1995 - National Treasury

1995 - National Treasury

1995 - National Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

m<br />

-1.6-<br />

government consumption expenditure is expected<br />

to be contained - no change in real consumption<br />

expenditure by the general government has been<br />

built into the official projections.<br />

Real gross domestic fixed investment in <strong>1995</strong> is<br />

likely to repeat its strong showing of 1994.<br />

Capacity creation in private manufacturing should<br />

lead the way, but significant rises in real capital<br />

spending by public corporations could also make<br />

a noteworthy contribution. It is also foreseen that<br />

the long overdue reversal of the downward<br />

tendency in real fixed investment by the public<br />

authorities will gain momentum in <strong>1995</strong>. The<br />

replenishment of industrial and commercial<br />

inventories is expected to continue during <strong>1995</strong>.<br />

Were it not for the expected decline in agricultural<br />

output, the growth in real GDP in <strong>1995</strong> could have<br />

been as high as 3 per cent. The decline in agricultural<br />

real value added could, however, possibly<br />

constrain aggregate output growth to 2 1 /2 per cent<br />

in <strong>1995</strong>. Over fiscal <strong>1995</strong>/96 it is anticipated to be<br />

somewhat higher.<br />

The expected strong growth in gross domestic<br />

fixed investment is likely to support a high level of<br />

imported capital equipment. The current account<br />

of the balance of payments should consequently<br />

remain in deficit throughout <strong>1995</strong>. Capital inflows<br />

from the rest of the world are expected to be more<br />

than sufficient to finance the anticipated deficit,<br />

and could lead to a further increase in the level of<br />

the gold and foreign exchange reserves.<br />

The underlying counter-inflationary policies, which<br />

have been applied over the past number of years,<br />

are expected to be sustained in <strong>1995</strong>. Some<br />

short-term upward adjustments in the general<br />

price level will nevertheless probably keep the<br />

average inflation rate in consumer prices in <strong>1995</strong><br />

more or less at the average rate recorded in 1994.<br />

The upswing in the economy will require careful<br />

nurturing, sound and consistent economic policies<br />

and an investor-friendly political environment if it<br />

is to be transformed into a sustained growth<br />

phase. The Government recognises that if the<br />

challenges of reconstruction, development and<br />

economic growth are to be met, it is important that<br />

the economic recovery should be responsibly<br />

strengthened.<br />

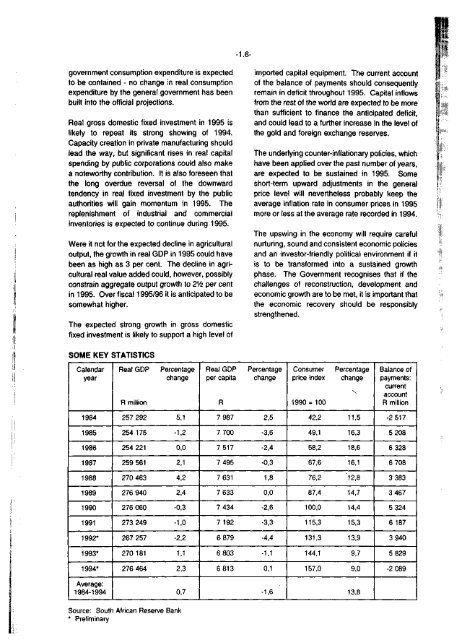

SOME KEY STATISTICS<br />

Calendar<br />

year<br />

Real GDP<br />

R million<br />

Percentage<br />

change<br />

Real GDP<br />

per capita<br />

R<br />

Percentage<br />

change<br />

Consumer<br />

price index<br />

1990 = 100<br />

Percentage<br />

change<br />

Balance of<br />

payments:<br />

current<br />

account<br />

R million<br />

1984 257 292 5,1 7 987 2,5 42,2 11,5 -2 517<br />

1985 254 175 -1,2 7 700 -3,6 49,1 16,3 5 208<br />

1986 254 221 0,0 7 517 -2,4 58,2 18,6 6 328<br />

1987 259 561 2,1 7 495 -0,3 67,6 16,1 6 708<br />

1988 270 463 4,2 7 631 1,8 76,2 12,8 3 383<br />

1989 276 940 2,4 7 633 0,0 87,4 14,7 3 467<br />

1990 276 060 -0,3 7 434 -2,6 100,0 14,4 5 324<br />

1991 273 249 -1,0 7 192 -3,3 115,3 15,3 6 187<br />

1992* 267 257 -2,2 6 879 -4,4 131,3 13,9 3 940<br />

1993* 270 181 1,1 6 803 -1,1 144,1 9,7 5 829<br />

1994* 276 464 2,3 6 813 0,1 157,0 9,0 -2 089<br />

Average:<br />

1984-1994 0,7 -1,6 13,8<br />

Source: South African Reserve Bank<br />

* Preliminary