1995 - National Treasury

1995 - National Treasury

1995 - National Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

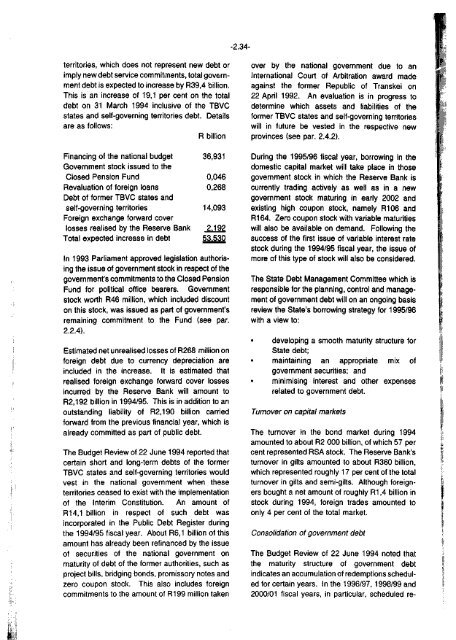

-2.34-<br />

territories, which does not represent new debt or<br />

imply new debt service commitments, total government<br />

debt is expected to increase by R39,4 billion.<br />

This is an increase of 19,1 per cent on the total<br />

debt on 31 March 1994 inclusive of the TBVC<br />

states and self-governing territories debt. Details<br />

are as follows:<br />

R billion<br />

Financing of the national budget 36,931<br />

Government stock issued to the<br />

Closed Pension Fund 0,046<br />

Revaluation of foreign loans 0,268<br />

Debt of former TBVC states and<br />

self-governing territories 14,093<br />

Foreign exchange forward cover<br />

losses realised by the Reserve Bank 2.192<br />

Total expected increase in debt 53.530<br />

In 1993 Parliament approved legislation authorising<br />

the issue of government stock in respect of the<br />

government's commitments to the Closed Pension<br />

Fund for political office bearers. Government<br />

stock worth R46 million, which included discount<br />

on this stock, was issued as part of government's<br />

remaining commitment to the Fund (see par.<br />

2.2.4).<br />

Estimated net unrealised losses of R268 million on<br />

foreign debt due to currency depreciation are<br />

included in the increase. It is estimated that<br />

realised foreign exchange forward cover losses<br />

incurred by the Reserve Bank will amount to<br />

R2.192 billion in 1994/95. This is in addition to an<br />

outstanding liability of R2.190 billion carried<br />

forward from the previous financial year, which is<br />

already committed as part of public debt.<br />

The Budget Review of 22 June 1994 reported that<br />

certain short and long-term debts of the former<br />

TBVC states and self-governing territories would<br />

vest in the national government when these<br />

territories ceased to exist with the implementation<br />

of the Interim Constitution. An amount of<br />

R14.1 billion in respect of such debt was<br />

incorporated in the Public Debt Register during<br />

the 1994/95 fiscal year. About R6,1 billion of this<br />

amount has already been refinanced by the issue<br />

of securities of the national government on<br />

maturity of debt of the former authorities, such as<br />

project bills, bridging bonds, promissory notes and<br />

zero coupon stock. This also includes foreign<br />

commitments to the amount of R199 million taken<br />

over by the national government due to an<br />

International Court of Arbitration award made<br />

against the former Republic of Transkei on<br />

22 April 1992. An evaluation is in progress to<br />

determine which assets and liabilities of the<br />

former TBVC states and self-governing territories<br />

will in future be vested in the respective new<br />

provinces (see par. 2.4.2).<br />

During the <strong>1995</strong>/96 fiscal year, borrowing in the<br />

domestic capital market will take place in those<br />

government stock in which the Reserve Bank is<br />

currently trading actively as well as in a new<br />

government stock maturing in early 2002 and<br />

existing high coupon stock, namely R106 and<br />

R164. Zero coupon stock with variable maturities<br />

will also be available on demand. Following the<br />

success of the first issue of variable interest rate<br />

stock during the 1994/95 fiscal year, the issue of<br />

more of this type of stock will also be considered.<br />

The State Debt Management Committee which is<br />

responsible for the planning, control and management<br />

of government debt will on an ongoing basis<br />

review the State's borrowing strategy for <strong>1995</strong>/96<br />

with a view to:<br />

• developing a smooth maturity structure for<br />

State debt;<br />

• maintaining an appropriate mix of<br />

government securities; and<br />

• minimising interest and other expenses<br />

related to government debt.<br />

Turnover on capital markets<br />

The turnover in the bond market during 1994<br />

amounted to about R2 000 billion, of which 57 per<br />

cent represented RSA stock. The Reserve Bank's<br />

turnover in gilts amounted to about R360 billion,<br />

which represented roughly 17 per cent of the total<br />

turnover in gilts and semi-gilts. Although foreigners<br />

bought a net amount of roughly R1,4 billion in<br />

stock during 1994, foreign trades amounted to<br />

only 4 per cent of the total market.<br />

Consolidation of government debt<br />

The Budget Review of 22 June 1994 noted that<br />

the maturity structure of government debt<br />

indicates an accumulation of redemptions scheduled<br />

for certain years. In the 1996/97, 1998/99 and<br />

2000/01 fiscal years, in particular, scheduled re-