OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

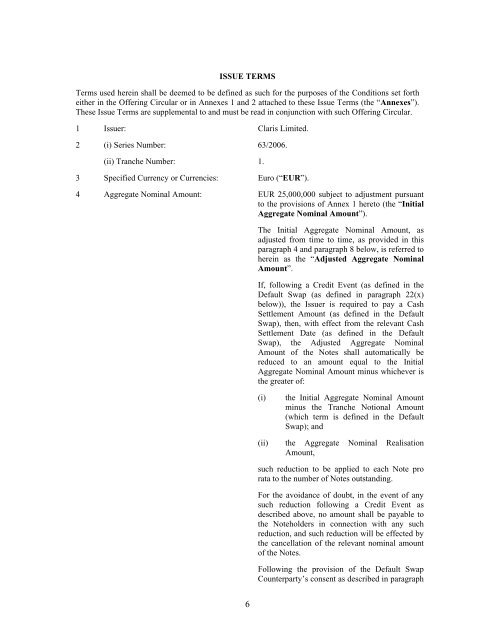

ISSUE TERMS<br />

Terms used herein shall be deemed to be defined <strong>as</strong> such for the purposes of the Conditions set forth<br />

either in the Offering Circular or in Annexes 1 and 2 attached to these Issue Terms (the “Annexes”).<br />

These Issue Terms are supplemental to and must be read in conjunction with such Offering Circular.<br />

1 <strong>Issuer</strong>: Claris Limited.<br />

2 (i) Series Number: 63/2006.<br />

(ii) Tranche Number: 1.<br />

3 Specified Currency or Currencies: Euro (“EUR”).<br />

4 Aggregate Nominal Amount: EUR 25,000,000 subject to adjustment pursuant<br />

to the provisions of Annex 1 hereto (the “Initial<br />

Aggregate Nominal Amount”).<br />

The Initial Aggregate Nominal Amount, <strong>as</strong><br />

adjusted from time to time, <strong>as</strong> provided in this<br />

paragraph 4 and paragraph 8 below, is referred to<br />

herein <strong>as</strong> the “Adjusted Aggregate Nominal<br />

Amount”.<br />

If, following a Credit Event (<strong>as</strong> defined in the<br />

Default Swap (<strong>as</strong> defined in paragraph 22(x)<br />

below)), the <strong>Issuer</strong> is required to pay a C<strong>as</strong>h<br />

Settlement Amount (<strong>as</strong> defined in the Default<br />

Swap), then, with effect from the relevant C<strong>as</strong>h<br />

Settlement Date (<strong>as</strong> defined in the Default<br />

Swap), the Adjusted Aggregate Nominal<br />

Amount of the Notes shall automatically be<br />

reduced to an amount equal to the Initial<br />

Aggregate Nominal Amount minus whichever is<br />

the greater of:<br />

(i)<br />

the Initial Aggregate Nominal Amount<br />

minus the Tranche Notional Amount<br />

(which term is defined in the Default<br />

Swap); and<br />

(ii) the Aggregate Nominal Realisation<br />

Amount,<br />

such reduction to be applied to each Note pro<br />

rata to the number of Notes outstanding.<br />

For the avoidance of doubt, in the event of any<br />

such reduction following a Credit Event <strong>as</strong><br />

described above, no amount shall be payable to<br />

the Noteholders in connection with any such<br />

reduction, and such reduction will be effected by<br />

the cancellation of the relevant nominal amount<br />

of the Notes.<br />

Following the provision of the Default Swap<br />

Counterparty’s consent <strong>as</strong> described in paragraph<br />

6