OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

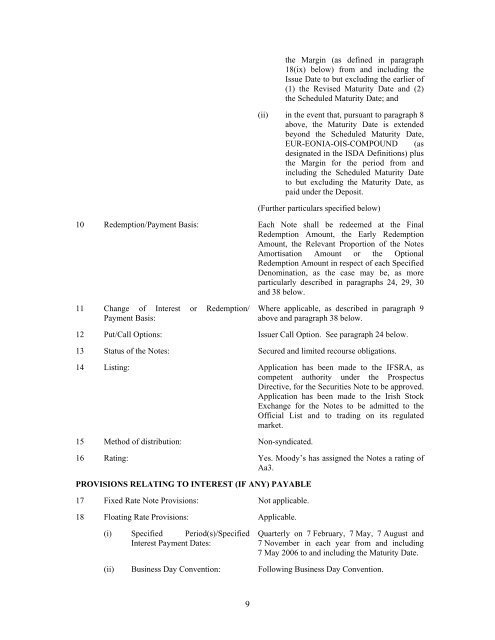

the Margin (<strong>as</strong> defined in paragraph<br />

18(ix) below) from and including the<br />

Issue Date to but excluding the earlier of<br />

(1) the Revised Maturity Date and (2)<br />

the Scheduled Maturity Date; and<br />

(ii) in the event that, pursuant to paragraph 8<br />

above, the Maturity Date is extended<br />

beyond the Scheduled Maturity Date,<br />

EUR-EONIA-OIS-COMPOUND (<strong>as</strong><br />

designated in the ISDA Definitions) plus<br />

the Margin for the period from and<br />

including the Scheduled Maturity Date<br />

to but excluding the Maturity Date, <strong>as</strong><br />

paid under the Deposit.<br />

(Further particulars specified below)<br />

10 Redemption/Payment B<strong>as</strong>is: Each Note shall be redeemed at the Final<br />

Redemption Amount, the Early Redemption<br />

Amount, the Relevant Proportion of the Notes<br />

Amortisation Amount or the Optional<br />

Redemption Amount in respect of each Specified<br />

Denomination, <strong>as</strong> the c<strong>as</strong>e may be, <strong>as</strong> more<br />

particularly described in paragraphs 24, 29, 30<br />

and 38 below.<br />

11 Change of Interest or Redemption/<br />

Payment B<strong>as</strong>is:<br />

Where applicable, <strong>as</strong> described in paragraph 9<br />

above and paragraph 38 below.<br />

12 Put/Call Options: <strong>Issuer</strong> Call Option. See paragraph 24 below.<br />

13 Status of the Notes: Secured and limited recourse obligations.<br />

14 Listing: Application h<strong>as</strong> been made to the IFSRA, <strong>as</strong><br />

competent authority under the Prospectus<br />

Directive, for the Securities Note to be approved.<br />

Application h<strong>as</strong> been made to the Irish Stock<br />

Exchange for the Notes to be admitted to the<br />

Official List and to trading on its regulated<br />

market.<br />

15 Method of distribution: Non-syndicated.<br />

16 Rating: Yes. Moody’s h<strong>as</strong> <strong>as</strong>signed the Notes a rating of<br />

Aa3.<br />

PROVISIONS RELATING TO INTEREST (IF ANY) PAYABLE<br />

17 Fixed Rate Note Provisions: Not applicable.<br />

18 Floating Rate Provisions: Applicable.<br />

(i) Specified Period(s)/Specified<br />

Interest Payment Dates:<br />

Quarterly on 7 February, 7 May, 7 August and<br />

7 November in each year from and including<br />

7 May 2006 to and including the Maturity Date.<br />

(ii) Business Day Convention: Following Business Day Convention.<br />

9