Wire & Cable R i l St d egional Study - Integer Research

Wire & Cable R i l St d egional Study - Integer Research

Wire & Cable R i l St d egional Study - Integer Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

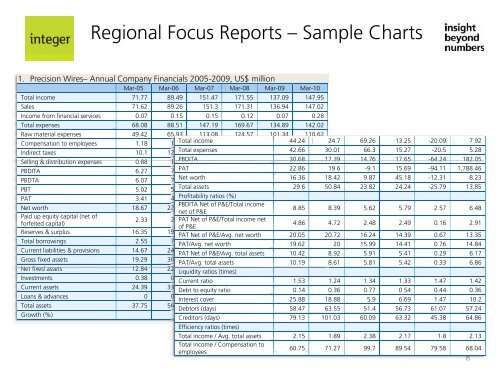

R<strong>egional</strong> Focus Reports – Sample Charts<br />

1. Precision <strong>Wire</strong>s– Annual Company Financials 2005-2009, US$ million<br />

Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10<br />

Total income 71.77 89.49 151.47 171.55 137.09 147.95<br />

Sales 71.62 89.26 151.3 171.31 136.94 147.02<br />

Income from financial services 0.07 0.15 0.15 0.12 0.07 0.28<br />

Total expenses 68.08 88.51 147.19 169.67 134.89 142.02<br />

Raw material expenses 49.42 65.93 113.08 124.57 101.34 110.62<br />

Compensation to employees 1.18 1.26<br />

Total income<br />

1.52 1.92 1.72<br />

44.24<br />

2.17<br />

24.7 69.26 13.25 -20.09 7.92<br />

Indirect taxes 10.1 12.71<br />

Total expenses<br />

21.88 28.72 19.98<br />

42.66<br />

14.11<br />

30.01 66.3 15.27 -20.5 5.28<br />

Selling &distribution ib ti expenses 088 0.88 105 1.05 PBDITA<br />

116 1.16 144 1.44 139 1.39 30.68 151 1.51<br />

17.39 14.76 17.65 -64.24 182.05<br />

PBDITA 6.27 7.36<br />

PAT<br />

8.45 9.94 3.55<br />

22.86<br />

10.02<br />

19.6 -9.1 15.69 -94.11 1,788.46<br />

PBDTA 6.07 7.02<br />

Net worth<br />

7.29 8.79 2.69<br />

16.36<br />

9.31<br />

18.42 9.87 45.18 -12.31 8.23<br />

PBT 5.02 5.95<br />

Total assets<br />

5.62 6.55 0.44<br />

29.6<br />

7.02<br />

50.84 23.82 24.24 -25.79 13.85<br />

PAT 3.41 4.08<br />

Profitability<br />

3.71<br />

ratios (%)<br />

4.29 0.25 4.77<br />

PBDITA Net of P&E/Total income<br />

Net worth 18.67 22.09 24.26 35.22 30.88 8.85 33.42 8.39 5.62 5.79 2.57 6.48<br />

net of P&E<br />

Pid Paid up equity capital (net of<br />

2.33 2.36 PAT Net of 2.31 P&E/Total income 2.87 net 2.52 2.44<br />

forfeited capital)<br />

4.86 4.72 2.48 2.49 0.16 2.91<br />

of P&E<br />

Reserves & surplus 16.35 19.72<br />

PAT Net of<br />

21.95<br />

P&E/Avg. net<br />

32.35<br />

worth<br />

28.36<br />

20.05<br />

30.98<br />

20.72 16.24 14.39 0.67 13.35<br />

Total borrowings 2.55 7.99<br />

PAT/Avg.<br />

18.68<br />

net worth<br />

18.98 13.67<br />

19.62<br />

11.91<br />

20 15.99 14.41 0.76 14.84<br />

Current liabilities & provisions 14.67 24.55<br />

PAT Net of<br />

24.59<br />

P&E/Avg. total<br />

29.55<br />

assets<br />

16.78<br />

10.42<br />

24.92<br />

8.92 5.91 5.41 0.29 6.17<br />

Gross fixed assets 19.29 30.21<br />

PAT/Avg.<br />

35.72<br />

total assets<br />

45.07 42.37<br />

10.19<br />

42.65<br />

8.61 5.81 5.42 0.33 6.86<br />

Net fixed assets 12.84 22.67 Liquidity ratios 26.7 (times)<br />

32.71 29.33 27.84<br />

Investments 0.38 0.49<br />

Current ratio<br />

1.37 0.04 0.03<br />

1.53 1.24 1.34 1.33 1.47 1.42<br />

Current assets 24.39 33.65<br />

Debt to equity<br />

41.39<br />

ratio<br />

54.76 35.42<br />

0.14<br />

46.08<br />

0.36 0.77 0.54 0.44 0.36<br />

Loans & advances 0 0.01<br />

Interest cover<br />

0.01 0 0<br />

25.88 18.88 5.9 6.69 1.47 10.2<br />

Total assets 37.75 56.94<br />

Debtors (days)<br />

70.5 87.59 65.01<br />

58.47<br />

74.01<br />

63.55 51.4 56.73 61.07 57.24<br />

Growth (%)<br />

Creditors (days) 79.13 101.03 60.09 63.32 45.38 64.86<br />

Efficiency ratios (times)<br />

Total income / Avg. total assets 2.15 1.89 2.38 2.17 1.8 2.13<br />

Total income / Compensation to<br />

employees<br />

60.75 71.27 99.7 89.54 79.58 68.04<br />

8