OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

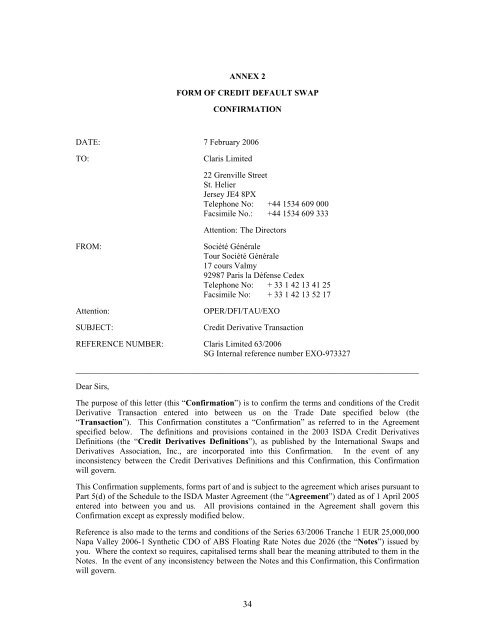

ANNEX 2<br />

FORM OF CREDIT DEFAULT SWAP<br />

CONFIRMATION<br />

DATE: 7 February 2006<br />

TO:<br />

Claris Limited<br />

22 Grenville Street<br />

St. Helier<br />

Jersey JE4 8PX<br />

Telephone No: +44 1534 609 000<br />

Facsimile No.: +44 1534 609 333<br />

Attention: The Directors<br />

FROM:<br />

Attention:<br />

SUBJECT:<br />

Société Générale<br />

Tour Société Générale<br />

17 cours Valmy<br />

92987 Paris la Défense Cedex<br />

Telephone No: + 33 1 42 13 41 25<br />

Facsimile No: + 33 1 42 13 52 17<br />

OPER/DFI/TAU/EXO<br />

Credit Derivative Transaction<br />

REFERENCE NUMBER: Claris Limited 63/2006<br />

SG Internal reference number EXO-973327<br />

__________________________________________________________________________________<br />

Dear Sirs,<br />

The purpose of this letter (this “Confirmation”) is to confirm the terms and conditions of the Credit<br />

Derivative Transaction entered into between us on the Trade Date specified below (the<br />

“Transaction”). This Confirmation constitutes a “Confirmation” <strong>as</strong> referred to in the Agreement<br />

specified below. The definitions and provisions contained in the 2003 ISDA Credit Derivatives<br />

Definitions (the “Credit Derivatives Definitions”), <strong>as</strong> published by the International Swaps and<br />

Derivatives Association, Inc., are incorporated into this Confirmation. In the event of any<br />

inconsistency between the Credit Derivatives Definitions and this Confirmation, this Confirmation<br />

will govern.<br />

This Confirmation supplements, forms part of and is subject to the agreement which arises pursuant to<br />

Part 5(d) of the Schedule to the ISDA M<strong>as</strong>ter Agreement (the “Agreement”) dated <strong>as</strong> of 1 April 2005<br />

entered into between you and us. All provisions contained in the Agreement shall govern this<br />

Confirmation except <strong>as</strong> expressly modified below.<br />

Reference is also made to the terms and conditions of the Series 63/2006 Tranche 1 EUR 25,000,000<br />

Napa Valley 2006-1 Synthetic CDO of ABS Floating Rate Notes due 2026 (the “Notes”) issued by<br />

you. Where the context so requires, capitalised terms shall bear the meaning attributed to them in the<br />

Notes. In the event of any inconsistency between the Notes and this Confirmation, this Confirmation<br />

will govern.<br />

34