OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

OFFERING CIRCULAR SUPPLEMENT CLARIS LIMITED as Issuer ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

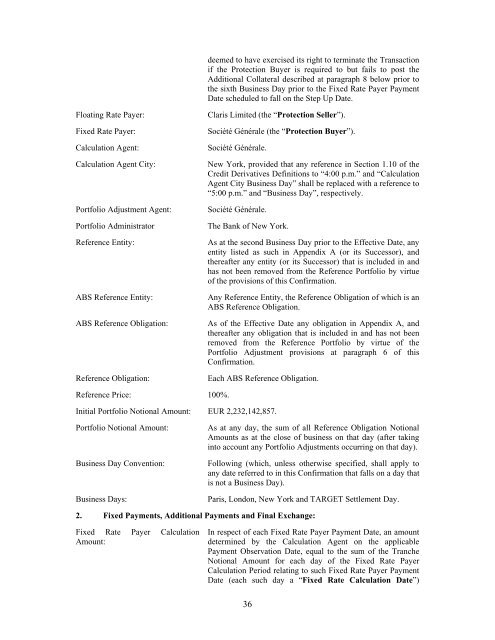

deemed to have exercised its right to terminate the Transaction<br />

if the Protection Buyer is required to but fails to post the<br />

Additional Collateral described at paragraph 8 below prior to<br />

the sixth Business Day prior to the Fixed Rate Payer Payment<br />

Date scheduled to fall on the Step Up Date.<br />

Floating Rate Payer:<br />

Fixed Rate Payer:<br />

Calculation Agent:<br />

Calculation Agent City:<br />

Portfolio Adjustment Agent:<br />

Portfolio Administrator<br />

Reference Entity:<br />

ABS Reference Entity:<br />

ABS Reference Obligation:<br />

Reference Obligation:<br />

Claris Limited (the “Protection Seller”).<br />

Société Générale (the “Protection Buyer”).<br />

Société Générale.<br />

New York, provided that any reference in Section 1.10 of the<br />

Credit Derivatives Definitions to “4:00 p.m.” and “Calculation<br />

Agent City Business Day” shall be replaced with a reference to<br />

“5:00 p.m.” and “Business Day”, respectively.<br />

Société Générale.<br />

The Bank of New York.<br />

As at the second Business Day prior to the Effective Date, any<br />

entity listed <strong>as</strong> such in Appendix A (or its Successor), and<br />

thereafter any entity (or its Successor) that is included in and<br />

h<strong>as</strong> not been removed from the Reference Portfolio by virtue<br />

of the provisions of this Confirmation.<br />

Any Reference Entity, the Reference Obligation of which is an<br />

ABS Reference Obligation.<br />

As of the Effective Date any obligation in Appendix A, and<br />

thereafter any obligation that is included in and h<strong>as</strong> not been<br />

removed from the Reference Portfolio by virtue of the<br />

Portfolio Adjustment provisions at paragraph 6 of this<br />

Confirmation.<br />

Each ABS Reference Obligation.<br />

Reference Price: 100%.<br />

Initial Portfolio Notional Amount: EUR 2,232,142,857.<br />

Portfolio Notional Amount:<br />

Business Day Convention:<br />

Business Days:<br />

As at any day, the sum of all Reference Obligation Notional<br />

Amounts <strong>as</strong> at the close of business on that day (after taking<br />

into account any Portfolio Adjustments occurring on that day).<br />

Following (which, unless otherwise specified, shall apply to<br />

any date referred to in this Confirmation that falls on a day that<br />

is not a Business Day).<br />

Paris, London, New York and TARGET Settlement Day.<br />

2. Fixed Payments, Additional Payments and Final Exchange:<br />

Fixed Rate Payer Calculation<br />

Amount:<br />

In respect of each Fixed Rate Payer Payment Date, an amount<br />

determined by the Calculation Agent on the applicable<br />

Payment Observation Date, equal to the sum of the Tranche<br />

Notional Amount for each day of the Fixed Rate Payer<br />

Calculation Period relating to such Fixed Rate Payer Payment<br />

Date (each such day a “Fixed Rate Calculation Date”)<br />

36