MARFIN EGNATIA BANK S.A. - Irish Stock Exchange

MARFIN EGNATIA BANK S.A. - Irish Stock Exchange

MARFIN EGNATIA BANK S.A. - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

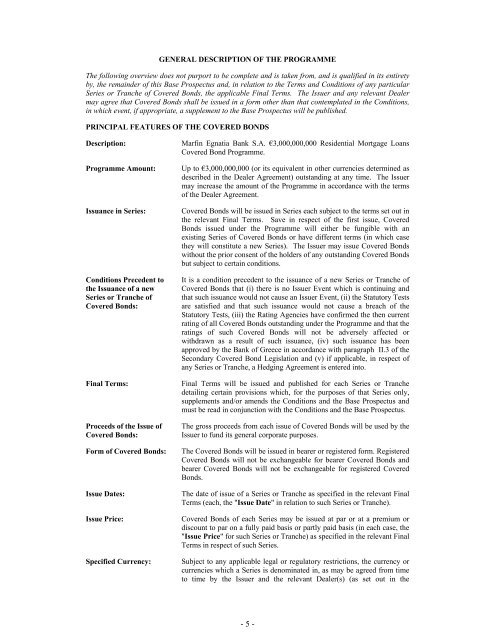

GENERAL DESCRIPTION OF THE PROGRAMME<br />

The following overview does not purport to be complete and is taken from, and is qualified in its entirety<br />

by, the remainder of this Base Prospectus and, in relation to the Terms and Conditions of any particular<br />

Series or Tranche of Covered Bonds, the applicable Final Terms. The Issuer and any relevant Dealer<br />

may agree that Covered Bonds shall be issued in a form other than that contemplated in the Conditions,<br />

in which event, if appropriate, a supplement to the Base Prospectus will be published.<br />

PRINCIPAL FEATURES OF THE COVERED BONDS<br />

Description:<br />

Programme Amount:<br />

Issuance in Series:<br />

Conditions Precedent to<br />

the Issuance of a new<br />

Series or Tranche of<br />

Covered Bonds:<br />

Final Terms:<br />

Proceeds of the Issue of<br />

Covered Bonds:<br />

Form of Covered Bonds:<br />

Issue Dates:<br />

Issue Price:<br />

Specified Currency:<br />

Marfin Egnatia Bank S.A. €3,000,000,000 Residential Mortgage Loans<br />

Covered Bond Programme.<br />

Up to €3,000,000,000 (or its equivalent in other currencies determined as<br />

described in the Dealer Agreement) outstanding at any time. The Issuer<br />

may increase the amount of the Programme in accordance with the terms<br />

of the Dealer Agreement.<br />

Covered Bonds will be issued in Series each subject to the terms set out in<br />

the relevant Final Terms. Save in respect of the first issue, Covered<br />

Bonds issued under the Programme will either be fungible with an<br />

existing Series of Covered Bonds or have different terms (in which case<br />

they will constitute a new Series). The Issuer may issue Covered Bonds<br />

without the prior consent of the holders of any outstanding Covered Bonds<br />

but subject to certain conditions.<br />

It is a condition precedent to the issuance of a new Series or Tranche of<br />

Covered Bonds that (i) there is no Issuer Event which is continuing and<br />

that such issuance would not cause an Issuer Event, (ii) the Statutory Tests<br />

are satisfied and that such issuance would not cause a breach of the<br />

Statutory Tests, (iii) the Rating Agencies have confirmed the then current<br />

rating of all Covered Bonds outstanding under the Programme and that the<br />

ratings of such Covered Bonds will not be adversely affected or<br />

withdrawn as a result of such issuance, (iv) such issuance has been<br />

approved by the Bank of Greece in accordance with paragraph II.3 of the<br />

Secondary Covered Bond Legislation and (v) if applicable, in respect of<br />

any Series or Tranche, a Hedging Agreement is entered into.<br />

Final Terms will be issued and published for each Series or Tranche<br />

detailing certain provisions which, for the purposes of that Series only,<br />

supplements and/or amends the Conditions and the Base Prospectus and<br />

must be read in conjunction with the Conditions and the Base Prospectus.<br />

The gross proceeds from each issue of Covered Bonds will be used by the<br />

Issuer to fund its general corporate purposes.<br />

The Covered Bonds will be issued in bearer or registered form. Registered<br />

Covered Bonds will not be exchangeable for bearer Covered Bonds and<br />

bearer Covered Bonds will not be exchangeable for registered Covered<br />

Bonds.<br />

The date of issue of a Series or Tranche as specified in the relevant Final<br />

Terms (each, the "Issue Date" in relation to such Series or Tranche).<br />

Covered Bonds of each Series may be issued at par or at a premium or<br />

discount to par on a fully paid basis or partly paid basis (in each case, the<br />

"Issue Price" for such Series or Tranche) as specified in the relevant Final<br />

Terms in respect of such Series.<br />

Subject to any applicable legal or regulatory restrictions, the currency or<br />

currencies which a Series is denominated in, as may be agreed from time<br />

to time by the Issuer and the relevant Dealer(s) (as set out in the<br />

- 5 -