MARFIN EGNATIA BANK S.A. - Irish Stock Exchange

MARFIN EGNATIA BANK S.A. - Irish Stock Exchange

MARFIN EGNATIA BANK S.A. - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

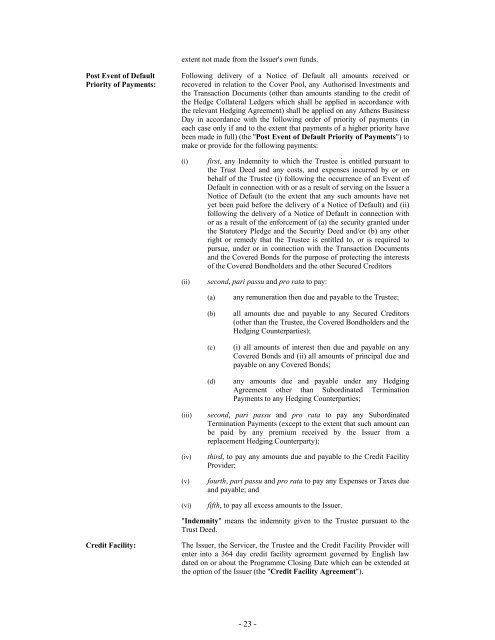

extent not made from the Issuer's own funds.<br />

Post Event of Default<br />

Priority of Payments:<br />

Following delivery of a Notice of Default all amounts received or<br />

recovered in relation to the Cover Pool, any Authorised Investments and<br />

the Transaction Documents (other than amounts standing to the credit of<br />

the Hedge Collateral Ledgers which shall be applied in accordance with<br />

the relevant Hedging Agreement) shall be applied on any Athens Business<br />

Day in accordance with the following order of priority of payments (in<br />

each case only if and to the extent that payments of a higher priority have<br />

been made in full) (the "Post Event of Default Priority of Payments") to<br />

make or provide for the following payments:<br />

(i)<br />

(ii)<br />

first, any Indemnity to which the Trustee is entitled pursuant to<br />

the Trust Deed and any costs, and expenses incurred by or on<br />

behalf of the Trustee (i) following the occurrence of an Event of<br />

Default in connection with or as a result of serving on the Issuer a<br />

Notice of Default (to the extent that any such amounts have not<br />

yet been paid before the delivery of a Notice of Default) and (ii)<br />

following the delivery of a Notice of Default in connection with<br />

or as a result of the enforcement of (a) the security granted under<br />

the Statutory Pledge and the Security Deed and/or (b) any other<br />

right or remedy that the Trustee is entitled to, or is required to<br />

pursue, under or in connection with the Transaction Documents<br />

and the Covered Bonds for the purpose of protecting the interests<br />

of the Covered Bondholders and the other Secured Creditors<br />

second, pari passu and pro rata to pay:<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

any remuneration then due and payable to the Trustee;<br />

all amounts due and payable to any Secured Creditors<br />

(other than the Trustee, the Covered Bondholders and the<br />

Hedging Counterparties);<br />

(i) all amounts of interest then due and payable on any<br />

Covered Bonds and (ii) all amounts of principal due and<br />

payable on any Covered Bonds;<br />

any amounts due and payable under any Hedging<br />

Agreement other than Subordinated Termination<br />

Payments to any Hedging Counterparties;<br />

(iii)<br />

(iv)<br />

(v)<br />

(vi)<br />

second, pari passu and pro rata to pay any Subordinated<br />

Termination Payments (except to the extent that such amount can<br />

be paid by any premium received by the Issuer from a<br />

replacement Hedging Counterparty);<br />

third, to pay any amounts due and payable to the Credit Facility<br />

Provider;<br />

fourth, pari passu and pro rata to pay any Expenses or Taxes due<br />

and payable; and<br />

fifth, to pay all excess amounts to the Issuer.<br />

"Indemnity" means the indemnity given to the Trustee pursuant to the<br />

Trust Deed.<br />

Credit Facility:<br />

The Issuer, the Servicer, the Trustee and the Credit Facility Provider will<br />

enter into a 364 day credit facility agreement governed by English law<br />

dated on or about the Programme Closing Date which can be extended at<br />

the option of the Issuer (the "Credit Facility Agreement").<br />

- 23 -