine We provide inspection and maintenance services for ...

Cosalt Marine We provide inspection and maintenance services for ...

Cosalt Marine We provide inspection and maintenance services for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Notes to the Company financial statements<br />

continued<br />

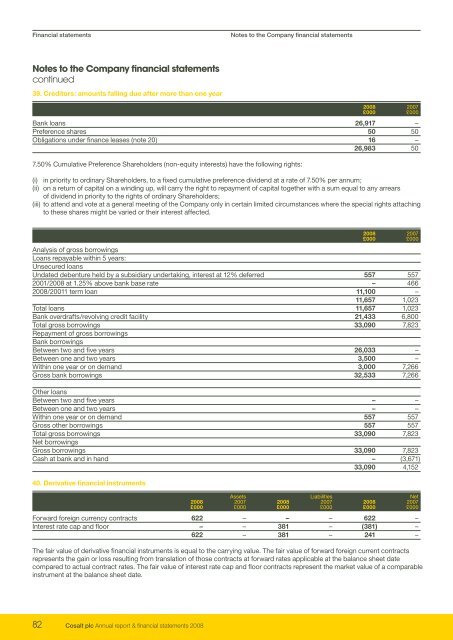

39. Creditors: amounts falling due after more than one year<br />

82 <strong>Cosalt</strong> plc Annual report & financial statements 2008<br />

Notes to the Company financial statements<br />

2008 2007<br />

£000 £000<br />

Bank loans 26,917 –<br />

Preference shares 50 50<br />

Obligations under finance leases (note 20) 16 –<br />

26,983 50<br />

7.50% Cumulative Preference Shareholders (non-equity interests) have the following rights:<br />

(i) in priority to ordinary Shareholders, to a fixed cumulative preference dividend at a rate of 7.50% per annum;<br />

(ii) on a return of capital on a winding up, will carry the right to repayment of capital together with a sum equal to any arrears<br />

of dividend in priority to the rights of ordinary Shareholders;<br />

(iii) to attend <strong>and</strong> vote at a general meeting of the Company only in certain limited circumstances where the special rights attaching<br />

to these shares might be varied or their interest affected.<br />

2008 2007<br />

£000 £000<br />

Analysis of gross borrowings<br />

Loans repayable within 5 years:<br />

Unsecured loans<br />

Undated debenture held by a subsidiary undertaking, interest at 12% deferred 557 557<br />

2001/2008 at 1.25% above bank base rate – 466<br />

2008/20011 term loan 11,100 –<br />

11,657 1,023<br />

Total loans 11,657 1,023<br />

Bank overdrafts/revolving credit facility 21,433 6,800<br />

Total gross borrowings<br />

Repayment of gross borrowings<br />

Bank borrowings<br />

33,090 7,823<br />

Between two <strong>and</strong> five years 26,033 –<br />

Between one <strong>and</strong> two years 3,500 –<br />

Within one year or on dem<strong>and</strong> 3,000 7,266<br />

Gross bank borrowings 32,533 7,266<br />

Other loans<br />

Between two <strong>and</strong> five years – –<br />

Between one <strong>and</strong> two years – –<br />

Within one year or on dem<strong>and</strong> 557 557<br />

Gross other borrowings 557 557<br />

Total gross borrowings 33,090 7,823<br />

Net borrowings<br />

Gross borrowings 33,090 7,823<br />

Cash at bank <strong>and</strong> in h<strong>and</strong> – (3,671)<br />

33,090 4,152<br />

40. Derivative financial instruments<br />

Assets Liabilities Net<br />

2008 2007 2008 2007 2008 2007<br />

£000 £000 £000 £000 £000 £000<br />

Forward <strong>for</strong>eign currency contracts 622 – – – 622 –<br />

Interest rate cap <strong>and</strong> floor – – 381 – (381) –<br />

622 – 381 – 241 –<br />

The fair value of derivative financial instruments is equal to the carrying value. The fair value of <strong>for</strong>ward <strong>for</strong>eign current contracts<br />

represents the gain or loss resulting from translation of those contracts at <strong>for</strong>ward rates applicable at the balance sheet date<br />

compared to actual contract rates. The fair value of interest rate cap <strong>and</strong> floor contracts represent the market value of a comparable<br />

instrument at the balance sheet date.